UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant: | x |

| Filed by a Party other than the Registrant: | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| x | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

REDWOOD TRUST, INC.

| (Name of Registrant as Specified in Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Explanatory Note: As part of its regular, ongoing engagement with stockholders, Redwood Trust, Inc. (“Redwood”) is conducting meetings or teleconferences with stockholders in advance of its 2023 Annual Meeting of Stockholders. The attached materials are intended to facilitate discussions at those meetings or teleconferences and present information regarding Redwood’s outreach and engagement efforts following its 2022 annual meeting and its response to stockholder feedback through updates and changes to the executive compensation program, including information taken from Redwood’s 2023 Annual Proxy Statement filed with the Securities and Exchange Commission on March 31, 2023.

The materials that follow are intended to supplement and be read together with the Compensation Discussion and Analysis (CD&A) set forth within Redwood’s 2023 Annual Proxy Statement. Defined terms used but not defined herein having the meanings set forth in the CD&A.

Message from Compensation Committee Chair:

As Redwood’s 2023 Annual Stockholders’ Meeting draws nearer, I am encouraging all of Redwood’s stockholders to review the Compensation Discussion & Analysis (CD&A) that the Compensation Committee (the Committee) included in Redwood’s annual proxy statement, as well as the Executive Summary of CD&A. We believe that these disclosures, which are summarized at a high level on the pages that follow, provide stockholders with a comprehensive overview of the steps the Committee took following the low level of Say-on-Pay support at last year’s 2022 annual meeting. In particular, the slides that follow:

| (1) | Review the scope of the outreach and engagement efforts that I led following last year’s annual meeting, which were an opportunity to listen to and obtain feedback from stockholders regarding the executive compensation program at Redwood; |

| (2) | Summarize the updates and changes that the Committee made to the compensation program in response to stockholder feedback, including by providing further background on the 28% increase to the Company’s financial performance target for 2022, the rigor of that financial performance target level, and the resulting pay-for-performance outcomes at Redwood for 2022; and |

| (3) | With respect to the compensation program’s annual bonus methodology going forward into 2023, provide a comprehensive review of several distinct updates in order to allow stockholders the ability to better evaluate the overall impact of these bonus methodology changes — which significantly “raise the bar” for achieving above-target bonus realization. |

We will be continuing engagement efforts with stockholders as we approach this year’s May 23rd Annual Meeting, and we appreciate the time that stockholders take to understand the executive compensation program and the changes we have made to it to ensure that it continues to be appropriately structured, responsive to stockholder feedback, and supportive of Redwood’s business and long-term strategic goals.

As we seek your support on Redwood’s 2023 Say-on-Pay proposal, if you have any questions, or need assistance in voting your shares, please call our proxy solicitor, MacKenzie at (212) 929-5500 or [email protected]. For your reference, you can view copies of our 2023 annual proxy statement and related proxy materials at www.envisionreports.com/RWT.

| Georganne C. Proctor | |

| Chair – Compensation Committee |

Scope of Outreach and Engagement Efforts

Ongoing outreach to stockholders regarding executive compensation has been a consistent practice at Redwood, led by the Chair of the Compensation Committee and conducted through in-person meetings, as well as virtual meetings and conference calls, with institutional stockholders. Together with the Committee Chair, Redwood’s outreach team includes key members of the Company’s Investor Relations, Human Resources, Finance and Corporate Secretary departments.

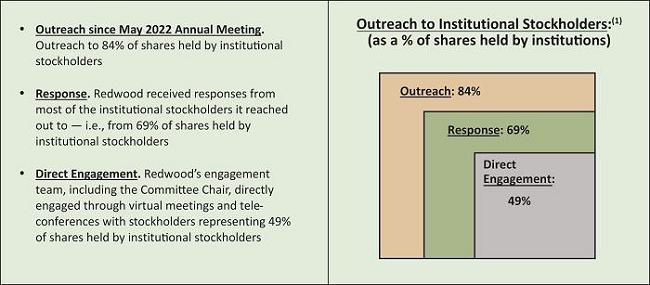

Following Redwood’s May 2022 Annual Meeting, the Committee re-doubled its efforts relating to outreach and engagement, with a focus on hearing detailed and specific feedback from stockholders about the executive compensation-related concerns that drove their 2022 “Say-on-Pay” voting decisions. In particular, Redwood undertook an outreach effort that reached a large majority of shares held by institutional stockholders, with significant stockholder response and engagement, as detailed below:

Following this engagement process, the Committee analyzed common stockholder feedback themes and, at the same time, completed an updated review of peer practices, in each case with assistance and fresh perspectives from a new independent compensation consultant. This process informed the evaluation and implementation of changes to the design and structure of the executive compensation program, as well as specific compensation determinations, with respect to both year-end 2022 and future compensation beginning in 2023.

Updates and Changes to Executive Compensation Program in Response to Stockholder Feedback / Pay-for-Performance Outcomes

The grids below summarize how the Committee responded to stockholder feedback during 2022, as well as how the Committee applied pay-for-performance outcomes based on performance as measured through the end of 2022. Further detail, review, and discussion of these updates, changes and outcomes is set forth on the pages that follow and within the CD&A and Executive Summary of CD&A sections of Redwood 2023 Annual Proxy Statement.

| Changes to Annual Bonus Methodology | Changes to Structure of Long-Term Incentives (LTIs) | |

· Increased Financial Performance Target for 2022 Annual Bonus o Increased Adjusted ROE(2) target to 11.5%, an increase of 28% from the 2021 target o See the following slides titled “Setting Rigorous Financial Performance Targets” for a review of key factors in 2022 target setting and the Committee’s approach to goal setting rigor |

· Updated Structure of Performance Stock Units (PSUs) o Switched to exclusively using 3-year performance periods (i.e., eliminated use of linked one-year performance periods) o Increased PSU vesting driven by relative TSR o Added above-median relative TSR performance target for at target vesting | |

· Reduced Above-Target “Leverage” in Annual Bonus Methodology o Going into 2023, formulaically reduced the percentage of above target annual bonus realized for above-target performance |

· Awarded 100% of CEO’s 2022 year-end equity award in the form of PSUs to further enhance pay-for-performance alignment with stockholders going forward | |

· Added Secondary Performance Metric o Beginning with 2023, EAD ROE(3) and Adjusted ROE will each drive 50% of annual bonus realization |

· Increased Stock Ownership Requirements o CEO’s ownership requirement increased to 6.25x of base salary o President’s ownership requirement increased to 3.25x of base salary o Other executive officers’ ownership requirement increased to 3.0x of base salary | |

· Lowered Maximum Bonus Opportunity o Starting with 2023, CEO’s annual bonus cap was reduced to 3.5x of target annual bonus (from 4.4x in 2021)

|

| 2022 Pay-for-Performance Outcome – Annual Bonus | 2022 Pay-for-Performance Outcome – Long-Term Incentives | |

· Reduced CEO’s 2022 Annual Bonus Realization o 0% of the portion of CEO’s 2022 target bonus linked to Redwood’s annual financial performance was realized and, overall, only 25% of CEO’s total 2022 target bonus was paid o CEO’s 2022 annual bonus of $450,000 was a decrease of more than 90% from 2021 |

· Reduced Value of CEO’s 2022 Year-End Equity Awards o Value of the 2022 equity award to CEO was reduced by 33% compared to 2021 o As noted above, 100% of CEO’s 2022 equity award value was provided in the form of PSUs (with realization contingent on 3-year performance through 2025)

| |

· CEO Realized Low Value from LTIs that Vested at Year-End 2022 o 0% vesting of PSUs awarded in 2019 o Only 64% of value from DSUs awarded in 2018 was realized

|

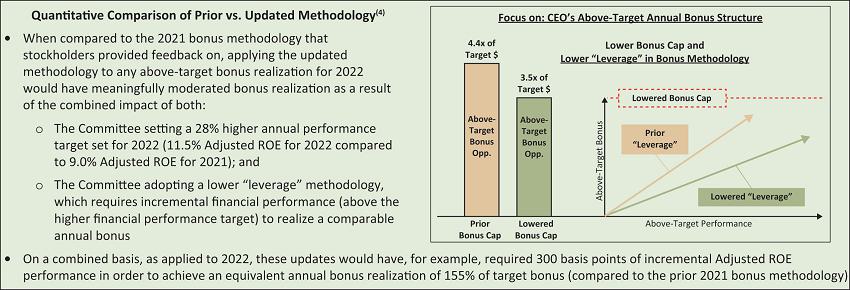

Overall Impact of Updated Annual Bonus Methodology

As described above, the Committee updated various aspects of its annual bonus methodology for 2022 and of the methodology to be used going into 2023 (e.g., higher financial performance target, additional financial performance metric, lower annual bonus caps, and lower “leverage” for above-target performance). Taken together, these changes were responsive to stockholder feedback and strengthened alignment with fundamental Company performance and the key metrics that drive stockholder value creation.

| · | Overall Moderation of Above-Target Bonus Payouts. As depicted in the graphic below, when compared to the bonus methodology that was in place for 2021, the Committee’s updated annual bonus methodology going forward into 2023 requires higher levels of above-target financial performance to achieve above-target and/or maximum annual bonus realization (i.e., the Committee has adopted a lower “leverage” bonus methodology) |

| · | Historically High Annual Financial Performance Would be Required to Reach Maximum Annual Bonus. Under this updated annual bonus methodology, reaching the CEO’s maximum annual bonus opportunity for 2022 would have required annual Company financial performance of approximately 23.5% Adjusted ROE |

| § | For historical context, since 2006, Redwood’s Adjusted ROE has only exceeded 23.5% once (in 2021, when Redwood significantly outperformed peers and broad-based indices) |

Setting Rigorous Financial Performance Targets

As described in the CD&A section of Redwood’s 2023 annual proxy statement, in the course of stockholder engagement following the Company’s 2022 Annual Meeting, the Compensation Committee Chair received feedback asking about the rigor of the financial performance target used in 2021 for determining realization of the CEO’s annual bonus opportunity, and whether it should be increased as macro-economic conditions change.

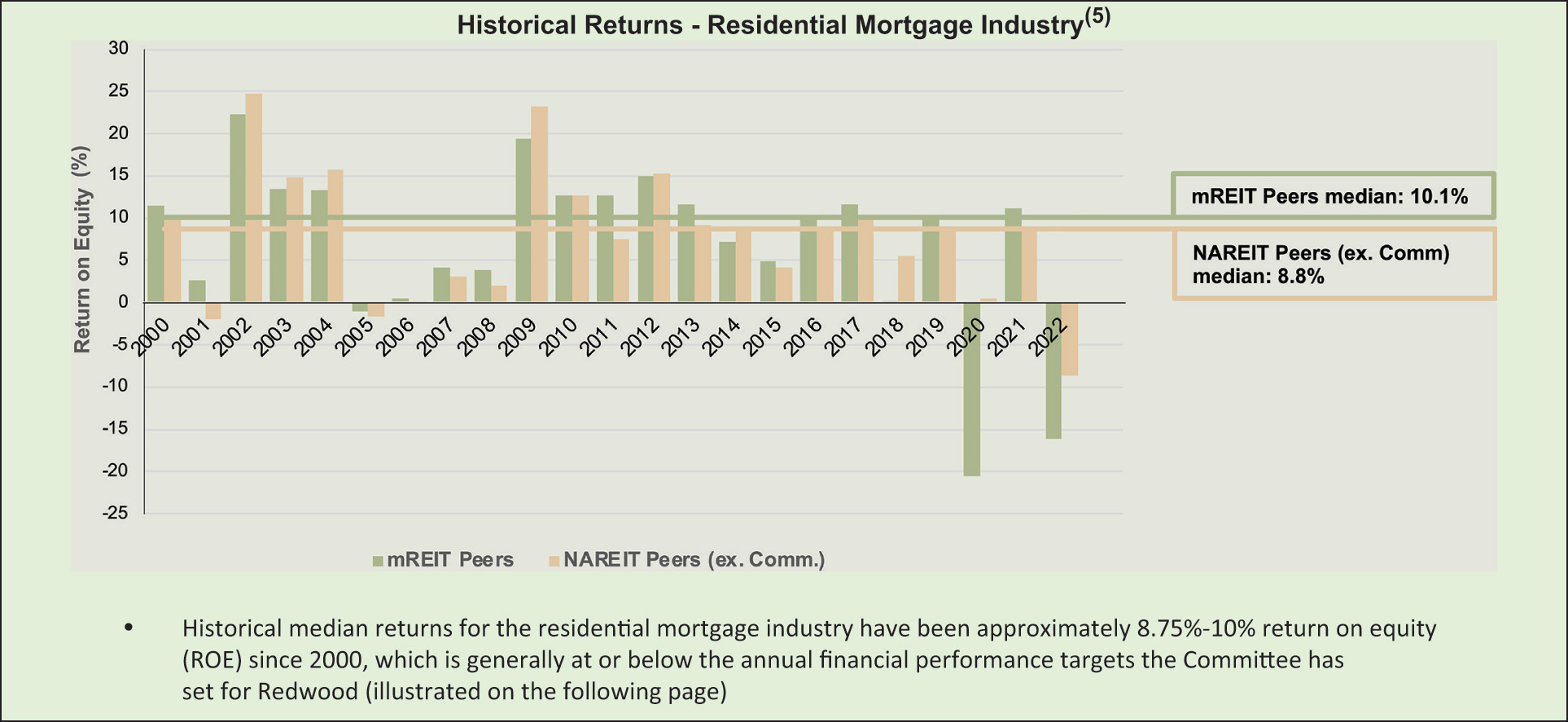

| · | Committee’s Process for Target Setting. The Committee’s Adjusted ROE target-setting process has historically been informed by a review of benchmark risk-free interest rates together with an analysis of a risk premium to add to the risk-free rate to reflect an appropriate financial performance target |

| o | The Company’s common stock dividend yield has been one of several key considerations in setting the risk premium and additional analysis supporting the appropriate risk premium has also included consideration of additional data and business model factors as Redwood’s business model and strategy has evolved – e.g., risk-adjusted returns available in the market and risk management considerations (such as desired risk capital level and approach to debt leverage). In addition, the Compensation Committee may also consider market expectations for the mortgage banking and mortgage REIT sectors historically, and for the specific year ahead, and the degree of alignment with forecasted returns |

The graph below illustrates historical returns in the residential mortgage industry and is illustrative of the type of information and analysis considered by the Committee in setting annual financial performance targets and ensuring that they reflect rigorous risk-adjusted targets.

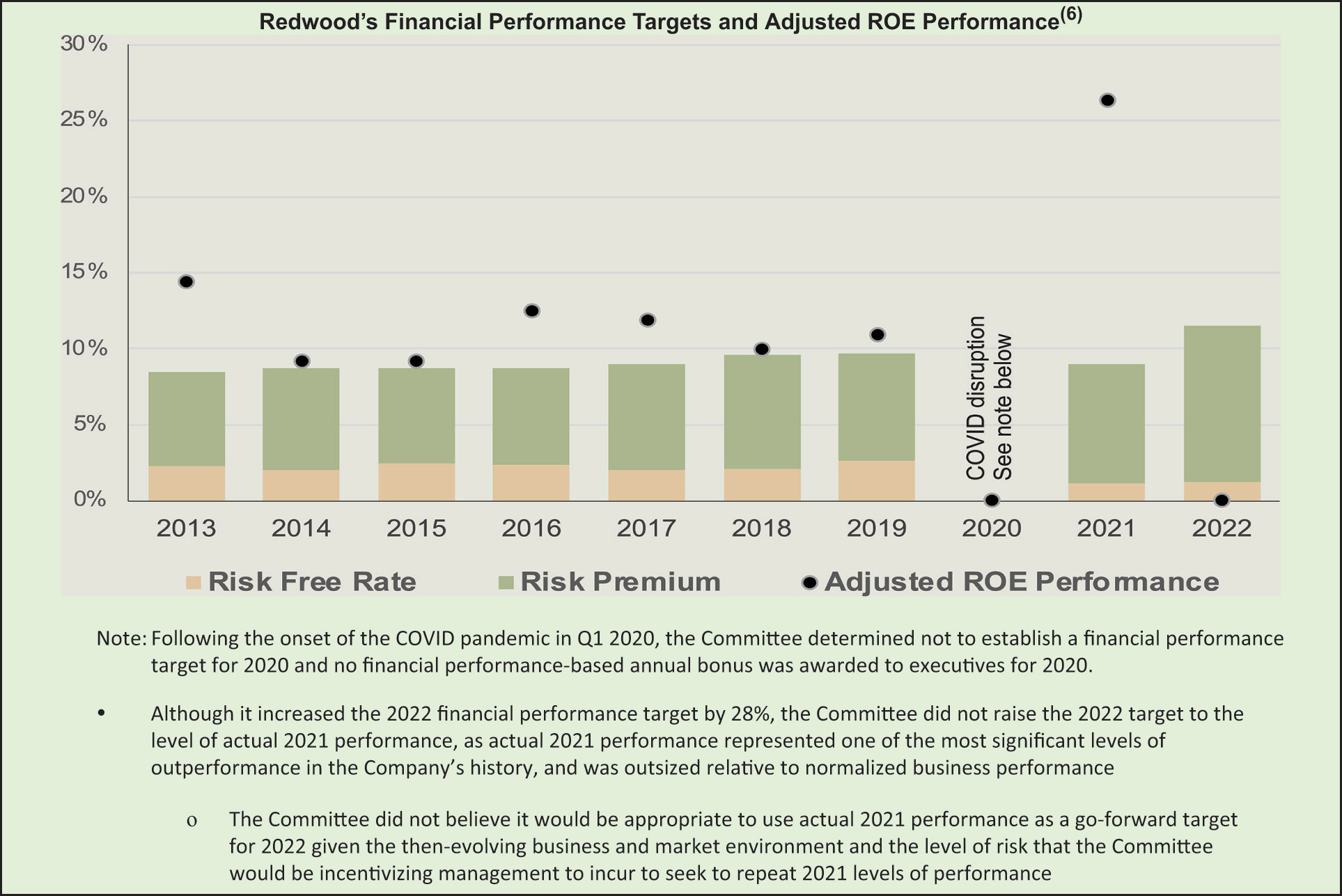

Setting Rigorous Financial Performance Targets (cont.)

| · | Increased Target from 2021 to 2022 by 28%. At the beginning of 2022, as part of its annual process and consistent with stockholder feedback, the Compensation Committee increased the financial performance target used in 2022 for determining the CEO’s (and other executives’) annual bonus to 11.5% Adjusted ROE, an increase of 28% from the 2021 target of 9% Adjusted ROE, reflecting the evolving business and market environment |

| o | In setting the financial performance target for 2022, the Compensation Committee, after consultation with the full Board of Directors, determined that a 28% increase to the target (from the 2021 level) represented a rigorous target, as well as one that would be consistent with stockholder alignment and feedback, while also appropriately incentivizing the Company’s executives (without incentivizing inappropriate risk taking) in accordance with the Company’s compensation philosophy |

| o | As illustrated in the graph below, the 11.5% Adjusted ROE target for 2022 reflected the highest target and the highest risk premium used by the Committee over the past 10 years – with an 11.5% Adjusted ROE reflecting more than 10 percentage points of premium over the reference risk-free rate (the average 10-year Treasury over the preceding two-year period) at the time this financial performance target was established in early 2022 |

| o | Detailed calculations of Adjusted ROE results for 2018 through 2022 are set forth in Annex A to Redwood’s 2023 Annual Proxy Statement |

Endnotes:

(1) Percentages of outstanding shares referred to in discussion of outreach, response and direct engagement are based on available data regarding percentages of shares held by specific stockholders as of December 31, 2022. Shares held by institutions is based on available data regarding percentage of shares held by institutional stockholders as of December 31, 2022. Source: IPreo.

(2) Adjusted ROE is a non-GAAP financial performance metric. Non-GAAP Adjusted ROE is further described on page 61 within the CD&A within Redwood’s 2023 Annual Proxy Statement (as filed with the SEC on March 31, 2023) and is reconciled to ROE based on GAAP financial results in Annex A to Redwood’s 2023 Annual Proxy Statement.

(3) Earnings Available for Distribution (“EAD”) and EAD ROE are non-GAAP measures derived from GAAP Net income and GAAP ROE, respectively. EAD is defined as: GAAP net income (loss) adjusted to (i) exclude investment fair value changes, net; (ii) adjust for change in economic basis of investments; (iii) exclude realized gains and losses; (iv) exclude acquisition related expenses; (v) exclude organizational restructuring charges; and (vi) adjust for the hypothetical income taxes associated with these adjustments. EAD ROE is defined as EAD divided by average common equity. EAD ROE is further described on page 80 within the CD&A within Redwood’s 2023 Annual Proxy Statement (as filed with the SEC on March 31, 2023).

(4) In the bar graph comparing the CEO’s prior and lowered bonus caps, (i) “Prior Bonus Cap” represents the CEO’s annual bonus cap for 2021 of $6.5 million, which represented approximately 4.4x of the CEO’s 2021 target bonus opportunity and (ii) “Lowered Bonus Cap” represents the CEO’s annual bonus cap for 2023 of $6.3 million, which represents approximately 3.5x of the CEO’s 2023 target bonus opportunity. In the line graph comparing the prior and lowered “leverage” in the CEO’s above-target annual bonus structure, (i) the “Prior ‘Leverage’” line depicts that, with respect to the annual bonus structure in place for 2021, for above-target performance, the portion of the CEO’s annual bonus linked to Company financial performance would equal, for example, approximately 155% of the target amount for that portion of annual bonus if Company financial performance was one-and-one-half percentage points above the target financial performance goal set for 2021 and (ii) the “Lowered ‘Leverage’” line depicts that, with respect to the annual bonus structure in place for 2023, for above-target performance, the portion of the CEO’s annual bonus linked to Company financial performance would equal, for example, approximately 155% of the target amount for that portion of annual bonus if Company financial performance was two percentage points above the target financial performance goal set for 2023. A more detailed description of the updated annual bonus methodology, including with respect to both the above-, at-, and below-target 2023 annual bonus structure, is further described on pages 80 - 81 within the CD&A within Redwood’s 2023 Annual Proxy Statement (as filed with the SEC on March 31, 2023).

(5) “NAREIT (ex. Comm.)” refers to the component companies of the FTSE Nareit Mortgage REITs index, excluding Redwood and mortgage REITs classified as commercial-focused with that index. “mREIT Peers” refers to a group of publicly-traded mortgage REITs whose business models share a common focus on investing in residential mortgages and related assets and that Redwood regularly compares its financial performance to. The compenent companies of the “mREIT Peers” are the following group of publicly-traded mortgage REITs (listed alphabetically using stock tickers): AGNC; ARR; CIM; DX; IVR; MFA; MITT; NLY; NYMT; PMT; RITM and TWO.

(6) Annual Adjusted ROE performance targets are comprised of a risk-free interest rate (the average 10-year Treasury rate over the preceding two calendar years) plus a risk premium determined by the Committee. Adjusted ROE performance in 2020 and 2022 was negative and is displayed as 0% within this graph. Source: Bloomberg data.