UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2013

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-13759

REDWOOD TRUST, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | 68-0329422 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

One Belvedere Place, Suite 300

Mill Valley, California 94941

(Address of Principal Executive Offices) (Zip Code)

(415) 389-7373

(Registrant’s Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class: |

Name of Exchange on Which Registered: | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer x Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

At June 30, 2013, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $1,385,595,030 based on the closing sale price as reported on the New York Stock Exchange.

The number of shares of the registrant’s Common Stock outstanding on February 21, 2014 was 82,534,625.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission under Regulation 14A within 120 days after the end of registrant’s fiscal year covered by this Annual Report are incorporated by reference into Part III.

REDWOOD TRUST, INC.

2013 ANNUAL REPORT ON FORM 10-K

i

PART I

Introduction

Redwood Trust, Inc., together with its subsidiaries, is an internally-managed specialty finance company focused on engaging in residential and commercial mortgage banking activities and investing in mortgage- and other real estate-related assets. We seek to invest in real estate-related assets that have the potential to generate attractive cash flow returns over time and to generate income through our mortgage banking activities. We operate our business in three segments: residential mortgage banking, residential investments, and commercial mortgage banking and investments.

Our primary sources of income are net interest income from our investment portfolios and income from our mortgage banking activities. Net interest income consists of the interest income we earn less the interest expenses we incur on borrowed funds and other liabilities. Income from mortgage banking activities consists of the profit we seek to generate through the acquisition or origination of loans and their subsequent sale or securitization. References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries, unless the context otherwise requires.

For tax purposes, Redwood Trust, Inc. is structured as a real estate investment trust (“REIT”) and we generally refer, collectively, to Redwood Trust, Inc. and those of its subsidiaries that are not subject to subsidiary-level corporate income tax as “the REIT” or “our REIT.” We generally refer to subsidiaries of Redwood Trust, Inc. that are subject to subsidiary-level corporate income tax as “our operating subsidiaries” or “our taxable REIT subsidiaries” or “TRS.” Our mortgage banking activities are generally carried out through our operating subsidiaries, while our portfolio of mortgage- and other real estate-related investments is primarily held at our REIT. We generally intend to retain profits generated and taxed at our operating subsidiaries, and to distribute as dividends at least 90% of the income we generate from the investment portfolio at our REIT.

Redwood Trust, Inc. was incorporated in the State of Maryland on April 11, 1994, and commenced operations on August 19, 1994. Our executive offices are located at One Belvedere Place, Suite 300, Mill Valley, California 94941.

Financial information concerning our business, both on a consolidated basis and with respect to each of our segments, is set forth in our consolidated financial statements and notes thereto included in this Annual Report on Form 10-K as well as in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the supplemental financial information, which are included in Part II, Items 7 and 8 of this Annual Report on Form 10-K.

Our Operating Business Segments

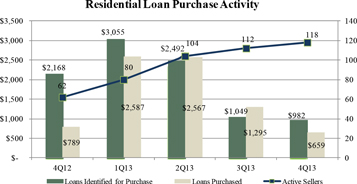

Our residential mortgage banking segment primarily consists of operating a mortgage loan platform. This platform is engaged in the business of acquiring residential loans from third-party originators and then selling, financing, or securitizing those loans with the intent of profiting from these activities. Jumbo loans we acquire are typically sold through private-label securitization through our Sequoia securitization program or to institutions that acquire pools of whole loans. Loans we acquire that conform to the eligibility criteria of Fannie Mae and Freddie Mac are generally sold to these entities. Our residential loan acquisitions are usually made on a loan-by-loan, or flow basis, after origination by banks or mortgage companies, and are periodically augmented by bulk acquisitions. Our acquisition and accumulation of residential loans is generally funded with our capital and short-term debt. This segment also includes various derivative financial instruments and interest-only (“IO”) securities retained from our Sequoia securitizations that we utilize to manage certain risks associated with residential loans we acquire. Our residential mortgage banking segment’s main source of revenue is mortgage banking income, which includes valuation increases (or gains) on the loans we acquire for sale or securitization as well as valuation changes in associated derivatives and IO securities that are used in part to manage risks associated with our mortgage banking activities. Additionally, this segment may generate interest income on loans held for future sale or securitization and interest income from IO securities. Interest expense on short-term debt used to fund the purchase of residential loans, direct operating expenses and tax expenses associated with these activities are also included in the residential mortgage banking segment.

Our residential investments segment includes a portfolio of investments in residential mortgage-backed securities retained from our Sequoia securitizations, as well as residential mortgage-backed securities issued by third parties. This segment also includes mortgage servicing rights (“MSRs”) associated with residential loans securitized through our Sequoia program and MSRs purchased from third parties. The owner of an MSR is entitled to receive a portion of the interest payments from the associated residential loan and is obligated to directly service, or retain a sub-servicer to directly service, the associated loan. Residential loans for which we own

1

the MSR are directly serviced by a licensed sub-servicer we retain, as we do not originate or directly service any residential loans. Our residential investment segment’s main sources of revenue are interest income from investment portfolio securities, as well as the realized gains recognized upon sales of these securities and income from MSRs. Also included in this segment is interest expense on the short-term debt and asset-backed securities used to partially finance certain of these securities, as well as direct operating expenses and tax provisions associated with these activities.

Our commercial mortgage banking and investments segment consists of our commercial mortgage banking operations as well as our portfolio of held-for-investment commercial real estate loans. We operate as a commercial real estate lender by originating mortgage loans and providing other forms of commercial real estate financing. This may include senior or subordinate mortgage loans, mezzanine loans, and other forms of financing, such as preferred equity interests in special purpose entities that own commercial real estate. We typically sell the senior loans we originate to third parties for securitization and the mezzanine and subordinate loans we originate are generally held for investment. This segment also includes derivative financial instruments we utilize to manage certain risks associated with our commercial loan origination activity. Our commercial mortgage banking and investments segment’s main sources of revenue are interest income from our commercial loan investments as well as income from mortgage banking activities, which includes valuation increases (or gains) on the senior commercial loans we originate for sale as well as valuation changes in associated derivatives that are used to manage risks associated with our mortgage banking activities. Interest expense from our Commercial Securitization and from short-term debt used to fund the purchase of commercial loans as well as operating expenses and the tax provisions associated with these activities are also included in the commercial mortgage banking segment.

Sponsored, Managed, and Consolidated Entities

Throughout our history we have sponsored or managed other investment entities, including a private limited partnership fund that we managed, the Redwood Opportunity Fund, LP (the “Fund”), as well as Acacia securitization entities, certain of which we continue to manage. The Fund was primarily invested in residential securities and the Acacia entities are primarily invested in a variety of real estate-related assets. We are not currently seeking to sponsor or manage other entities like the Fund or the Acacia securitization entities.

During the third quarter of 2011, we engaged in a transaction in which we resecuritized a pool of senior residential securities (the “Residential Resecuritization”) primarily for the purpose of obtaining permanent non-recourse financing on a portion the residential securities we hold in our investment portfolio at the REIT. Similarly, during the fourth quarter of 2012, we engaged in a transaction in which we securitized a pool of commercial loans (the “Commercial Securitization”) primarily for the purpose of obtaining permanent non-recourse financing on a portion of the commercial loans we hold in our investment portfolio at the REIT.

Many of the entities we have sponsored or managed are currently, or have been historically, recorded on our consolidated balance sheets for financial reporting purposes based upon applicable accounting guidance set forth by Generally Accepted Accounting Principles in the United States (“GAAP”). However, each of these entities is independent of Redwood and of each other and the assets and liabilities of these entities are not, respectively, owned by us or legal obligations of ours, although we are exposed to certain financial risks associated with our role as the sponsor or manager of these entities and, to the extent we hold securities issued by, or other investments in, these entities, we are exposed to the performance of these entities and the assets they hold.

Information Available on Our Website

Our website can be found at www.redwoodtrust.com. We make available, free of charge through the investor information section of our website, access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”). We also make available, free of charge, access to our charters for our Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee, our Corporate Governance Standards, and our Code of Ethics governing our directors, officers, and employees. Within the time period required by the SEC and the New York Stock Exchange, we will post on our website any amendment to the Code of Ethics and any waiver applicable to any executive officer, director, or senior officer (as defined in the Code). In addition, our website includes information concerning purchases and sales of our equity securities by our executive officers and directors, as well as disclosure relating to certain non-GAAP financial measures (as defined in the SEC’s Regulation G) that we may make public orally, telephonically, by webcast, by broadcast, or by similar means from time to time. Through the Commercial link on our website, we also disclose information about our recent originations and acquisitions of commercial loans and other commercial investments. We believe that this information may be of interest to investors in Redwood, although we may not always disclose on our website each new commercial loan or other new commercial investment we originate or acquire due to, among other reasons, confidentiality obligations to the borrowers of those loans or counterparties to those investments. The information on our website is not part of this Annual Report on Form 10-K.

2

Our Investor Relations Department can be contacted at One Belvedere Place, Suite 300, Mill Valley, CA 94941, Attn: Investor Relations, telephone (866) 269-4976.

Cautionary Statement

This Annual Report on Form 10-K and the documents incorporated by reference herein contain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in this Annual Report on Form 10-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the SEC, including reports on Forms 10-Q and 8-K. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: (i) statements we make regarding Redwood’s future business strategy and strategic focus, including statements relating to our confidence in our overall market position, strategy and long-term prospects, and our belief in the long-term efficiency of private label securitization as a form of mortgage financing; (ii) statements we make regarding the outlook for our residential business, investing in prime mortgage credit risk and our positioning to pursue investments in conforming credit through potential risk-sharing arrangements (recourse and other types) with the GSEs; (iii) our belief that triple-A investors will return to the private label securitization market for prime quality loans when improved securitization structures and issuer best practices become more widely adopted by participants, and our expectation that subordination levels will decline over time, reflecting the performance of the underlying collateral, and that this will improve the economics for issuers such as Redwood; (iv) statements we make regarding GSE reform legislation, including that the private sector will become the provider of first-loss credit risk, ahead of a government guarantee, and the opportunity this presents for private credit risk investors with loan acquisition platforms, such as Redwood; (v) our expectations regarding our loan sale distribution via whole loan sales and securitizations, our expectation to complete a securitization late in the first quarter or early in the second quarter of 2014 and our outlook for residential loan sale profit margins, including our statement that we believe we can generate attractive loan sale profit margins within our long-term target range of 25 to 50 basis points; (vi) statements relating to acquiring residential mortgage loans in the future that we have identified for purchase, including the amount of such loans that we identified for purchase at December 31, 2013; (vii) statements relating to our expectation to increase the number of sellers we acquire loans from; (viii) statements relating to the volume of jumbo and conforming residential mortgage loans expected to be available for purchase during 2014, including that we expect the decline in our jumbo loan acquisition volume from 2013 to be less than the decline projected for the industry as a whole, and our goal to ramp up to a run rate of $1 billion per month of conforming loan acquisitions by the end of 2014; (ix) our outlook and expectations relating to our commercial real estate platform, including statements regarding our expectations regarding improvement in underlying commercial real estate fundamentals and potential refinancing opportunities for lenders with established commercial loan origination platforms such as Redwood, and our plans to expand our commercial platform in 2014 by adding originators, (x) our expectations regarding the volume of senior and mezzanine commercial loans that we will originate in 2014, and our expectation that the amount of capital we had previously allocated to fund commercial mortgage banking and investment activities should remain adequate for us to continue growing this platform, and statements relating to the possibility of raising dedicated capital for our commercial platform; (xi) statements relating to our estimate of our investment capacity (including that we estimate our investment capacity at December 31, 2013 to be approximately $130 million) and our statement that we believe this level of investment capacity and liquidity should be sufficient to fund our business and investment objectives for most or all of 2014; and (xii) statements regarding our expectations and estimates relating to the characterization for income tax purposes of our dividend distributions, our expectations and estimates relating to tax accounting, tax liabilities and tax savings, and GAAP tax provisions, our estimates of REIT taxable income and TRS taxable income, and our anticipation of additional credit losses for tax purposes in future periods (and, in particular, our statement that, for tax purposes, we expect an additional $59 million of tax credit losses on residential securities we currently own to be realized over an estimated three- to five-year period).

Important factors, among others, that may affect our actual results include: general economic trends, Federal Reserve monetary policy, the performance of the housing, commercial real estate, mortgage, credit, and broader financial markets, and their effects on the prices of earning assets and the credit status of borrowers; federal and state legislative and regulatory developments, and the actions of governmental authorities, including those affecting the mortgage industry or our business; our exposure to credit risk and the timing of credit losses within our portfolio; the concentration of the credit risks we are exposed to, including due to the structure of assets we hold and the geographical concentration of real estate underlying assets we own; the efficacy and expense of our efforts to

3

manage or hedge credit risk, interest rate risk, and other financial and operational risks; changes in credit ratings on assets we own and changes in the rating agencies’ credit rating methodologies; changes in interest rates; changes in mortgage prepayment rates; the availability of assets for purchase at attractive prices and our ability to reinvest cash we hold; changes in the values of assets we own; changes in liquidity in the market for real estate securities and loans; our ability to finance the acquisition of real estate-related assets with short-term debt; the ability of counterparties to satisfy their obligations to us; our involvement in securitization transactions, the timing and profitability of those transactions, and the risks we are exposed to in engaging in securitization transactions; exposure to claims and litigation, including litigation arising from our involvement in securitization transactions; whether we have sufficient liquid assets to meet short-term needs; our ability to successfully compete and retain or attract key personnel; our ability to adapt our business model and strategies to changing circumstances; changes in our investment, financing, and hedging strategies and new risks we may be exposed to if we expand our business activities; exposure to environmental liabilities and the effects of global climate change; failure to comply with applicable laws and regulations; our failure to maintain appropriate internal controls over financial reporting and disclosure controls and procedures; the impact on our reputation that could result from our actions or omissions or from those of others; changes in accounting principles and tax rules; our ability to maintain our status as a REIT for tax purposes; limitations imposed on our business due to our REIT status and our status as exempt from registration under the Investment Company Act of 1940; decisions about raising, managing, and distributing capital; and other factors not presently identified.

This Annual Report on Form 10-K may contain statistics and other data that in some cases have been obtained from or compiled from information made available by servicers and other third-party service providers.

Certifications

Our Chief Executive Officer and Chief Financial Officer have executed certifications dated February 25, 2014, as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, and we have included those certifications as exhibits to this Annual Report on Form 10-K. In addition, our Chief Executive Officer certified to the New York Stock Exchange (NYSE) on May 28, 2013 that he was unaware of any violations by Redwood Trust, Inc. of the NYSE’s corporate governance listing standards in effect as of that date.

Employees

As of December 31, 2013, Redwood employed 141 people.

General economic developments and trends and the performance of the housing, commercial real estate, mortgage finance, and broader financial markets may adversely affect our business and the value of, and returns on, real estate-related and other assets we own or may acquire and could also negatively impact our business and financial results.

Our level of business activity and the profitability of our business, as well as the values of, and the cash flows from, the assets we own, are affected by developments in the U.S. economy. As a result, negative economic developments are likely to negatively impact our business and financial results. There are a number of factors that could contribute to negative economic developments, including, but not limited to, high unemployment, rising government debt levels, U.S. fiscal and monetary policy changes, including Federal Reserve policy shifts, changing U.S. consumer spending patterns, negative developments in the housing and commercial real estate markets, and changing expectations for inflation and deflation. Personal income and unemployment levels affect borrowers’ ability to repay residential mortgage loans underlying residential real estate-related assets we own, and there is risk that economic growth and activity could be weaker than anticipated or negative.

The economic downturn that began in 2007 and the significant government interventions into the financial markets and fiscal stimulus spending that occurred in subsequent years have contributed to significantly increased U.S. budget deficits and overall debt levels. These increases have put upward pressure on interest rates and could be among the factors that could lead to higher interest rates over the long-term future. Higher long-term interest rates could adversely affect our overall business, income, and our ability to pay dividends, as discussed further below under “Interest rate fluctuations can have various negative effects on us and could lead to reduced earnings and increased volatility in our earnings.” Furthermore, our business and financial results may be harmed by our inability to accurately anticipate developments associated with changes in, or the outlook for, interest rates. In addition, near-term and long-term U.S. economic conditions are likely to be impacted by the ability of Congress and the President to effectively address policy differences regarding the U.S. federal budget, budget deficit, and debt level.

Real estate values, and the ability to generate returns by owning or taking credit risk on loans secured by real estate, are important to our business. Over the last several years, government intervention has been important to support real estate markets, the overall U.S. economy, capital markets, and mortgage markets. We expect the government will continue to gradually withdraw this support, although we remain uncertain about the extent, timing, process, and implications of any withdrawal. Mortgage markets have also received substantial U.S. government support. In particular, the government’s support of mortgage markets through its support of

4

Fannie Mae and Freddie Mac expanded in late 2008, as the U.S. Treasury Department chose to backstop these government-sponsored enterprises. The governmental support for these entities has contributed to Fannie Mae’s and Freddie Mac’s continued dominance of residential mortgage finance and securitization activity, inhibiting the return of private mortgage securitization. This support may continue for some time and could have potentially negative consequences to us, since we have traditionally taken an active role in assuming credit risk in the private sector mortgage market, including through investments in Sequoia securitizations we sponsor.

Developments relating to the fixed income and mortgage finance markets and the Federal Reserve’s statements regarding its future open market activity and monetary policy could adversely affect our future business and financial results and the value of, and returns on, real estate-related investments and other assets we own or may acquire.

During 2013 and to date in 2014, statements made by the Chair and other members of the Board of Governors of the Federal Reserve System and by other Federal Reserve Bank officials regarding the U.S. economy, future economic growth, and the Federal Reserve’s future open market activity (and the so-called “tapering” of certain of that activity relating to the acquisition of Treasury securities and mortgage-backed securities (MBS)) and monetary policy have had a significant impact on, among other things, benchmark interest rates, the value of residential mortgage loans, and, more generally, the fixed income markets. These statements, the actions of the Federal Reserve, and other factors also significantly impacted many market participants’ expectations and outlooks regarding future levels of benchmark interest rates and the expected yields these market participants would require to invest in fixed income instruments, including most residential mortgages and residential mortgage-backed securities (RMBS).

One of the immediate potential impacts of rising benchmark interest rates on our business would be a reduction in the overall value of the pool of residential mortgage loans that we own and the overall value of the pipeline of residential mortgage loans that we have identified for purchase. Rising benchmark interest rates also generally have a negative impact on the overall cost of short-term borrowings we use to finance our acquisitions and holdings of residential mortgage loans, including as a result of the requirement to post additional margin (or collateral) to lenders to offset any associated decline in value of the mortgage loans we finance with short-term borrowings. The short-term borrowings we use to finance our acquisitions and holdings of residential mortgage loans are uncommitted and have a limited term, which could result in these types of borrowings not being available in the future to fund our acquisitions and holdings and could result in our being required to sell holdings of residential mortgage loans and incur losses. Similar impacts would also be expected with respect to the short-term borrowings we use to finance our acquisitions and holdings of RMBS. In addition, any inability to fund acquisitions of mortgage loans could damage our reputation as a reliable counterparty in the mortgage finance markets.

Rising benchmark interest rates have also impacted, and are likely to continue to impact, the volume of residential mortgage loans available for purchase in the marketplace and our ability to compete to acquire residential mortgage loans as part of our residential mortgage banking activities. These impacts could result from, among other things, a lower overall volume of mortgage refinance activity by mortgage borrowers and an increased level of competition from large commercial banks that may operate with a lower cost of capital than we do, including as a result of Federal Reserve monetary policies that impact banks more favorably than us and other non-bank institutions. These and other impacts of developments of the type described above have had, and may continue to have, a negative impact on our business and results of operations and we cannot accurately predict the full extent of these impacts or for how long they may persist.

Federal and state legislative and regulatory developments and the actions of governmental authorities and entities may adversely affect our business and the value of, and the returns on, mortgages, mortgage-related securities, and other assets we own or may acquire in the future.

As noted above, our business is affected by conditions in the residential and commercial real estate markets and the broader financial markets, as well as by the financial condition and resources of other participants in these markets. These markets and many of the participants in these markets are subject to, or regulated under, various federal and state laws and regulations. In some cases, the government or government-sponsored entities, such as Fannie Mae and Freddie Mac, directly participate in these markets. In particular, because issues relating to residential real estate and housing finance can be areas of political focus, federal, state and local governments may be more likely to take actions that affect residential real estate, the markets for financing residential real estate, and the participants in residential real estate-related industries than they would with respect to other industries. As a result of the government’s statutory and regulatory oversight of the markets we participate in and the government’s direct and indirect participation in these markets, federal and state governmental actions, policies, and directives can have an adverse effect on these markets and on our business and the value of, and the returns on, mortgages, mortgage-related securities, and other assets we own or may acquire in the future, which effects may be material.

As an example, based on published data, we believe that through financing or guarantees Fannie Mae, Freddie Mac, the Federal Housing Administration, and other governmental agencies accounted for more than 85% of the financing for new residential mortgage loans in 2009, 2010, 2011, 2012 and the first nine months of 2013. As a result, most of the market for housing finance in the U.S. is effectively controlled by the federal government and can be materially affected by decisions of federal policy makers, the President,

5

and Congress. In addition, the Federal Reserve has taken certain actions (e.g., implementing a program to acquire, and now “tapering” the pace of acquiring, Treasury securities and MBS) and may take other actions that could have significant implications for mortgage-related securities pricing and the returns we expect on our mortgage-related assets. Financial regulators globally are coordinating the implementation of capital regulations under the Basel III accord in an attempt to better coordinate and set capital standards for certain types of regulated financial institutions and appropriately account for risk, which may also have indirect impacts on our business and financial results.

If the federal government determines to maintain or expand its current role in the markets for financing residential mortgage loans, it may adversely affect our business or our ability to effectively compete. Even if the federal government determines to decrease its role in the markets for financing residential mortgage loans, it may establish regulations for other market participants that have an adverse effect on our ability to effectively participate or compete or which may diminish or eliminate the returns on mortgages, mortgage-related securities, and other assets we own or may acquire in the future.

Changes to income tax laws and regulations, or other tax laws or regulations, which may be enacted at the federal or state level, could also negatively impact residential and commercial real estate markets, mortgage finance markets, and our business and financial results. For example, an elimination or reduction in the current personal income tax deduction for interest payments on residential mortgage debt, which is one of the mechanisms that lawmakers have discussed in connection with resolving the U.S. federal budget deficit, could negatively impact real estate values, our business, and our financial results.

Furthermore, the credit crisis and subsequent financial turmoil prompted the federal government to put into place new statutory and regulatory frameworks and policies for reforming the U.S. financial system. These financial reforms are aimed at, among other things, promoting robust supervision and regulation of financial firms, establishing comprehensive supervision of financial markets, protecting consumers and investors from financial abuse, providing the U.S. government with additional tools to manage financial crises, and raising international regulatory standards and improving international cooperation, but their scope could be expanded beyond what has been currently enacted, implemented, and proposed. Certain financial reforms focused specifically on the issuance of asset-backed securities through securitization transactions have not been fully implemented, but are expected to include significantly enhanced disclosure requirements, risk retention requirements, and rules restricting a broad range of conflicts of interests in regard to these transactions. Implementation of financial reforms, whether through law, regulations, or policy, including changes to the manner in which financial institutions, financial products, and financial markets operate and are regulated and any related changes in the accounting standards that govern them, could adversely affect our business and financial results by subjecting us to regulatory oversight, making it more expensive to conduct our business, reducing or eliminating any competitive advantage we may have, or limiting our ability to expand, or could have other adverse effects on us.

During and since 2008, the federal government has also made available programs designed to provide homeowners with assistance in avoiding residential mortgage loan foreclosures, including through loan modification and refinancing programs. In addition, certain mortgage lenders and servicers have voluntarily, or as part of settlements with law enforcement authorities, established loan modification programs relating to the mortgages they hold or service and adopted new servicing standards intended to protect homeowners. Changes to servicing standards, whether resulting from a settlement or a change in regulation, are likely to have the effect of lengthening the time it takes for a servicer to foreclose on the property underlying a delinquent mortgage loan. Loan modification programs and changes to servicing standards and regulations, as well as future law enforcement and legislative or regulatory actions, may adversely affect the value of, and the returns on, the mortgage loans and mortgage securities we currently own or may acquire in the future.

In January 2014, new regulations promulgated by the Consumer Financial Protection Bureau (“CFPB”) under the Dodd-Frank Act became effective that require mortgage lenders, prior to originating most residential mortgage loans, to make a determination of a borrower’s ability to repay the loan and establish protections from liability under this requirement for mortgages that meet certain criteria, so-called “qualified mortgages.” Under these regulations, if a mortgage lender does not appropriately establish a borrower’s ability to repay the loan, the borrower may be able to assert against the originator of the loan or any subsequent transferee, as a defense to foreclosure by way of recoupment or setoff, a violation of the ability-to-repay regulations. The impact of these ability-to-repay regulations on the availability of mortgage credit, the mortgage finance market, and our ability to securitize residential mortgage loans is unclear. The actual short- and long-term impact of these ability-to-repay regulations on us will depend, in large part, on how the credit rating agencies, triple-A securitization investors, warehouse lenders we borrow from, and other mortgage market investors assess the investment risks that result from the new regulations, including, for example, how they assess investment risks associated with residential mortgage loans that have an interest-only payment feature or loans under which the borrower has a debt-to-income ratio of more than 43% (as these types of loans have historically accounted for a portion of the loans we have securitized, but they are not considered “qualified mortgages” under the ability-to-repay regulations). If these and other regulations have a negative impact on the volume of mortgage loan originations or on our ability to finance, sell, or securitize residential mortgage loans, it could adversely affect our business and financial results.

Over the course of 2012 and 2013, certain counties, cities and other municipalities took steps to begin to consider how the power of eminent domain could be used to acquire residential mortgage loans from private-label securitization trusts and additional

6

municipalities may be similarly considering this matter or may do so in the future. To the extent municipalities or other governmental authorities proceed to implement and carry out these or similar proposals and acquire residential mortgage loans from securitization trusts in which we hold an economic interest, there would likely be a negative impact on the value of our interests in those securitization trusts and a negative impact on our ability to engage in future securitizations (or on the returns we would otherwise expect to earn from executing future securitizations), which impacts could be material.

Ultimately, we cannot assure you of the impact that governmental actions may have on our business or the financial markets and, in fact, they may adversely affect us, possibly materially. We cannot predict whether or when such actions may occur or what unintended or unanticipated impacts, if any, such actions could have on our business and financial results. Even after governmental actions have been taken and we believe we understand the impacts of those actions, we may not be able to effectively respond to them so as to avoid a negative impact on our business or financial results.

The nature of the assets we hold and the investments we make expose us to credit risk that could negatively impact the value of those assets and investments, our earnings, dividends, cash flows, and access to liquidity, and otherwise negatively affect our business.

Overview of credit risk

We assume credit risk primarily through the ownership of securities backed by residential and commercial real estate loans and through direct investments in residential and commercial real estate loans. We may also assume similar credit risks through other types of transactions with counterparties who are seeking to reduce their exposure to credit risk. Credit losses on residential real estate loans can occur for many reasons, including: fraud; poor underwriting; poor servicing practices; weak economic conditions; increases in payments required to be made by borrowers; declines in the value of homes; earthquakes, the effects of climate change (including flooding, drought, and severe weather) and other natural events; uninsured property loss; over-leveraging of the borrower; costs of remediation of environmental conditions, such as indoor mold; changes in zoning or building codes and the related costs of compliance; acts of war or terrorism; changes in legal protections for lenders and other changes in law or regulation; and personal events affecting borrowers, such as reduction in income, job loss, divorce, or health problems. In addition, the amount and timing of credit losses could be affected by loan modifications, delays in the liquidation process, documentation errors, and other action by servicers. Weakness in the U.S. economy or the housing market could cause our credit losses to increase beyond levels that we currently anticipate.

In addition, rising interest rates may increase the credit risks associated with certain residential real estate loans. For example, the interest rate is adjustable for many of the loans held at securitization entities we have sponsored and for a portion of the loans underlying residential securities we have acquired from securitizations sponsored by others. Accordingly, when short-term interest rates rise, required monthly payments from homeowners will rise under the terms of these adjustable-rate mortgages, and this may increase borrowers’ delinquencies and defaults.

Credit losses on commercial real estate loans can occur for many of the reasons noted above for residential real estate loans. Losses on commercial real estate loans can also occur for other reasons including decreases in the net operating income from the underlying property, which could be adversely affected by a weak U.S. or international economy. Moreover, at any given time, most or all of our commercial real estate loans are not fully amortizing and, therefore, the borrower’s ability to repay the principal when due may depend upon the ability of the borrower to refinance or sell the property at maturity.

Commercial real estate loans are particularly sensitive to changes in the local economy, so even minor local adverse economic events may adversely affect the performance of commercial real estate assets. We are typically exposed to credit risk associated with both senior and subordinated commercial loans, and much of our exposure to credit risk associated with commercial loans is in the form of subordinate financing (e.g., mezzanine loans, b-notes, preferred equity, and subordinated interests in securitized pools). We directly originate commercial loans and may participate in loans originated by others (including through ownership of commercial mortgage-backed securities). Directly originating commercial loans exposes us to credit, legal, and other risks that may be greater than risks associated with loans we acquire or participate in that are originated by others. We may incur losses on commercial real estate loans and securities for reasons not necessarily related to an adverse change in the performance of the property (or properties) associated with any such loan or the loan (or loans) underlying any such security. This includes bankruptcy by the owner of the property, issues regarding the form of ownership of the property, poor property management, origination errors, inaccurate appraisals, fraud, and non-timely actions by servicers. If and when these problems become apparent, we may have little or no recourse to the borrower, issuer of the securities, or seller of the loan and we may incur credit losses as a result.

We may have heightened credit losses associated with certain securities and investments we own.

Within a securitization of residential or commercial real estate loans, various securities are created, each of which has varying degrees of credit risk. We may own the securities in which there is more (or the most) concentrated credit risk associated with the underlying real estate loans.

7

In general, losses on an asset securing a residential or commercial real estate loan included in a securitization will be borne first by the owner of the property (i.e., the owner will first lose any equity invested in the property) and, thereafter, by mezzanine or preferred equity investors, if any, then by a cash reserve fund or letter of credit, if any, then by the first-loss security holder, and then by holders of more senior securities. In the event the losses incurred upon default on the loan exceed any equity support, reserve fund, letter of credit, and classes of securities junior to those in which we invest (if any), we may not be able to recover all of our investment in the securities we hold. In addition, if the underlying properties have been overvalued by the originating appraiser or if the values subsequently decline and, as a result, less collateral is available to satisfy interest and principal payments due on the related security, then the first-loss securities may suffer a total loss of principal, followed by losses on the second-loss and then third-loss securities (or other residential and commercial securities that we own). In addition, with respect to residential securities we own, we may be subject to risks associated with the determination by a loan servicer to discontinue servicing advances (advances of mortgage interest payments not made by a delinquent borrower) if they deem continued advances to be unrecoverable, which could reduce the value of these securities or impair our ability to project and realize future cash flows from these securities.

For loans or other investments we own directly (not through a securitization structure), we will most likely be in a position to incur credit losses – should they occur – only after losses are borne by the owner of the property (e.g., by a reduction in the owner’s equity stake in the property). We may take actions available to us in an attempt to protect our position and mitigate the amount of credit losses, but these actions may not prove to be successful and could result in our increasing the amount of credit losses we ultimately incur on a loan.

The nature of the assets underlying some of the securities and investments we hold could increase the credit risk of those securities.

For certain types of loans underlying securities we may own or acquire, the loan rate or borrower payment rate may increase over time, increasing the potential for default. For example, securities may be backed by residential real estate loans that have negative amortization features. The rate at which interest accrues on these loans may change more frequently or to a greater extent than payment adjustments on an adjustable-rate loan, and adjustments of monthly payments may be subject to limitations or may be limited by the borrower’s option to pay less than the full accrual rate. As a result, the amount of interest accruing on the remaining principal balance of the loans at the applicable adjustable mortgage loan rate may exceed the amount of the monthly payment. To the extent we are exposed to it, this is particularly a risk in a rising interest rate environment. Negative amortization occurs when the resulting excess (of interest owed over interest paid) is added to the unpaid principal balance of the related adjustable mortgage loan. For certain loans that have a negative amortization feature, the required monthly payment is increased after a specified number of months or after a maximum amount of negative amortization has occurred in order to amortize fully the loan by the end of its original term. Other negative amortizing loans limit the amount by which the monthly payment can be increased, which results in a larger final payment at maturity. As a result, negatively amortizing loans have performance characteristics similar to those of balloon loans. Negative amortization may result in increases in delinquencies, loan loss severity, and loan defaults, which may, in turn, result in payment delays and credit losses on our investments. Other types of loans and investments to which we are exposed, such as hybrid loans and adjustable-rate loans, may also have greater credit risk than more traditional amortizing fixed-rate mortgage loans.

Most or all of the commercial real estate loan assets we own are only partially amortizing or do not provide for any principal amortization prior to a balloon principal payment at maturity. Commercial loans that only partially amortize or that have a balloon principal payment at maturity may have a higher risk of default at maturity than fully amortizing loans. In addition, since most of the principal of these loans is repaid at maturity, the amount of loss upon default is generally greater than on other loans that provide for more principal amortization.

We have concentrated credit risk in certain geographical regions and may be disproportionately affected by an economic or housing downturn, natural disaster, terrorist event, climate change, or any other adverse event specific to those regions.

A decline in the economy or difficulties in certain real estate markets, such as a high level of foreclosures in a particular area, are likely to cause a decline in the value of residential and commercial properties. This, in turn, will increase the risk of delinquency, default, and foreclosure on real estate underlying securities and loans we hold with properties in those regions. This may then adversely affect our credit loss experience and other aspects of our business, including our ability to securitize (or otherwise sell) real estate loans and securities.

The occurrence of a natural disaster (such as an earthquake, tornado, hurricane, or flood), or the effects of climate change (including flooding, drought, and severe weather), may cause decreases in the value of real estate (including sudden or abrupt changes) and would likely reduce the value of the properties collateralizing commercial and residential real estate loans we own or those underlying the securities or other investments we own. Since certain natural disasters may not typically be covered by the standard hazard insurance policies maintained by borrowers, the borrowers may have to pay for repairs due to the disasters. Borrowers may not repair their property or may stop paying their mortgage loans under those circumstances, especially if the property is damaged. This would likely cause foreclosures to increase and lead to higher credit losses on our loans or investments or on the pool of mortgage loans underlying securities we own.

8

A significant number of residential real estate loans that underlie the securities we own are secured by properties in California and, thus, we have a higher concentration of credit risk within California than in other states. Additional states where we have concentrations of residential loan credit risk are set forth in Note 6 to the Financial Statements within this Annual Report on Form 10-K. Balances on commercial loans we originate or otherwise acquire are larger than residential loans and we may continue to have a geographically concentrated commercial loan portfolio until our portfolio increases in size. While we intend to originate commercial loans throughout the country, our commercial loans are generally concentrated in or near major metropolitan areas. Additional information on geographic distribution of our commercial loan portfolio is set forth in Note 7 to the Financial Statements within this Annual Report on Form 10-K.

The timing of credit losses can harm our economic returns.

The timing of credit losses can be a material factor in our economic returns from residential and commercial loans, investments, and securities. If unanticipated losses occur within the first few years after a loan is originated, an investment is made, or a securitization is completed, those losses could have a greater negative impact on our investment returns than unanticipated losses on more seasoned loans, investments, or securities. In addition, higher levels of delinquencies and cumulative credit losses within a securitized loan pool can delay our receipt of principal and interest that is due to us under the terms of the securities backed by that pool. This would also lower our economic returns. The timing of credit losses could be affected by the creditworthiness of the borrower, the borrower’s willingness and ability to continue to make payments, and new legislation, legal actions, or programs that allow for the modification of loans or ability for borrowers to get relief through bankruptcy or other avenues.

Our efforts to manage credit risks may fail.

We attempt to manage risks of credit losses by continually evaluating our investments for impairment indicators and establishing reserves under GAAP for credit and other risks based upon our assessment of these risks. We cannot establish credit reserves for tax accounting purposes. The amount of reserves that we establish may prove to be insufficient, which would negatively impact our financial results and would result in earnings volatility. In addition, cash and other capital we hold to help us manage credit and other risks and liquidity issues may prove to be insufficient. If these increased credit losses are greater than we anticipated and we need to increase our credit reserves, our GAAP earnings might be reduced. Increased credit losses may also adversely affect our cash flows, ability to invest, dividend distribution requirements and payments, asset fair values, access to short-term borrowings, and ability to securitize or finance assets.

Despite our efforts to manage credit risk, there are many aspects of credit risk that we cannot control. Our quality control and loss mitigation policies and procedures may not be successful in limiting future delinquencies, defaults, and losses, or they may not be cost effective. Our underwriting reviews may not be effective. The securitizations in which we have invested may not receive funds that we believe are due from mortgage insurance companies and other counterparties. Loan servicing companies may not cooperate with our loss mitigation efforts or those efforts may be ineffective. Service providers to securitizations, such as trustees, loans servicers, bond insurance providers, and custodians, may not perform in a manner that promotes our interests. Delay of foreclosures could delay resolution and increase ultimate loss severities, as a result.

The value of the homes collateralizing or underlying residential loans or investments may decline. The value of the commercial properties collateralizing or underlying commercial loans or investments may decline. The frequency of default and the loss severity on loans upon default may be greater than we anticipate. Interest-only loans, negative amortization loans, adjustable-rate loans, larger balance loans, reduced documentation loans, subprime loans, alt-a loans, second lien loans, loans in certain locations, residential mortgage loans that are not “qualified mortgages” under regulations promulgated by the CFPB, and loans or investments that are partially collateralized by non-real estate assets may have increased risks and severity of loss. If property securing or underlying loans become real estate owned as a result of foreclosure, we bear the risk of not being able to sell the property and recovering our investment and of being exposed to the risks attendant to the ownership of real property.

Changes in consumer behavior, bankruptcy laws, tax laws, regulation of the mortgage industry, and other laws may exacerbate loan or investment losses. Changes in rules that would cause loans owned by a securitization entity to be modified may not be beneficial to our interests if the modifications reduce the interest we earn and increase the eventual severity of a loss. In some states and circumstances, the securitizations in which we invest have recourse as owner of the loan against the borrower’s other assets and income in the event of loan default. However, in most cases, the value of the underlying property will be the sole effective source of funds for any recoveries. Other changes or actions by judges or legislators regarding mortgage loans and contracts, including the voiding of certain portions of these agreements, may reduce our earnings, impair our ability to mitigate losses, or increase the probability and severity of losses. Any expansion of our loss mitigation efforts as we grow our portfolio could increase our operating costs and the expanded loss mitigation efforts may not reduce our future credit losses.

9

Credit ratings assigned to debt securities by the credit rating agencies may not accurately reflect the risks associated with those securities. Furthermore, downgrades in the credit ratings of bond insurers or any downgrades in the credit ratings of mortgage insurers could increase our credit risk, reduce our cash flows, or otherwise adversely affect our business and operations.

We generally do not consider credit ratings in assessing our estimates of future cash flows and desirability of our investments (although our assessment of the quality of an investment may prove to be inaccurate and we may incur credit losses in excess of our initial expectations). The assignment of an “investment grade” rating to a security by a rating agency does not mean that there is not credit risk associated with the security or that the risk of a credit loss with respect to such security is necessarily remote. Many of the securities we own do have credit ratings and, to the extent we securitize loans and securities, we expect to retain credit rating agencies to provide ratings on the securities created by these securitization entities (as we have in the past).

Rating agencies rate debt securities based upon their assessment of the safety of the receipt of principal and interest payments. Rating agencies do not consider the risks of fluctuations in fair value or other factors that may influence the value of debt securities and, therefore, any assigned credit rating may not fully reflect the true risks of an investment in securities. Also, rating agencies may fail to make timely adjustments to credit ratings based on available data or changes in economic outlook or may otherwise fail to make changes in credit ratings in response to subsequent events, so that our investments may be better or worse than the ratings indicate. Credit rating agencies may change their methods of evaluating credit risk and determining ratings on securities backed by real estate loans and securities. These changes may occur quickly and often. The market’s ability to understand and absorb these changes and the impact to the securitization market in general are difficult to predict. Such changes may have an impact on the amount of investment-grade and non-investment-grade securities that are created or placed on the market in the future. Downgrades to the ratings of securities could have an adverse effect on the value of some of our investments and our cash flows from those investments.

Currently, and in the future, some of the loans we own or that underlie mortgage-backed securities we own may be insured in part by mortgage insurers or financial guarantors. Mortgage insurance protects the lender or other holder of a loan up to a specified amount, in the event the borrower defaults on the loan. Mortgage insurance is generally obtained only when the principal amount of the loan at the time of origination is greater than 80% of the value of the property (loan-to-value), although it may not always be obtained in these circumstances. Any inability of the mortgage insurers to pay in full the insured portion of the loans that we hold would adversely affect the value of the securities we own that are backed by these loans, which could increase our credit risk, reduce our cash flows, or otherwise adversely affect our business.

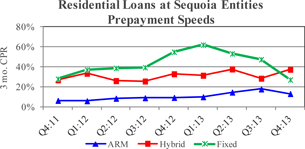

Changes in prepayment rates of residential mortgage loans could reduce our earnings, dividends, cash flows, and access to liquidity. Similarly, with respect to commercial real estate loans, borrowers’ decisions to prepay or extend loans could reduce our earnings, dividends, cash flows, and access to liquidity.

The economic returns we earn from most of the residential real estate securities and loans we own (directly or indirectly) are affected by the rate of prepayment of the underlying residential mortgage loans. Prepayments are difficult to accurately predict and adverse changes in the rate of prepayment could reduce our cash flows, earnings, and dividends. Adverse changes in cash flows would likely reduce the fair values of many of our assets, which could reduce our ability to borrow against our assets and may cause market valuation adjustments for GAAP purposes, which could reduce our reported earnings. While we estimate prepayment rates to determine the effective yield of our assets and valuations, these estimates are not precise and prepayment rates do not necessarily change in a predictable manner as a function of interest rate changes. Prepayment rates can change rapidly. As a result, changes can cause volatility in our financial results, affect our ability to securitize assets, affect our ability to fund acquisitions, and have other negative impacts on our ability to generate earnings.

We own a number of securities backed by residential loans that are particularly sensitive to changes in prepayments rates. These securities include interest-only securities (IOs) that we acquire from third parties and from our Sequoia entities. Faster prepayments than we anticipated on the underlying loans backing these IOs will have an adverse effect on our returns on these investments and may result in losses. Similarly, we own mortgage servicing rights, or MSRs, associated with residential mortgage loans that are particularly sensitive to changes in prepayments rates. As the owner of an MSR, we are entitled to a portion of the interest payments made by the borrower in respect of the associated loan and we are responsible for hiring and compensating a sub-servicer to directly service the associated loan. Faster prepayments than we anticipate on loans associated with MSRs we own will have an adverse effect on our returns from these MSRs and may result in losses.

Some of the commercial real estate loans we originate or hold may allow the borrower to make prepayments without incurring a prepayment penalty and some may include provisions allowing the borrower to extend the term of the loan beyond the originally scheduled maturity. Because the decision to prepay or extend a commercial loan is controlled by the borrower, we may not accurately anticipate the timing of these events, which could affect the earnings and cash flows we anticipate and could impact our ability to finance these assets.

10

Interest rate fluctuations can have various negative effects on us and could lead to reduced earnings and increased volatility in our earnings.

Changes in interest rates, the interrelationships between various interest rates, and interest rate volatility could have negative effects on our earnings, the fair value of our assets and liabilities, loan prepayment rates, and our access to liquidity. Changes in interest rates can also harm the credit performance of our assets. We generally seek to hedge some but not all interest rate risks. Our hedging may not work effectively and we may change our hedging strategies or the degree or type of interest rate risk we assume.

Some of the loans and securities we own or may acquire have adjustable-rate coupons (i.e., they may earn interest at a rate that adjusts periodically based on an interest rate index). The cash flows we receive from these assets may vary as a function of interest rates, as may the reported earnings generated by these assets. We also acquire loans and securities for future sale, as assets we are accumulating for securitization, or as a longer term investment. We expect to fund assets with a combination of equity, fixed rate debt and adjustable rate debt. To the extent we use adjustable rate debt to fund assets that have a fixed interest rate (or use fixed rate debt to fund assets that have an adjustable interest rate), an interest rate mismatch could exist and we could, for example, earn less (and fair values could decline) if interest rates rise, at least for a time. We may or may not seek to mitigate interest rate mismatches for these assets with hedges such as interest rate agreements and other derivatives and, to the extent we do use hedging techniques, they may not be successful.

Higher interest rates generally reduce the fair value of many of our assets, with the exception of our adjustable-rate assets. This may affect our earnings results, reduce our ability to securitize, re-securitize, or sell our assets, or reduce our liquidity. Higher interest rates could reduce the ability of borrowers to make interest payments or to refinance their loans. Higher interest rates could reduce property values and increased credit losses could result. Higher interest rates could reduce mortgage originations, thus reducing our opportunities to acquire new assets.

When short-term interest rates are high relative to long-term interest rates, an increase in adjustable-rate residential loan prepayments may occur, which would likely reduce our returns from owning interest-only securities backed by adjustable-rate residential loans.

We have significant investment and reinvestment risks.

New assets we originate or acquire may not generate yields as attractive as yields on our current assets, which could result in a decline in our earnings per share over time.

Assets we originate or acquire may not generate the economic returns and GAAP yields we expect. Realized cash flow could be significantly lower than expected and returns from new asset originations and acquisitions could be negative. In order to maintain our portfolio size and our earnings, we must reinvest in new assets a portion of the cash flows we receive from principal, interest, and sales. We receive monthly payments from many of our assets, consisting of principal and interest. In addition, occasionally some of our residential securities are called (effectively sold). We may also sell assets from time to time as part of our portfolio and capital management strategies. Principal payments, calls, and sales reduce the size of our current portfolio and generate cash for us.

If the assets we acquire in the future earn lower GAAP yields than do the assets we currently own, our reported earnings per share could decline over time as the older assets are paid down, are called, or are sold, assuming comparable expenses, credit costs, and market valuation adjustments. Under the effective yield method of accounting that we use for GAAP purposes for some of our assets, we recognize yields on assets based on our assumptions regarding future cash flows. A portion of the cash flows we receive may be used to reduce our basis in these assets. As a result of these various factors, our basis for GAAP amortization purposes may be lower than their current fair values. Assets with a lower GAAP basis than current fair values generate higher GAAP yields, yields that are not necessarily available on newly acquired assets. Future economic conditions, including credit results, prepayment patterns, and interest rate trends, are difficult to project with accuracy over the life of the assets we acquire, so there will be volatility in the reported returns over time.

Our growth may be limited if assets are not available or not available at attractive prices.

To reinvest proceeds from principal repayments and deploy capital we raise, we must originate or acquire new assets. If the availability of new assets is limited, we may not be able to originate or acquire assets that will generate attractive returns. Generally, asset supply can be reduced if originations of a particular product are reduced or if there are few sales in the secondary market of seasoned product from existing portfolios. In particular, assets we believe have a favorable risk/reward ratio may not be available for purchase.

We do not originate residential loans; rather, we rely on the origination market to supply the types of loans we seek to invest in. At times, due to increases in interest rates, heightened credit concerns, strengthened underwriting standards, increased regulation, and/or concerns about economic growth or housing values, the volume of originations may decrease significantly. For example, in recent

11

years residential mortgage interest rates were generally declining, with the result that a significant portion of industry-wide origination volumes have been related to residential borrowers refinancing existing mortgage loans. More recently, residential mortgage interest rates have been increasing or remaining steady. To the extent interest rates increase or remain steady, the volume of refinance loans is likely to decline significantly and this volume may not return to previous levels. A reduced volume of loan originations may make it difficult for us to acquire loans and securities.

We originate commercial loans, but we may not be willing to provide the level of loan proceeds to the borrower or interest rate that borrowers find acceptable or that matches our competitors. While the overall industry-wide volume of commercial real estate loan originations and financings is increasing from prior low levels, it is not at the volume the industry has experienced in the past. And, the high-quality commercial assets we seek to finance are highly sought after by numerous lenders.

The supply of new issue RMBS collateralized by jumbo mortgage loans available for purchase could be adversely affected if the economics of executing securitizations are not favorable or if the regulations governing the execution of securitizations discourage or preclude certain potential market participants from engaging in these transactions. In addition, if there is not a robust market for triple-A rated securities, the supply of real estate subordinate securities could be significantly diminished.

Investments in diverse types of assets and businesses could expose us to new, different, or increased risks.

We have invested in and may in the future invest in a variety of real estate and non-real estate related assets that may not be closely related to the types of investments we have traditionally made. Additionally, we may enter into or engage in various types of securitizations, transactions, services, and other operating businesses that are different than the types we have traditionally entered into or engaged in, including, for example, ownership of MSRs associated with residential mortgage loans, which we began to increase our holdings of during 2012 and 2013. Any of these actions may expose us to new, different, or increased investment, operational, financial, or management risks. We may invest in non-real estate asset-backed securities (ABS), corporate debt, or equity. We have invested in diverse types of IOs from residential and commercial securitizations sponsored by us or by others. The higher credit and prepayment risks associated with these types of investments may increase our exposure to losses. We may invest in non-U.S. assets that may expose us to currency risks (which we may choose not to hedge) and different types of credit, prepayment, hedging, interest rate, liquidity, legal, and other risks. We originate first mortgage commercial loans primarily for the sale to others (while, in some cases, retaining a subordinate interest in these loans or retaining subordinate financing for the same property) and this exposes us to certain representation and warranty, aggregation, market value, and other risks on loan balances in excess of our potential investments.

In addition, when investing in assets or businesses we are exposed to the risk that those assets, or interest income or revenue generated by those assets or businesses, result in our not meeting the requirements to maintain our REIT status or our status as exempt from registration under the Investment Company Act of 1940, as amended (Investment Company Act), as further described in the risk factors titled “Redwood has elected to be a REIT and, as such, is required to meet certain tests in order to maintain its REIT status. This adds complexity and costs to running our business and exposes us to additional risks” and “Conducting our business in a manner so that we are exempt from registration under, and in compliance with, the Investment Company Act may reduce our flexibility and could limit our ability to pursue certain opportunities. At the same time, failure to continue to qualify for exemption from the Investment Company Act could adversely affect us.”

We may change our investment strategy or financing plans, which may result in riskier investments and diminished returns.

We may change our investment strategy or financing plans at any time, which could result in our making investments that are different from, and possibly riskier than, the investments we have previously made or described. A change in our investment strategy or financing plans may increase our exposure to interest rate and default risk and real estate market fluctuations. Decisions to employ additional leverage could increase the risk inherent in our investment strategy. Furthermore, a change in our investment strategy could result in our making investments in new asset categories or in different proportions among asset categories than we previously have. For example, we could in the future determine to invest a greater proportion of our assets in securities backed by subprime residential mortgage loans. These changes could result in our making riskier investments, which could ultimately have an adverse effect on our financial returns. Alternatively, we could determine to change our investment strategy or financing plans to be more risk averse, resulting in potentially lower returns, which could also have an adverse effect on our financial returns.

The performance of the assets we own and the investments we make will vary and may not meet our earnings or cash flow expectations. In addition, the cash flows and earnings from, and market values of, securities, loans, and other assets we own may be volatile.

We seek to manage certain of the risks associated with acquiring, originating, holding, selling, and managing real estate loans and securities and other real estate-related investments. No amount of risk management or mitigation, however, can change the variable nature of the cash flows of, fair values of, and financial results generated by these loans, securities, and other assets. Changes in the

12

credit performance of, or the prepayments on, these investments, including real estate loans and the loans underlying these securities, and changes in interest rates impact the cash flows on these securities and investments, and the impact could be significant for our loans, securities, and other assets with concentrated risks. Changes in cash flows lead to changes in our return on investment and also to potential variability in and level of reported income. The revenue recognized on some of our assets is based on an estimate of the yield over the remaining life of the asset. Thus, changes in our estimates of expected cash flow from an asset will result in changes in our reported earnings on that asset in the current reporting period. We may be forced to recognize adverse changes in expected future cash flows as a current expense, further adding to earnings volatility.

Changes in the fair values of our assets, liabilities, and derivatives can have various negative effects on us, including reduced earnings, increased earnings volatility, and volatility in our book value.