Exhibit 4.1

EXECUTION VERSION

Redwood Trust, Inc.

WARRANT AGREEMENT

Dated as of March 18, 2024

Table of Contents

Page

| Section 1. Definitions | 1 |

| Section 2. Rules of Construction | 8 |

| Section 3. The Warrants | 8 |

| (a) Original Issuance of Warrants | 8 |

| (b) Form, Dating and Denominations | 9 |

| (c) Execution and Delivery | 9 |

| (d) Method of Payment | 9 |

| (e) Registrar and Exercise Agent | 10 |

| (f) Legends | 10 |

| (g) Transfers and Exchanges; Transfer Taxes; Certain Transfer Restrictions | 11 |

| (h) Exchange and Cancellation of Exercised Warrants | 13 |

| (i) Replacement Certificates | 14 |

| (j) Registered Holders | 14 |

| (k) Cancellation | 14 |

| (l) Outstanding Warrants | 14 |

| Section 4. No Right of Redemption by the Company | 15 |

| Section 5. Exercise of Warrants | 15 |

| (a) Generally | 15 |

| (b) Exercise at the Option of the Holders | 15 |

| (c) Automatic Exercise on Exercise Period Expiration Date or Effective Date of Cash Common Stock Change Event | 16 |

| (d) Mandatory Exercise at the Company’s Election | 16 |

| (e) Exercise Procedures | 17 |

| (f) Settlement Upon Exercise | 18 |

| (g) Strike Price and Number of Underlying Shares Adjustments | 19 |

| (h) Voluntary Adjustments | 28 |

| (i) Adjustments Effective Without Need to Amend Certificates | 29 |

| (j) Effect of Common Stock Change Event | 29 |

| Section 6. Certain Provisions Relating to the Issuance of Common Stock | 31 |

| (a) Equitable Adjustments to Prices | 31 |

| (b) Reservation of Shares of Common Stock | 31 |

| (c) Status of Shares of Common Stock | 31 |

| (d) Taxes Upon Issuance of Common Stock | 31 |

| Section 7. Early Termination of Warrants | 31 |

| Section 8. Calculations | 32 |

| (a) Responsibility; Schedule of Calculations | 32 |

| (b) Calculations Aggregated for Each Holder | 32 |

| Section 9. Miscellaneous | 32 |

| (a) Notices | 32 |

| (b) Governing Law; Waiver of Jury Trial | 32 |

| (c) Submission to Jurisdiction | 32 |

| (d) No Adverse Interpretation of Other Agreements | 33 |

| (e) Successors; Benefits of Warrant Agreement | 33 |

| (f) Severability | 33 |

| (g) Counterparts | 33 |

| (h) Table of Contents, Headings, Etc. | 33 |

| (i) Withholding Taxes | 33 |

| (j) Entire Agreement | 33 |

| (k) No Other Rights | 33 |

| (l) No Obligation to Purchase Securities of the Company | 34 |

| (m) Tax Treatment of Warrants | 34 |

| (n) Limitation on Ownership of Warrants, Exercise of Warrants and Shares of Common Stock Deliverable Upon Conversion | 34 |

- i -

Exhibits

| Exhibit A: Form of Warrant Certificate | A-1 |

| Exhibit B-1: Form of Restricted Security Legend | B1-1 |

| Exhibit B-2: Charter Ownership Limitation Legend | B2-1 |

- ii -

WARRANT AGREEMENT

WARRANT AGREEMENT, dated as of March 18, 2024, between Redwood Trust, Inc., a Maryland corporation, as issuer (the “Company”), and the other signatory to this Warrant Agreement (as defined below), as the initial Holder (as defined in this Warrant Agreement).

In consideration of the mutual agreements herein contained, each party to this Warrant Agreement (as defined below) agrees as follows.

Section 1. Definitions.

“Affiliate” has the meaning set forth in Rule 144.

“Agent” means any Registrar or Exercise Agent.

“Authorized Denomination” means, with respect to a Warrant, either (a) such Warrant in its entirety, representing all of the Underlying Shares thereof; or (b) any portion of such Warrant that represents a whole number of the Underlying Shares thereof.

“Automatic Exercise” means the exercise of a Warrant pursuant to Section 5(c).

“Automatic Exercise Date” means an Exercise Date occurring with respect to any Warrant pursuant to Section 5(c).

“Board of Directors” means the Company’s board of directors or a committee of such board duly authorized to act on behalf of such board.

“Business Day” means any day other than a Saturday, a Sunday or any day on which the Federal Reserve Bank of New York is authorized or required by law or executive order to close or be closed.

“Bylaws” means the Company’s Amended and Restated Bylaws, as the same may be further amended, supplemented or restated.

“Capital Stock” of any Person means any and all shares of, interests in, rights to purchase, warrants or options for, participations in, or other equivalents of, in each case however designated, the equity of such Person, but excluding any debt securities convertible into such equity.

“Certificate” means a Physical Certificate or an Electronic Certificate.

“Charter” means the Company’s Charter, as in effect on the date of this Agreement, as the same may be amended, supplemented or restated.

“Charter Ownership Limitation Legend” means a legend substantially in the form set forth in Exhibit B-2.

“Close of Business” means 5:00 p.m., New York City time.

- 1 -

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Stock” means the common stock, $0.01 par value per share, of the Company, subject to Section 5(j).

“Common Stock Change Event” has the meaning set forth in Section 5(j)(i).

“Company” means Redwood Trust, Inc., a Maryland corporation.

“CoreVest” means CoreVest American Finance Lender LLC.

“CoreVest-Originated Loans” means mortgage loans originated by CoreVest for investor borrowers.

“CPP JV Limited Partner” means CPPIB Credit Structured North America II, Inc.

“CPPIB Entity” means Canada Pension Plan Investment Board and any subsidiary thereof, including the CPP JV Limited Partner.

“Credit Agreement” means that certain Credit Agreement, dated as of March 18, 2024, among the Company, CPPIB Credit Investments III Inc. and the other parties thereto.

“Dividend Threshold” has the meaning set forth in Section 5(g)(i)(4).

“Electronic Certificate” means any electronic book entry maintained by the Registrar that represents one (1) Warrant.

“Ex-Dividend Date” means, with respect to an issuance, dividend or distribution on the Common Stock, the first date on which shares of Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such issuance, dividend or distribution (including pursuant to due bills or similar arrangements required by the relevant stock exchange). For the avoidance of doubt, any alternative trading convention on the applicable exchange or market in respect of the Common Stock under a separate ticker symbol or CUSIP number will not be considered “regular way” for this purpose.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Exercise” means an Automatic Exercise, a Mandatory Exercise or an Optional Exercise. The terms “Exercised” and “Exercisable” will have a meaning correlative to the foregoing.

“Exercise Agent” has the meaning set forth in Section 3(e)(i).

“Exercise Consideration” means, with respect to the Exercise of any Warrant, the type and amount of consideration payable to settle such Exercise, determined in accordance with Section 5.

- 2 -

“Exercise Date” means an Automatic Exercise Date, a Mandatory Exercise Date or an Optional Exercise Date.

“Exercise Period” means (a) with respect to any First Tranche Warrant, the First Tranche Warrants Exercise Period; and (b) with respect to any Second Tranche Warrant, the Second Tranche Warrants Exercise Period.

“Exercise Period Expiration Date” means March 18, 2029 (or, if such date is not a Business Day, the immediately following Business Day).

“Exercise Share” means any share of Common Stock issued or issuable upon Exercise of any Warrant.

“First Tranche Warrants” has the meaning set forth in Section 3(a).

“First Tranche Warrants Exercise Period” means the period from, and including, the date that is three hundred and sixty-five (365) days following the Initial Issue Date to, and including, the Exercise Period Expiration Date.

“Holder” means a person in whose name any Warrant is registered on the Registrar’s books.

“Initial Issue Date” means March 18, 2024.

“JV Agreement” means that certain limited partnership agreement dated as of March 18, 2024, among Redwood Maple Mortgage Fund GP, LLC, RWT Venture Holdings II, LLC, and the CPP JV Limited Partner.

“JV Fund” means Redwood Maple Mortgage Fund, LP.

“Last Reported Sale Price” of the Common Stock for any Trading Day means the closing sale price per share (or, if no closing sale price is reported, the average of the last bid price and the last ask price per share or, if more than one in either case, the average of the average last bid prices and the average last ask prices per share) of the Common Stock on such Trading Day as reported in composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is then listed. If the Common Stock is not listed on a U.S. national or regional securities exchange on such Trading Day, then the Last Reported Sale Price will be the last quoted bid price per share of Common Stock on such Trading Day in the over-the-counter market as reported by OTC Markets Group Inc. or a similar organization. If the Common Stock is not so quoted on such Trading Day, then the Last Reported Sale Price will be the average of the mid-point of the last bid price and the last ask price per share of Common Stock on such Trading Day from a nationally recognized independent investment banking firm the Company selects.

“Liquidity Condition” means, with respect to any Mandatory Exercise, that either (a) both of the following conditions are satisfied: (i) the Exercise Date for such Mandatory Exercise is before the date that is one (1) year after the Initial Issue Date; and (ii) as of the Mandatory Exercise Notice Date for such Mandatory Exercise, (1) the Company has satisfied the conditions set forth in Rule 144(c) under the Securities Act; and (2) the due date, under the Exchange Act, for the Company’s next annual report or quarterly report under Section 13(a) or 15(d) of the Exchange Act is either (x) at least thirty (30) calendar days after such Mandatory Exercise Notice Date; or (y) after the date that is one (1) year after the Initial Issue Date; or (b) the Exercise Date for such Mandatory Exercise is on or after the date that is one (1) year after the Initial Issue Date.

- 3 -

“Loan” has the meaning set forth in the Credit Agreement.

“Loan Administration Agreement” has the meaning set forth in the JV Agreement.

“Mandatory Exercise” has the meaning set forth in Section 5(d)(i).

“Mandatory Exercise Condition” has the meaning set forth in Section 5(d)(i).

“Mandatory Exercise Date” means an Exercise Date designated with respect to any Warrant pursuant to Section 5(d)(i) and 5(d)(ii).

“Mandatory Exercise Notice” has the meaning set forth in Section 5(d)(iii).

“Mandatory Exercise Notice Date” means, with respect to a Mandatory Exercise, the date on which the Company sends the Mandatory Exercise Notice for such Mandatory Exercise pursuant to Section 5(d)(iii).

“Mandatory Exercise Right” has the meaning set forth in Section 5(d)(i).

“Mandatory Exercise Trigger Date” means the date that is six (6) months after the Initial Issue Date.

“Market Disruption Event” means, with respect to any date, the occurrence or existence, during the one-half hour period ending at the scheduled close of trading on such date on the principal U.S. national or regional securities exchange or other market on which the Common Stock is listed for trading or trades, of any material suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock.

“Officer” means the Chief Executive Officer, the President, the Chief Financial Officer, or the Treasurer of the Company.

“Open of Business” means 9:00 a.m., New York City time.

“Optional Exercise” means the exercise of any Warrant other than an Automatic Exercise or a Mandatory Exercise.

“Optional Exercise Date” means, with respect to the Optional Exercise of any Warrant, the first Business Day on which the requirements set forth in Section 5(e)(ii) for such Optional Exercise are satisfied.

- 4 -

“Optional Exercise Notice” means a notice substantially in the form of the “Optional Exercise Notice” set forth in Exhibit A.

“Person” or “person” means any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, unincorporated organization or government or other agency or political subdivision thereof. Any division or series of a limited liability company, limited partnership or trust will constitute a separate “person” under this Warrant Agreement.

“Physical Certificate” means any certificate (other than an Electronic Certificate) representing one (1) Warrant, which certificate is substantially in the form set forth in Exhibit A, registered in the name of the Holder of such Warrant and duly executed by the Company.

“Record Date” means, with respect to any dividend or distribution on, or issuance to holders of, Common Stock, the date fixed (whether by law, contract or the Board of Directors or otherwise) to determine the holders of Common Stock that are entitled to such dividend, distribution or issuance.

“Reference Property” has the meaning set forth in Section 5(j)(i).

“Reference Property Unit” has the meaning set forth in Section 5(j)(i).

“Register” has the meaning set forth in Section 3(e)(ii).

“Registrar” has the meaning set forth in Section 3(e)(i).

“Restricted Security Legend” means a legend substantially in the form set forth in Exhibit B-1.

“Rule 144” means Rule 144 under the Securities Act (or any successor rule thereto), as the same may be amended from time to time.

“Second Tranche Vesting Date” means the first date on which the sale of CoreVest-Originated Loans to the JV Fund in an aggregate principal amount equal to $1.25 billion has occurred pursuant to the JV Agreement.

“Second Tranche Warrants” has the meaning set forth in Section 3(a).

“Second Tranche Warrants Exercise Period” means the period from, and including, the Second Tranche Vesting Date to, and including, the Exercise Period Expiration Date.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

- 5 -

“Security” means any Warrant or Exercise Share.

“Specified Courts” has the meaning set forth in Section 9(c).

“Spin-Off” has the meaning set forth in Section 5(g)(i)(3)(B).

“Spin-Off Valuation Period” has the meaning set forth in Section 5(g)(i)(3)(B).

“Strike Price” initially means $7.76 per share; provided, however, that the Strike Price is subject to adjustment pursuant to Sections 5(g) and 5(h). Each reference in this Warrant Agreement or any Certificate to the Strike Price as of a particular date without setting forth a particular time on such date will be deemed to be a reference to the Strike Price immediately after the Close of Business on such date.

“Subsidiary” means, with respect to any Person, (a) any corporation, association or other business entity (other than a partnership or limited liability company) of which more than fifty percent (50%) of the total voting power of the Capital Stock entitled (without regard to the occurrence of any contingency, but after giving effect to any voting agreement or stockholders’ agreement that effectively transfers voting power) to vote in the election of directors, managers or trustees, as applicable, of such corporation, association or other business entity is owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person; and (b) any partnership or limited liability company where (x) more than fifty percent (50%) of the capital accounts, distribution rights, equity and voting interests, or of the general and limited partnership interests, as applicable, of such partnership or limited liability company are owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person, whether in the form of membership, general, special or limited partnership or limited liability company interests or otherwise, and (y) such Person or any one or more of the other Subsidiaries of such Person is a controlling general partner of, or otherwise controls, such partnership or limited liability company.

“Successor Person” has the meaning set forth in Section 5(j)(iii).

“Tender/Exchange Offer Expiration Date” has the meaning set forth in Section 5(g)(i)(5).

“Tender/Exchange Offer Expiration Time” has the meaning set forth in Section 5(g)(i)(5).

“Tender/Exchange Offer Valuation Period” has the meaning set forth in Section 5(g)(i)(5).

“Trading Day” means any day on which (a) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded; and (b) there is no Market Disruption Event. If the Common Stock is not so listed or traded, then “Trading Day” means a Business Day.

- 6 -

“Transfer-Restricted Security” means any Security that constitutes a “restricted security” (as defined in Rule 144); provided, however, that such Security will cease to be a Transfer-Restricted Security upon the earliest to occur of the following events:

(a) such Security is sold or otherwise transferred to a Person (other than the Company or an Affiliate of the Company) pursuant to a registration statement that was effective under the Securities Act at the time of such sale or transfer;

(b) such Security is sold or otherwise transferred to a Person (other than the Company or an Affiliate of the Company) pursuant to an available exemption (including Rule 144) from the registration and prospectus-delivery requirements of, or in a transaction not subject to, the Securities Act and, immediately after such sale or transfer, such Security ceases to constitute a “restricted security” (as defined in Rule 144); and

(c) such Security is eligible for resale, by a Person that is not an Affiliate of the Company and that has not been an Affiliate of the Company during the immediately preceding three (3) months, pursuant to Rule 144 without any limitations thereunder as to volume, manner of sale, availability of current public information or notice.

“Triggering Dividend/Distribution” has the meaning set forth in Section 5(g)(i)(4).

“Underlying Shares” initially means, with respect to any Warrant, that number of shares of Common Stock identified as the initial number of “Underlying Shares” in the Certificate representing such Warrant; provided, however, that (a) the number of Underlying Shares of each Warrant will be subject to adjustment pursuant to Sections 5(g) and 5(h), and (b) upon the Exercise of any Warrant (or any portion thereof representing less than all of the Underlying Shares thereof), the number of Underlying Shares of such Warrant will be reduced, effective as of the time such Warrant (or such portion thereof) ceases to be outstanding pursuant to Section 3(l), by the number of Underlying Shares so Exercised.

“Valuation Price” means, with respect to the Exercise of any Warrant, the Last Reported Sale Price per share of Common Stock on the Exercise Date for such Exercise (or, if such Exercise Date is not a Trading Day, the immediately preceding Trading Day).

“Warrant” means each warrant issued by the Company pursuant to, and having the terms, and conferring to the Holders thereof the rights, set forth in, this Warrant Agreement. Subject to the terms of this Warrant Agreement, each Warrant will be Exercisable for shares of Common Stock based on the number of Underlying Shares of such Warrant and the Strike Price.

“Warrant Agreement” means this Warrant Agreement, as amended or supplemented from time to time.

A “Warrant Termination Event” will be deemed to occur (a) with respect to the First Tranche Warrants if, at any time on or before the three hundred and sixty fifth (365th) day after the Initial Issue Date, a CPPIB Entity exercises its right to terminate the JV Fund pursuant to the JV Agreement or the Loan Administration Agreement; and (b) with respect to the Second Tranche Warrants if, either (i) a CPPIB Entity exercises its right to terminate the JV Fund pursuant to the JV Agreement or the Loan Administration Agreement at any time on or before the three hundred and sixty fifth (365th) day after the Initial Issue Date, or (ii) the CPP JV Limited Partner is a Defaulting Limited Partner as defined in the JV Agreement.

- 7 -

Section 2. Rules of Construction. For purposes of this Warrant Agreement:

(a) “or” is not exclusive;

(b) “including” means “including without limitation”;

(c) “will” expresses a command;

(d) the “average” of a set of numerical values refers to the arithmetic average of such numerical values;

(e) a merger involving, or a transfer of assets by, a limited liability company, limited partnership or trust will be deemed to include any division of or by, or an allocation of assets to a series of, such limited liability company, limited partnership or trust, or any unwinding of any such division or allocation;

(f) words in the singular include the plural and in the plural include the singular, unless the context requires otherwise;

(g) “herein,” “hereof” and other words of similar import refer to this Warrant Agreement as a whole and not to any particular Section or other subdivision of this Warrant Agreement, unless the context requires otherwise;

(h) references to currency mean the lawful currency of the United States of America, unless the context requires otherwise; and

(i) the exhibits, schedules and other attachments to this Warrant Agreement are deemed to form part of this Warrant Agreement.

Section 3. The Warrants.

(a) Original Issuance of Warrants. On the Initial Issue Date, there will be originally issued (i) Warrants having an initial aggregate of one million nine hundred seventy four thousand nine hundred five (1,974,905) Underlying Shares (the “First Tranche Warrants”); and (ii) Warrants having an initial aggregate of four million six hundred eight thousand one hundred twelve (4,608,112) Underlying Shares (the “Second Tranche Warrants”). Such Warrants will be initially registered in the name of CPPIB Credit Investments III Inc. For the avoidance of doubt, the number of Underlying Shares of each of the First Tranche Warrants and the Second Tranche Warrants is subject to adjustment pursuant to Section 5(g)(i)(6).

- 8 -

(b) Form, Dating and Denominations.

(i) Form and Date of Certificates Representing Warrants. Each Certificate representing any Warrant will (1) be substantially in the form set forth in Exhibit A; (2) bear the legends required by Section 3(f) and may bear notations, legends or endorsements required by law or stock exchange rule; and (3) be dated as of the date it is executed by the Company.

(ii) Electronic Certificates; Physical Certificates. The Warrants will be originally issued initially in the form of one or more Physical Certificates. Electronic Certificates may be exchanged for Physical Certificates, and Physical Certificates may be exchanged for Electronic Certificates, upon request by the Holder thereof pursuant to customary procedures, subject to Section 3(g).

(iii) Electronic Certificates; Interpretation. For purposes of this Warrant Agreement, (1) each Electronic Certificate will be deemed to include the text of the form of Certificate set forth in Exhibit A; (2) any legend, registration number or other notation that is required to be included on a Certificate will be deemed to be affixed to any Electronic Certificate notwithstanding that such Electronic Certificate may be in a form that does not permit affixing legends thereto; (3) any reference in this Warrant Agreement to the “delivery” of any Electronic Certificate will be deemed to be satisfied upon the registration of the electronic book entry representing such Electronic Certificate in the name of the applicable Holder; (4) upon satisfaction of any applicable requirements of the Maryland General Corporation Law, the Charter and the Bylaws of the Company, and any related requirements of the Registrar, in each case for the issuance of Warrants in the form of one or more Electronic Certificates, such Electronic Certificates will be deemed to be executed by the Company.

(iv) No Bearer Certificates. The Warrants will be issued only in registered form.

(v) Registration and Tranche Numbers. Each Certificate representing any Warrant will bear (1) a unique registration number that is not affixed to any other Certificate representing any other outstanding Warrant; and (2) an indication whether the Warrant(s) represented by such Certificate constitute First Tranche Warrants or Second Tranche Warrants.

(c) Execution and Delivery. A duly authorized Officer will sign each Certificate representing any Warrant on behalf of the Company by manual or facsimile signature.

(d) Method of Payment. The Company will pay all cash amounts due on any Warrant of any Holder by check mailed to the address of such Holder set forth in the Register; provided, however, that the Company will instead pay such cash amounts by wire transfer of immediately available funds to the account of such Holder within the United States specified in a written request of such Holder delivered to the Company no later than the Close of Business on the date that is ten (10) Business Days immediately before the date such payment is due (or specified in the related Optional Exercise Notice, if applicable).

- 9 -

(e) Registrar and Exercise Agent.

(i) Generally. The Company designates its principal U.S. executive offices as an office or agency where Warrants may be presented for (1) registration of transfer or for exchange (the “Registrar”); and (2) Exercise (the “Exercise Agent”). At all times when any Warrant is outstanding, the Company will maintain an office in the continental United States constituting the Registrar and Exercise Agent.

(ii) Maintenance of the Register. The Company will keep, or cause there to be kept, a record (the “Register”) of the names and addresses of the Holders, the number of Warrants (and the respective numbers of Underlying Shares thereof) held by each Holder and the transfer, exchange and Exercise of the Warrants. Absent manifest error, the entries in the Register will be conclusive and the Company and each Agent may treat each Person whose name is recorded as a Holder in the Register as a Holder for all purposes. The Register will be in written form or in any form capable of being converted into written form reasonably promptly. The Company will provide a copy of the Register to any Holder upon its request as soon as reasonably practicable.

(iii) Subsequent Appointments. By notice to each Holder, the Company may, at any time, appoint any Person (including any Subsidiary of the Company) to act as Registrar or Exercise Agent.

(f) Legends.

(i) Restricted Security Legend.

(1) Each Certificate representing any Warrant that is a Transfer-Restricted Security will bear the Restricted Security Legend.

(2) If any Warrant (such Warrant being referred to as the “new Warrant” for purposes of this Section 3(f)(i)(2)) is issued in exchange for, or in substitution of, other Warrant(s), or to effect the Exercise of less than all of the Underlying Shares of a Warrant represented by any Certificate (such other Warrant(s) or Exercised Warrant, as applicable, being referred to as the “old Warrant(s)” for purposes of this Section 3(f)(i)(2)), including pursuant to Section 3(g)(ii), 3(h) or 3(i), then the Certificate representing such new Warrant will bear the Restricted Security Legend if the Certificate representing such old Warrant(s) bore the Restricted Security Legend at the time of such exchange or substitution, or on the related Exercise Date with respect to such Exercise, as applicable; provided, however, that the Certificate representing such new Warrant need not bear the Restricted Security Legend if such new Warrant does not constitute a Transfer-Restricted Security immediately after such exchange or substitution, or as of such Exercise Date, as applicable.

(ii) Charter Ownership Limitation Legend. Each Certificate representing any Warrant will bear the Charter Ownership Limitation Legend.

(iii) Other Legends on Certificates. The Certificate representing any Warrant may bear any other legend or text, not inconsistent with this Warrant Agreement, as may be required by applicable law, by the rules of any applicable depositary for such Warrant or by any securities exchange or automated quotation system on which such Warrant is traded or quoted or as may be otherwise reasonably determined by the Company to be appropriate.

- 10 -

(iv) Acknowledgement and Agreement by the Holders. A Holder’s acceptance of any Warrant represented by a Certificate bearing any legend required by this Section 3(f) will constitute such Holder’s acknowledgement of, and agreement to comply with, the restrictions set forth in such legend.

(v) Legends on Exercise Shares.

(1) Each Exercise Share will bear a legend (A) substantially to the same effect as the Restricted Security Legend if the Warrant upon the Exercise of which such Exercise Share was issued was (or would have been had it not been Exercised) a Transfer-Restricted Security at the time such Exercise Share was issued, provided that such Exercise Share need not bear such a legend if the Company determines, in its reasonable discretion, that such Exercise Share need not bear such a legend; and (B) referencing the restrictions on ownership and transfer as set forth in the Charter.

(2) Notwithstanding anything to the contrary in Section 3(f)(v)(1), an Exercise Share need not bear a legend pursuant to Section 3(f)(v)(1) if such Exercise Share is issued in an uncertificated form that does not permit affixing legends thereto, provided the Company takes measures (including, if applicable, the assignment thereto of a “restricted” CUSIP number) that it reasonably deems appropriate to enforce the transfer restrictions referred to in such legend.

(g) Transfers and Exchanges; Transfer Taxes; Certain Transfer Restrictions.

(i) Provisions Applicable to All Transfers and Exchanges.

(1) Generally. Subject to this Section 3(g) (including, for the avoidance of doubt, Section 3(g)(i)(2)), any Warrant represented by any Certificate may be transferred or exchanged from time to time, and the Company will cause the Registrar to record each such transfer or exchange in the Register.

(2) Transfers Permitted Only If to an Affiliate. Notwithstanding anything to the contrary in this Agreement, without the consent of the Company (which consent may be withheld or conditioned in the Company’s sole and absolute discretion), a Holder will not be entitled to transfer or exchange any Warrant (or any beneficial interest therein) to or for the benefit of any Person that is not an Affiliate of such Holder.

(3) No Services Charge; Transfer Taxes. The Company and the Agents will not impose any service charge on any Holder for any transfer, exchange or Exercise of any Warrant, but the Company, the Registrar and the Exercise Agent may require payment of a sum sufficient to cover any transfer tax or similar governmental charge that may be imposed in connection with any transfer, exchange or Exercise of any Warrant, other than exchanges pursuant to Section 3(h) not involving any transfer.

- 11 -

(4) Transfers and Exchanges Must Be in Authorized Denominations. Notwithstanding anything to the contrary in this Warrant Agreement, all transfers or exchanges of Warrants must be in an Authorized Denomination.

(5) Legends. Each Certificate representing any Warrant that is issued upon transfer of, or in exchange for, another Warrant will bear each legend, if any, required by Section 3(f).

(ii) Transfers and Exchanges of Warrants.

(1) Subject to this Section 3(g), a Holder of any Warrant represented by a Certificate may (A) transfer any Authorized Denomination of such Warrant to one or more other Person(s); and (B) exchange any Authorized Denomination of such Warrant for Warrant(s) that (x) represent that same aggregate number of Underlying Shares as the number of Underlying Shares being exchanged; and (y) are represented by one or more other Certificates; provided, however, that, to effect any such transfer or exchange, such Holder must:

(A) if such Certificate is a Physical Certificate, surrender such Physical Certificate to the office of the Registrar, together with any endorsements or transfer instruments reasonably required by the Company or the Registrar; and

(B) deliver such certificates, documentation or evidence as may be required pursuant to Section 3(g)(iii).

(2) Upon the satisfaction of the requirements of this Warrant Agreement to effect a transfer or exchange of any Authorized Denomination of a Holder’s Warrant represented by a Certificate (such Certificate being referred to as the “old Certificate” for purposes of this Section 3(g)(ii)(2)):

(A) such old Certificate will be promptly cancelled pursuant to Section 3(k);

(B) if less than all of the Underlying Shares of the Warrant represented by such old Certificate are to be so transferred or exchanged, then the Company will issue, execute and deliver, in accordance with Section 3(c), one or more Certificates that (x) in the aggregate, represent a total number of Underlying Shares equal to the number of Underlying Shares represented by such old Certificate not to be so transferred or exchanged; (y) are registered in the name of such Holder; and (z) bear each legend, if any, required by Section 3(f);

(C) in the case of a transfer to a transferee, the Company will issue, execute and deliver, in accordance with Section 3(c), one or more Certificates that (x) in the aggregate, represent a total number of Underlying Shares equal to the number of Underlying Shares to be so transferred; (y) are registered in the name of such transferee; and (z) bear each legend, if any, required by Section 3(f); and

- 12 -

(D) in the case of an exchange, the Company will issue, execute and deliver, in accordance with Section 3(c), one or more Certificates that (x) in the aggregate, represent a total number of Underlying Shares equal to the number of Underlying Shares to be so exchanged; (y) are registered in the name of the Person to whom such old Certificate was registered; and (z) bear each legend, if any, required by Section 3(f).

(iii) Requirement to Deliver Documentation and Other Evidence. If a Holder of any Warrant that is a Transfer-Restricted Security, or that is represented by a Certificate that bears a Restricted Security Legend, requests to register the transfer of such Warrant to the name of another Person, then the Company and the Registrar may refuse to effect such transfer unless there is delivered to the Company and the Registrar such certificates or other documentation or evidence as the Company and the Registrar may reasonably require to determine that such transfer complies with the Securities Act and other applicable securities laws.

(iv) Transfers of Warrants Subject to Exercise. Notwithstanding anything to the contrary in this Warrant Agreement, the Company and the Registrar will not be required to register the transfer of or exchange any Warrant that has been surrendered for Exercise.

(h) Exchange and Cancellation of Exercised Warrants.

(i) Partial Exercises of Physical Certificates. If less than all of the Underlying Shares of a Holder’s Warrant represented by a Physical Certificate (such Physical Certificate being referred to as the “old Physical Certificate” for purposes of this Section 3(h)(i)) are Exercised pursuant to Section 5, then, as soon as reasonably practicable after such old Physical Certificate is surrendered for such Exercise, the Company will cause such old Physical Certificate to be exchanged, pursuant and subject to Section 3(g)(ii), for (1) one or more Physical Certificates that represent one or more Warrants that, in the aggregate, have a total number of Underlying Shares equal to the number of Underlying Shares of the Warrant represented by such old Physical Certificate that are not to be so Exercised and deliver such Physical Certificate(s) to such Holder; and (2) a Physical Certificate representing a Warrant having a total number of Underlying Shares equal to the number of Underlying Shares of the Warrant represented by such old Physical Certificate that are to be so Exercised, which Physical Certificate will be Exercised pursuant to the terms of this Warrant Agreement; provided, however, that the Physical Certificate referred to in this clause (2) need not be issued at any time after which the Warrant that would otherwise be represented by such Physical Certificate would be deemed to cease to be outstanding pursuant to Section 3(l).

- 13 -

(ii) Cancellation of Warrants That Are Exercised. If the Underlying Shares of a Holder’s Warrant represented by a Certificate (or any portion thereof that has not theretofore been exchanged pursuant to Section 3(h)(i)) (such Certificate being referred to as the “old Certificate” for purposes of this Section 3(h)(ii)) are Exercised pursuant to Section 5, then, promptly after the later of the time such Warrant (or the portion thereof representing the Underlying Shares so Exercised) is deemed to cease to be outstanding pursuant to Section 3(l) and the time such old Certificate is surrendered for such Exercise, (1) such old Certificate will be cancelled pursuant to Section 3(k); and (2) in the case of a partial Exercise, the Company will issue, execute and deliver to such Holder, in accordance with Section 3(c), one or more Certificates that (x) represent one or more Warrants that, in the aggregate, have a total number of Underlying Shares equal to the number of Underlying Shares of the Warrant represented by such old Certificate that are not to be so Exercised; (y) are registered in the name of such Holder; and (z) bear each legend, if any, required by Section 3(f).

(i) Replacement Certificates. If a Holder of any Warrant(s) claims that the Certificate(s) representing such Warrant(s) have been mutilated, lost, destroyed or wrongfully taken, then the Company will issue, execute and deliver, in accordance with Section 3(c), one or more replacement Certificates representing such Warrant(s) upon surrender to the Company or the Registrar of such mutilated Certificate(s), or upon delivery to the Company or the Registrar of evidence of such loss, destruction or wrongful taking reasonably satisfactory to the Company and the Registrar. In the case of a lost, destroyed or wrongfully taken Certificate representing any Warrant, the Company and Registrar Agent may require the Holder thereof to provide such security or indemnity that is reasonably satisfactory to the Company and the Registrar to protect the Company and the Registrar from any loss that any of them may suffer if such Certificate is replaced.

Every replacement Warrant issued pursuant to this Section 3(i) will, upon such replacement, be deemed to be an outstanding Warrant, entitled to all of the benefits of this Warrant Agreement equally and ratably with all other Warrants then outstanding.

(j) Registered Holders. Only the Holder of any Warrant(s) will have rights under this Warrant Agreement as the owner of such Warrant(s).

(k) Cancellation. In accordance with the terms and conditions of this Warrant Agreement, the Company may at any time deliver any Warrant to the Registrar for cancellation. The Exercise Agent will forward to the Registrar each Warrant duly surrendered to them for transfer, exchange, payment or Exercise. The Company will cause the Registrar to promptly cancel all Warrants so surrendered to it in accordance with its customary procedures.

(l) Outstanding Warrants.

(i) Generally. The Warrants that are outstanding at any time will be deemed to be those Warrants that, at such time, have been duly executed by the Company, excluding those Warrants (or any portions of any Warrants representing less than all of the initial number of Underlying Shares thereof) that have theretofore been (1) cancelled by the Registrar or delivered to the Registrar for cancellation in accordance with Section 3(k); (2) paid or settled in full upon their Exercise in accordance with this Warrant Agreement; (3) terminated pursuant to Section 7; or (4) deemed to cease to be outstanding to the extent provided in, and subject to, clause (ii), (iii) or (iv) of this Section 3(l).

- 14 -

(ii) Replaced Warrants. If any Certificate representing any Warrant is replaced pursuant to Section 3(i), then such Warrant will cease to be outstanding at the time of such replacement, unless the Registrar and the Company receive proof reasonably satisfactory to them that such Warrant is held by a “bona fide purchaser” under applicable law.

(iii) Exercised Warrants. If any Warrant(s) (or any portions of any Warrant(s) representing less than all of the Underlying Shares thereof) are Exercised, then, at the Close of Business on the Exercise Date for such Exercise (unless there occurs a default in the delivery of the Exercise Consideration due pursuant to Section 5 upon such Exercise): (1) such Warrant(s) (or such portions thereof) will be deemed to cease to be outstanding; and (2) the rights of the Holder(s) of such Warrant(s) (or such portions thereof), as such, will terminate with respect to such Warrant(s) (or such portions thereof), other than the right to receive such Exercise Consideration as provided in Section 5.

(iv) Warrants Remaining Unexercised as of the Exercise Period Expiration Date. If any Warrant(s) are otherwise outstanding as of the Close of Business on the Exercise Period Expiration Date, then, without limiting the operation of Section 5(c), such Warrant(s) will cease to be outstanding as of immediately after the Close of Business on the Exercise Period Expiration Date.

(v) Certificates Need Not Be Amended. A reduction in the number of Underlying Shares of any Warrant as a result of a Warrant (or any portion thereof representing less than all of the Underlying Shares thereof) ceasing to be outstanding pursuant to this Section 3(l) will be effective without the need to notate the same on, or otherwise amend, the Certificate representing such Warrant.

Section 4. No Right of Redemption by the Company. Without limiting Section 5(d), the Company does not have the right to redeem the Warrants at its election.

Section 5. Exercise of Warrants.

(a) Generally. Subject to the provisions of this Section 5 and Section 7, the Warrants may be exercised only pursuant to an Optional Exercise, a Mandatory Exercise or an Automatic Exercise.

(b) Exercise at the Option of the Holders.

(i) Exercise Right; When Warrants May Be Submitted for Optional Exercise. Subject to Section 5(e)(ii)(3) and Section 7, each Holder of any Warrant(s) will have the right to submit all, or any Authorized Denomination, of such Warrant(s) for Optional Exercise at any time during (1) the First Tranche Warrants Exercise Period (if such Warrant(s) are First Tranche Warrants) or (2) the Second Tranche Warrants Exercise Period (if such Warrant(s) are Second Tranche Warrants); provided, however, that, notwithstanding anything to the contrary in this Warrant Agreement, Warrants that are subject to Mandatory Exercise may not be submitted for Optional Exercise after the Close of Business on the Business Day immediately before the related Mandatory Exercise Date.

- 15 -

(ii) Exercises of Warrants Not In Authorized Denominations Prohibited. Notwithstanding anything to the contrary in this Warrant Agreement, in no event will any Holder be entitled to Exercise any Warrant other than in an Authorized Denomination thereof.

(c) Automatic Exercise on Exercise Period Expiration Date or Effective Date of Cash Common Stock Change Event. Subject to the provisions of this Section 5 and Section 7, each Warrant, if any, that is outstanding and not Exercised as of immediately before the Close of Business on (i) the Exercise Period Expiration Date will be deemed to be Exercised with an Exercise Date occurring on the Exercise Period Expiration Date (or, if such Exercise Period Expiration Date is not a Business Day, the immediately preceding Business Day); or (ii) the effective date of a Common Stock Change Event whose reference property consists entirely of cash, will be deemed to be Exercised with an Exercise Date occurring on such effective date (or, if such effective date is not a Business Day, the next Business Day). For the avoidance of doubt, (x) a Warrant as to which a Warrant Termination Event has occurred will, pursuant to Section 7, not be subject to exercise pursuant to this Section 5(c); and (y) each Exercise of any Warrant pursuant to clause (ii) of the preceding sentence will be settled in accordance with Section 5(j)(i)(B).

(d) Mandatory Exercise at the Company’s Election.

(i) Mandatory Exercise Right. Subject to the provisions of this Section 5 and Section 7, the Company will have the right (the “Mandatory Exercise Right”), exercisable at its election, to designate any Business Day on or after the Mandatory Exercise Trigger Date as an Exercise Date for the exercise (such an exercise, a “Mandatory Exercise”) of all, or any Authorized Denomination, of (1) the outstanding First Tranche Warrants, but only if (x) the Liquidity Condition is satisfied; and (y) the Last Reported Sale Price per share of Common Stock exceeds two hundred percent (200%) of the Strike Price then in effect on each of at least twenty (20) Trading Days (whether or not consecutive) during the thirty (30) consecutive Trading Days ending on, and including, the Trading Day immediately before the Mandatory Exercise Notice Date for such Mandatory Exercise (the conditions set forth in the preceding clause (x) and (y), together, the “Mandatory Exercise Condition”); and (2) the outstanding Second Tranche Warrants, but only if (x) the Mandatory Exercise Condition has been satisfied; and (y) the Mandatory Exercise Notice Date for such Mandatory Exercise occurs during the Second Tranche Warrants Exercise Period.

(ii) Mandatory Exercise Date. The Mandatory Exercise Date for any Mandatory Exercise will be a Business Day of the Company’s choosing that is no more than twenty (20) Business Days after the Mandatory Exercise Notice Date for such Mandatory Exercise.

(iii) Mandatory Exercise Notice. To exercise its Mandatory Exercise Right with respect to any Warrants, the Company must send to each Holder of such Warrants (with a copy to the Exercise Agent) a written notice of such exercise (a “Mandatory Exercise Notice”).

- 16 -

Such Mandatory Exercise Notice must state:

(1) that the Company has exercised its Mandatory Exercise Right to cause the Mandatory Exercise of the Warrants, briefly describing the Company’s Mandatory Exercise Right under this Warrant Agreement;

(2) the Mandatory Exercise Date for such Mandatory Exercise and the date scheduled for the settlement of such Mandatory Exercise;

(3) the name and address of the Exercise Agent;

(4) that Warrants subject to Mandatory Exercise may be Exercised earlier at the option of the Holders thereof pursuant to an Optional Exercise at any time before the Close of Business on the Business Day immediately before the Mandatory Exercise Date; and

(5) the Strike Price in effect on the Mandatory Exercise Notice Date for such Mandatory Exercise.

(iv) Selection and Optional Exercise of Warrants Subject to Partial Mandatory Exercise. If less than all Warrants then outstanding are subject to Mandatory Exercise, then:

(1) the Warrants to be subject to such Mandatory Exercise will be selected by the Company pro rata, by lot or by such other method the Company considers fair and appropriate; and

(2) if only a portion of the Warrant represented by a Certificate is subject to Mandatory Exercise and a portion of such Warrant is subject to Optional Exercise, then the Exercised portion of such Certificate will be deemed to be from the portion of such Certificate that was subject to Mandatory Exercise.

(e) Exercise Procedures.

(i) Mandatory Exercise and Automatic Exercise. If the Company duly exercises, in accordance with this Section 5(d), its Mandatory Exercise Right with respect to any Warrant, or if any Warrant is subject to an Automatic Exercise, then (1) the Mandatory Exercise or Automatic Exercise, as applicable, of such Warrant will occur automatically and without the need for any action on the part of the Holder(s) thereof; and (2) the shares of Common Stock due upon such Mandatory Exercise or Automatic Exercise, as applicable, will be registered in the name of, and, if applicable, the cash due upon such Mandatory Exercise or Automatic Exercise, as applicable, will be delivered to, the Holder(s) of such Warrant as of the Close of Business on the related Mandatory Exercise Date or Automatic Exercise Date, as applicable.

- 17 -

(ii) Requirements for Holders to Exercise Their Optional Exercise Right.

(1) Generally. To Exercise any Warrant represented by a Certificate pursuant to an Optional Exercise, the Holder of such Warrant must (v) complete, manually sign and deliver to the Exercise Agent an Optional Exercise Notice (at which time, in the case such Certificate is an Electronic Certificate, such Optional Exercise will become irrevocable); (w) if such Certificate is a Physical Certificate, deliver such Physical Certificate to the Exercise Agent (at which time such Optional Exercise will become irrevocable); (x) furnish any endorsements and transfer documents that the Company or the Exercise Agent may require; and (y) if applicable, pay any documentary or other taxes pursuant to Section 6(d).

(2) Deemed Payment of Strike Price. For the avoidance of doubt, payment of the Strike Price upon exercise of any Warrant will be deemed to be satisfied by operation of the formula set forth in Section 5(f)(i).

(3) Optional Exercise Permitted only During Business Hours. Warrants may be surrendered for Optional Exercise only after the Open of Business and before the Close of Business on a day that is a Business Day that occurs during the Exercise Period.

(iii) When Holders Become Stockholders of Record of the Shares of Common Stock Issuable Upon Exercise. The Person in whose name any share of Common Stock is issuable upon Exercise of any Warrant will be deemed to become the holder of record of such share as of the Close of Business on the Exercise Date for such Exercise.

(f) Settlement Upon Exercise.

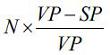

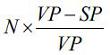

(i) Exercise Consideration. Subject to Section 5(f)(ii), Section 5(j) and Section 8(b), the consideration due upon settlement of the Exercise of each Warrant will consist of a number of shares of Common Stock equal to the greater of (x) zero; and (y) an amount equal to:

where:

| N | = | the number of Underlying Shares of such Warrant that are being so Exercised; |

| VP | = | the Valuation Price per share of Common Stock for such Exercise; and |

| SP | = | the Strike Price in effect immediately after the Close of Business on such Exercise Date. |

- 18 -

(ii) Payment of Cash in Lieu of any Fractional Share of Common Stock. Subject to Section 8(b), in lieu of delivering any fractional share of Common Stock otherwise due upon Exercise of any Warrant, the Company will pay cash based on the Valuation Price.

(iii) Delivery of Exercise Consideration. Except as provided in Sections 5(g)(i)(3)(B), 5(g)(i)(5) and 5(j)(i)(B), the Company will pay or deliver, as applicable, the Exercise Consideration due upon Exercise of any Warrant on or before the second (2nd) Business Day immediately after the Exercise Date for such Exercise.

(g) Strike Price and Number of Underlying Shares Adjustments.

(i) Events Requiring an Adjustment to the Strike Price and the Number of Underlying Shares. Each of the Strike Price and the number of Underlying Shares of each Warrant will be adjusted from time to time as follows:

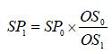

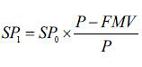

(1) Stock Dividends, Splits and Combinations. If the Company issues solely shares of Common Stock as a dividend or distribution on all or substantially all shares of the Common Stock, or if the Company effects a stock split or a stock combination of the Common Stock (in each case excluding an issuance solely pursuant to a Common Stock Change Event, as to which Section 5(j) will apply), then the Strike Price will be adjusted based on the following formula (with a corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)):

where:

| SP0 | = | the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such dividend or distribution, or immediately before the Open of Business on the effective date of such stock split or stock combination, as applicable; | |

| SP1 | = | the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date or effective date, as applicable; | |

| OS0 | = | the number of shares of Common Stock outstanding immediately before the Open of Business on such Ex-Dividend Date or effective date, as applicable, without giving effect to such dividend, distribution, stock split or stock combination; and | |

| OS1 | = | the number of shares of Common Stock outstanding immediately after giving effect to such dividend, distribution, stock split or stock combination. |

If any dividend, distribution, stock split or stock combination of the type described in this Section 5(g)(i)(1) is declared or announced, but not so paid or made, then each of the Strike Price and the number of Underlying Shares of each Warrant will be readjusted, effective as of the date the Board of Directors determines not to pay such dividend or distribution or to effect such stock split or stock combination, to the Strike Price and the number of Underlying Shares, respectively, that would then be in effect had such dividend, distribution, stock split or stock combination not been declared or announced.

- 19 -

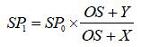

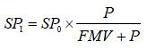

(2) Rights, Options and Warrants. If the Company distributes, to all or substantially all holders of Common Stock, rights, options or warrants (other than rights issued or otherwise distributed pursuant to a stockholder rights plan, as to which Section 5(g)(i)(3)(A) and Section 5(g)(vi) will apply) entitling such holders, for a period of not more than sixty (60) calendar days after the Record Date of such distribution, to subscribe for or purchase shares of Common Stock at a price per share that is less than the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is announced, then the Strike Price will be adjusted based on the following formula (with a corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)):

where:

| SP0 | = | the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such distribution; | |

| SP1 | = | the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date; | |

| OS | = | the number of shares of Common Stock outstanding immediately before the Open of Business on such Ex-Dividend Date; |

| Y | = | a number of shares of Common Stock obtained by dividing (x) the aggregate price payable to exercise such rights, options or warrants by (y) the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is announced; and |

| X | = | the total number of shares of Common Stock issuable pursuant to such rights, options or warrants. |

To the extent such rights, options or warrants are not so distributed, each of the Strike Price and the number of Underlying Shares of each Warrant will be readjusted to the Strike Price and the number of Underlying Shares, respectively, that would then be in effect had the adjustment thereto for such distribution been made on the basis of only the rights, options or warrants, if any, actually distributed. In addition, to the extent that shares of Common Stock are not delivered after the expiration of such rights, options or warrants (including as a result of such rights, options or warrants not being exercised), each of the Strike Price and the number of Underlying Shares of each Warrant will be readjusted to the Strike Price and the number of Underlying Shares, respectively, that would then be in effect had the adjustment thereto for such distribution been made on the basis of delivery of only the number of shares of Common Stock actually delivered upon exercise of such rights, option or warrants.

For purposes of this Section 5(g)(i)(2), in determining whether any rights, options or warrants entitle holders of Common Stock to subscribe for or purchase shares of Common Stock at a price per share that is less than the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date the distribution of such rights, options or warrants is announced, and in determining the aggregate price payable to exercise such rights, options or warrants, there will be taken into account any consideration the Company receives for such rights, options or warrants and any amount payable on exercise thereof, with the value of such consideration, if not cash, to be determined by the Board of Directors.

- 20 -

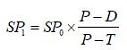

(3) Spin-Offs and Other Distributed Property.

(A) Distributions Other than Spin-Offs. If the Company distributes shares of its Capital Stock, evidences of the Company’s indebtedness or other assets or property of the Company, or rights, options or warrants to acquire the Company’s Capital Stock or other securities, to all or substantially all holders of the Common Stock, excluding:

(I) dividends, distributions, rights, options or warrants for which an adjustment to the Strike Price is required (or would be required without regard to Section 5(g)(iii)) pursuant to Section 5(g)(i)(1) or 5(g)(i)(2);

(II) dividends or distributions paid exclusively in cash for which an adjustment to the Strike Price is required (or would be required assuming the Dividend Threshold were zero and without regard to Section 5(g)(iii)) pursuant to Section 5(g)(i)(4);

(III) rights issued or otherwise distributed pursuant to a stockholder rights plan, except to the extent provided in Section 5(g)(vi);

(IV) Spin-Offs for which an adjustment to the Strike Price is required (or would be required without regard to Section 5(g)(iii)) pursuant to Section 5(g)(i)(3)(B);

(V) a distribution solely pursuant to a tender offer or exchange offer for shares of Common Stock, as to which Section 5(g)(i)(5) will apply; and

(VI) a distribution solely pursuant to a Common Stock Change Event, as to which Section 5(j) will apply,

then the Strike Price will be adjusted based on the following formula (with a corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)):

where:

| SP0 | = | the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such distribution; | |

| SP1 | = | the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date; | |

| P | = | the average of the Last Reported Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before such Ex-Dividend Date; and | |

| FMV | = | the fair market value (as determined by Company in good faith and in a commercially reasonable manner), as of such Ex-Dividend Date, of the shares of Capital Stock, evidences of indebtedness, assets, property, rights, options or warrants distributed per share of Common Stock pursuant to such distribution; |

provided, however, that, if FMV is equal to or greater than P, then, in lieu of the foregoing adjustment to the Strike Price (and the corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)), each Holder will receive, for each Warrant held by such Holder on the Record Date for such distribution, at the same time and on the same terms as holders of Common Stock, the amount and kind of shares of Capital Stock, evidences of indebtedness, assets, property, rights, options or warrants that such Holder would have received in such distribution if such Holder had owned, on such Record Date, a number of shares of Common Stock equal to the number of Underlying Shares of such Warrant as of on such Record Date.

- 21 -

To the extent such distribution is not so paid or made, each of the Strike Price and the number of Underlying Shares of each Warrant will be readjusted to the Strike Price and the number of Underlying Shares, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the distribution, if any, actually made or paid.

(B) Spin-Offs. If the Company distributes or dividends shares of Capital Stock of any class or series, or similar equity interests, of or relating to an Affiliate or Subsidiary or other business unit of the Company to all or substantially all holders of the Common Stock (other than solely pursuant to (x) a Common Stock Change Event, as to which Section 5(j) will apply; or (y) a tender offer or exchange offer for shares of Common Stock, as to which Section 5(g)(i)(5) will apply), and such Capital Stock or equity interests are listed or quoted (or will be listed or quoted upon the consummation of the transaction) on a U.S. national securities exchange (a “Spin-Off”), then the Strike Price will be adjusted based on the following formula (with a corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)):

where:

| SP0 | = | the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such Spin-Off; | |

| SP1 | = | the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date; | |

| P | = | the average of the Last Reported Sale Prices per share of Common Stock for each Trading Day in the Spin-Off Valuation Period; and | |

| FMV | = | the product of (x) the average of the Last Reported Sale Prices per share or unit of the Capital Stock or equity interests distributed in such Spin-Off over the ten (10) consecutive Trading Day period (the “Spin-Off Valuation Period”) beginning on, and including, such Ex-Dividend Date (such average to be determined as if references to Common Stock in the definitions of “Last Reported Sale Price,” “Trading Day” and “Market Disruption Event” were instead references to such Capital Stock or equity interests); and (y) the number of shares or units of such Capital Stock or equity interests distributed per share of Common Stock in such Spin-Off. |

The adjustment to the Strike Price and the number of Underlying Shares of each Warrant pursuant to this Section 5(g)(i)(3)(B) and Section 5(g)(i)(6), respectively, will be calculated as of the Close of Business on the last Trading Day of the Spin-Off Valuation Period but will be given effect immediately after the Open of Business on the Ex-Dividend Date for the Spin-Off, with retroactive effect. If any Warrant is Exercised and the Exercise Date for such Exercise occurs during the Spin-Off Valuation Period, then, notwithstanding anything to the contrary in this Warrant Agreement, the Company will, if necessary, delay the settlement of such Exercise until the second (2nd) Business Day after the Last Trading Day of the Spin-Off Valuation Period.

- 22 -

To the extent any dividend or distribution of the type described in this Section 5(g)(i)(3)(B) is declared but not made or paid, each of the Strike Price and the number of Underlying Shares of each Warrant will be readjusted to the Strike Price and the number of Underlying Shares, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the dividend or distribution, if any, actually made or paid.

(4) Cash Dividends or Distributions. If any cash dividend or distribution (the “Triggering Dividend/Distribution”) is made to all or substantially all holders of Common Stock (other than cash dividends or distributions that, together with all other such cash dividends or distributions paid in the same calendar quarter, do not exceed, in aggregate, the Dividend Threshold per share of Common Stock), then the Strike Price will be adjusted based on the following formula (with a corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)):

where:

| SP0 | = | the Strike Price in effect immediately before the Open of Business on the Ex-Dividend Date for such Triggering Dividend/Distribution; | |

| SP1 | = | the Strike Price in effect immediately after the Open of Business on such Ex-Dividend Date; | |

| P | = | the Last Reported Sale Price per share of Common Stock on the Trading Day immediately before such Ex-Dividend Date; | |

| D | = | the sum of (x) the cash amount distributed per share of Common Stock in such Triggering Dividend/Distribution; and (y) the sum of the cash amounts distributed per share of Common Stock in all prior cash dividends or distributions paid in the same calendar quarter to all or substantially all holders of Common Stock; provided, however, that if, pursuant to clause (x) of the proviso to the definition of “T” below, T is equal to zero dollars ($0.00) per share of Common Stock with respect to such Triggering Dividend/Distribution, then, for purposes of such Triggering Dividend/Distribution, the amount set forth in the preceding clause (y) will be deemed to be zero dollars ($0.00); and | |

| T | = | an amount (subject to the proviso below, the “Dividend Threshold”) initially equal to $0.16 per share of Common Stock; provided, however, that (x) if the sum of all cash dividends or distributions (other than the Triggering Dividend/Distribution) paid, during the calendar quarter in which such Triggering Dividend/Distribution is paid, to all or substantially all holders of Common Stock exceeds the Dividend Threshold per share of Common Stock, then T will be deemed to be zero dollars ($0.00) per share of Common Stock with respect to such Triggering Dividend/Distribution; and (y) the Dividend Threshold will be adjusted in the same manner as, and at the same time and for the same events for which, the Strike Price is adjusted pursuant to Section 5(g)(i)(1). |

provided, however, that, if D is equal to or greater than P, or if T is equal to or greater than P, then, in lieu of the foregoing adjustment to the Strike Price (and the corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)), each Holder will receive, for each Warrant held by such Holder on the Record Date for such Triggering Dividend/Distribution, at the same time and on the same terms as holders of Common Stock, the amount of cash that such Holder would have received in such Triggering Dividend/Distribution if such Holder had owned, on such Record Date, a number of shares of Common Stock equal to the number of Underlying Shares of such Warrant as of such Record Date. To the extent such Triggering Dividend/Distribution is declared but not made or paid, each of the Strike Price and the number of Underlying Shares of each Warrant will be readjusted to the Strike Price and the number of Underlying Shares, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the dividend or distribution, if any, actually made or paid.

- 23 -

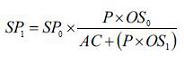

(5) Tender Offers or Exchange Offers. If the Company or any of its Subsidiaries makes a payment in respect of a tender offer or exchange offer for shares of Common Stock (other than solely pursuant to an odd-lot tender offer pursuant to Rule 13e-4(h)(5) under the Exchange Act), and the value (determined as of the Tender/Exchange Offer Expiration Time by the Company in good faith and in a commercially reasonable manner) of the cash and other consideration paid per share of Common Stock in such tender or exchange offer exceeds the Last Reported Sale Price per share of Common Stock on the Trading Day immediately after the last date (the “Tender/Exchange Offer Expiration Date”) on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), then the Strike Price will be adjusted based on the following formula (with a corresponding adjustment to the number of Underlying Shares of each Warrant pursuant to Section 5(g)(i)(6)):

where:

| SP0 | = | the Strike Price in effect immediately before the time (the “Tender/Exchange Offer Expiration Time”) such tender or exchange offer expires; | |

| SP1 | = | the Strike Price in effect immediately after the Tender/Exchange Offer Expiration Time; | |

| P | = | the average of the Last Reported Sale Prices per share of Common Stock over the ten (10) consecutive Trading Day period (the “Tender/Exchange Offer Valuation Period”) beginning on, and including, the Trading Day immediately after the Tender/Exchange Offer Expiration Date; | |

| OS0 | = | the number of shares of Common Stock outstanding immediately before the Tender/Exchange Offer Expiration Time (including all shares of Common Stock accepted for purchase or exchange in such tender or exchange offer); | |

| AC | = | the aggregate value (determined as of the Tender/Exchange Offer Expiration Time by the Company in good faith and in a commercially reasonable manner) of all cash and other consideration paid for shares of Common Stock purchased or exchanged in such tender or exchange offer; and | |

| OS1 | = | the number of shares of Common Stock outstanding immediately after the Tender/Exchange Offer Expiration Time (excluding all shares of Common Stock accepted for purchase or exchange in such tender or exchange offer); |

provided, however, that the Strike Price will in no event be adjusted up pursuant to this Section 5(g)(i)(5), and the number of Underlying Shares of the Warrants will in no event be adjusted down in the corresponding adjustment pursuant to Section 5(g)(i)(6), in each case except to the extent provided in the last paragraph of this Section 5(g)(i)(5).

- 24 -

The adjustment to the Strike Price and the number of Underlying Shares of each Warrant pursuant to this Section 5(g)(i)(5) and Section 5(g)(i)(6), respectively, will be calculated as of the Close of Business on the last Trading Day of the Tender/Exchange Offer Valuation Period but will be given effect immediately after the Tender/Exchange Offer Expiration Time, with retroactive effect. If any Warrant is Exercised and the Exercise Date for such Exercise occurs on the Tender/Exchange Offer Expiration Date or during the Tender/Exchange Offer Valuation Period, then, notwithstanding anything to the contrary in this Warrant Agreement, the Company will, if necessary, delay the settlement of such Exercise until the second (2nd) Business Day after the last Trading Day of the Tender/Exchange Offer Valuation Period.

To the extent such tender or exchange offer is announced but not consummated (including as a result of being precluded from consummating such tender or exchange offer under applicable law), or any purchases or exchanges of shares of Common Stock in such tender or exchange offer are rescinded, each of the Strike Price and the number of Underlying Shares of each Warrant will be readjusted to the Strike Price and the number of Underlying Shares, respectively, that would then be in effect had the adjustment thereto been made on the basis of only the purchases or exchanges of shares of Common Stock, if any, actually made, and not rescinded, in such tender or exchange offer.

(6) Adjustment to the Number of Underlying Shares. If the Strike Price is adjusted pursuant to the formulas set forth in any of clauses (1) through (5) of this Section 5(g)(i) (excluding, for these purposes, a readjustment pursuant to the text following such formulas), then, effective as of the same time at which such adjustment to the Strike Price becomes effective, the number of Underlying Shares of each Warrant will be adjusted to an amount equal to the product of (A) the number of Underlying Shares of such Warrant in effect immediately before such adjustment to such number of Underlying Shares; and (B) the quotient obtained by dividing (x) the Strike Price in effect immediately before such adjustment to the Strike Price by (y) the Strike Price in effect immediately after such adjustment to the Strike Price; provided, however, that the number of Underlying Shares of each Warrant will be subject to readjustment to the extent set forth in such clauses. For purposes of calculating the adjustment to the number of Underlying Shares of each Warrant pursuant to the preceding sentence, the amount set forth in clause (B)(y) of the preceding sentence will calculated without giving effect to any rounding pursuant to Section 5(g)(viii).

(ii) No Adjustments in Certain Cases.

(1) Where Holders Participate in the Transaction or Event Without Exercising. Notwithstanding anything to the contrary in Section 5(g)(i), the Company is not required to adjust the Strike Price or the number of Underlying Shares of any Warrant for a transaction or other event otherwise requiring an adjustment pursuant to Section 5(g)(i) (other than a stock split or combination of the type set forth in Section 5(g)(i)(1) or a tender or exchange offer of the type set forth in Section 5(g)(i)(5)) if each Holder participates, at the same time and on the same terms as holders of Common Stock, and solely by virtue of being a Holder of the Warrants, in such transaction or event without having to Exercise such Holder’s Warrants and as if such Holder had owned, on the Record Date for such transaction or event, a number of shares of Common Stock equal to the aggregate number of Underlying Shares, as of such Record Date, of the Warrants held by such Holder on such Record Date.

- 25 -

(2) Certain Events. The Company will not be required to adjust the Strike Price or the number of Underlying Shares of any Warrant except pursuant to Section 5(g)(i). Without limiting the foregoing, the Company will not be required to adjust the Strike Price or the number of Underlying Shares of any Warrant on account of:

(A) except as otherwise provided in Section 5(g)(i), the sale of shares of Common Stock for a purchase price that is less than the market price per share of Common Stock or less than the Strike Price;

(B) the issuance of any shares of Common Stock pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on the Company’s securities and the investment of additional optional amounts in shares of Common Stock under any such plan;

(C) the issuance of any shares of Common Stock or options or rights to purchase shares of Common Stock pursuant to any present or future employee, director or consultant benefit plan or program of, or assumed by, the Company or any of its Subsidiaries;

(D) the issuance of any shares of Common Stock pursuant to any option, warrant, right or convertible or exchangeable security of the Company outstanding as of the Initial Issue Date; or

(E) solely a change in the par value of the Common Stock.

(iii) Adjustment Deferral. If an adjustment to the Strike Price and the number of Underlying Shares of the Warrants otherwise required by this Warrant Agreement would result in a change of less than one percent (1%) to the Strike Price, then the Company may, at its election, defer and carry forward such adjustment to the Strike Price and the number of Underlying Shares of all outstanding Warrants, except that all such deferred adjustments must be given effect immediately with respect to all outstanding Warrants upon the earliest of the following: (1) when all such deferred adjustments would, had they not been so deferred and carried forward, result in a change of at least one percent (1%) to the Strike Price; and (2) the Exercise Date of any Warrant.

- 26 -

(iv) Adjustments Not Yet Effective. Notwithstanding anything to the contrary in this Warrant Agreement, if:

(1) a Warrant is Exercised;

(2) the Record Date, effective date or Tender/Exchange Offer Expiration Time for any event that requires an adjustment to the Strike Price pursuant to Section 5(g)(i) has occurred on or before the Exercise Date for such Exercise, but an adjustment to the Strike Price or the number of Underlying Shares of the Warrants for such event has not yet become effective as of such Exercise Date;

(3) the Exercise Consideration due upon such Exercise includes any whole shares of Common Stock; and

(4) such shares are not entitled to participate in such event (because they were not held on the related Record Date or otherwise),

then, solely for purposes of such Exercise, the Company will, without duplication, give effect to such adjustment on such Exercise Date. In such case, if the date on which the Company is otherwise required to deliver the Exercise Consideration due upon such Exercise is before the first date on which the amount of such adjustment can be determined, then the Company will delay the settlement of such Exercise until the second (2nd) Business Day after such first date.

(v) Adjustments Where Exercising Holders Participate in the Relevant Transaction or Event. Notwithstanding anything to the contrary in this Warrant Agreement, if: