1 Q2 2022 Redwood Review July 28, 2022 Exhibit 99.3

2 Forward Looking Statements This presentation contains forward-looking statements, including statements regarding our 2022 forward outlook, statements related to increasing our market share of BPL origination, estimates of upside and potential earnings in our investment portfolio from embedded discounts to par value on securities, and target yields on investment opportunities. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward- looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and any subsequent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected may be described from time to time in reports the Company files with the Securities and Exchange Commission, including reports on Form 8-K. Additionally, this presentation contains estimates and information concerning our industry, including market size and growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those referred to above, that could cause results to differ materially from those expressed in these publications and reports.

3 Redwood’s mission is to help make quality housing, whether rented or owned, accessible to all American households R W T H O R I Z O N S Innovative Technology Organically and Through Partnerships Industry Leading Operating Platforms Ability to Organically Create Assets for Balance Sheet Best-in-Class Securitization Platforms and Distribution Channels Differentiated and Balanced Earnings Profile Integrated Business Model Our Differentiators Deep Product Set with Diversified Earnings Streams Track Record of Strong Performance and Earnings Generation Deep and Experienced Management Team Ticker: RWT IPO Date: 1995 Market Cap: $1.0 billion Indicative Dividend Yield: 11.9% Detailed Endnotes are included at the end of this presentation. TM

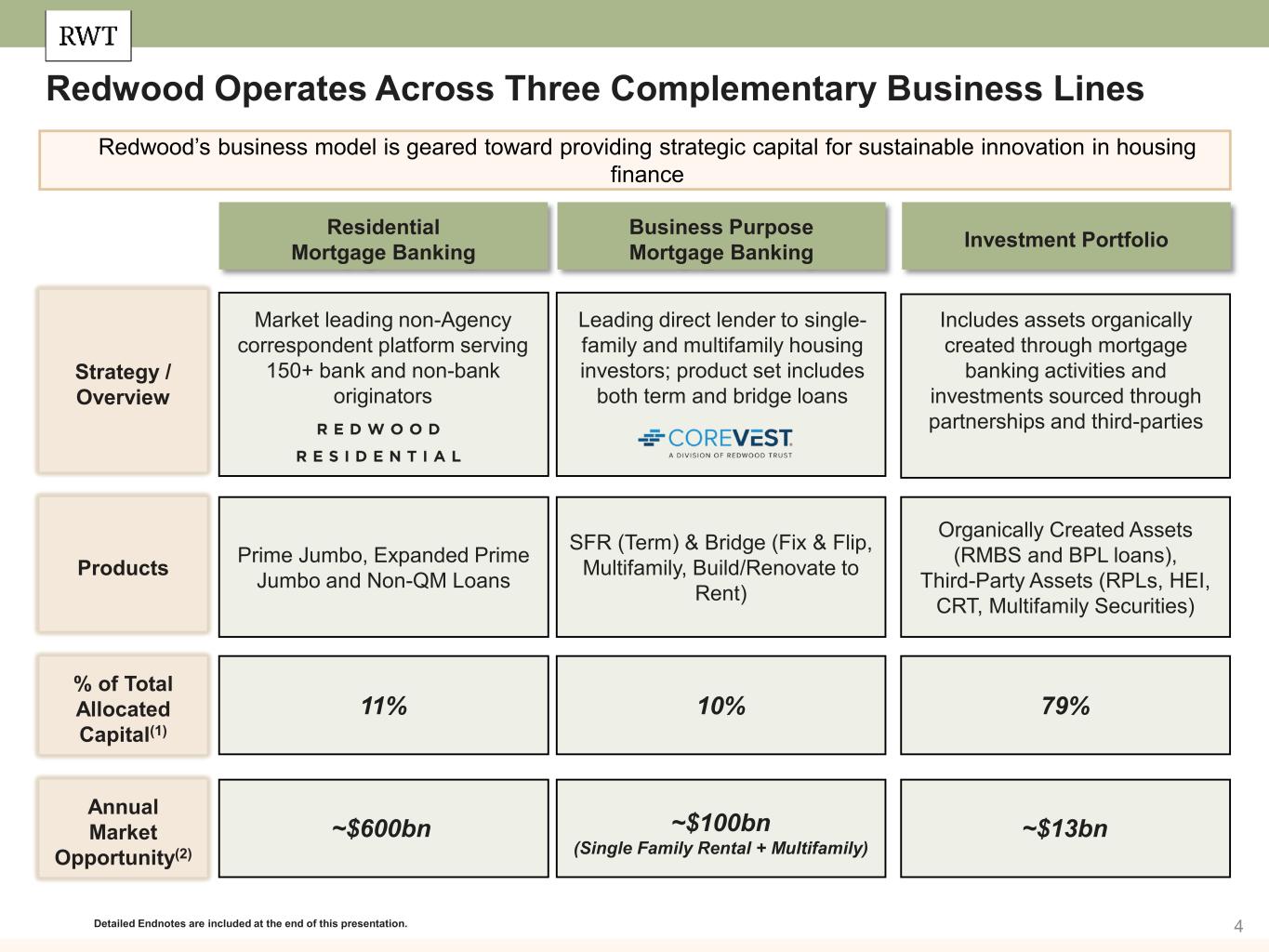

4Detailed Endnotes are included at the end of this presentation. Redwood Operates Across Three Complementary Business Lines Redwood’s business model is geared toward providing strategic capital for sustainable innovation in housing finance Residential Mortgage Banking Business Purpose Mortgage Banking Investment Portfolio Strategy / Overview ~$600bn ~$13bn~$100bn (Single Family Rental + Multifamily) 79%11% 10% % of Total Allocated Capital(1) Annual Market Opportunity(2) Organically Created Assets (RMBS and BPL loans), Third-Party Assets (RPLs, HEI, CRT, Multifamily Securities) Prime Jumbo, Expanded Prime Jumbo and Non-QM Loans SFR (Term) & Bridge (Fix & Flip, Multifamily, Build/Renovate to Rent) Products Market leading non-Agency correspondent platform serving 150+ bank and non-bank originators Includes assets organically created through mortgage banking activities and investments sourced through partnerships and third-parties Leading direct lender to single- family and multifamily housing investors; product set includes both term and bridge loans

5 Q2’22 Financial Performance $(0.85) per diluted share ~$(0.74) due to estimated market valuation adjustments on long-term investments $1.8 billion of allocated capital Detailed Endnotes are included at the end of this presentation. GAAP Net Loss GAAP Book Value Common Dividend Capital Allocation(3) Return on Capital(4) Capital and Financing Recourse Leverage Ratio(5) Unrestricted Cash ($mm) Q2’22 Total Economic Return: (8.3)%(1) 11.9% Indicative Dividend Yield as of June 30, 2022(2) $0.23 $0.23 Q1'22 Q2'22 $12.01 $10.78 Q1'22 Q2'22 2.1x 2.5x Q1'22 Q2'22 $409 $371 Q1'22 Q2'22 Q1'22 Q2'22 Investment Portfolio 79% Residential Mortgage Banking 11% Business Purpose Mortgage Banking 10% $0.24 $(0.85) GAAP ROC Adjusted ROC 3% 8% -19% 0% LTM Q2'22 Adjusted return on capital (“ROC”) is a non-GAAP measure that is reconciled to GAAP return on capital on slide 35 in the Endnotes.

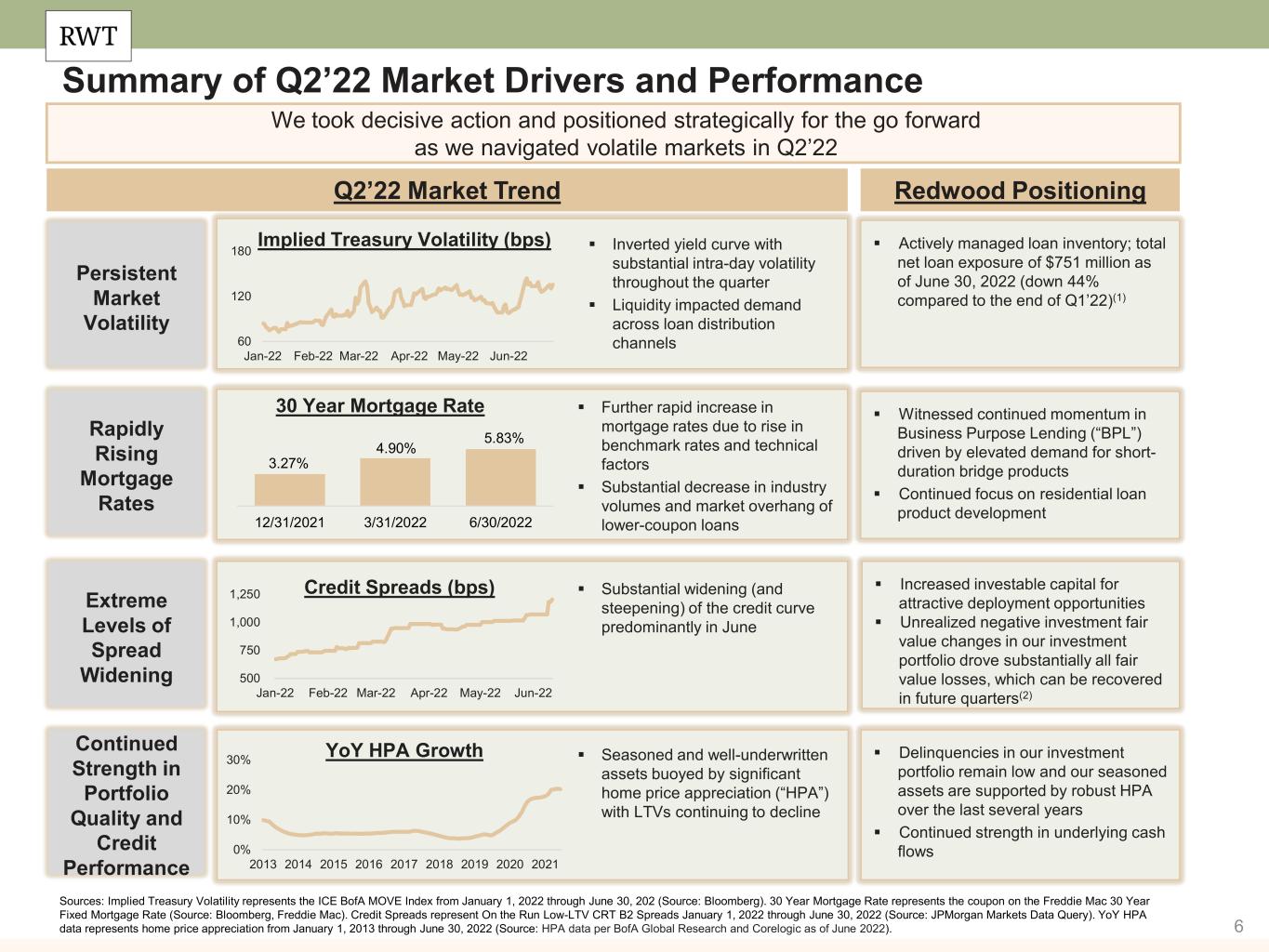

6 Witnessed continued momentum in Business Purpose Lending (“BPL”) driven by elevated demand for short- duration bridge products Continued focus on residential loan product development Increased investable capital for attractive deployment opportunities Unrealized negative investment fair value changes in our investment portfolio drove substantially all fair value losses, which can be recovered in future quarters(2) Delinquencies in our investment portfolio remain low and our seasoned assets are supported by robust HPA over the last several years Continued strength in underlying cash flows Summary of Q2’22 Market Drivers and Performance We took decisive action and positioned strategically for the go forward as we navigated volatile markets in Q2’22 Q2’22 Market Trend Extreme Levels of Spread Widening Continued Strength in Portfolio Quality and Credit Performance Credit Spreads (bps) YoY HPA Growth 0% 10% 20% 30% 2013 2014 2015 2016 2017 2018 2019 2020 2021 Persistent Market Volatility Rapidly Rising Mortgage Rates Implied Treasury Volatility (bps) 30 Year Mortgage Rate 500 750 1,000 1,250 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Actively managed loan inventory; total net loan exposure of $751 million as of June 30, 2022 (down 44% compared to the end of Q1’22)(1) Redwood Positioning Sources: Implied Treasury Volatility represents the ICE BofA MOVE Index from January 1, 2022 through June 30, 202 (Source: Bloomberg). 30 Year Mortgage Rate represents the coupon on the Freddie Mac 30 Year Fixed Mortgage Rate (Source: Bloomberg, Freddie Mac). Credit Spreads represent On the Run Low-LTV CRT B2 Spreads January 1, 2022 through June 30, 2022 (Source: JPMorgan Markets Data Query). YoY HPA data represents home price appreciation from January 1, 2013 through June 30, 2022 (Source: HPA data per BofA Global Research and Corelogic as of June 2022). 60 120 180 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 3.27% 4.90% 5.83% 12/31/2021 3/31/2022 6/30/2022 Inverted yield curve with substantial intra-day volatility throughout the quarter Liquidity impacted demand across loan distribution channels Further rapid increase in mortgage rates due to rise in benchmark rates and technical factors Substantial decrease in industry volumes and market overhang of lower-coupon loans Substantial widening (and steepening) of the credit curve predominantly in June Seasoned and well-underwritten assets buoyed by significant home price appreciation (“HPA”) with LTVs continuing to decline

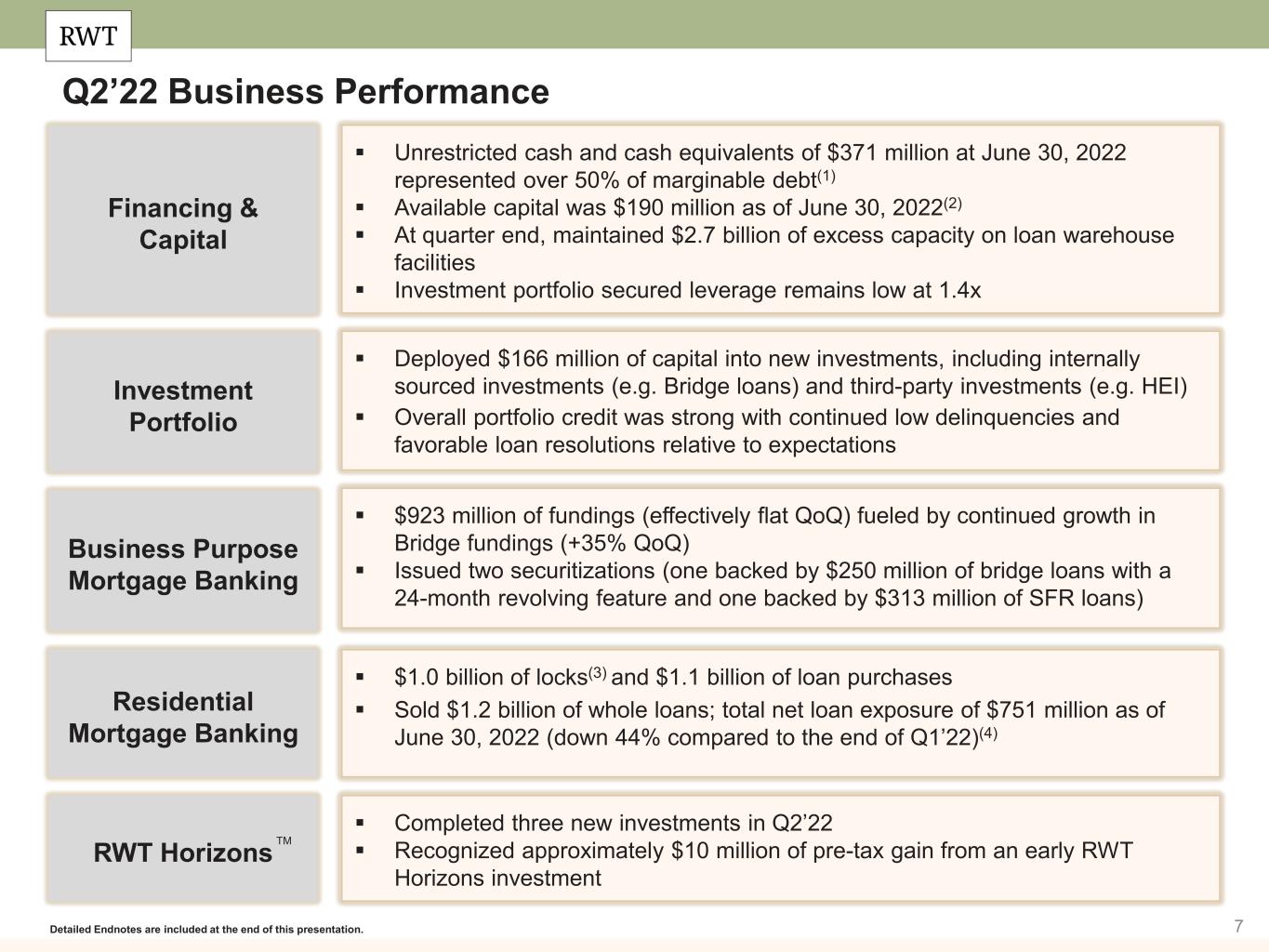

7 Q2’22 Business Performance Detailed Endnotes are included at the end of this presentation. $1.0 billion of locks(3) and $1.1 billion of loan purchases Sold $1.2 billion of whole loans; total net loan exposure of $751 million as of June 30, 2022 (down 44% compared to the end of Q1’22)(4) Residential Mortgage Banking Completed three new investments in Q2’22 Recognized approximately $10 million of pre-tax gain from an early RWT Horizons investment RWT Horizons $923 million of fundings (effectively flat QoQ) fueled by continued growth in Bridge fundings (+35% QoQ) Issued two securitizations (one backed by $250 million of bridge loans with a 24-month revolving feature and one backed by $313 million of SFR loans) Business Purpose Mortgage Banking TM Deployed $166 million of capital into new investments, including internally sourced investments (e.g. Bridge loans) and third-party investments (e.g. HEI) Overall portfolio credit was strong with continued low delinquencies and favorable loan resolutions relative to expectations Investment Portfolio Unrestricted cash and cash equivalents of $371 million at June 30, 2022 represented over 50% of marginable debt(1) Available capital was $190 million as of June 30, 2022(2) At quarter end, maintained $2.7 billion of excess capacity on loan warehouse facilities Investment portfolio secured leverage remains low at 1.4x Financing & Capital

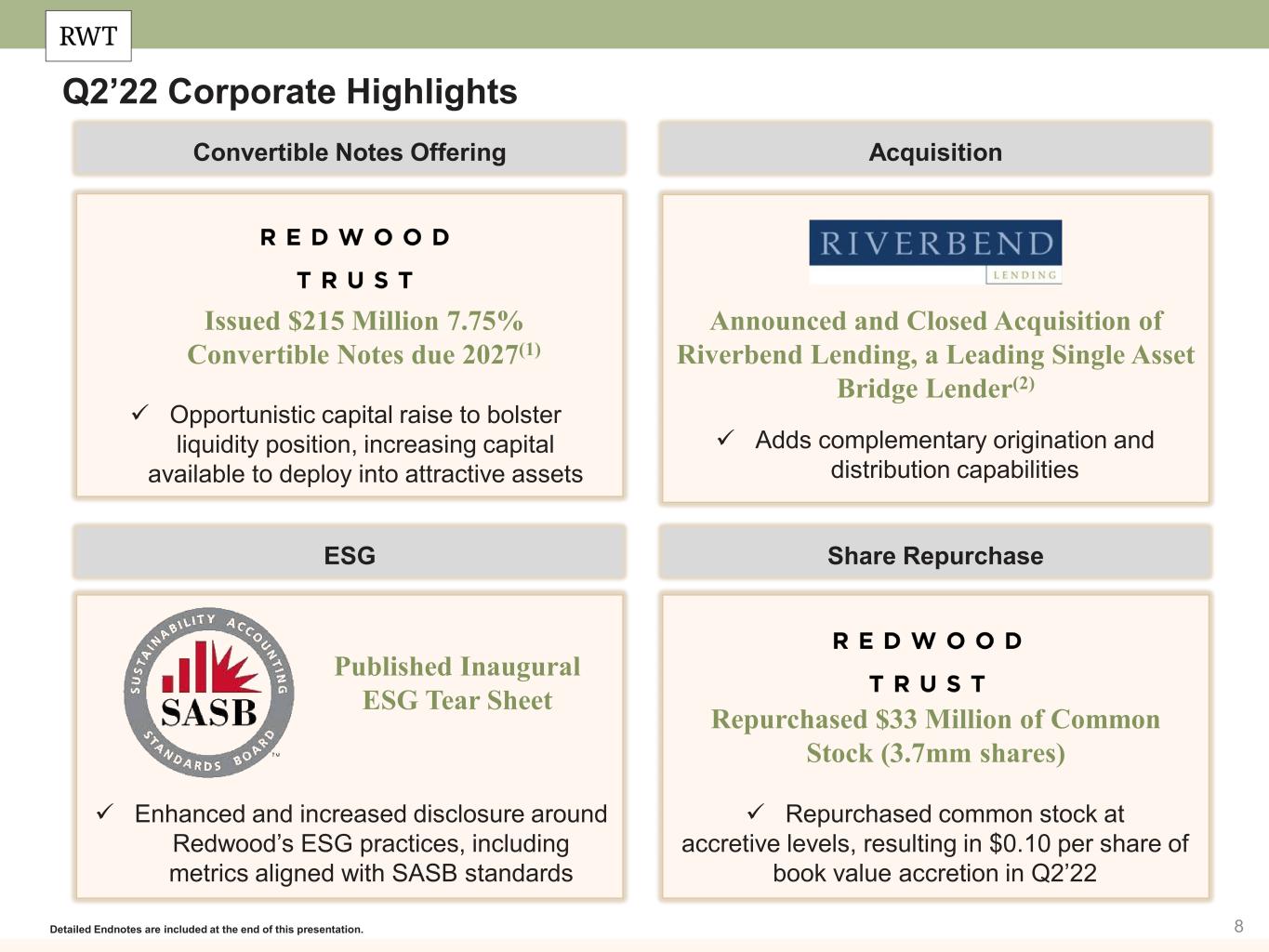

8 Q2’22 Corporate Highlights Detailed Endnotes are included at the end of this presentation. Convertible Notes Offering Acquisition ESG Share Repurchase Published Inaugural ESG Tear Sheet Announced and Closed Acquisition of Riverbend Lending, a Leading Single Asset Bridge Lender(2) Issued $215 Million 7.75% Convertible Notes due 2027(1) Repurchased $33 Million of Common Stock (3.7mm shares) Opportunistic capital raise to bolster liquidity position, increasing capital available to deploy into attractive assets Adds complementary origination and distribution capabilities Repurchased common stock at accretive levels, resulting in $0.10 per share of book value accretion in Q2’22 Enhanced and increased disclosure around Redwood’s ESG practices, including metrics aligned with SASB standards

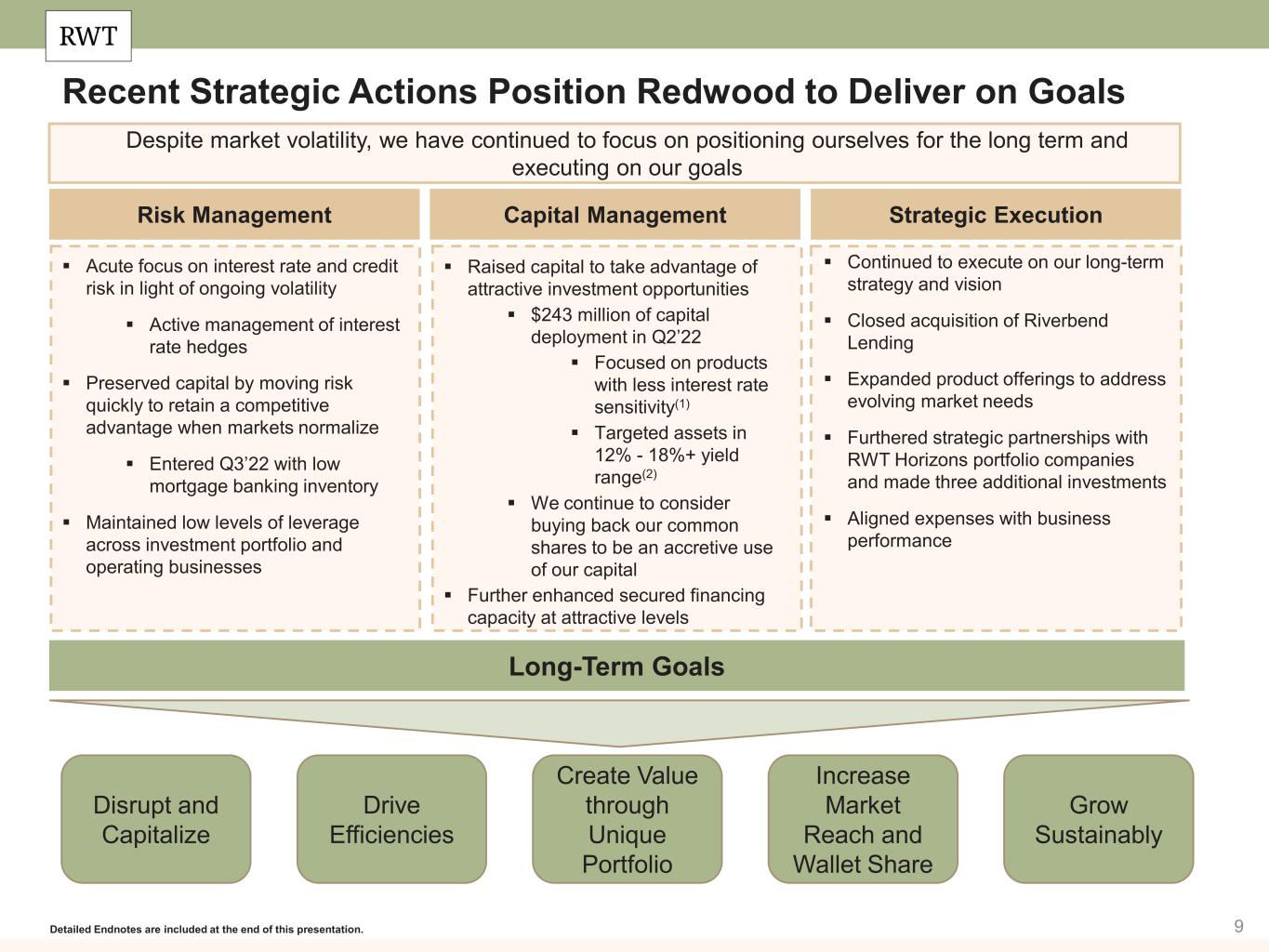

9 Recent Strategic Actions Position Redwood to Deliver on Goals Detailed Endnotes are included at the end of this presentation. Despite market volatility, we have continued to focus on positioning ourselves for the long term and executing on our goals Risk Management Capital Management Strategic Execution Disrupt and Capitalize Drive Efficiencies Increase Market Reach and Wallet Share Grow Sustainably Create Value through Unique Portfolio Long-Term Goals Raised capital to take advantage of attractive investment opportunities $243 million of capital deployment in Q2’22 Focused on products with less interest rate sensitivity(1) Targeted assets in 12% - 18%+ yield range(2) We continue to consider buying back our common shares to be an accretive use of our capital Further enhanced secured financing capacity at attractive levels Continued to execute on our long-term strategy and vision Closed acquisition of Riverbend Lending Expanded product offerings to address evolving market needs Furthered strategic partnerships with RWT Horizons portfolio companies and made three additional investments Aligned expenses with business performance Acute focus on interest rate and credit risk in light of ongoing volatility Active management of interest rate hedges Preserved capital by moving risk quickly to retain a competitive advantage when markets normalize Entered Q3’22 with low mortgage banking inventory Maintained low levels of leverage across investment portfolio and operating businesses

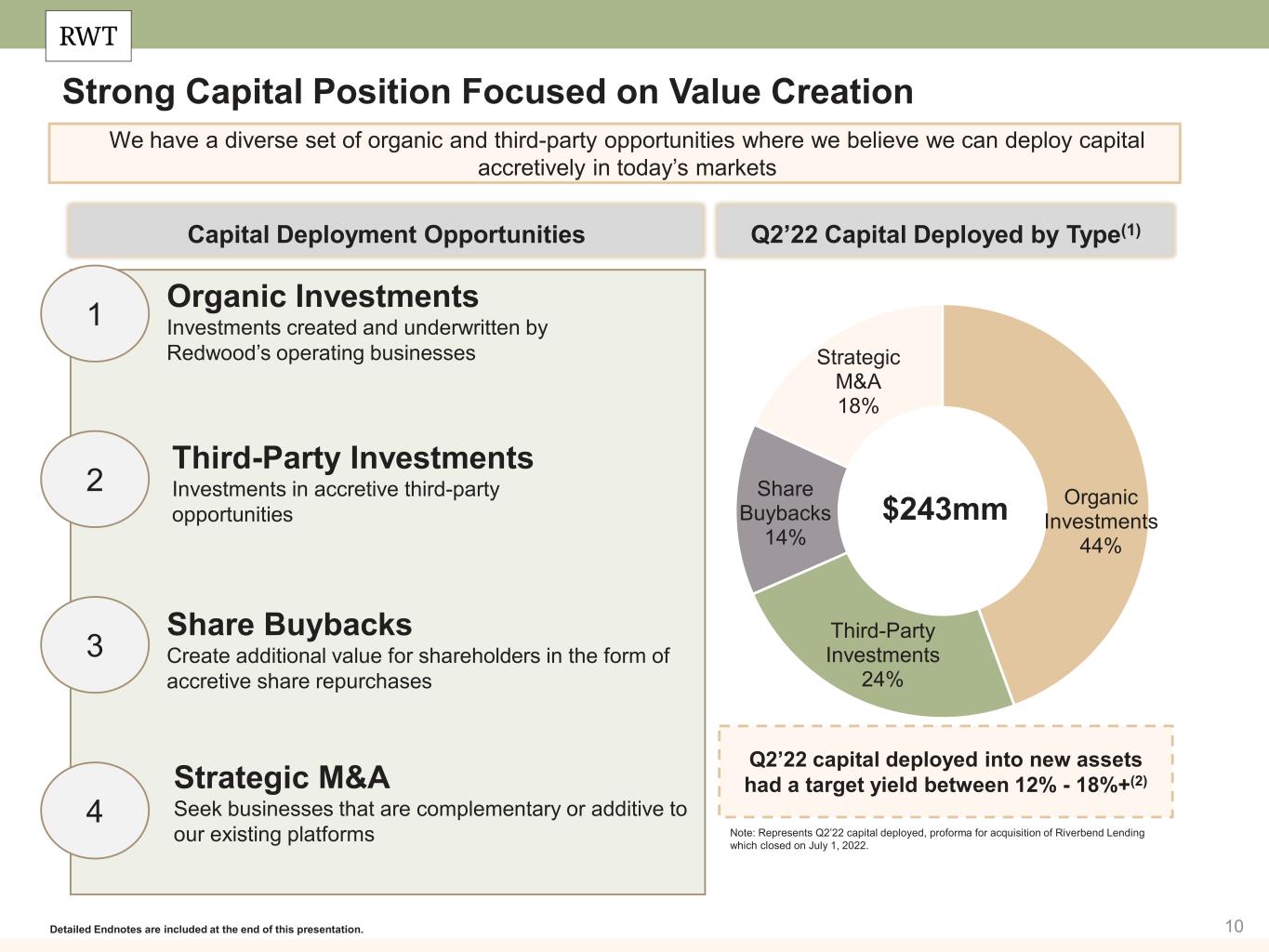

10 Strong Capital Position Focused on Value Creation Detailed Endnotes are included at the end of this presentation. We have a diverse set of organic and third-party opportunities where we believe we can deploy capital accretively in today’s markets 1 2 3 4 Capital Deployment Opportunities Organic Investments Investments created and underwritten by Redwood’s operating businesses Third-Party Investments Investments in accretive third-party opportunities Share Buybacks Create additional value for shareholders in the form of accretive share repurchases Strategic M&A Seek businesses that are complementary or additive to our existing platforms Q2’22 Capital Deployed by Type(1) Note: Represents Q2’22 capital deployed, proforma for acquisition of Riverbend Lending which closed on July 1, 2022. Organic Investments 44% Third-Party Investments 24% Share Buybacks 14% Strategic M&A 18% $243mm Q2’22 capital deployed into new assets had a target yield between 12% - 18%+(2)

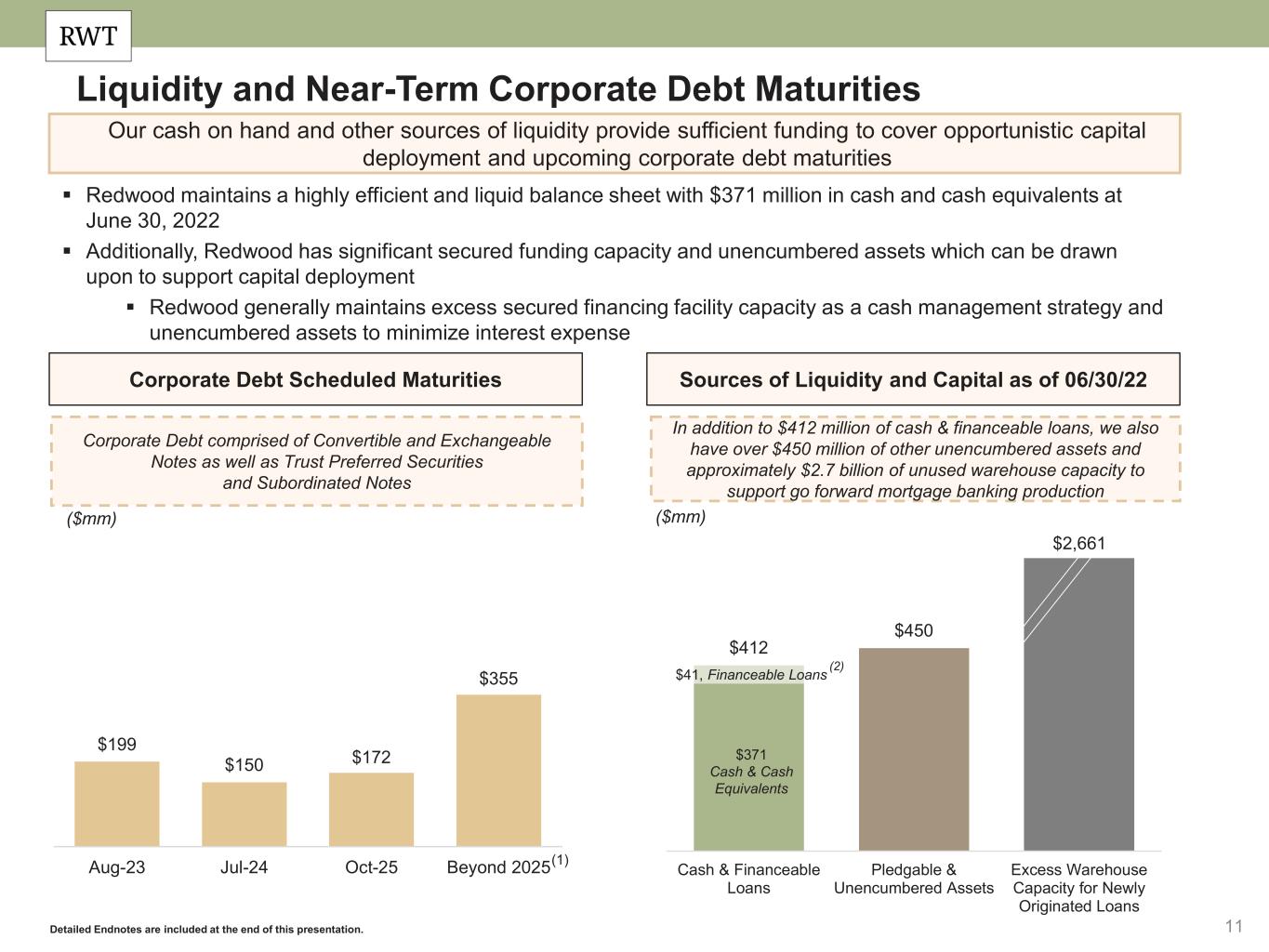

11 $412 $450 Cash & Financeable Loans Pledgable & Unencumbered Assets Excess Warehouse Capacity for Newly Originated Loans Liquidity and Near-Term Corporate Debt Maturities $199 $150 $172 $355 Aug-23 Jul-24 Oct-25 Beyond 2025 ($mm) Corporate Debt Scheduled Maturities Sources of Liquidity and Capital as of 06/30/22 Corporate Debt comprised of Convertible and Exchangeable Notes as well as Trust Preferred Securities and Subordinated Notes Redwood maintains a highly efficient and liquid balance sheet with $371 million in cash and cash equivalents at June 30, 2022 Additionally, Redwood has significant secured funding capacity and unencumbered assets which can be drawn upon to support capital deployment Redwood generally maintains excess secured financing facility capacity as a cash management strategy and unencumbered assets to minimize interest expense Our cash on hand and other sources of liquidity provide sufficient funding to cover opportunistic capital deployment and upcoming corporate debt maturities Detailed Endnotes are included at the end of this presentation. In addition to $412 million of cash & financeable loans, we also have over $450 million of other unencumbered assets and approximately $2.7 billion of unused warehouse capacity to support go forward mortgage banking production (1) $2,661 $371 Cash & Cash Equivalents $41, Financeable Loans ($mm) (2)

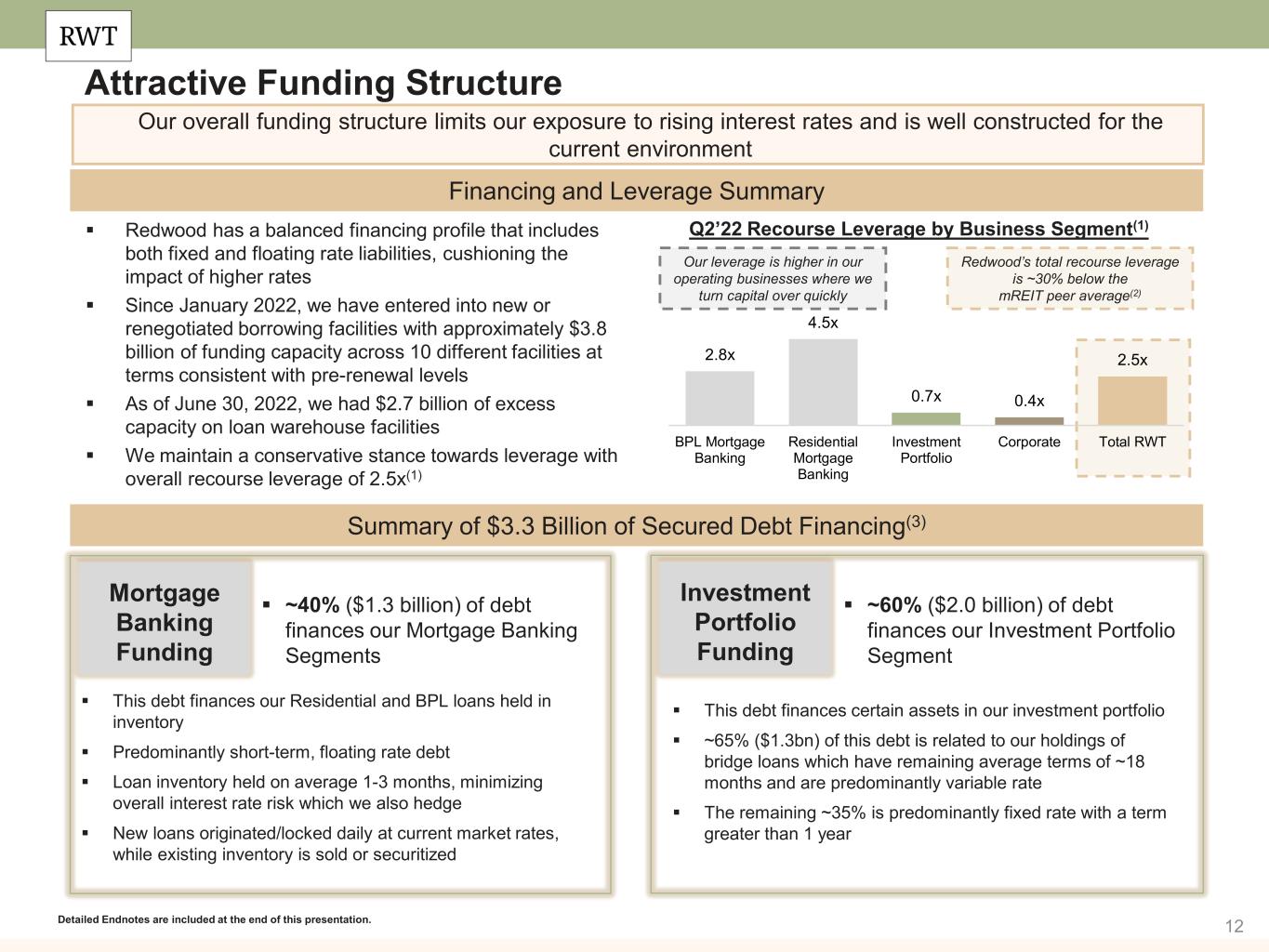

12 Attractive Funding Structure Our overall funding structure limits our exposure to rising interest rates and is well constructed for the current environment Financing and Leverage Summary Redwood has a balanced financing profile that includes both fixed and floating rate liabilities, cushioning the impact of higher rates Since January 2022, we have entered into new or renegotiated borrowing facilities with approximately $3.8 billion of funding capacity across 10 different facilities at terms consistent with pre-renewal levels As of June 30, 2022, we had $2.7 billion of excess capacity on loan warehouse facilities We maintain a conservative stance towards leverage with overall recourse leverage of 2.5x(1) Summary of $3.3 Billion of Secured Debt Financing(3) This debt finances our Residential and BPL loans held in inventory Predominantly short-term, floating rate debt Loan inventory held on average 1-3 months, minimizing overall interest rate risk which we also hedge New loans originated/locked daily at current market rates, while existing inventory is sold or securitized Mortgage Banking Funding ~40% ($1.3 billion) of debt finances our Mortgage Banking Segments This debt finances certain assets in our investment portfolio ~65% ($1.3bn) of this debt is related to our holdings of bridge loans which have remaining average terms of ~18 months and are predominantly variable rate The remaining ~35% is predominantly fixed rate with a term greater than 1 year Investment Portfolio Funding ~60% ($2.0 billion) of debt finances our Investment Portfolio Segment Detailed Endnotes are included at the end of this presentation. Q2’22 Recourse Leverage by Business Segment(1) 2.8x 4.5x 0.7x 0.4x 2.5x BPL Mortgage Banking Residential Mortgage Banking Investment Portfolio Corporate Total RWT Our leverage is higher in our operating businesses where we turn capital over quickly Redwood’s total recourse leverage is ~30% below the mREIT peer average(2)

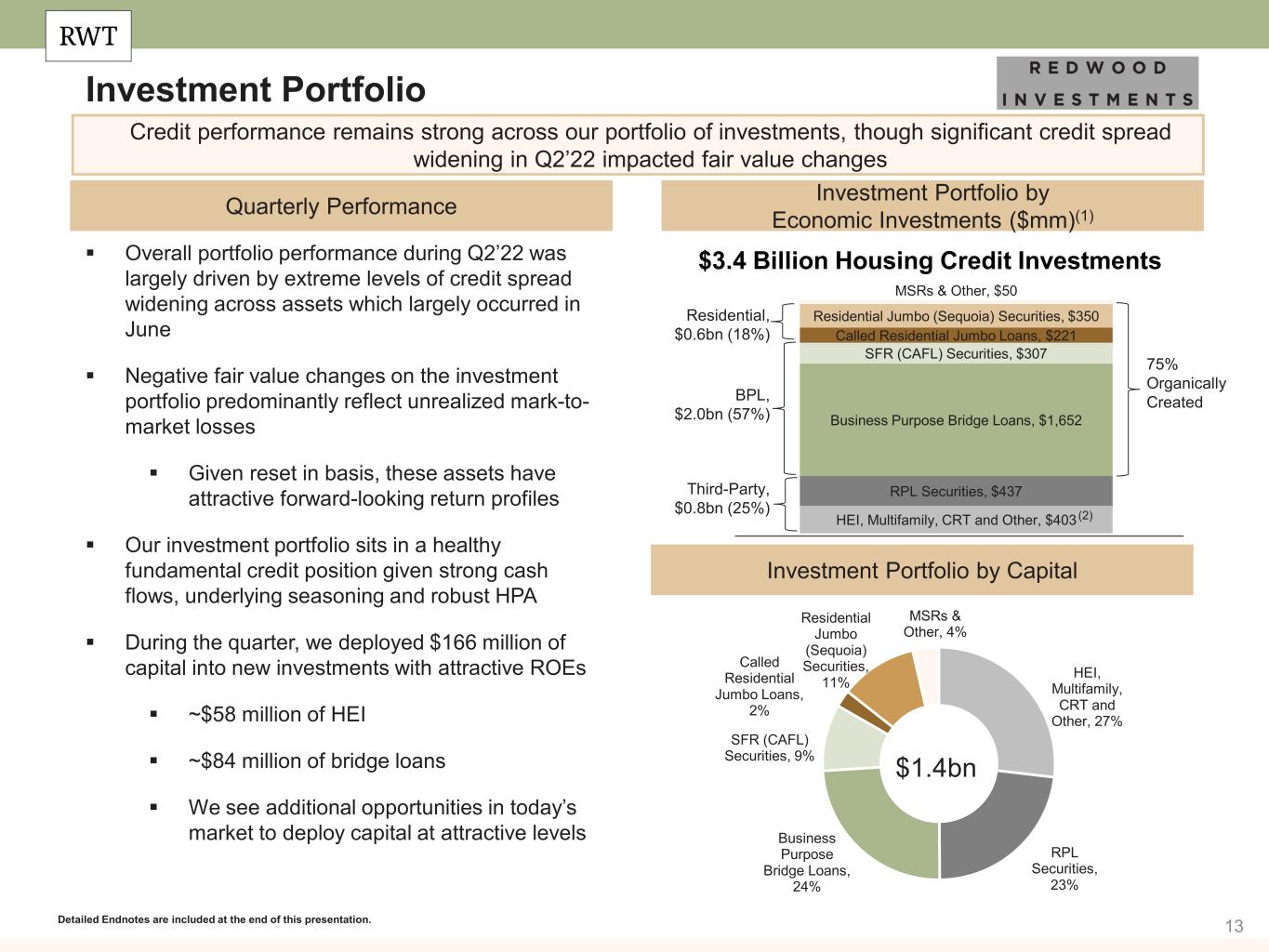

13 HEI, Multifamily, CRT and Other, $403 RPL Securities, $437 Business Purpose Bridge Loans, $1,652 SFR (CAFL) Securities, $307 Called Residential Jumbo Loans, $221 Residential Jumbo (Sequoia) Securities, $350 MSRs & Other, $50 Investment Portfolio Investment Portfolio by Economic Investments ($mm)(1)Quarterly Performance Overall portfolio performance during Q2’22 was largely driven by extreme levels of credit spread widening across assets which largely occurred in June Negative fair value changes on the investment portfolio predominantly reflect unrealized mark-to- market losses Given reset in basis, these assets have attractive forward-looking return profiles Our investment portfolio sits in a healthy fundamental credit position given strong cash flows, underlying seasoning and robust HPA During the quarter, we deployed $166 million of capital into new investments with attractive ROEs ~$58 million of HEI ~$84 million of bridge loans We see additional opportunities in today’s market to deploy capital at attractive levels $3.4 Billion Housing Credit Investments 75% Organically Created Detailed Endnotes are included at the end of this presentation. Credit performance remains strong across our portfolio of investments, though significant credit spread widening in Q2’22 impacted fair value changes Investment Portfolio by Capital $1.4bn Third-Party, $0.8bn (25%) BPL, $2.0bn (57%) Residential, $0.6bn (18%) HEI, Multifamily, CRT and Other, 27% RPL Securities, 23% Business Purpose Bridge Loans, 24% SFR (CAFL) Securities, 9% Called Residential Jumbo Loans, 2% Residential Jumbo (Sequoia) Securities, 11% MSRs & Other, 4% (2)

14 Investment Portfolio (Continued) Detailed Endnotes are included at the end of this presentation. Credit performance in our underlying portfolio remains stable and supported by significant levels of HPA, seasoning and other favorable credit characteristics During the second quarter, our investment portfolio continued to demonstrate strong performance across a range of credit metrics and we are not seeing notable deterioration in housing credit through Q2’22 We primarily target investments that have a sensitivity to housing credit risk, typically sourced through our operating businesses where we control the underwriting and review of underlying collateral Given the seasoned nature of our investments (particularly our SLST and SEMT securities), many of these investments are supported by substantial home price appreciation and borrower equity in the underlying homes Overall portfolio delinquencies have remained low and we have seen continued favorable loan resolutions Improving LTVs backed by increases in HPA support low overall losses Underlying Loan Seasoning (Years) Low Delinquencies (% 90+ DQ) 12.1 10.2 10.2 10.9 13.3 2.0 2.1 1.5 1.5 1.71.7 1.7 1.9 2.1 2.4 4.9 3.7 1.9 4.2 2.6 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 SLST (RPL) SEMT (Jumbo) CAFL (SFR) BridgeSeasoned assets that have lower sensitivity to changes in interest rates Delinquencies have remained low 15.6 4.2 2.6 1.0 SLST (RPL) SEMT (Jumbo) CAFL (SFR) Bridge Declining LTVs (HPA Adjusted LTVs(1)) 50.5 49.7 48.1 46.6 44.2 53.7 53.3 48.6 47.9 46.4 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 SLST (RPL) SEMT (Jumbo) Assets are supported by elevated levels of HPA that are well in excess of modeled expectations

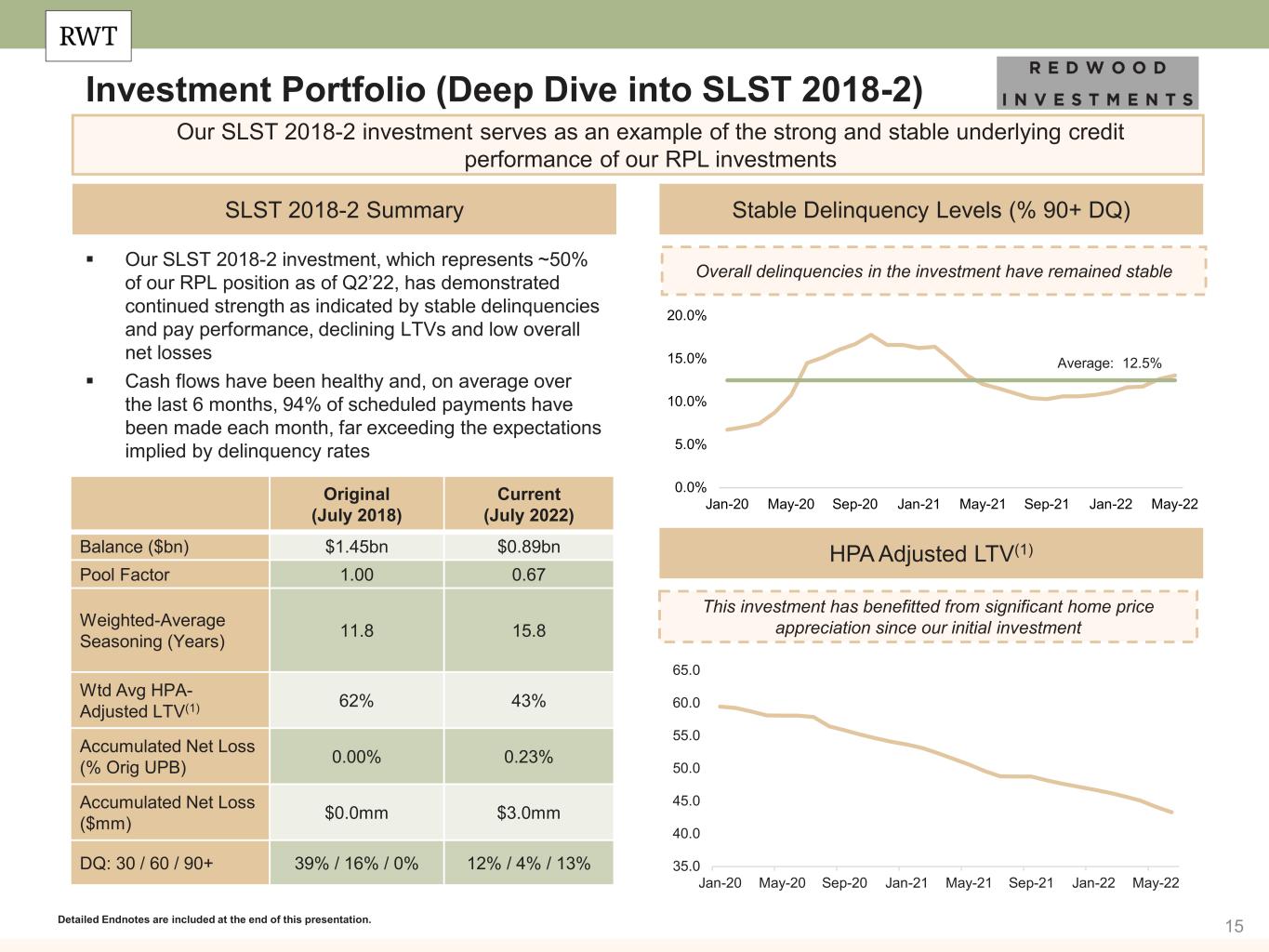

15 Investment Portfolio (Deep Dive into SLST 2018-2) Detailed Endnotes are included at the end of this presentation. Our SLST 2018-2 investment serves as an example of the strong and stable underlying credit performance of our RPL investments Original (July 2018) Current (July 2022) Balance ($bn) $1.45bn $0.89bn Pool Factor 1.00 0.67 Weighted-Average Seasoning (Years) 11.8 15.8 Wtd Avg HPA- Adjusted LTV(1) 62% 43% Accumulated Net Loss (% Orig UPB) 0.00% 0.23% Accumulated Net Loss ($mm) $0.0mm $3.0mm DQ: 30 / 60 / 90+ 39% / 16% / 0% 12% / 4% / 13% SLST 2018-2 Summary Our SLST 2018-2 investment, which represents ~50% of our RPL position as of Q2’22, has demonstrated continued strength as indicated by stable delinquencies and pay performance, declining LTVs and low overall net losses Cash flows have been healthy and, on average over the last 6 months, 94% of scheduled payments have been made each month, far exceeding the expectations implied by delinquency rates Stable Delinquency Levels (% 90+ DQ) HPA Adjusted LTV(1) 35.0 40.0 45.0 50.0 55.0 60.0 65.0 Jan-20 May-20 Sep-20 Jan-21 May-21 Sep-21 Jan-22 May-22 This investment has benefitted from significant home price appreciation since our initial investment Overall delinquencies in the investment have remained stable 0.0% 5.0% 10.0% 15.0% 20.0% Jan-20 May-20 Sep-20 Jan-21 May-21 Sep-21 Jan-22 May-22 Average: 12.5%

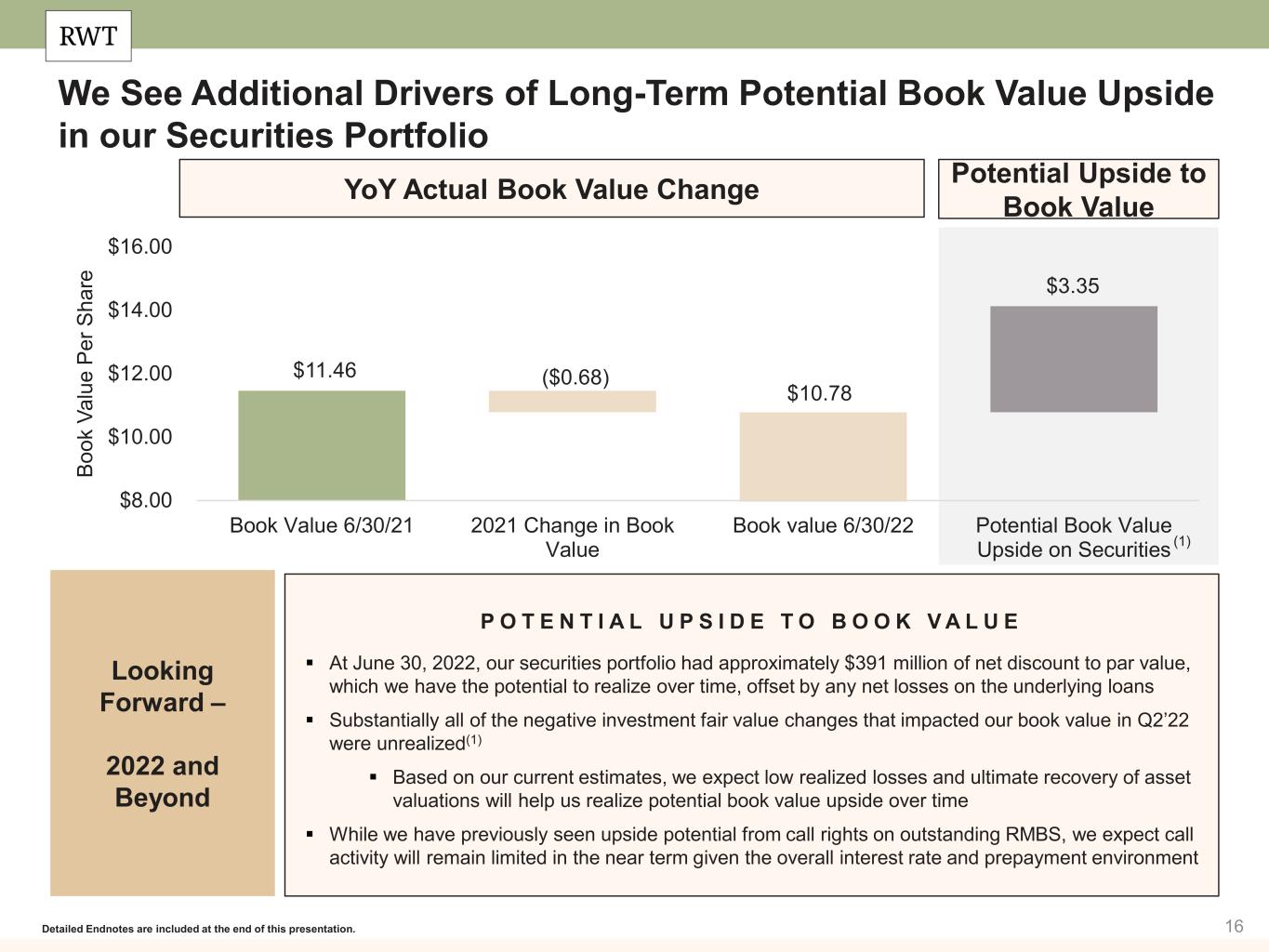

16 YoY Actual Book Value Change Detailed Endnotes are included at the end of this presentation. Potential Upside to Book Value P O T E N T I A L U P S I D E T O B O O K V A L U E At June 30, 2022, our securities portfolio had approximately $391 million of net discount to par value, which we have the potential to realize over time, offset by any net losses on the underlying loans Substantially all of the negative investment fair value changes that impacted our book value in Q2’22 were unrealized(1) Based on our current estimates, we expect low realized losses and ultimate recovery of asset valuations will help us realize potential book value upside over time While we have previously seen upside potential from call rights on outstanding RMBS, we expect call activity will remain limited in the near term given the overall interest rate and prepayment environment Looking Forward – 2022 and Beyond We See Additional Drivers of Long-Term Potential Book Value Upside in our Securities Portfolio $11.46 ($0.68) $10.78 $3.35 $8.00 $10.00 $12.00 $14.00 $16.00 Book Value 6/30/21 2021 Change in Book Value Book value 6/30/22 Potential Book Value Upside on Securities Bo ok V al ue P er S ha re (1)

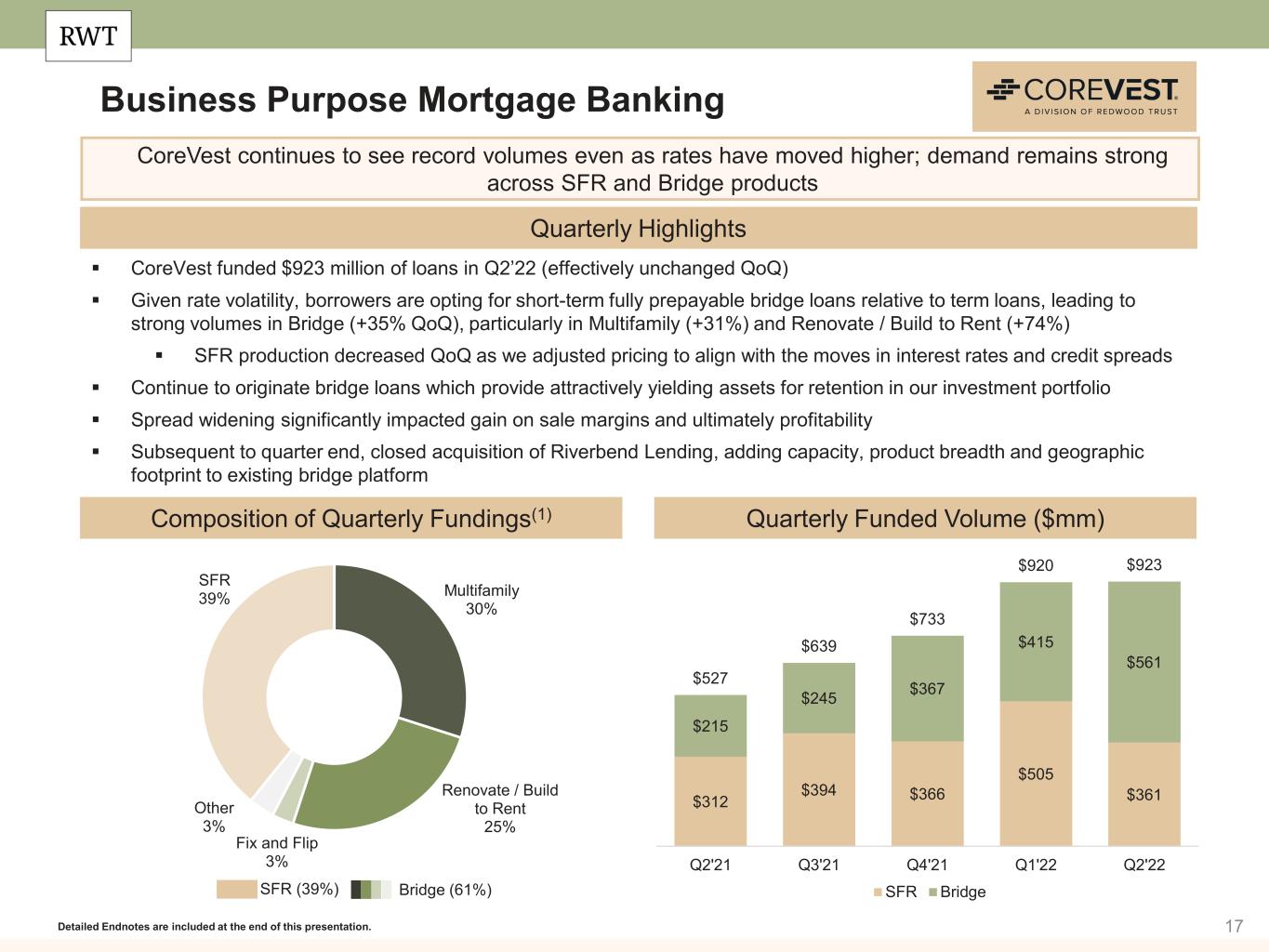

17 $312 $394 $366 $505 $361 $215 $245 $367 $415 $561 $527 $639 $733 $920 $923 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 SFR Bridge Business Purpose Mortgage Banking Quarterly Highlights Composition of Quarterly Fundings(1) Detailed Endnotes are included at the end of this presentation. CoreVest continues to see record volumes even as rates have moved higher; demand remains strong across SFR and Bridge products Quarterly Funded Volume ($mm) SFR (39%) Bridge (61%) Multifamily 30% Renovate / Build to Rent 25% Fix and Flip 3% Other 3% SFR 39% CoreVest funded $923 million of loans in Q2’22 (effectively unchanged QoQ) Given rate volatility, borrowers are opting for short-term fully prepayable bridge loans relative to term loans, leading to strong volumes in Bridge (+35% QoQ), particularly in Multifamily (+31%) and Renovate / Build to Rent (+74%) SFR production decreased QoQ as we adjusted pricing to align with the moves in interest rates and credit spreads Continue to originate bridge loans which provide attractively yielding assets for retention in our investment portfolio Spread widening significantly impacted gain on sale margins and ultimately profitability Subsequent to quarter end, closed acquisition of Riverbend Lending, adding capacity, product breadth and geographic footprint to existing bridge platform

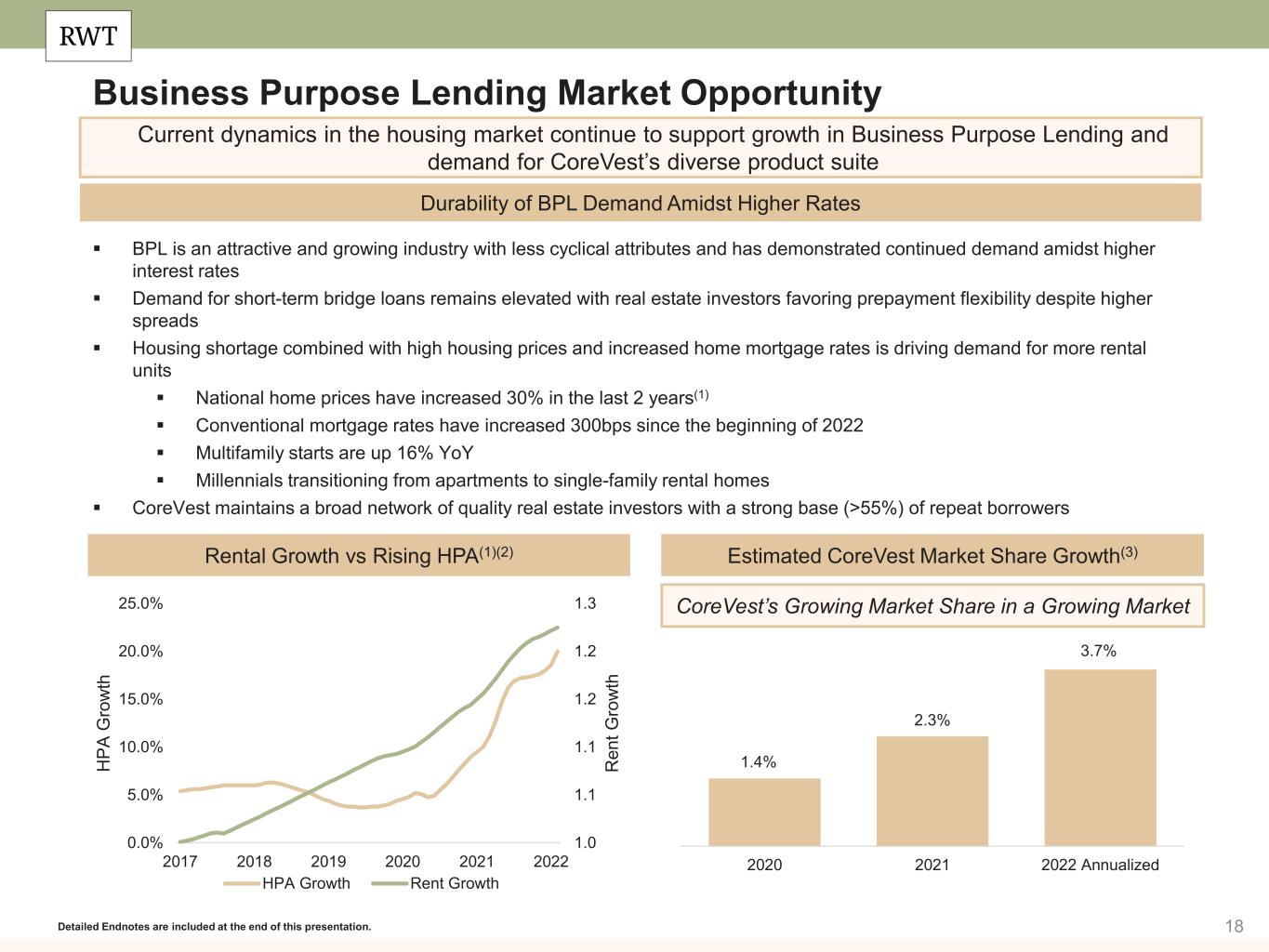

18 Business Purpose Lending Market Opportunity Durability of BPL Demand Amidst Higher Rates Estimated CoreVest Market Share Growth(3) Detailed Endnotes are included at the end of this presentation. Current dynamics in the housing market continue to support growth in Business Purpose Lending and demand for CoreVest’s diverse product suite Rental Growth vs Rising HPA(1)(2) CoreVest’s Growing Market Share in a Growing Market BPL is an attractive and growing industry with less cyclical attributes and has demonstrated continued demand amidst higher interest rates Demand for short-term bridge loans remains elevated with real estate investors favoring prepayment flexibility despite higher spreads Housing shortage combined with high housing prices and increased home mortgage rates is driving demand for more rental units National home prices have increased 30% in the last 2 years(1) Conventional mortgage rates have increased 300bps since the beginning of 2022 Multifamily starts are up 16% YoY Millennials transitioning from apartments to single-family rental homes CoreVest maintains a broad network of quality real estate investors with a strong base (>55%) of repeat borrowers 1.4% 2.3% 3.7% 2020 2021 2022 Annualized 1.0 1.1 1.1 1.2 1.2 1.3 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2017 2018 2019 2020 2021 2022 R en t G ro w th H PA G ro w th HPA Growth Rent Growth

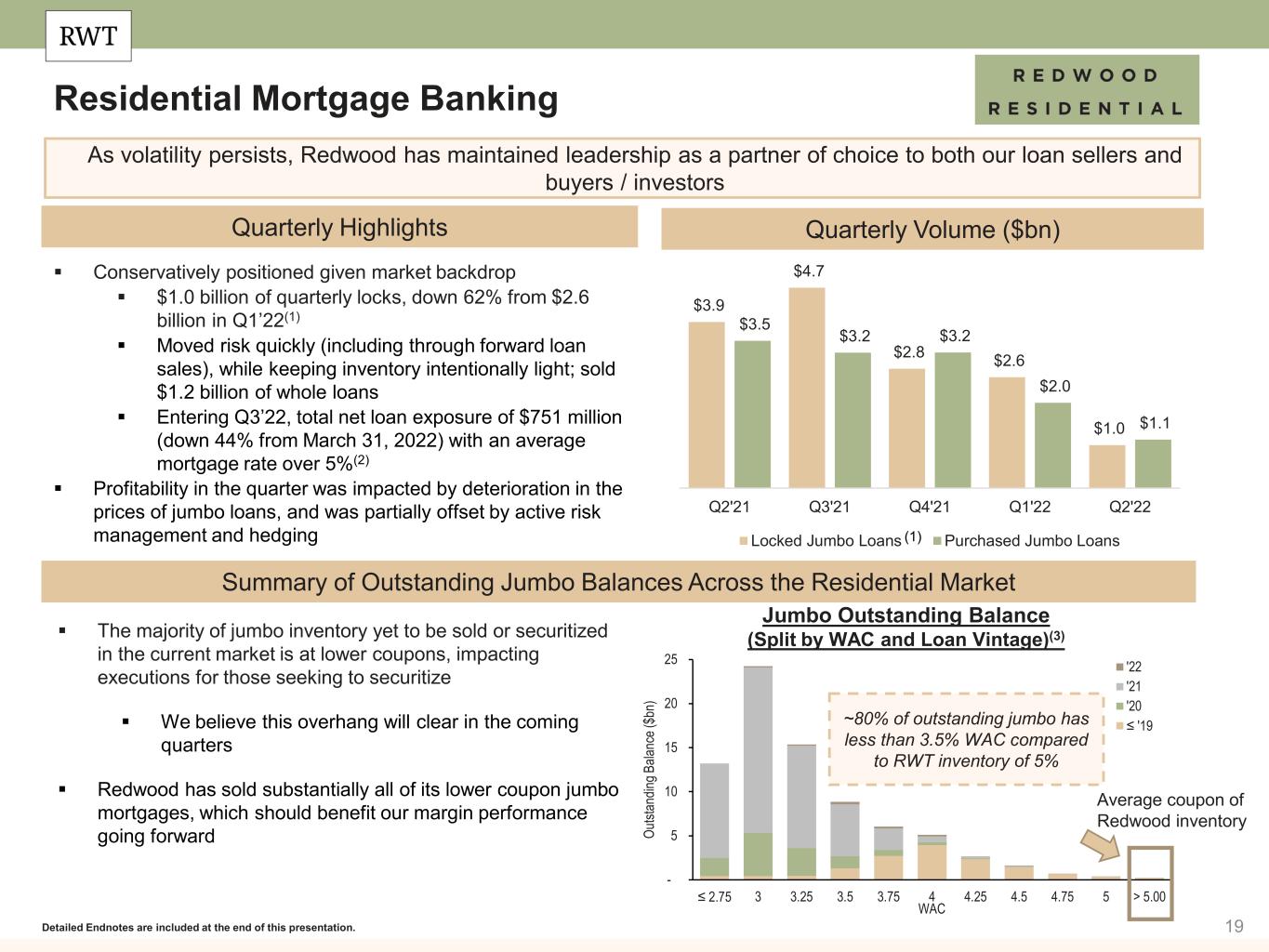

19 - 5 10 15 20 25 ≤ 2.75 3 3.25 3.5 3.75 4 4.25 4.5 4.75 5 > 5.00 Ou tst an din g B ala nc e ( $b n) WAC '22 '21 '20 ≤ '19 Conservatively positioned given market backdrop $1.0 billion of quarterly locks, down 62% from $2.6 billion in Q1’22(1) Moved risk quickly (including through forward loan sales), while keeping inventory intentionally light; sold $1.2 billion of whole loans Entering Q3’22, total net loan exposure of $751 million (down 44% from March 31, 2022) with an average mortgage rate over 5%(2) Profitability in the quarter was impacted by deterioration in the prices of jumbo loans, and was partially offset by active risk management and hedging Residential Mortgage Banking Quarterly Volume ($bn) Summary of Outstanding Jumbo Balances Across the Residential Market Quarterly Highlights Detailed Endnotes are included at the end of this presentation. As volatility persists, Redwood has maintained leadership as a partner of choice to both our loan sellers and buyers / investors (1) $3.9 $4.7 $2.8 $2.6 $1.0 $3.5 $3.2 $3.2 $2.0 $1.1 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Locked Jumbo Loans Purchased Jumbo Loans The majority of jumbo inventory yet to be sold or securitized in the current market is at lower coupons, impacting executions for those seeking to securitize We believe this overhang will clear in the coming quarters Redwood has sold substantially all of its lower coupon jumbo mortgages, which should benefit our margin performance going forward ~80% of outstanding jumbo has less than 3.5% WAC compared to RWT inventory of 5% Jumbo Outstanding Balance (Split by WAC and Loan Vintage)(3) Average coupon of Redwood inventory

20 Industry Leading Distribution Platform is a Clear Differentiator Business Purpose Mortgage Banking (CAFL) Residential Mortgage Banking (Sequoia) Detailed Endnotes are included at the end of this presentation. Distribution channels were challenged during Q2’22 as investor demand slowed in light of ongoing volatility $ millions $ millions $276 $606 $304 $563 $202 $332 $276 $606 $506 $332 $563 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Securitizations Sales $1,530 $449 $1,335 $687 $1,795 $2,361 $1,457 $1,827 $1,238 $3,325 $2,810 $2,792 $2,515 $1,238 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Securitizations Sales Redwood Distribution Overview Industry leader for our speed, innovation, quality and ability to successfully distribute loans Various distribution channels support our execution (securitizations, whole loan sales and private structured transactions) Track record of whole loan sales to repeat investors improves liquidity and diversity of distribution outlets across market environments Recent Distribution Activity Distribution channels in Q2’22 were challenged amidst market volatility In Residential Mortgage Banking, we focused on moving risk and selling our lower coupon inventory expediently to whole loan investors In Business Purpose Mortgage Banking, we successfully executed two securitizations (one SFR and one bridge) As markets normalize, we expect securitization activity to pick up, particularly as banks seek a place to invest deposits

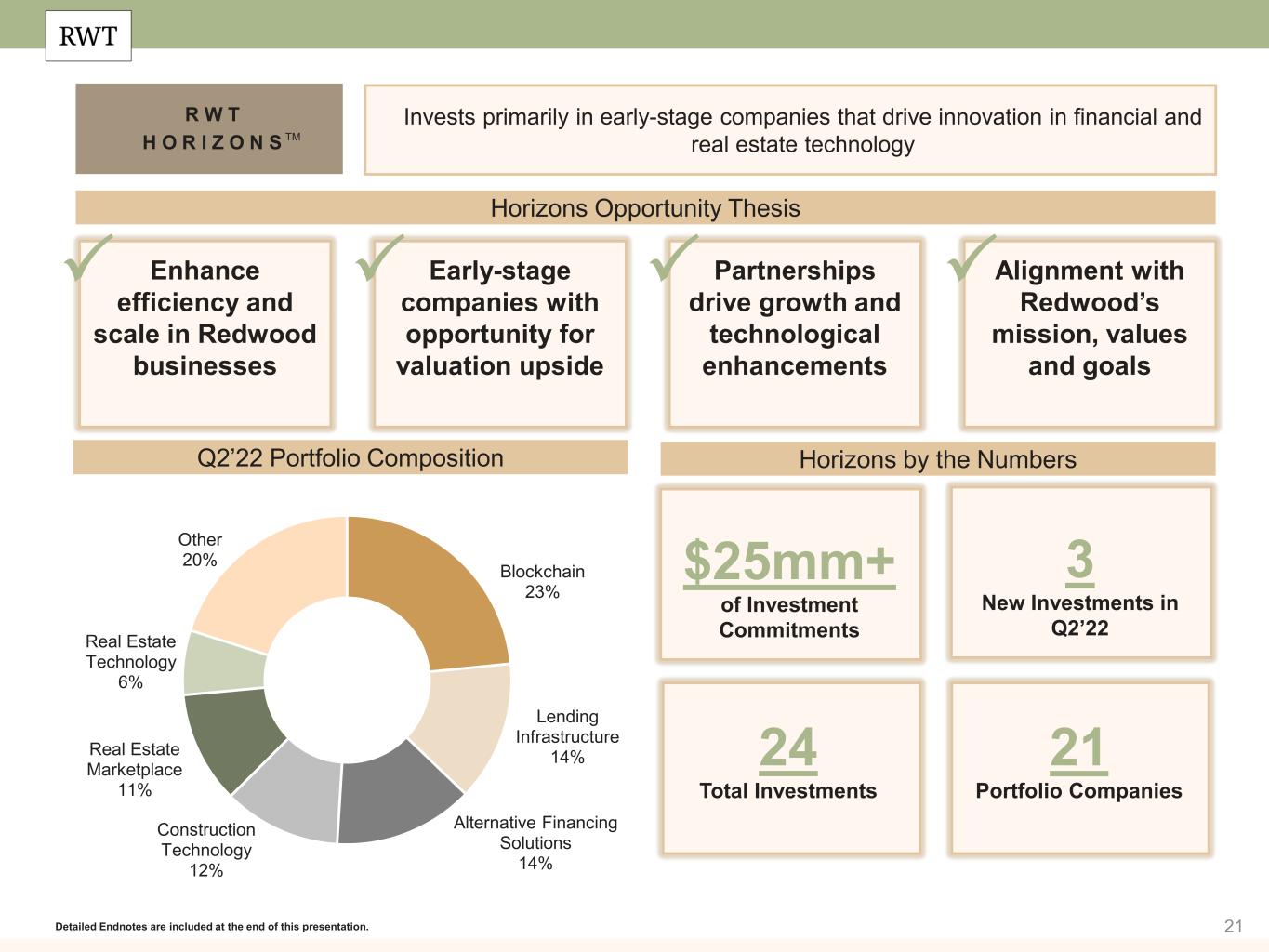

21 R W T H O R I Z O N S Horizons by the Numbers Detailed Endnotes are included at the end of this presentation. Invests primarily in early-stage companies that drive innovation in financial and real estate technologyTM Horizons Opportunity Thesis Enhance efficiency and scale in Redwood businesses Early-stage companies with opportunity for valuation upside Partnerships drive growth and technological enhancements Alignment with Redwood’s mission, values and goals $25mm+ of Investment Commitments 24 Total Investments 21 Portfolio Companies Q2’22 Portfolio Composition 3 New Investments in Q2’22 Blockchain 23% Lending Infrastructure 14% Alternative Financing Solutions 14% Construction Technology 12% Real Estate Marketplace 11% Real Estate Technology 6% Other 20%

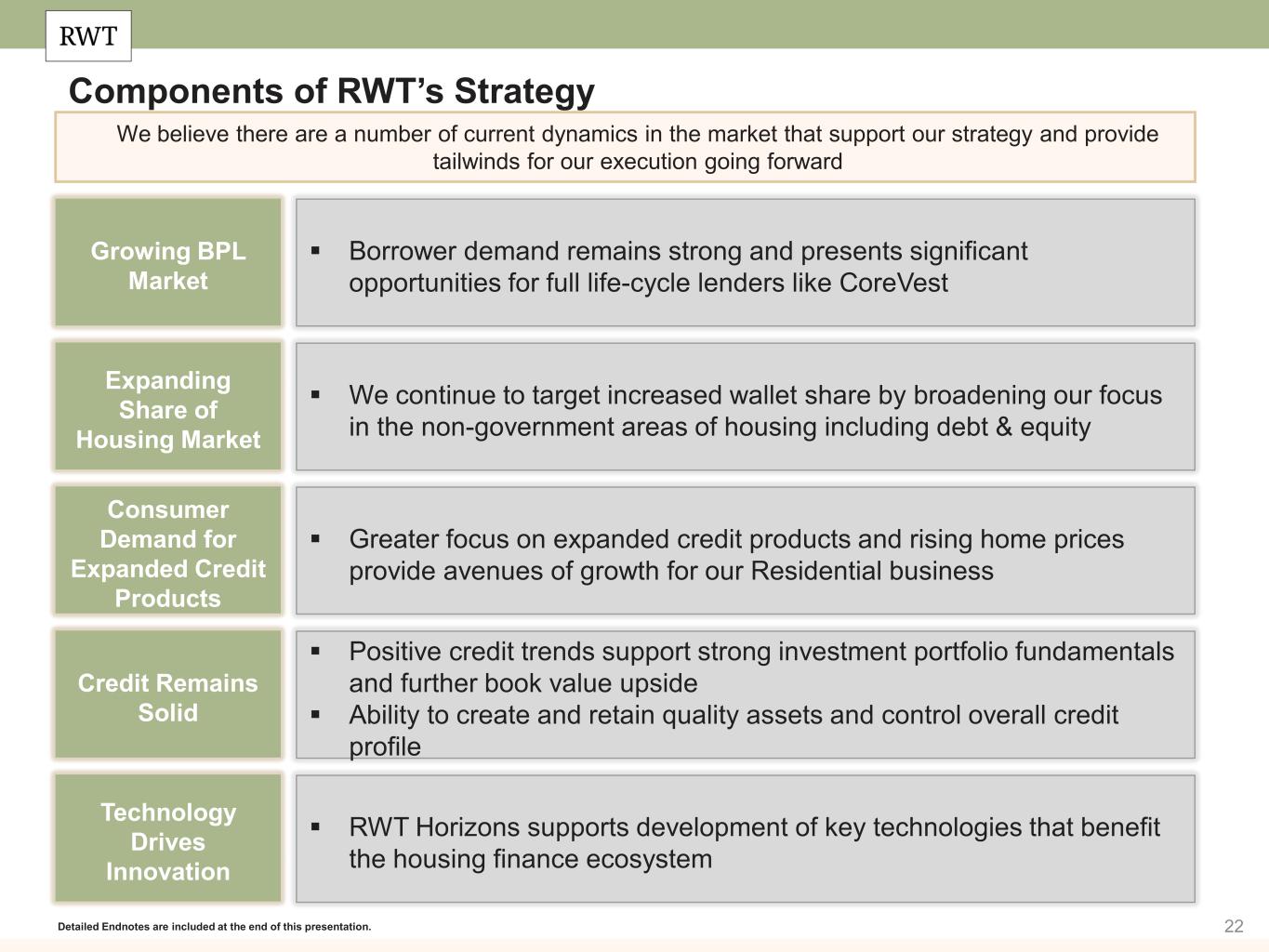

22 Components of RWT’s Strategy Expanding Share of Housing Market Consumer Demand for Expanded Credit Products Technology Drives Innovation Credit Remains Solid We continue to target increased wallet share by broadening our focus in the non-government areas of housing including debt & equity Greater focus on expanded credit products and rising home prices provide avenues of growth for our Residential business Positive credit trends support strong investment portfolio fundamentals and further book value upside Ability to create and retain quality assets and control overall credit profile RWT Horizons supports development of key technologies that benefit the housing finance ecosystem Detailed Endnotes are included at the end of this presentation. Growing BPL Market Borrower demand remains strong and presents significant opportunities for full life-cycle lenders like CoreVest We believe there are a number of current dynamics in the market that support our strategy and provide tailwinds for our execution going forward

23 Financial Results

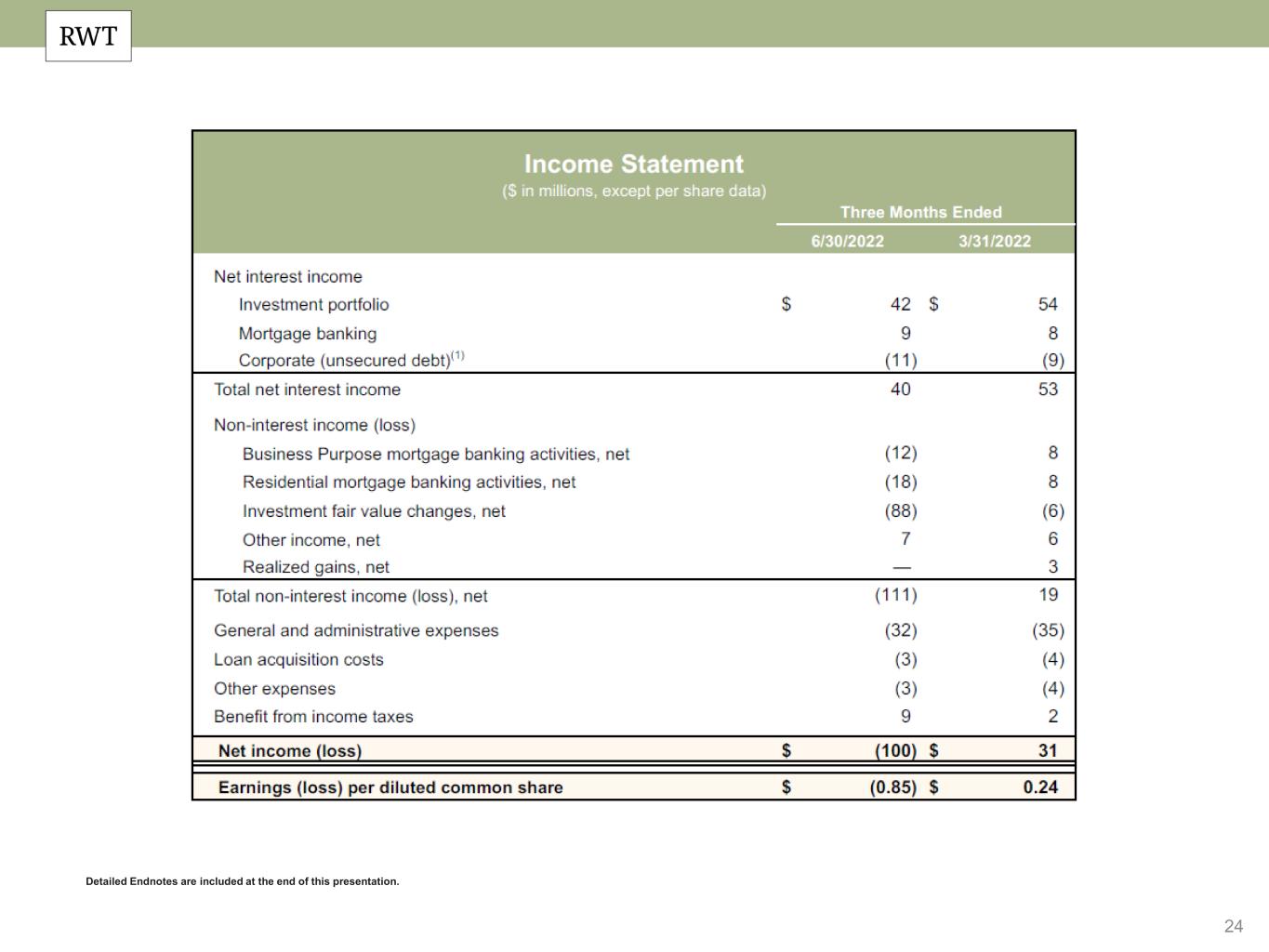

24 Detailed Endnotes are included at the end of this presentation.

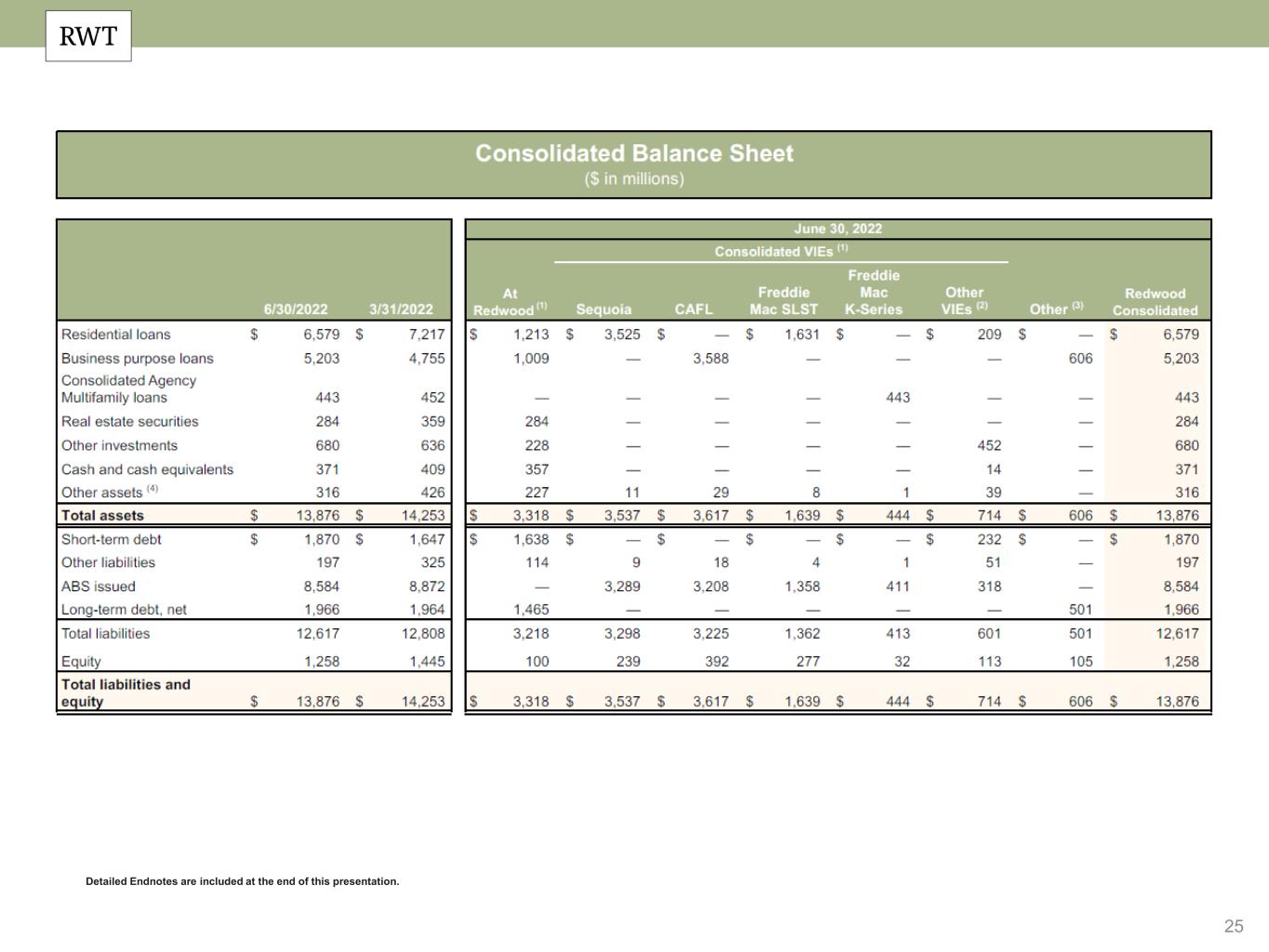

25 Detailed Endnotes are included at the end of this presentation.

26 Detailed Endnotes are included at the end of this presentation.

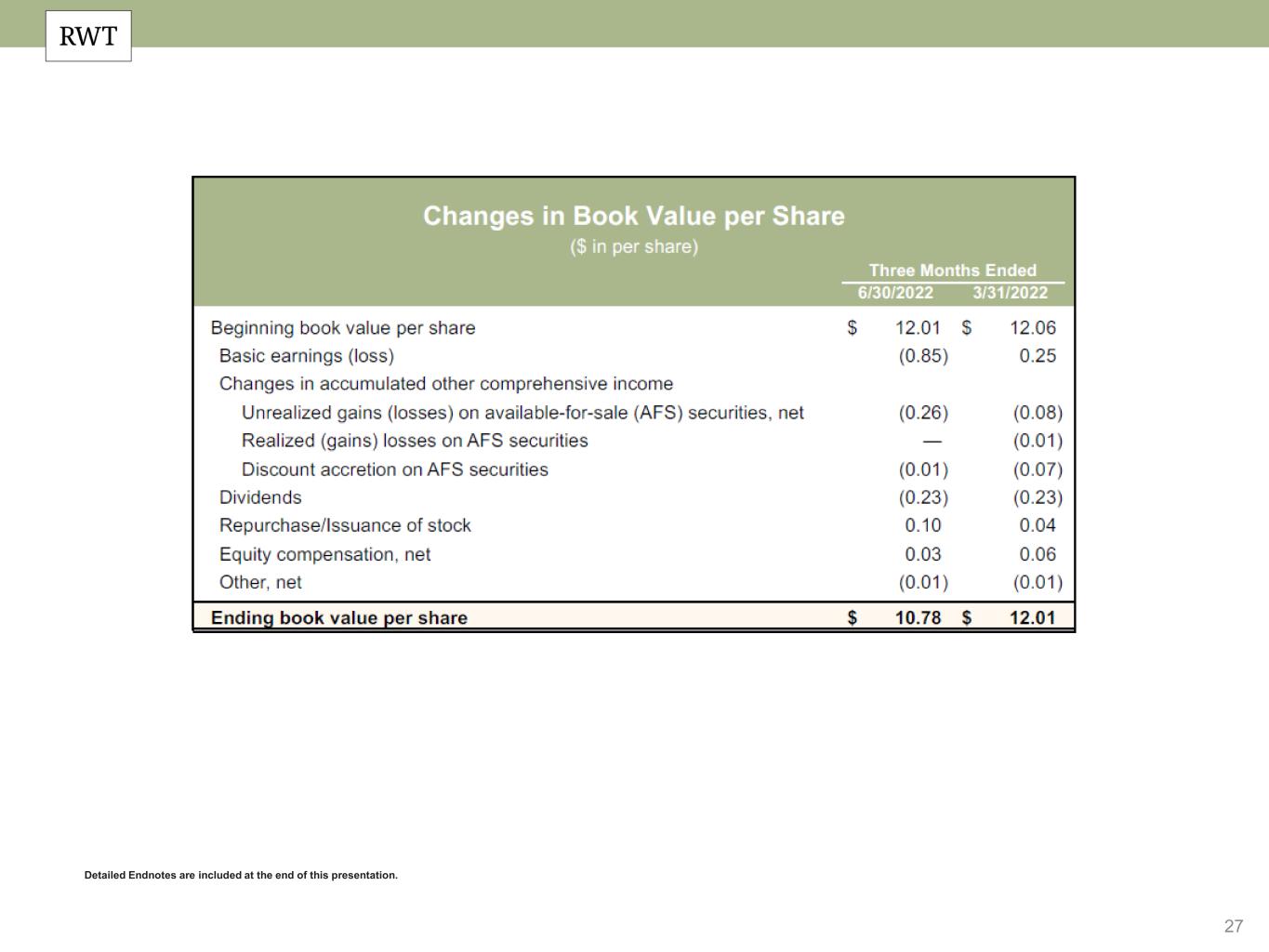

27 (1) Detailed Endnotes are included at the end of this presentation.

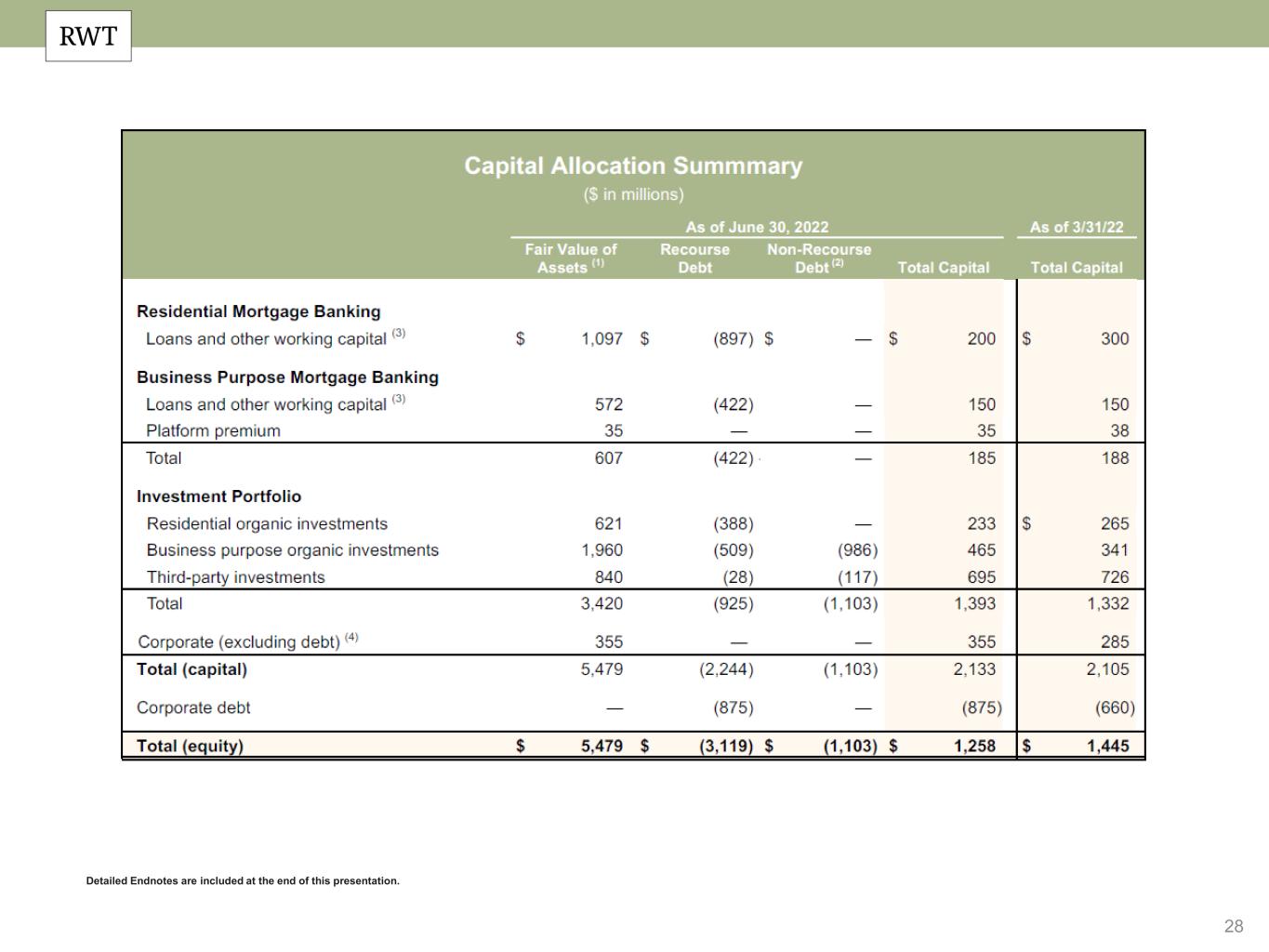

28 Detailed Endnotes are included at the end of this presentation.

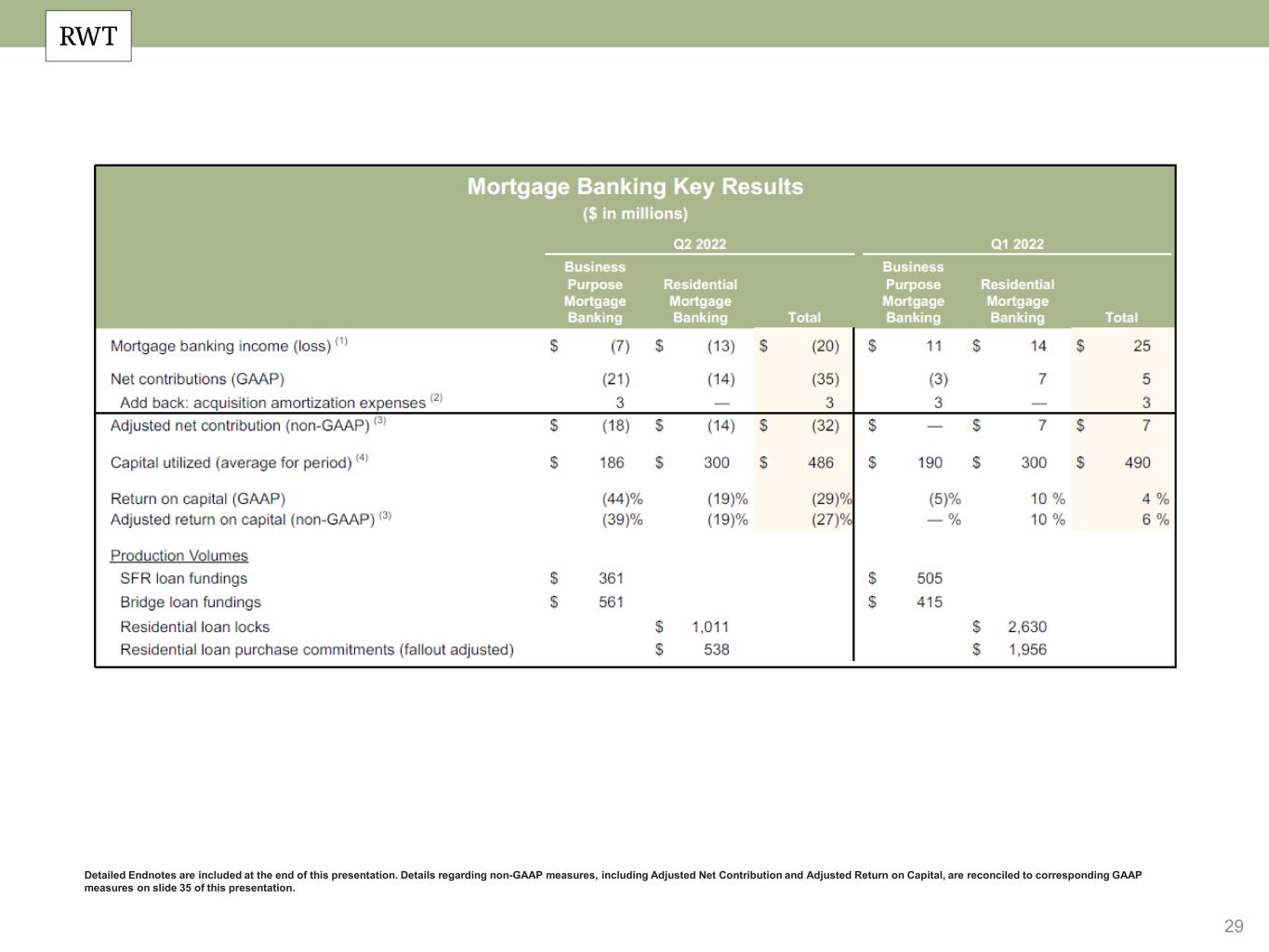

29 Detailed Endnotes are included at the end of this presentation. Details regarding non-GAAP measures, including Adjusted Net Contribution and Adjusted Return on Capital, are reconciled to corresponding GAAP measures on slide 35 of this presentation.

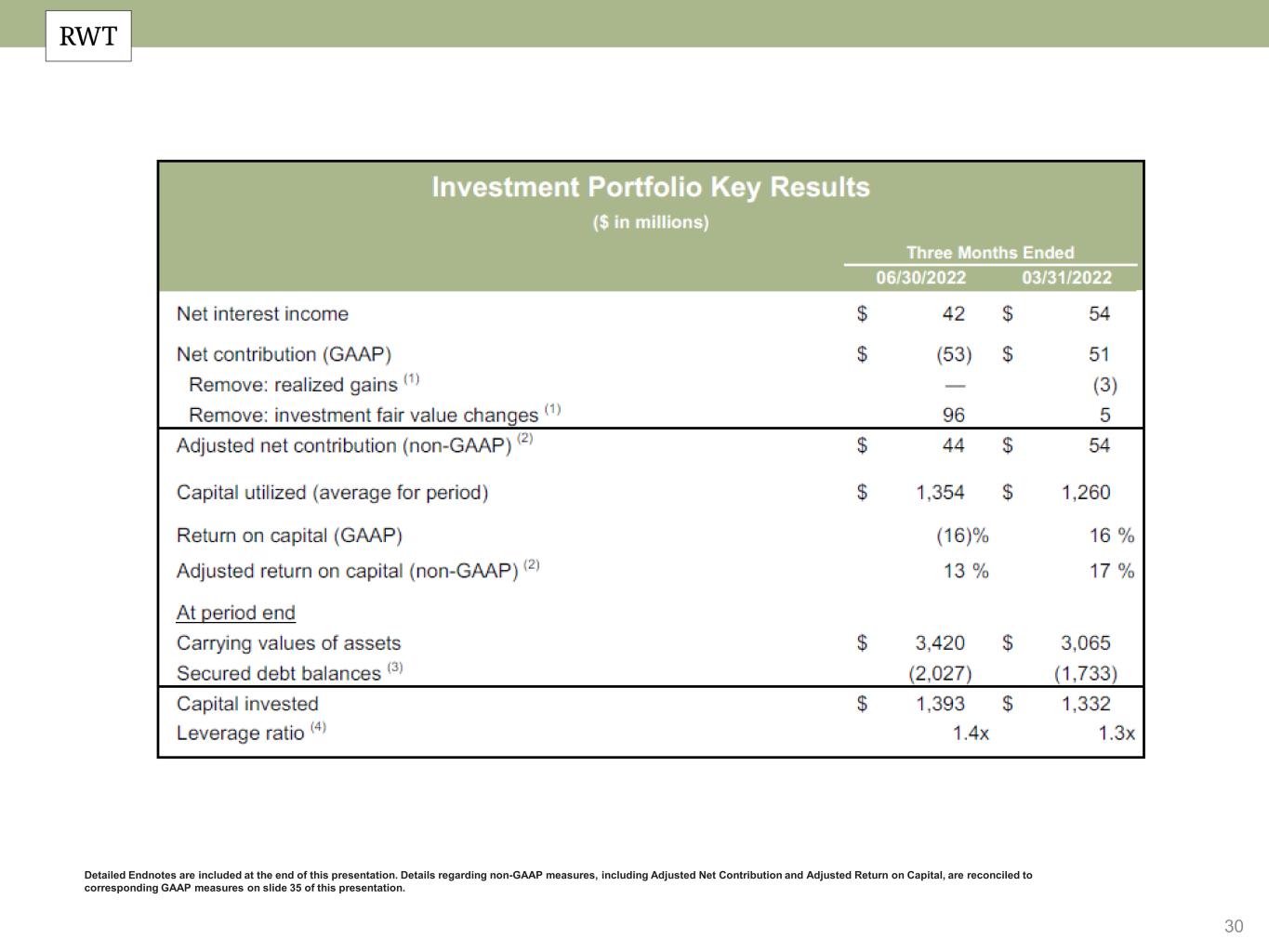

30 Detailed Endnotes are included at the end of this presentation. Details regarding non-GAAP measures, including Adjusted Net Contribution and Adjusted Return on Capital, are reconciled to corresponding GAAP measures on slide 35 of this presentation.

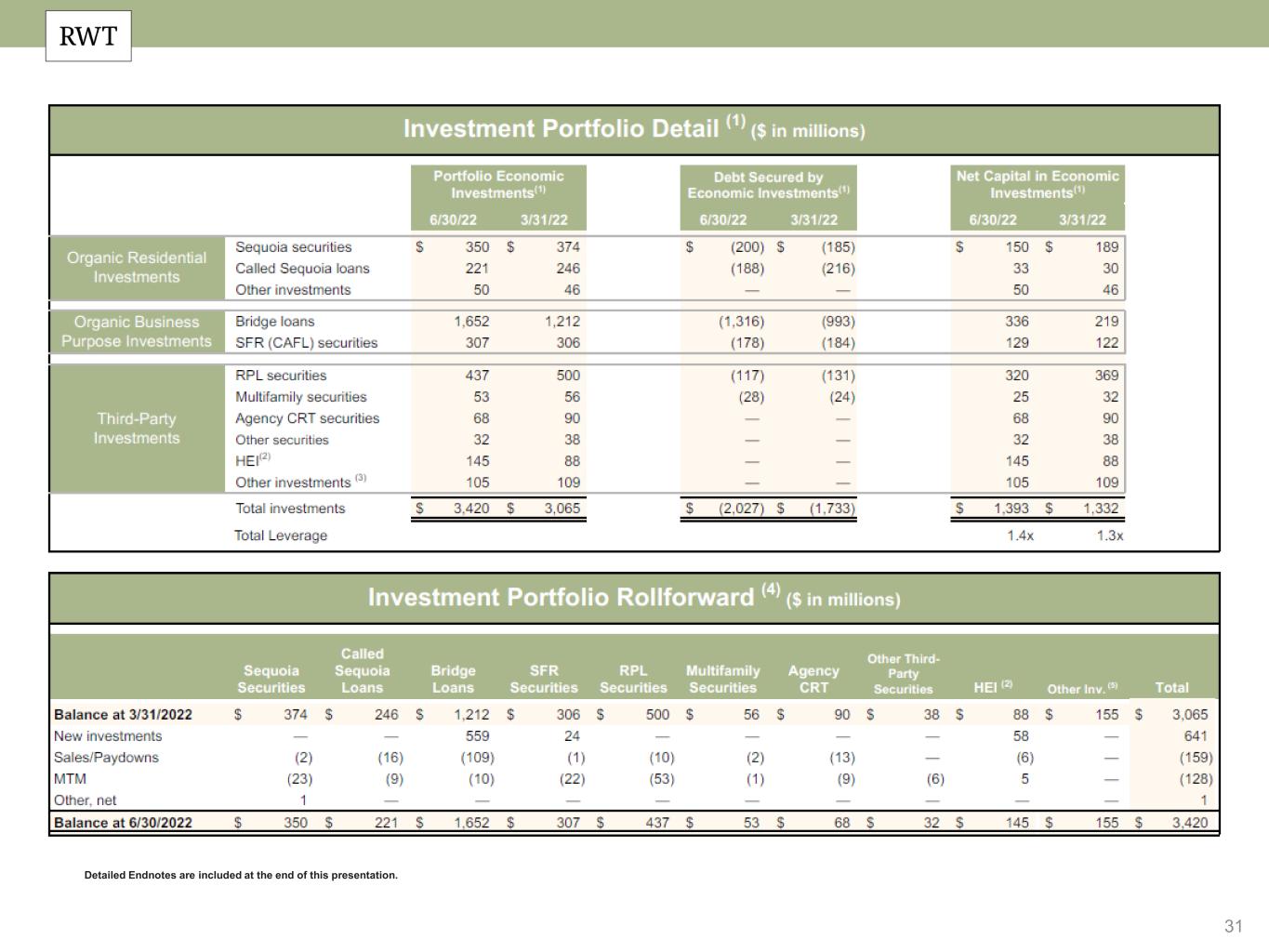

31 Detailed Endnotes are included at the end of this presentation.

32 Detailed Endnotes are included at the end of this presentation.

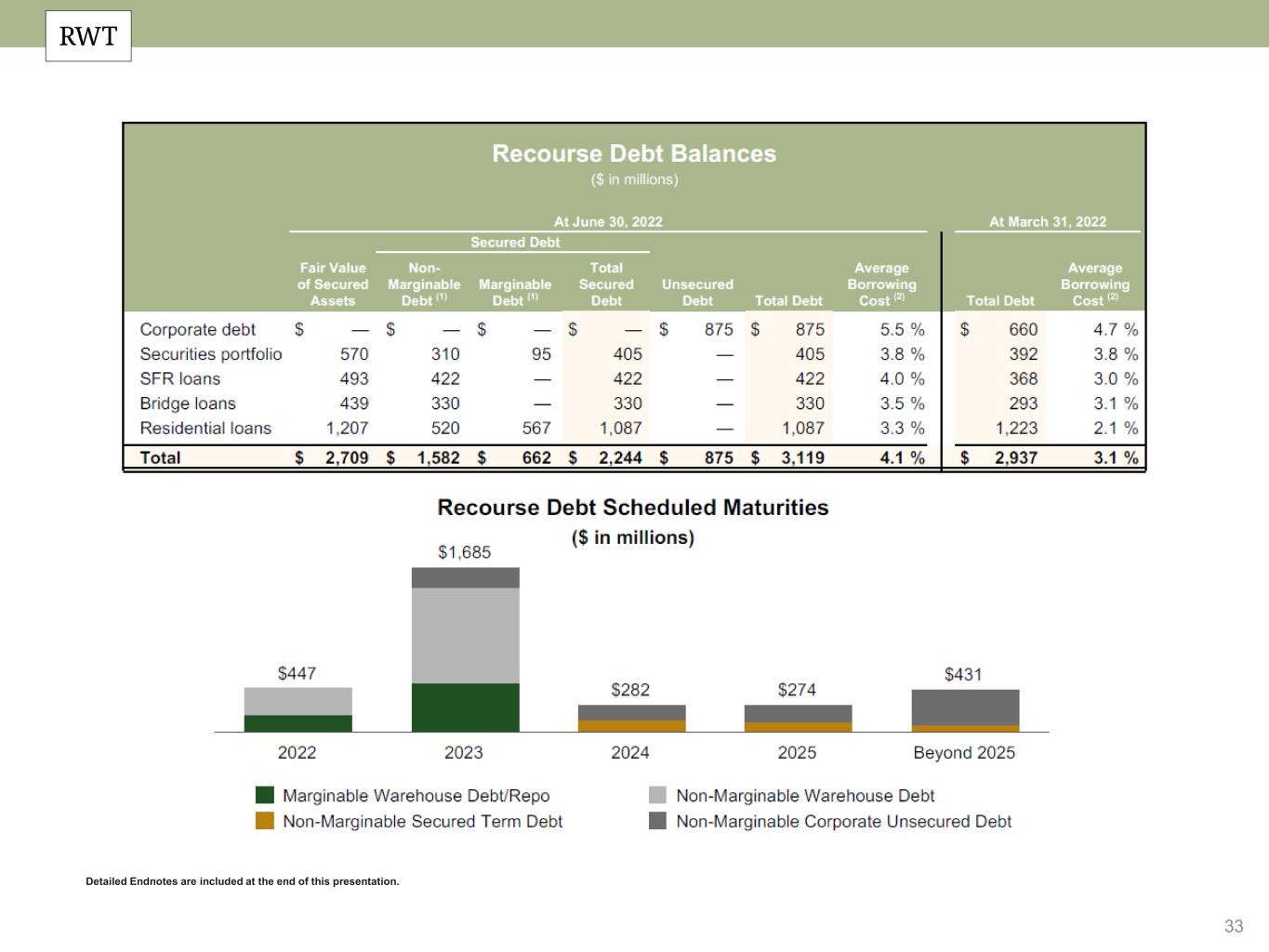

33 Detailed Endnotes are included at the end of this presentation.

34 Endnotes

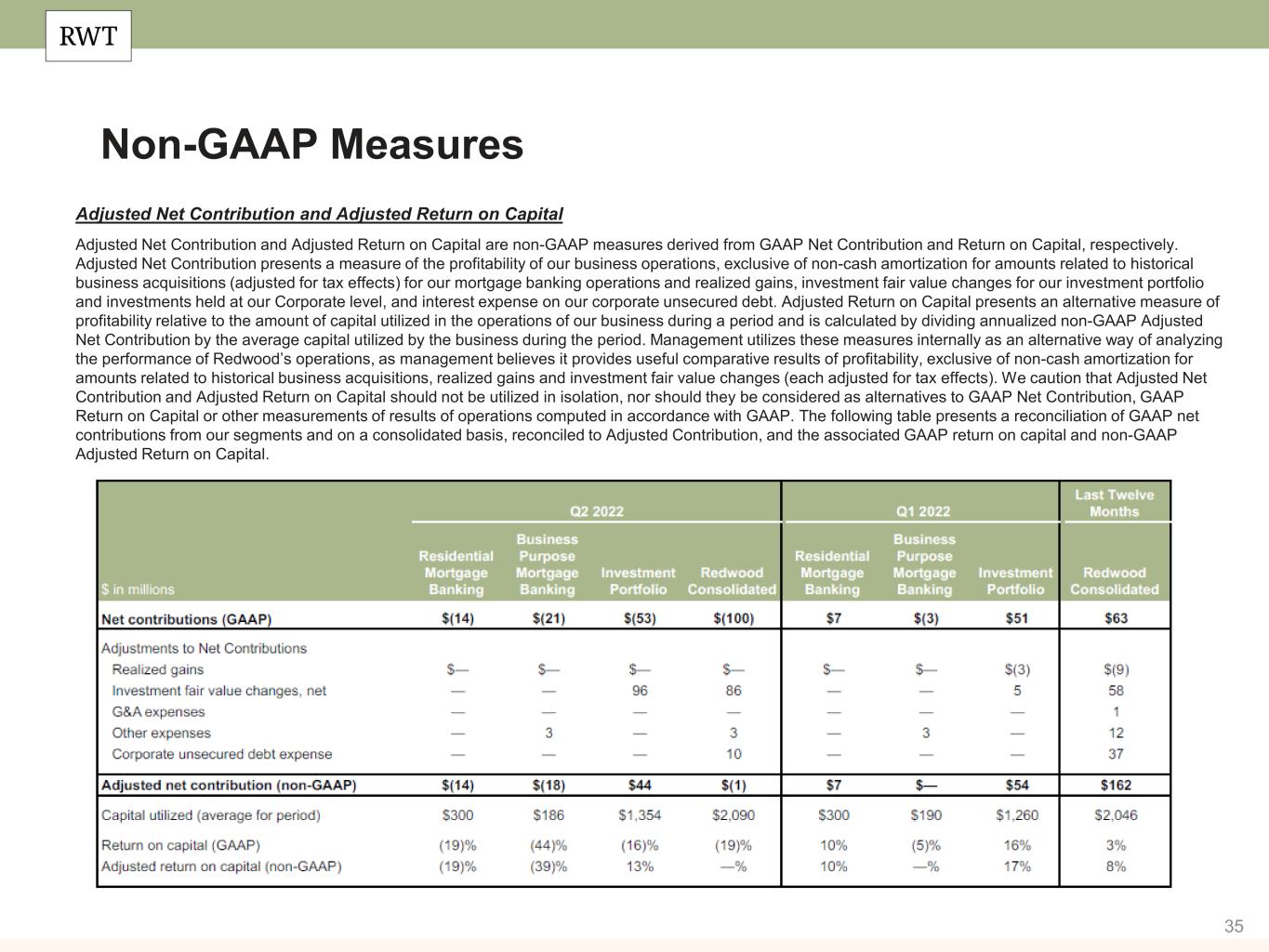

35 Non-GAAP Measures Adjusted Net Contribution and Adjusted Return on Capital Adjusted Net Contribution and Adjusted Return on Capital are non-GAAP measures derived from GAAP Net Contribution and Return on Capital, respectively. Adjusted Net Contribution presents a measure of the profitability of our business operations, exclusive of non-cash amortization for amounts related to historical business acquisitions (adjusted for tax effects) for our mortgage banking operations and realized gains, investment fair value changes for our investment portfolio and investments held at our Corporate level, and interest expense on our corporate unsecured debt. Adjusted Return on Capital presents an alternative measure of profitability relative to the amount of capital utilized in the operations of our business during a period and is calculated by dividing annualized non-GAAP Adjusted Net Contribution by the average capital utilized by the business during the period. Management utilizes these measures internally as an alternative way of analyzing the performance of Redwood’s operations, as management believes it provides useful comparative results of profitability, exclusive of non-cash amortization for amounts related to historical business acquisitions, realized gains and investment fair value changes (each adjusted for tax effects). We caution that Adjusted Net Contribution and Adjusted Return on Capital should not be utilized in isolation, nor should they be considered as alternatives to GAAP Net Contribution, GAAP Return on Capital or other measurements of results of operations computed in accordance with GAAP. The following table presents a reconciliation of GAAP net contributions from our segments and on a consolidated basis, reconciled to Adjusted Contribution, and the associated GAAP return on capital and non-GAAP Adjusted Return on Capital. $ in millions

36 Slide 3 (Redwood’s Mission is to Help Make Quality Housing, Whether Rented or Owned, Accessible to all American Households) Source: Company financial data as of June 30, 2022 unless otherwise noted. Market data per Bloomberg as of June 30, 2022. Slide 4 (Redwood Operates Across Three Complementary Business Lines) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Allocated capital includes working capital and platform premium for mortgage banking operations and all investments net of associated debt for investment portfolio. Note, capital allocation excludes corporate capital and RWT Horizons. Further detail on the components of allocated capital is included on slide 28 of this presentation. 2. Annualized Addressable Market Opportunity. Residential Mortgage Banking represents Q1’22 volumes of Jumbo and Expanded Credit origination annualized (Source: Inside Mortgage Finance as of May 19, 2022). Business Purpose Mortgage Banking based on combined opportunity for SFR and Multifamily Rental. SFR based on June 2022 data and potential financing opportunity for SFR of $140 billion over 3-4 years (Source: John Burns Real Estate Consulting, LLC and internal Company estimates). Multifamily based on Freddie Mac 2022 multifamily origination estimate of $450 billion and applying the estimated percentage from latest available FNMA data for origination by non-traditional multifamily lenders. Investment Portfolio represents 2022 estimated investment opportunities across PLS Subs, CRT, HEI, MF, Bridge and CAFL SFR investments (Source: internal Company estimates). Endnotes Slide 5 (Q2’22 Financial Performance) Source: Company financial data as of June 30, 2022 unless otherwise noted. Market data per Bloomberg as of June 30, 2022. 1. Total economic return is based on the periodic change in GAAP book value per common share plus dividends declared per common share during the period, divided by beginning period GAAP book value per common share. 2. Indicative dividend yield based on RWT closing stock price of $7.71 as of June 30, 2022. 3. Allocated capital includes working capital and platform premium for mortgage banking operations and all investments net of associated debt for investment portfolio. Capital allocation excludes corporate capital and RWT Horizons. Further detail on the components of allocated capital is included on slide 28 of this presentation. 4. Adjusted Return on Capital is a non-GAAP metric. Please refer to Non- GAAP Measures on slide 35 for more information. 5. Recourse leverage ratio is defined as recourse debt at Redwood exclusive of other liabilities, divided by tangible stockholders' equity. Recourse debt excludes $9.3 billion of consolidated securitization debt (ABS issued and servicer advance financing) and other debt that is non-recourse to Redwood, and tangible stockholders' equity excludes $35 million of intangible assets. Slide 6 (Summary of Q2’22 Market Drivers and Performance) 1. Total net loan exposure represents the sum of $1.0 billion of loans held on balance sheet and $0.3 billion of loans identified for purchase (locked loans not yet purchased), less $0.5 billion of loans subject to forward sale commitments, each at June 30, 2022. 2. Based on our current estimates, we expect low realized losses and ultimate recovery of asset resolutions will help Redwood realize positive fair value changes for its investment portfolio over time. There are several factors that may impact our ability to realize all, or a portion, of these positive fair value changes which many be out of our control, including credit performance and prepayment speeds. Actual fair value changes may differ materially.

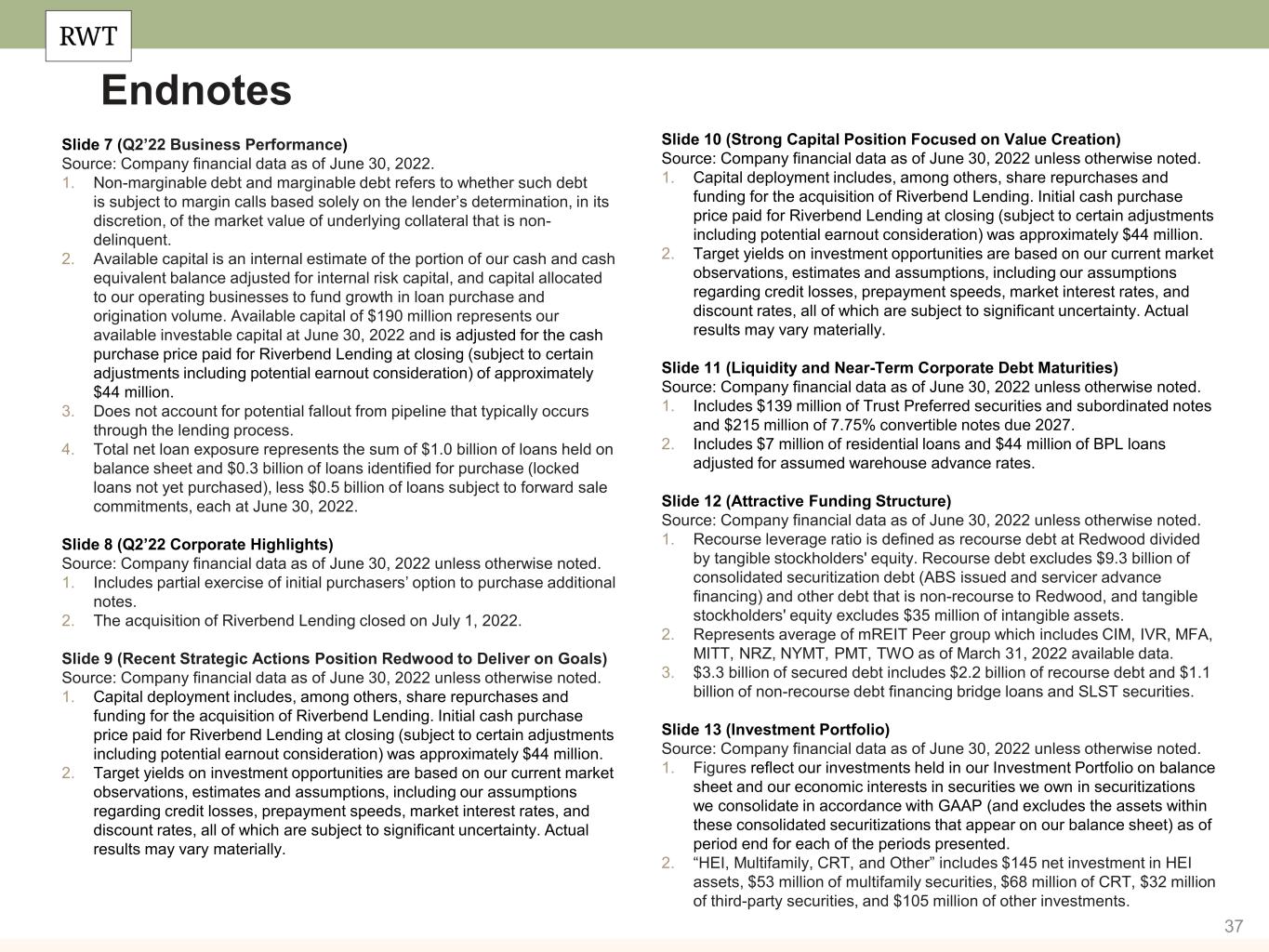

37 Endnotes Slide 7 (Q2’22 Business Performance) Source: Company financial data as of June 30, 2022. 1. Non-marginable debt and marginable debt refers to whether such debt is subject to margin calls based solely on the lender’s determination, in its discretion, of the market value of underlying collateral that is non- delinquent. 2. Available capital is an internal estimate of the portion of our cash and cash equivalent balance adjusted for internal risk capital, and capital allocated to our operating businesses to fund growth in loan purchase and origination volume. Available capital of $190 million represents our available investable capital at June 30, 2022 and is adjusted for the cash purchase price paid for Riverbend Lending at closing (subject to certain adjustments including potential earnout consideration) of approximately $44 million. 3. Does not account for potential fallout from pipeline that typically occurs through the lending process. 4. Total net loan exposure represents the sum of $1.0 billion of loans held on balance sheet and $0.3 billion of loans identified for purchase (locked loans not yet purchased), less $0.5 billion of loans subject to forward sale commitments, each at June 30, 2022. Slide 8 (Q2’22 Corporate Highlights) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Includes partial exercise of initial purchasers’ option to purchase additional notes. 2. The acquisition of Riverbend Lending closed on July 1, 2022. Slide 9 (Recent Strategic Actions Position Redwood to Deliver on Goals) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Capital deployment includes, among others, share repurchases and funding for the acquisition of Riverbend Lending. Initial cash purchase price paid for Riverbend Lending at closing (subject to certain adjustments including potential earnout consideration) was approximately $44 million. 2. Target yields on investment opportunities are based on our current market observations, estimates and assumptions, including our assumptions regarding credit losses, prepayment speeds, market interest rates, and discount rates, all of which are subject to significant uncertainty. Actual results may vary materially. Slide 10 (Strong Capital Position Focused on Value Creation) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Capital deployment includes, among others, share repurchases and funding for the acquisition of Riverbend Lending. Initial cash purchase price paid for Riverbend Lending at closing (subject to certain adjustments including potential earnout consideration) was approximately $44 million. 2. Target yields on investment opportunities are based on our current market observations, estimates and assumptions, including our assumptions regarding credit losses, prepayment speeds, market interest rates, and discount rates, all of which are subject to significant uncertainty. Actual results may vary materially. Slide 11 (Liquidity and Near-Term Corporate Debt Maturities) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Includes $139 million of Trust Preferred securities and subordinated notes and $215 million of 7.75% convertible notes due 2027. 2. Includes $7 million of residential loans and $44 million of BPL loans adjusted for assumed warehouse advance rates. Slide 12 (Attractive Funding Structure) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Recourse leverage ratio is defined as recourse debt at Redwood divided by tangible stockholders' equity. Recourse debt excludes $9.3 billion of consolidated securitization debt (ABS issued and servicer advance financing) and other debt that is non-recourse to Redwood, and tangible stockholders' equity excludes $35 million of intangible assets. 2. Represents average of mREIT Peer group which includes CIM, IVR, MFA, MITT, NRZ, NYMT, PMT, TWO as of March 31, 2022 available data. 3. $3.3 billion of secured debt includes $2.2 billion of recourse debt and $1.1 billion of non-recourse debt financing bridge loans and SLST securities. Slide 13 (Investment Portfolio) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Figures reflect our investments held in our Investment Portfolio on balance sheet and our economic interests in securities we own in securitizations we consolidate in accordance with GAAP (and excludes the assets within these consolidated securitizations that appear on our balance sheet) as of period end for each of the periods presented. 2. “HEI, Multifamily, CRT, and Other” includes $145 net investment in HEI assets, $53 million of multifamily securities, $68 million of CRT, $32 million of third-party securities, and $105 million of other investments.

38 Slide 14 (Investment Portfolio Continued) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Source: Bloomberg (HPI LTV (Amort) %), Home Price Indexed Amortized Loan to Value. Slide 15 (Investment Portfolio Deep Dive into SLST 2018-2) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Source: Bloomberg (HPI LTV (Amort) %), Home Price Indexed Amortized Loan to Value. Slide 16 (We See Additional Drivers of Long-Term Potential Book Value Upside in our Securities Portfolio) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Represents potential book value per share upside on the securities portfolio due to the net discount to par value. There are several factors that may impact our ability to realize all, or a portion, of this amount which may be outside our control, including credit performance and prepayment speeds. Actual realized book value returns may differ materially. Slide 17 (Business Purpose Mortgage Banking) Source: Company financial data as of June 30, 2022. 1. Composition percentages are based on unpaid principal balance. Slide 18 (Business Purpose Lending Market Opportunity) Source: Company financial data as of June 30, 2022. 1. HPA data per BofA Global Research and Corelogic as of June 2022. 2. Rent Growth data per Beekin as of June 2022. 3. Market share based on combined opportunity for Single Family Rental (“SFR”) and Multifamily Rental. SFR based on March 2022 data and potential financing opportunity for SFR of $112 billion over 3-4 years (Source: John Burns Real Estate Consulting, LLC and internal Company estimates). Multifamily based on Freddie Mac 2022 multifamily origination estimate of $450 billion and applying the estimated percentage from latest available FNMA data for origination by non-traditional multifamily lenders. Endnotes Slide 19 (Residential Mortgage Banking) Source: Company financial data as of June 30, 2022 unless otherwise noted. 1. Does not account for potential fallout from pipeline that typically occurs through the lending process. 2. Total net loan exposure represents the sum of $1.0 billion of loans held on balance sheet and $0.3 billion of loans identified for purchase (locked loans not yet purchased), less $0.5 billion of loans subject to forward sale commitments, each at June 30, 2022. 3. Source: JP Morgan and CoreLogic. Slide 20 (Industry Leading Distribution Platform is a Clear Differentiator) Source: Company financial data as of June 30, 2022 unless otherwise noted. Slide 21 (RWT Horizons) Source: Company financial data as of June 30, 2022 unless otherwise noted. Slide 24 (Appendix: Income Statement) 1. Net interest income from “Corporate (unsecured debt)” consists primarily of interest expense on corporate unsecured debt as well as net interest income from Legacy Sequoia consolidated VIEs.

39 Endnotes Slide 25 (Appendix: Consolidated Balance Sheet) 1. The format of this consolidated balance sheet is provided to more clearly delineate between the assets and liabilities belonging to securitization entities (Consolidated VIEs) that we are required to consolidate on our balance sheet in accordance with GAAP, versus the assets that are legally ours and the liabilities of ours for which there is recourse to us (At Redwood). Each of these Consolidated VIEs is independent of Redwood and of each other and the assets and liabilities of these entities are not owned by and are not legal obligations of ours. Our exposure to these entities is primarily through the financial interests we have retained or acquired in these entities (generally subordinate and interest-only securities), the fair value of which is represented by our equity in each entity, as presented in this table. 2. Includes our consolidated Legacy Sequoia, Servicing Investment, and Point entities. 3. Includes certain business purpose bridge and SFR loans and associated non-recourse secured financing. 4. At March 31, 2022, and December 31, 2021, other assets at Redwood included a total of $34 million of assets held by third-party custodians and pledged as collateral to the GSEs in connection with credit risk-sharing arrangements. These pledged assets can only be used to settle obligations to the GSEs under these risk-sharing arrangements. Slide 26 (Appendix: Net Interest Income Analysis) 1. Interest Income, interest expense and average capital for investment portfolio assets presented in this table are in relation to our economic investments (including our economic investments in consolidated VIEs) and do not present amounts associated with the assets within VIEs that we consolidate under GAAP. See the Consolidated Balance Sheet on slide 25 for additional information on consolidated VIEs. 2. GAAP NII yield on capital represents our levered yield only in respect to net interest income earned on associated investments. Our economic yield (for which a component of our effective interest may be included within investment fair value changes on our income statement) in most instances varies from this GAAP NII yield. Slide 28 (Appendix: Capital Allocation Summary) 1. Amounts of assets in our investment portfolio, as presented in this table, represent our economic investments (including our economic investments in consolidated VIEs) and do not present the assets within VIEs that we consolidate under GAAP. See the Consolidated Balance Sheet on slide 25 for additional information on consolidated VIEs. 2. Non-recourse debt presented within this table excludes ABS issued from whole loan securitizations consolidated on our balance sheet, including Sequoia, CAFL SFR, Freddie Mac and Servicing Investment securitization entities, as well as ABS issued from our Point HEI securitization and non- recourse debt used to finance certain servicing investments. 3. Capital allocated to mortgage banking operations represents the working capital we have allocated to manage our loan inventory at each of our operating businesses. This amount generally includes our net capital in loans held on balance sheet (net of financing), capital to acquire loans in our pipeline, net capital utilized for hedges, and risk capital. 4. Corporate capital includes among other things, capital allocated to RWT Horizons and other strategic investments and available capital. Slide 29 (Appendix: Mortgage Banking Key Results) 1. "Mortgage banking income (loss)" presented in this table represents the sum of net interest income earned on loan inventory, income from mortgage banking activities, and other income within each of our mortgage banking operations. 2. "Acquisition amortization expenses" within this table represent purchase related stock-based consideration amortization expense (a component of General and administrative expenses) and amortization of purchase intangibles (a component of Other expenses), each on a tax-adjusted basis. 3. Adjusted Net Contribution and Adjusted Return on Capital are non-GAAP measures. Please refer to Non-GAAP Measures on slide 35 for more information. 4. Capital utilized during the quarter for business purpose mortgage banking operations includes $35 million of platform premium.

40 Endnotes Slide 30 (Appendix: Investment Portfolio Key Results) 1. Realized gains and investment fair value changes presented in this table to calculate Adjusted Net Contribution (non-GAAP), are presented on a tax-adjusted basis. 2. Adjusted Net Contribution and Adjusted Return on Capital are non-GAAP measures. Please refer to Non-GAAP Measures on slide 35 for more information. 3. Secured debt includes both recourse debt and non-recourse debt (including for bridge loans and resecuritized RPL securities), secured by our investment assets. 4. Leverage ratio is calculated as Secured debt balances divided by capital invested, as presented within this table. Slide 31 (Appendix: Investment Portfolio Detail) 1. Economic investments and associated secured debt presented in Investment Portfolio Detail table include our economic investments in consolidated VIEs and exclude the assets and debt within the VIEs that we consolidate under GAAP. See the Consolidated Balance Sheet on slide 25 for additional information on consolidated VIEs. 2. HEI investments presented in Investment Portfolio Detail and Rollforward tables include HEIs we own directly as well as our economic interests in our consolidated Point HEI entity. 3. Other third-party investments presented in the Investment Portfolio Detail table primarily includes investments in MSRs and our economic investments in consolidated Servicing Investment entities. 4. Amounts presented in Investment Portfolio Rollforward table represent our economic investments, which exclude assets of VIEs consolidated on our GAAP balance sheet and include our economic interests in those same consolidated VIEs. See the Consolidated Balance Sheet on slide 25 for additional information on consolidated VIEs. 5. Other investments presented in Investment Portfolio Rollforward table includes other investments within Organic Residential, Organic Business Purpose and Third-Party presented in the Investment Portfolio Detail table. Slide 32 (Appendix: Investment Portfolio Credit Characteristics) 1. Underlying loan performance information provided in this table is generally reported on a one-month lag. As such, the data reported in this table is from June 2022 reports, which reflect a loan performance date of May 31, 2022. 2. Sequoia Select and Sequoia Choice securities presented in this table include subordinate securities and do not include interest only or certificated servicing securities. 3. HPI updated average LTV is calculated based on the current loan balance and an updated property value amount that is formulaically adjusted from value at origination based on the FHFA home price index (HPI). 4. Delinquency percentages at underlying securitizations are calculated using unpaid principal balance ("UPB"). Aggregate delinquency amounts by security type are weighted using the market value of our investments in each securitization. Includes loans over 90 days delinquent and all loans in foreclosure (regardless of delinquency status). 5. "Investment thickness" represents the average size of the subordinate securities we own as investments in securitizations, relative to the average overall size of the securitizations. For example, if our investment thickness (of first-loss securities) with respect to a particular securitization is 10%, we have exposure to the first 10% of credit losses resulting from loans underlying that securitization. Investment thickness is not applicable to our BPL Bridge Loan investments as they are whole loans. 6. Average current debt service coverage ratio (or DSCR) with respect to a loan is the ratio by which net operating income of the underlying property exceeds its fixed debt costs. 7. Average loan to value (or LTV) (at origination) is calculated based on the original loan amount and the property value at the time the loan was originated. Slide 33 (Appendix: Recourse Debt Balances) 1. Non-Marginable debt and marginable debt refers to whether such debt is subject to margin calls based solely on the lender’s determination in its discretion of the market value of underlying collateral that is non- delinquent. 2. Average borrowing cost represents the weighted average contractual cost of recourse debt outstanding at the end of each period presented and does not include deferred issuance costs or debt discounts.