R E D W O O D T R U S T . C O M Q3 2025 Redwood Review October 29, 2025 Exhibit 99.3

2 This presentation contains forward-looking statements, including statements regarding our 2025 forward outlook and strategic priorities, key drivers to increase earnings, book value, mortgage banking volumes, and target capital allocations between our Core and Legacy Investments Segments. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, opportunities, or intentions. Cautionary Statement; Forward-Looking Statements These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and any subsequent Quarterly Reports on Form 10-K, Form 10-Q and Form 8-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected may be described from time to time in reports the Company files with the Securities and Exchange Commission, including Current Reports on Form 8-K. Additionally, this presentation contains estimates and information concerning our industry, including market size and growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those referred to above, that could cause results to differ materially from those expressed in these publications and reports.

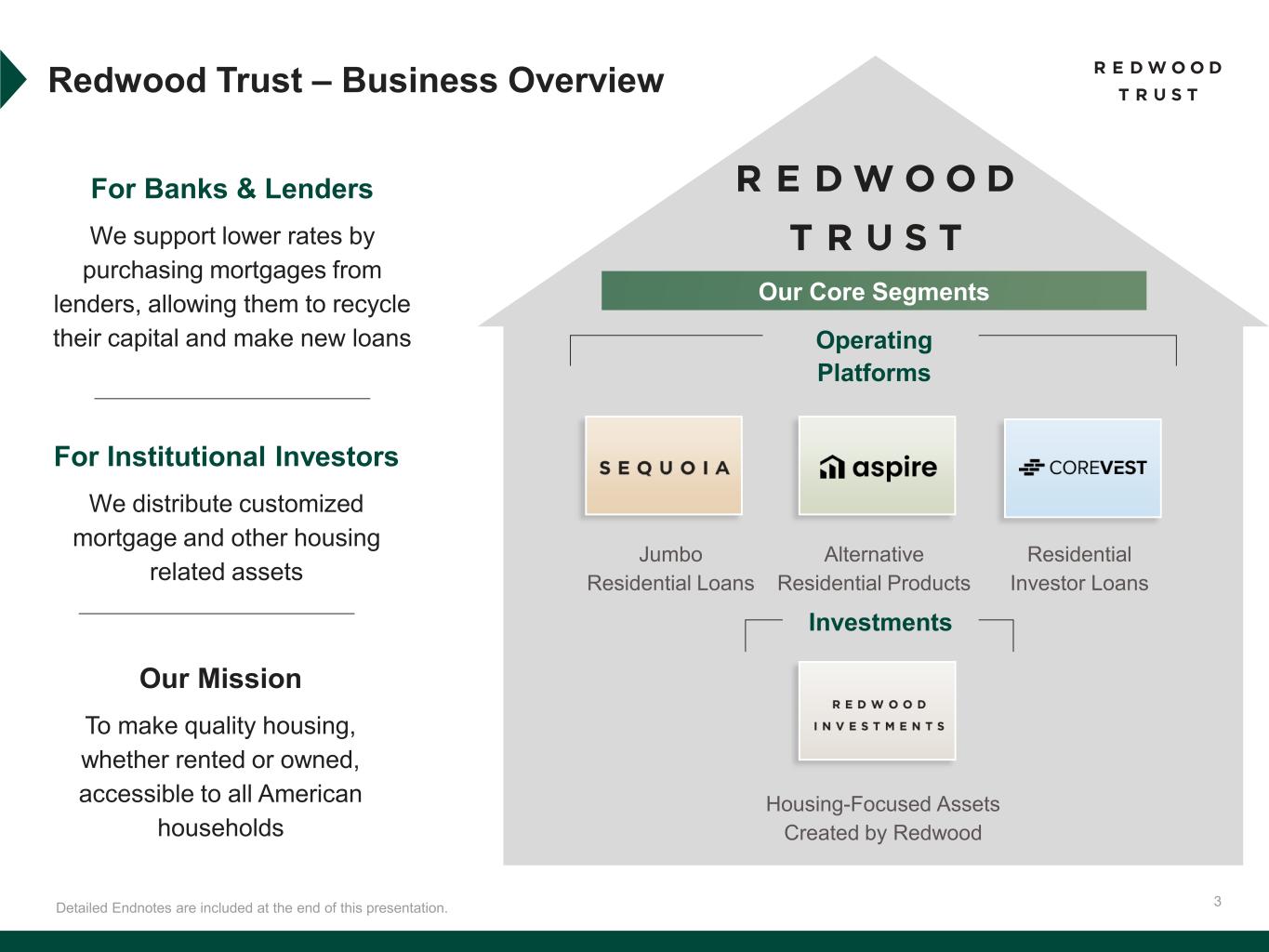

3 Redwood Trust – Business Overview Detailed Endnotes are included at the end of this presentation. For Banks & Lenders We support lower rates by purchasing mortgages from lenders, allowing them to recycle their capital and make new loans For Institutional Investors We distribute customized mortgage and other housing related assets Our Mission To make quality housing, whether rented or owned, accessible to all American households Our Core Segments Jumbo Residential Loans Residential Investor Loans Alternative Residential Products Housing-Focused Assets Created by Redwood Investments Operating Platforms

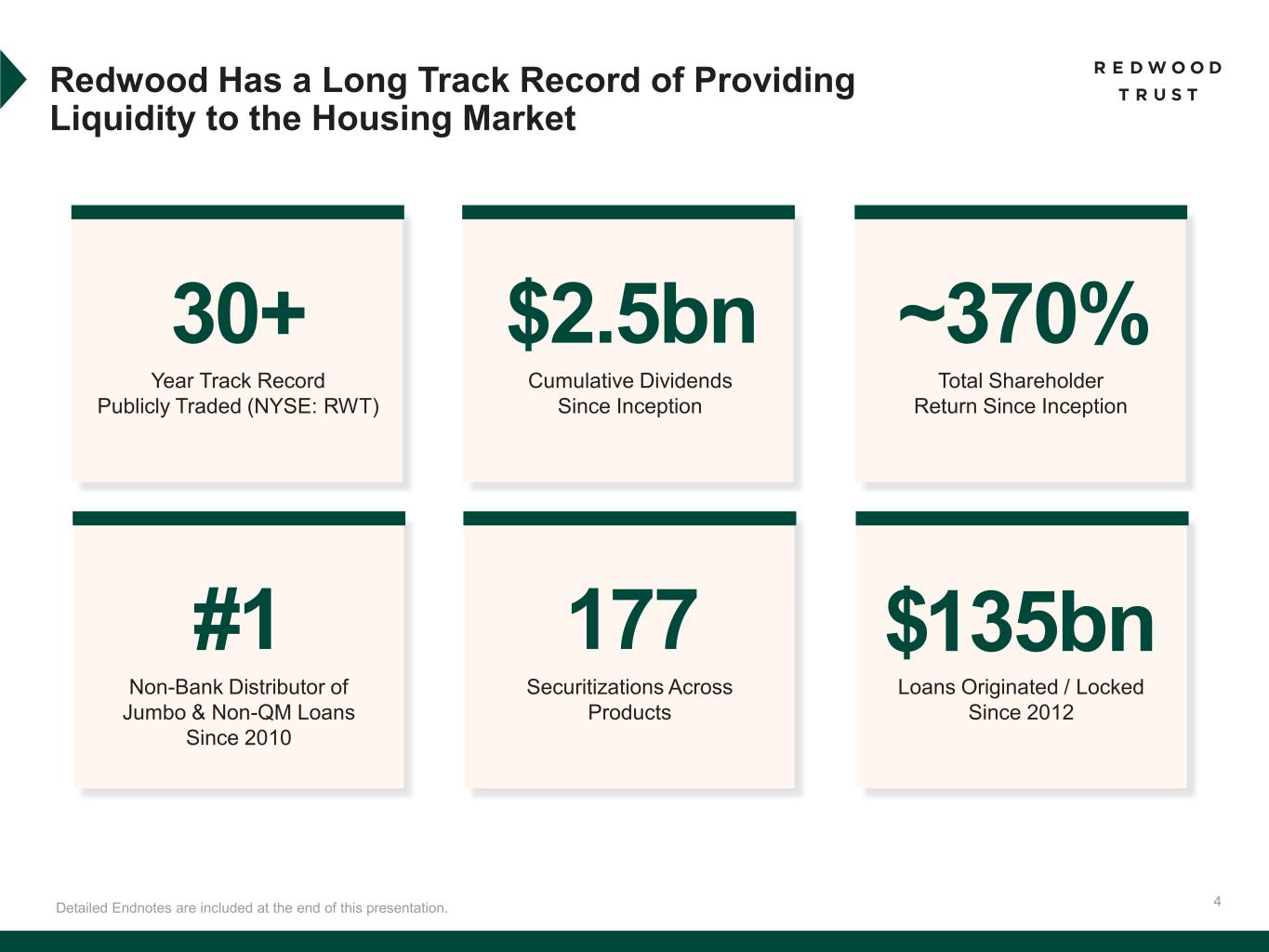

4Detailed Endnotes are included at the end of this presentation. 30+ Year Track Record Publicly Traded (NYSE: RWT) $2.5bn Cumulative Dividends Since Inception ~370% Total Shareholder Return Since Inception #1 Non-Bank Distributor of Jumbo & Non-QM Loans Since 2010 177 Securitizations Across Products Loans Originated / Locked Since 2012 Redwood Has a Long Track Record of Providing Liquidity to the Housing Market 135bn$

5 Redwood is the Leading Private Sector Alternative to the Government Agencies Focused on Conventional Loans ▪ Transparent underwriting and credit guidelines ▪ Does not originate or service loans to homeowners ▪ Not a depository institution ▪ Mission-driven focus on housing accessibility ▪ Acquire loans that conform to federal eligibility standards ▪ Issue MBS guaranteed by the federal government ▪ Standardized products and return profiles for investors ▪ Expands access to housing beyond government programs ▪ Issues mortgage-backed securities (MBS) backed by private capital ▪ Provides customized products and return profiles for investors Similarities Government Agencies

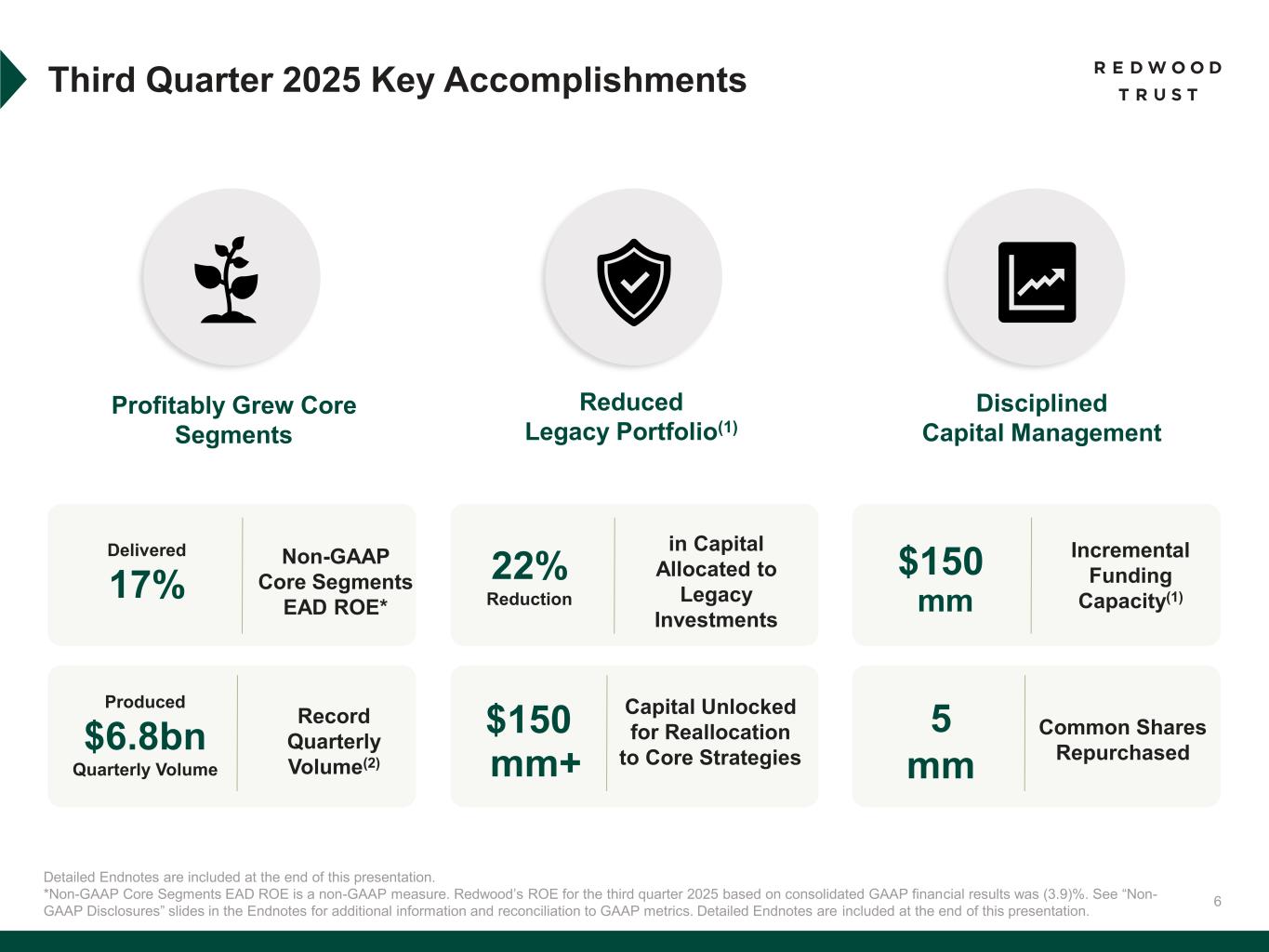

6 Third Quarter 2025 Key Accomplishments Detailed Endnotes are included at the end of this presentation. *Non-GAAP Core Segments EAD ROE is a non-GAAP measure. Redwood’s ROE for the third quarter 2025 based on consolidated GAAP financial results was (3.9)%. See “Non- GAAP Disclosures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. Detailed Endnotes are included at the end of this presentation. Reduced Legacy Portfolio(1) Profitably Grew Core Segments Disciplined Capital Management Non-GAAP Core Segments EAD ROE* Delivered 17% Record Quarterly Volume(2) Produced $6.8bn Quarterly Volume Incremental Funding Capacity(1) Common Shares Repurchased 5 mm 22% Reduction in Capital Allocated to Legacy Investments Capital Unlocked for Reallocation to Core Strategies $150 mm+ $150 mm

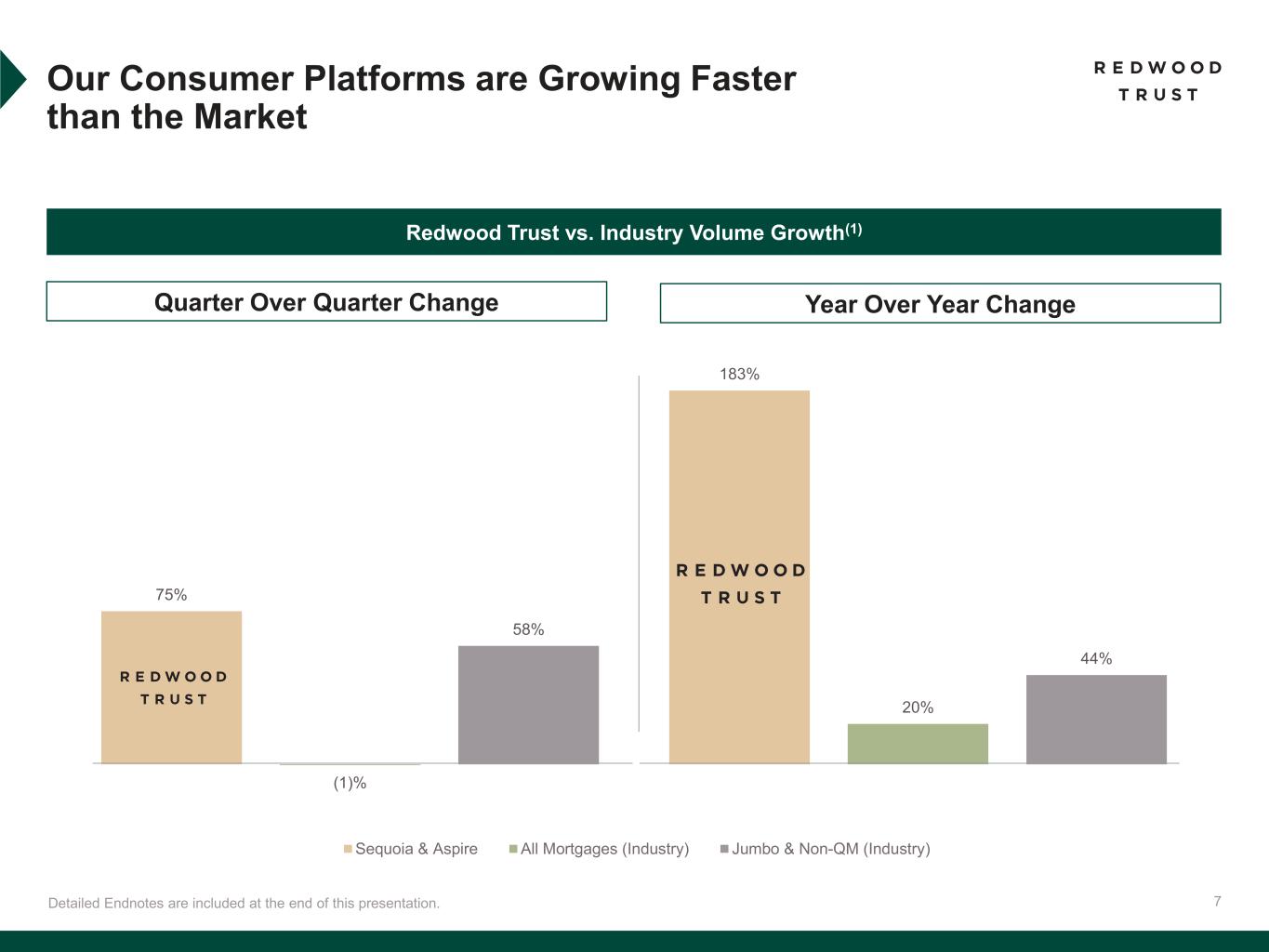

7 75% 183% (1)% 20% 58% 44% Sequoia & Aspire All Mortgages (Industry) Jumbo & Non-QM (Industry) Detailed Endnotes are included at the end of this presentation. Redwood Trust vs. Industry Volume Growth(1) Our Consumer Platforms are Growing Faster than the Market Quarter Over Quarter Change Year Over Year Change

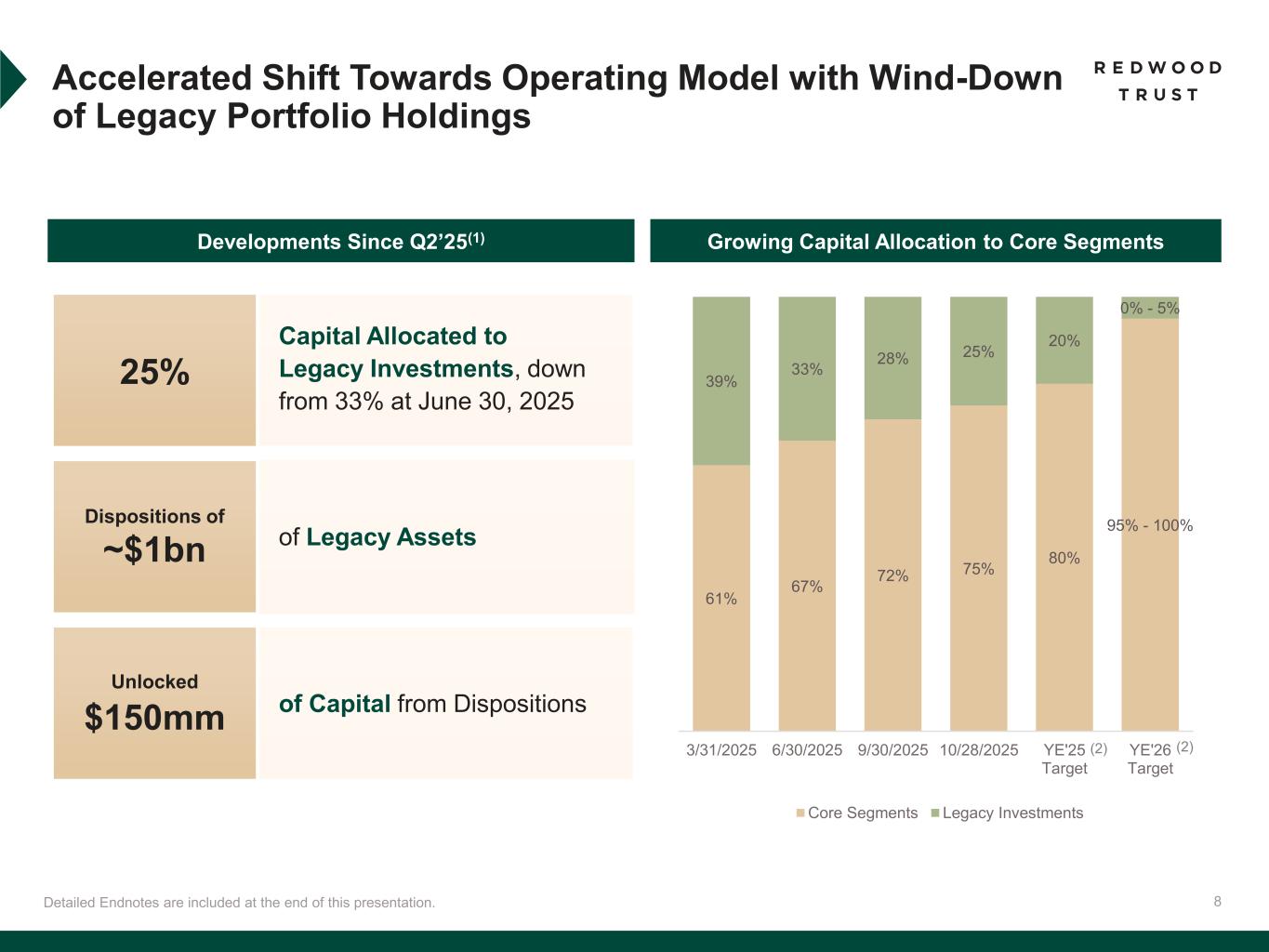

8 Accelerated Shift Towards Operating Model with Wind-Down of Legacy Portfolio Holdings Detailed Endnotes are included at the end of this presentation. t of Capital from Dispositions Growing Capital Allocation to Core SegmentsDevelopments Since Q2’25(1) 25% Dispositions of ~$1bn Capital Allocated to Legacy Investments, down from 33% at June 30, 2025 of Legacy Assets Unlocked $150mm 61% 67% 72% 75% 80% 95% - 100% 39% 33% 28% 25% 20% 0% - 5% 3/31/2025 6/30/2025 9/30/2025 10/28/2025 YE'25 Target YE'26 Target Core Segments Legacy Investments (2) (2)

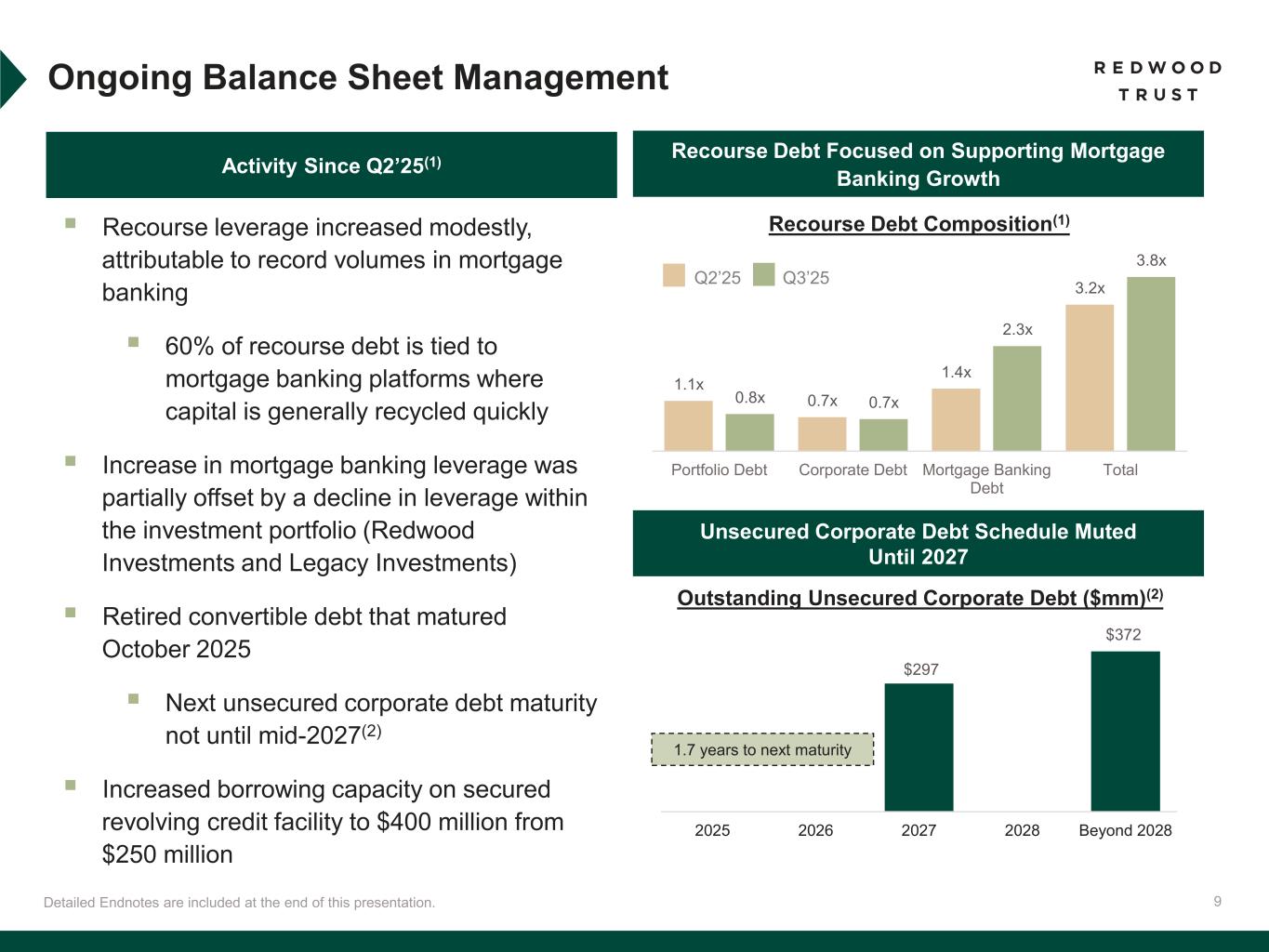

9 Ongoing Balance Sheet Management Detailed Endnotes are included at the end of this presentation. Activity Since Q2’25(1) ▪ Recourse leverage increased modestly, attributable to record volumes in mortgage banking ▪ 60% of recourse debt is tied to mortgage banking platforms where capital is generally recycled quickly ▪ Increase in mortgage banking leverage was partially offset by a decline in leverage within the investment portfolio (Redwood Investments and Legacy Investments) ▪ Retired convertible debt that matured October 2025 ▪ Next unsecured corporate debt maturity not until mid-2027(2) ▪ Increased borrowing capacity on secured revolving credit facility to $400 million from $250 million $297 $372 2025 2026 2027 2028 Beyond 2028 1.7 years to next maturity Recourse Debt Focused on Supporting Mortgage Banking Growth Unsecured Corporate Debt Schedule Muted Until 2027 Outstanding Unsecured Corporate Debt ($mm)(2) Recourse Debt Composition(1) Q3’25Q2’25 1.1x 0.7x 1.4x 3.2x 0.8x 0.7x 2.3x 3.8x Portfolio Debt Corporate Debt Mortgage Banking Debt Total

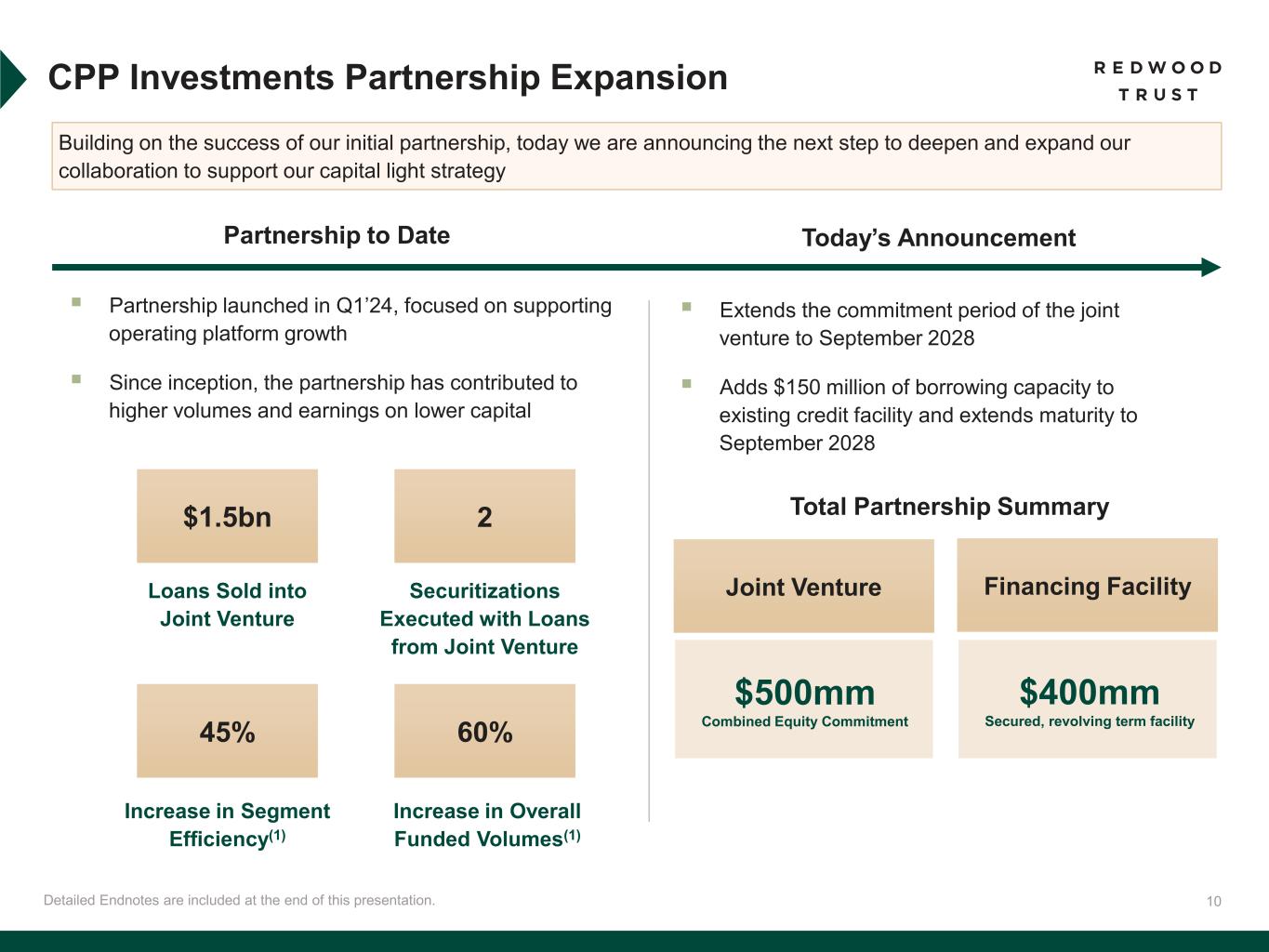

10 CPP Investments Partnership Expansion Detailed Endnotes are included at the end of this presentation. Building on the success of our initial partnership, today we are announcing the next step to deepen and expand our collaboration to support our capital light strategy Partnership to Date Today’s Announcement $1.5bn Loans Sold into Joint Venture 2 Securitizations Executed with Loans from Joint Venture 45% Increase in Segment Efficiency(1) 60% Increase in Overall Funded Volumes(1) $500mm Combined Equity Commitment ▪ Partnership launched in Q1’24, focused on supporting operating platform growth ▪ Since inception, the partnership has contributed to higher volumes and earnings on lower capital ▪ Extends the commitment period of the joint venture to September 2028 ▪ Adds $150 million of borrowing capacity to existing credit facility and extends maturity to September 2028 Total Partnership Summary Joint Venture Financing Facility $400mm Secured, revolving term facility

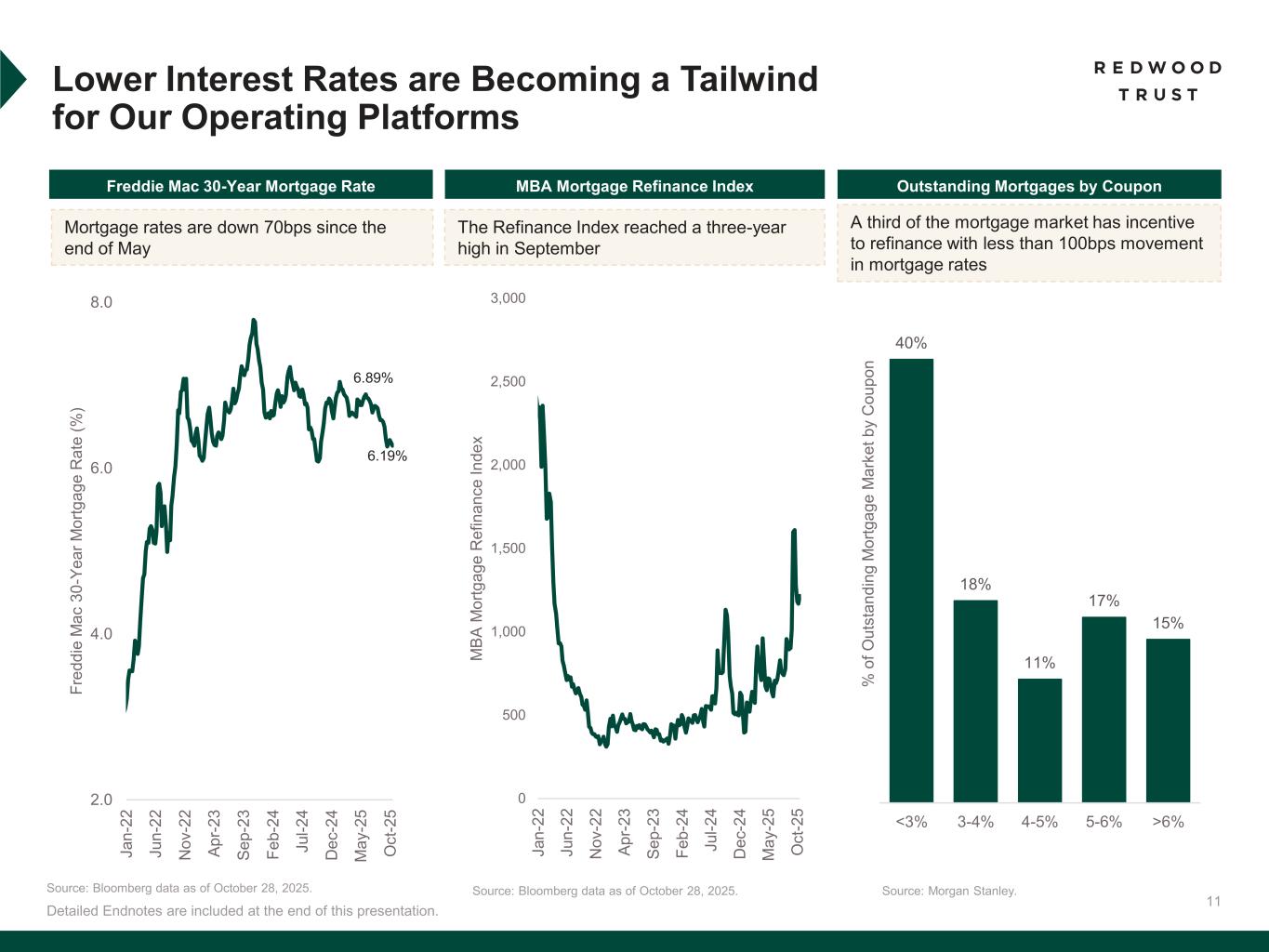

11 Lower Interest Rates are Becoming a Tailwind for Our Operating Platforms Detailed Endnotes are included at the end of this presentation. MBA Mortgage Refinance Index 40% 18% 11% 17% 15% <3% 3-4% 4-5% 5-6% >6% % o f O u ts ta n d in g M o rt g a g e M a rk e t b y C o u p o n The Refinance Index reached a three-year high in September A third of the mortgage market has incentive to refinance with less than 100bps movement in mortgage rates Freddie Mac 30-Year Mortgage Rate Mortgage rates are down 70bps since the end of May Source: Bloomberg data as of October 28, 2025. Source: Bloomberg data as of October 28, 2025. Source: Morgan Stanley. Outstanding Mortgages by Coupon 6.89% 6.19% 0 500 1,000 1,500 2,000 2,500 3,000 J a n -2 2 J u n -2 2 N o v -2 2 A p r- 2 3 S e p -2 3 F e b -2 4 J u l- 2 4 D e c -2 4 M a y -2 5 O c t- 2 5 M B A M o rt g a g e R e fi n a n c e I n d e x 2.0 4.0 6.0 8.0 J a n -2 2 J u n -2 2 N o v -2 2 A p r- 2 3 S e p -2 3 F e b -2 4 J u l- 2 4 D e c -2 4 M a y -2 5 O c t- 2 5 F re d d ie M a c 3 0 -Y e a r M o rt g a g e R a te ( % )

12 Third Quarter 2025 Earnings & Segment Results

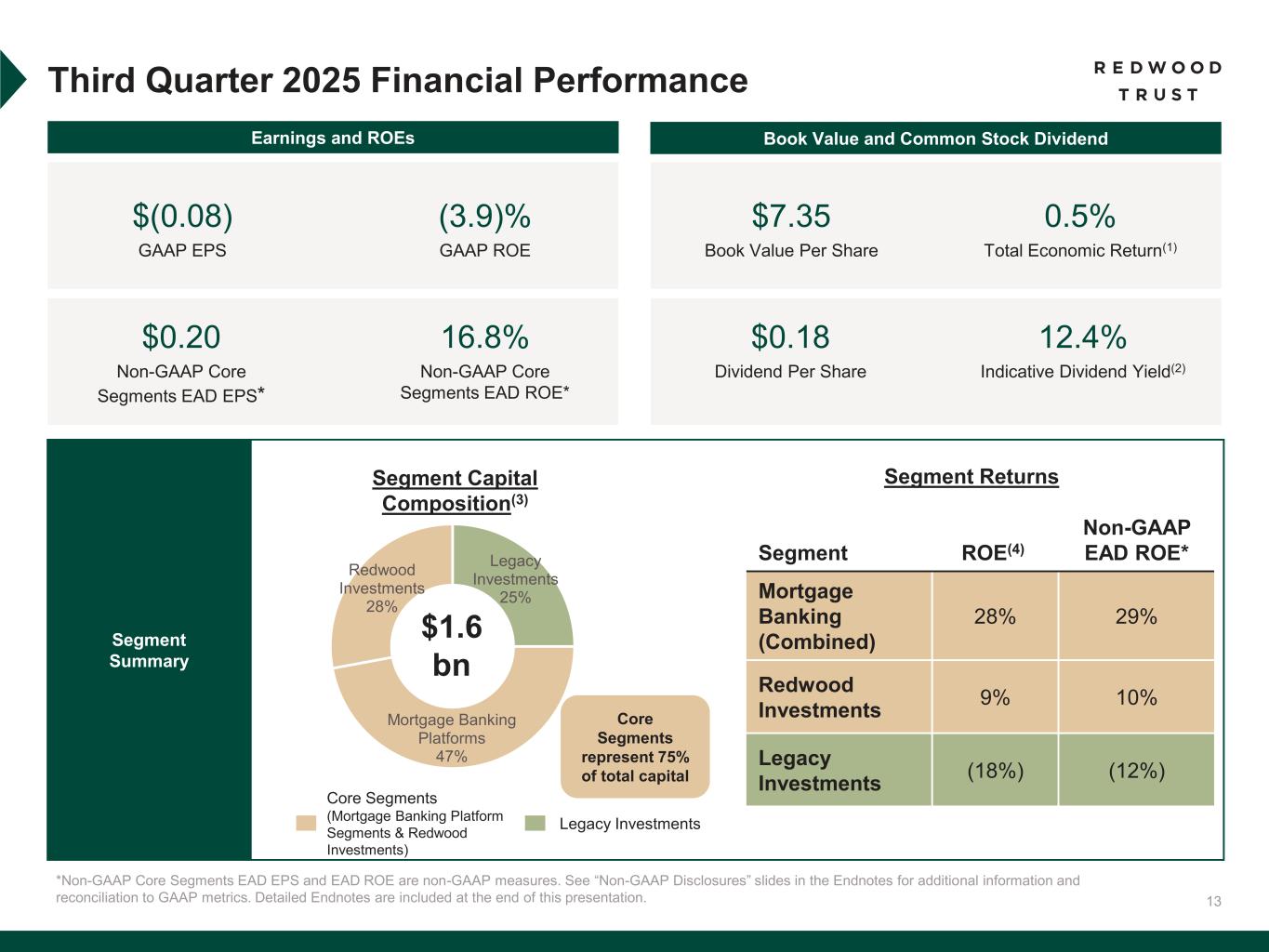

13 Third Quarter 2025 Financial Performance *Non-GAAP Core Segments EAD EPS and EAD ROE are non-GAAP measures. See “Non-GAAP Disclosures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. Detailed Endnotes are included at the end of this presentation. Earnings and ROEs Book Value and Common Stock Dividend $(0.08) GAAP EPS $0.18 Dividend Per Share 12.4% Indicative Dividend Yield(2) (3.9)% GAAP ROE Segment Summary $7.35 Book Value Per Share 0.5% Total Economic Return(1) $1.6 bn Core Segments represent 75% of total capital $0.20 Non-GAAP Core Segments EAD EPS* 16.8% Non-GAAP Core Segments EAD ROE* Segment ROE(4)) Non-GAAP EAD ROE* Mortgage Banking (Combined) 28% 29% Redwood Investments 9% 10% Legacy Investments (18%) (12%) Core Segments (Mortgage Banking Platform Segments & Redwood Investments) Legacy Investments Legacy Investments 25% Mortgage Banking Platforms 47% Redwood Investments 28% Segment Capital Composition(3) Segment Returns

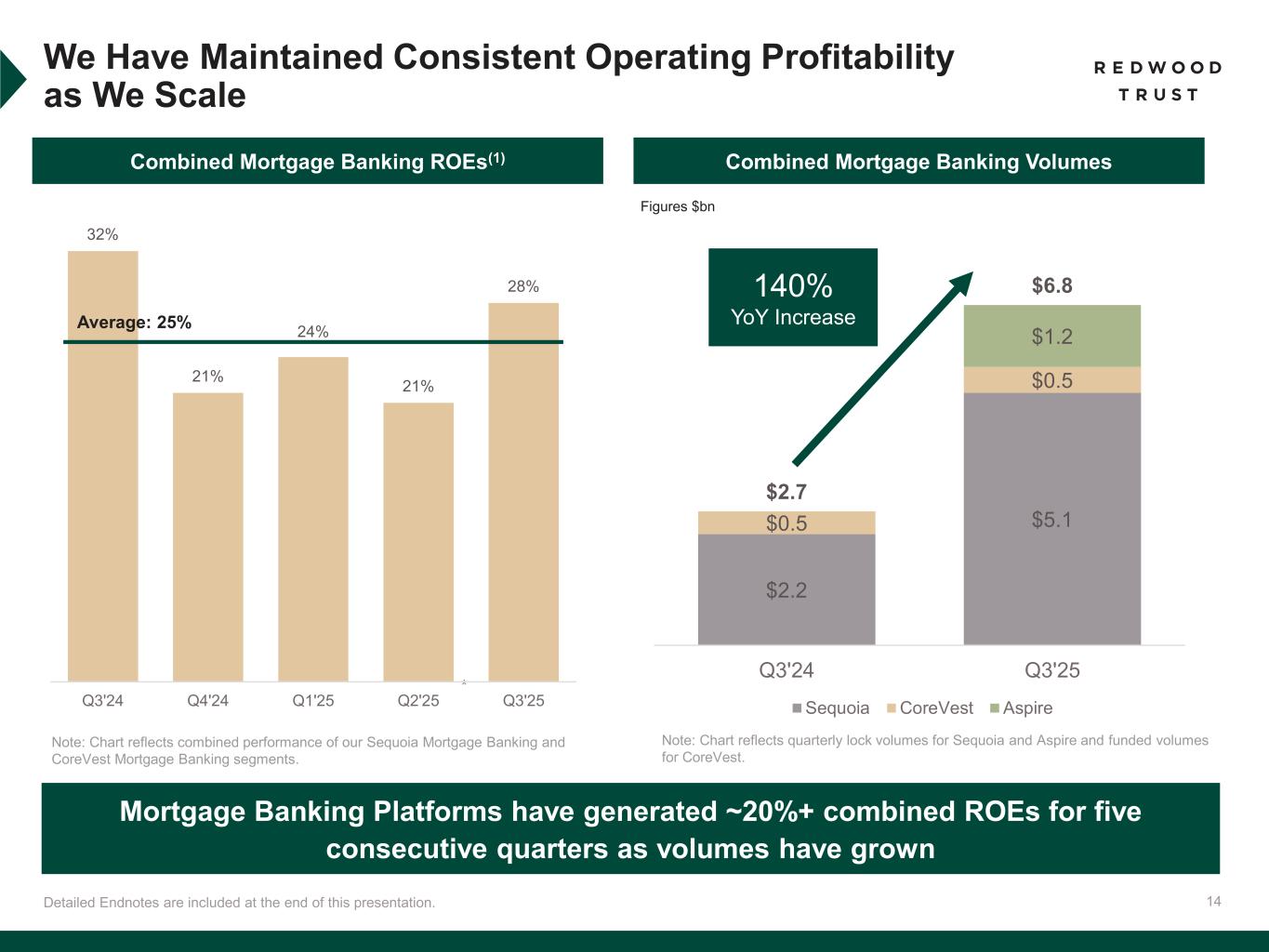

14 $2.2 $5.1$0.5 $0.5 $1.2 $2.7 $6.8 Q3'24 Q3'25 Sequoia CoreVest Aspire We Have Maintained Consistent Operating Profitability as We Scale Detailed Endnotes are included at the end of this presentation. Combined Mortgage Banking ROEs(1) Combined Mortgage Banking Volumes Figures $bn Mortgage Banking Platforms have generated ~20%+ combined ROEs for five consecutive quarters as volumes have grown 140% YoY Increase Note: Chart reflects quarterly lock volumes for Sequoia and Aspire and funded volumes for CoreVest. * 32% 21% 24% 21% 28% Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Note: Chart reflects combined performance of our Sequoia Mortgage Banking and CoreVest Mortgage Banking segments. Average: 25%

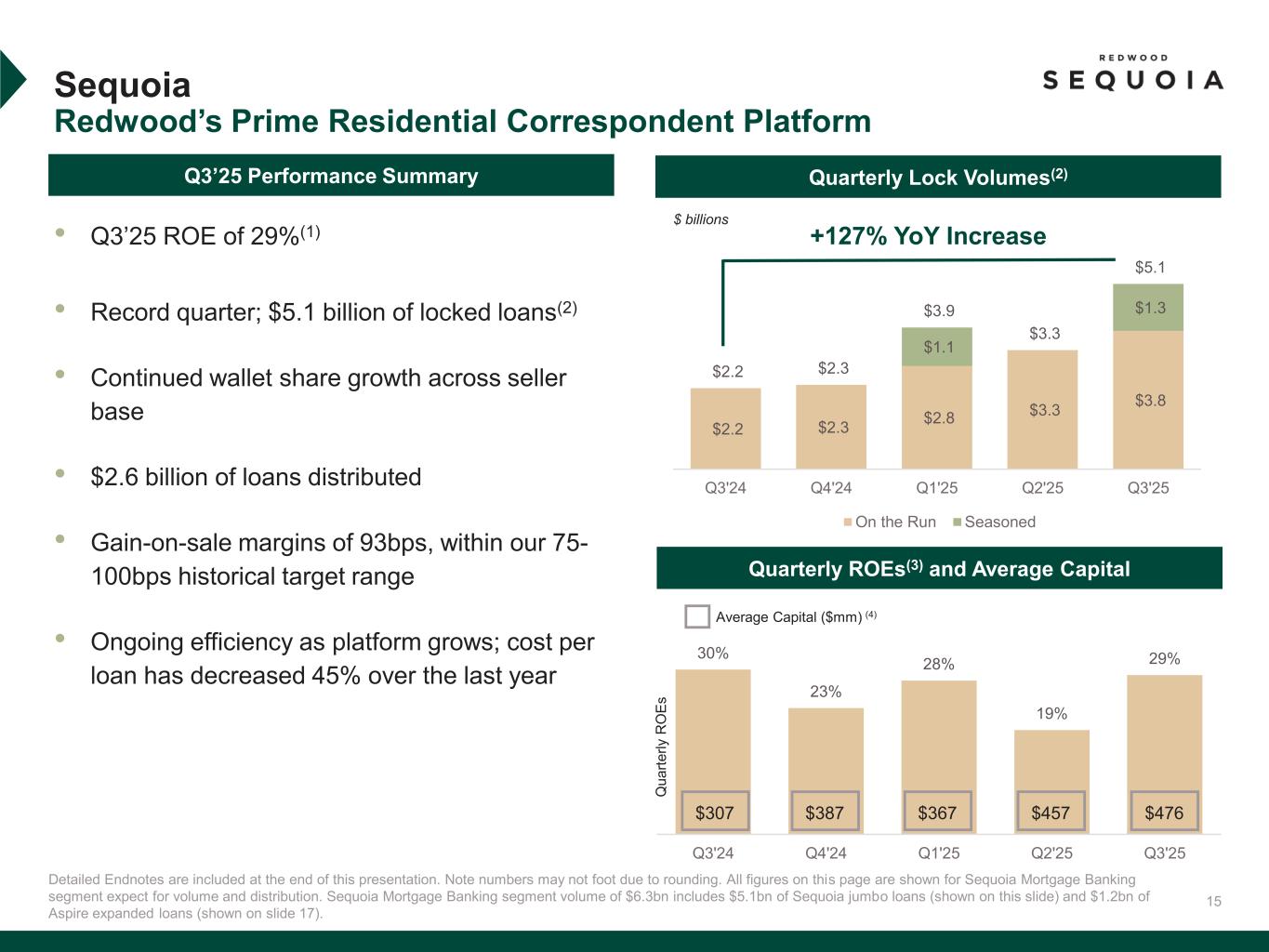

15 30% 23% 28% 19% 29% Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Detailed Endnotes are included at the end of this presentation. Note numbers may not foot due to rounding. All figures on this page are shown for Sequoia Mortgage Banking segment expect for volume and distribution. Sequoia Mortgage Banking segment volume of $6.3bn includes $5.1bn of Sequoia jumbo loans (shown on this slide) and $1.2bn of Aspire expanded loans (shown on slide 17). Sequoia Redwood’s Prime Residential Correspondent Platform Quarterly Lock Volumes(2) $ billions +127% YoY Increase Quarterly ROEs(3) and Average Capital Average Capital ($mm) (4) • Q3’25 ROE of 29%(1) • Record quarter; $5.1 billion of locked loans(2) • Continued wallet share growth across seller base • $2.6 billion of loans distributed • Gain-on-sale margins of 93bps, within our 75- 100bps historical target range • Ongoing efficiency as platform grows; cost per loan has decreased 45% over the last year $307 $387 $367 $457 $476 Q u a rt e rl y R O E s Q3’25 Performance Summary $2.2 $2.3 $2.8 $3.3 $3.8 $1.1 $1.3 $2.2 $2.3 $3.9 $3.3 $5.1 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 On the Run Seasoned

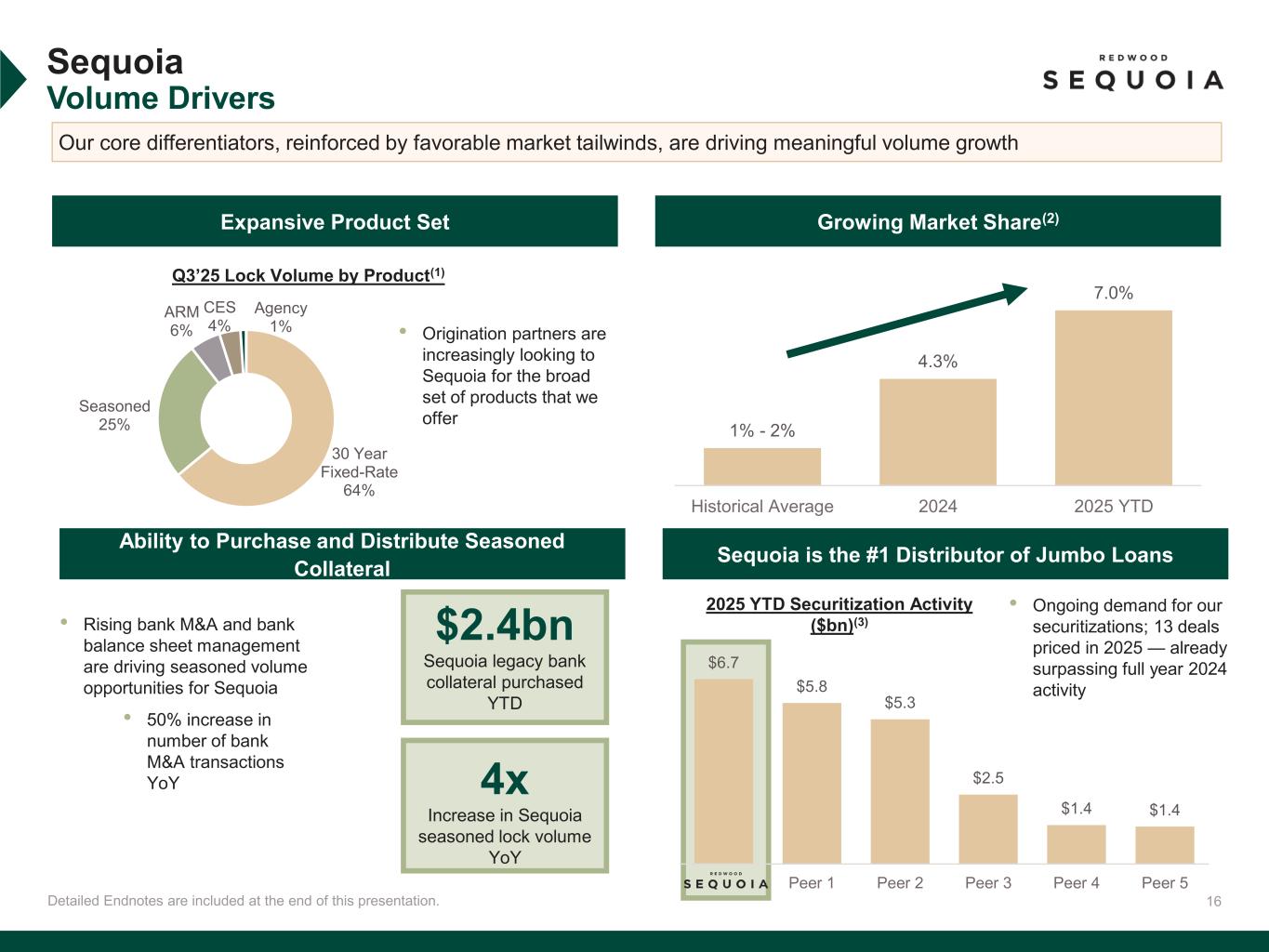

16 1% - 2% 4.3% 7.0% Historical Average 2024 2025 YTD Detailed Endnotes are included at the end of this presentation. Sequoia Volume Drivers Our core differentiators, reinforced by favorable market tailwinds, are driving meaningful volume growth Growing Market Share(2)Expansive Product Set Sequoia is the #1 Distributor of Jumbo Loans Ability to Purchase and Distribute Seasoned Collateral • Rising bank M&A and bank balance sheet management are driving seasoned volume opportunities for Sequoia • 50% increase in number of bank M&A transactions YoY $2.4bn Sequoia legacy bank collateral purchased YTD • Ongoing demand for our securitizations; 13 deals priced in 2025 — already surpassing full year 2024 activity 2025 YTD Securitization Activity ($bn)(3) Q3’25 Lock Volume by Product(1) • Origination partners are increasingly looking to Sequoia for the broad set of products that we offer 30 Year Fixed-Rate 64% Seasoned 25% ARM 6% CES 4% Agency 1% 4x Increase in Sequoia seasoned lock volume YoY $6.7 $5.8 $5.3 $2.5 $1.4 $1.4 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5

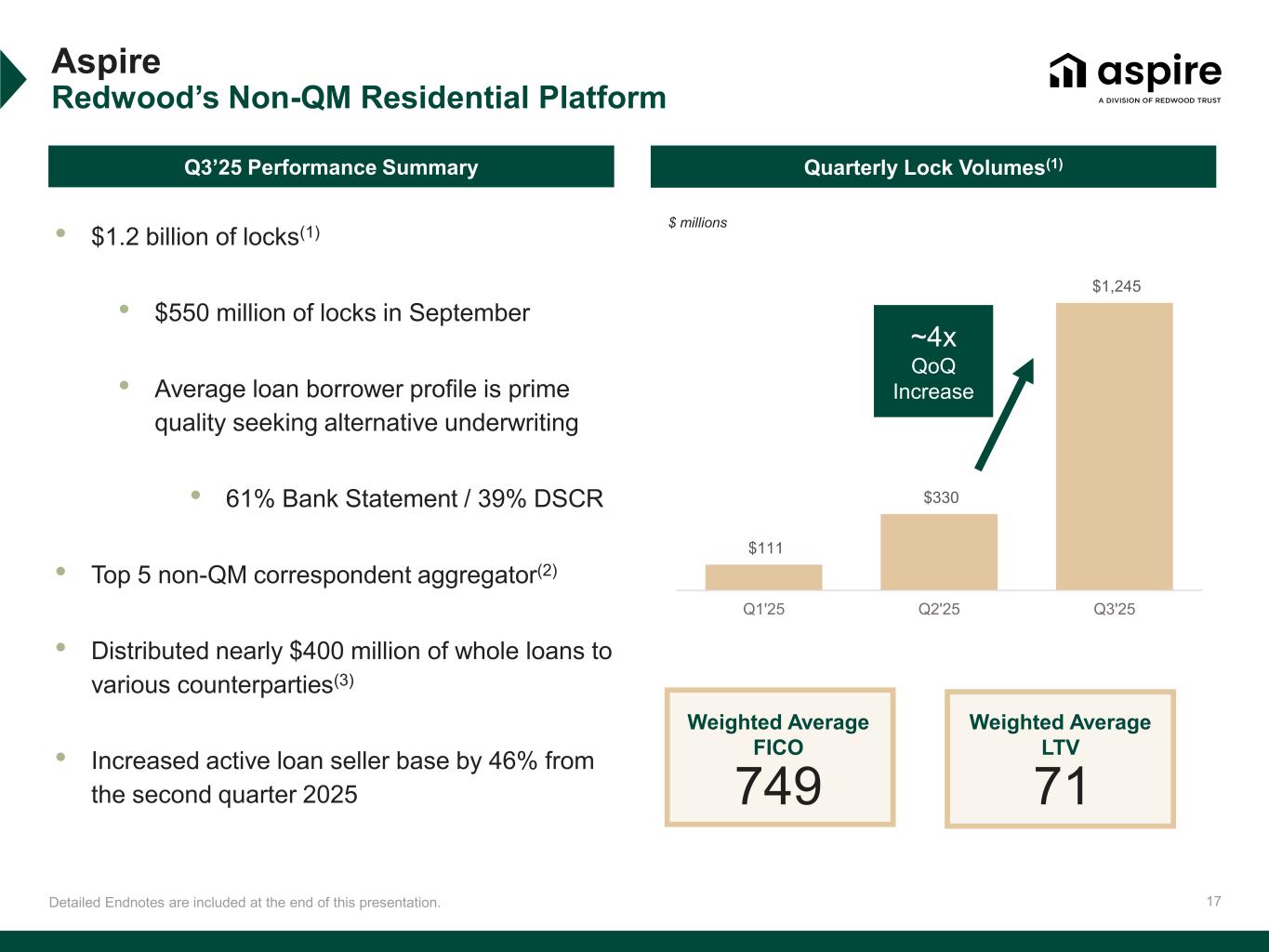

17 $111 $330 $1,245 Q1'25 Q2'25 Q3'25 Aspire Redwood’s Non-QM Residential Platform Detailed Endnotes are included at the end of this presentation. Quarterly Lock Volumes(1) ~4x QoQ Increase Weighted Average LTV 71 Weighted Average FICO 749 $ millions Q3’25 Performance Summary • $1.2 billion of locks(1) • $550 million of locks in September • Average loan borrower profile is prime quality seeking alternative underwriting • 61% Bank Statement / 39% DSCR • Top 5 non-QM correspondent aggregator(2) • Distributed nearly $400 million of whole loans to various counterparties(3) • Increased active loan seller base by 46% from the second quarter 2025

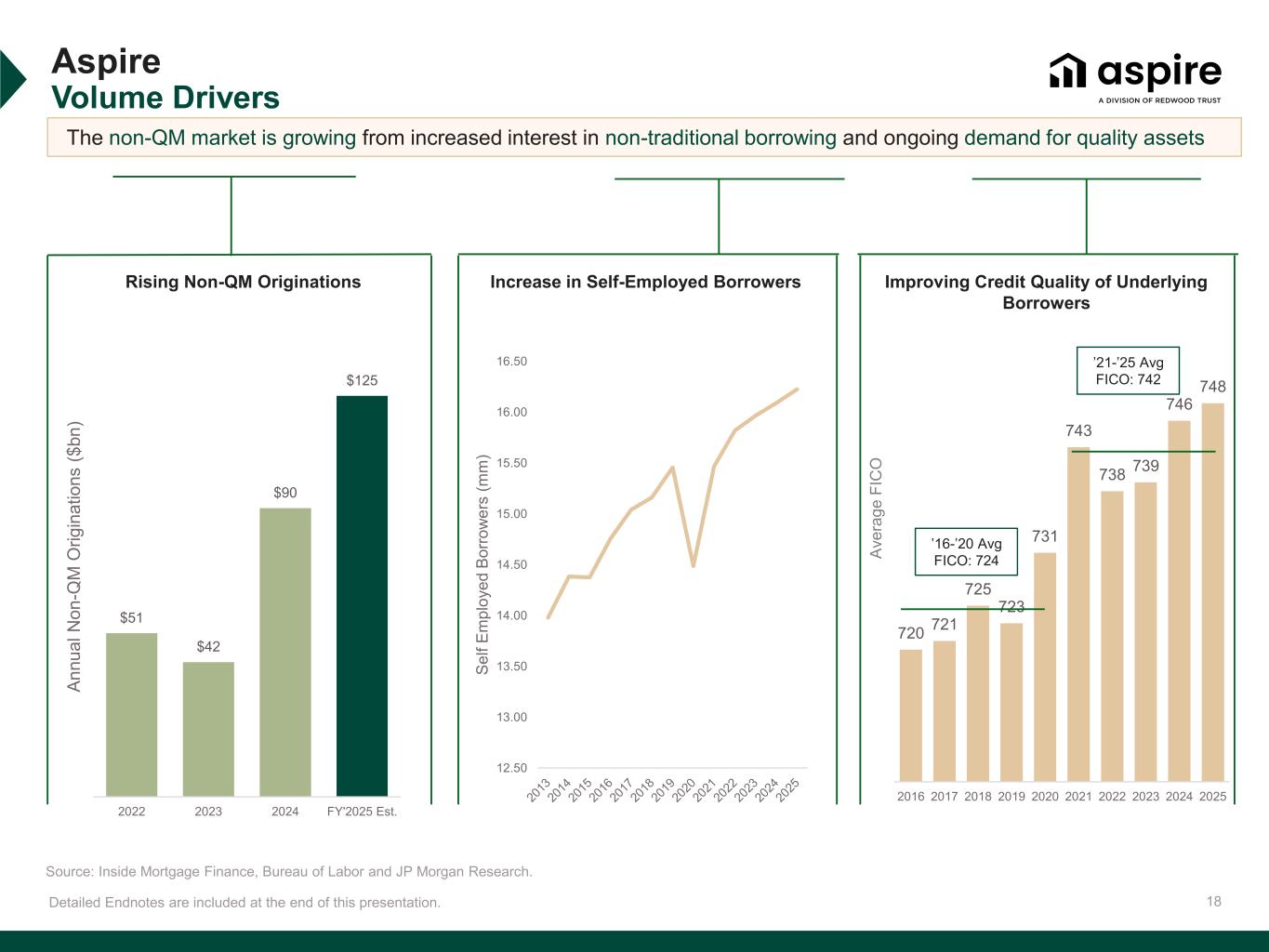

18 Aspire Volume Drivers Detailed Endnotes are included at the end of this presentation. Increase in Self-Employed BorrowersRising Non-QM Originations Improving Credit Quality of Underlying Borrowers $51 $42 $90 $125 2022 2023 2024 FY'2025 Est. A n n u a l N o n -Q M O ri g in a ti o n s ( $ b n ) The non-QM market is growing from increased interest in non-traditional borrowing and ongoing demand for quality assets Source: Inside Mortgage Finance, Bureau of Labor and JP Morgan Research. 12.50 13.00 13.50 14.00 14.50 15.00 15.50 16.00 16.50 S e lf E m p lo y e d B o rr o w e rs ( m m ) 720 721 725 723 731 743 738 739 746 748 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 ’16-’20 Avg FICO: 724 ’21-’25 Avg FICO: 742 A v e ra g e F IC O

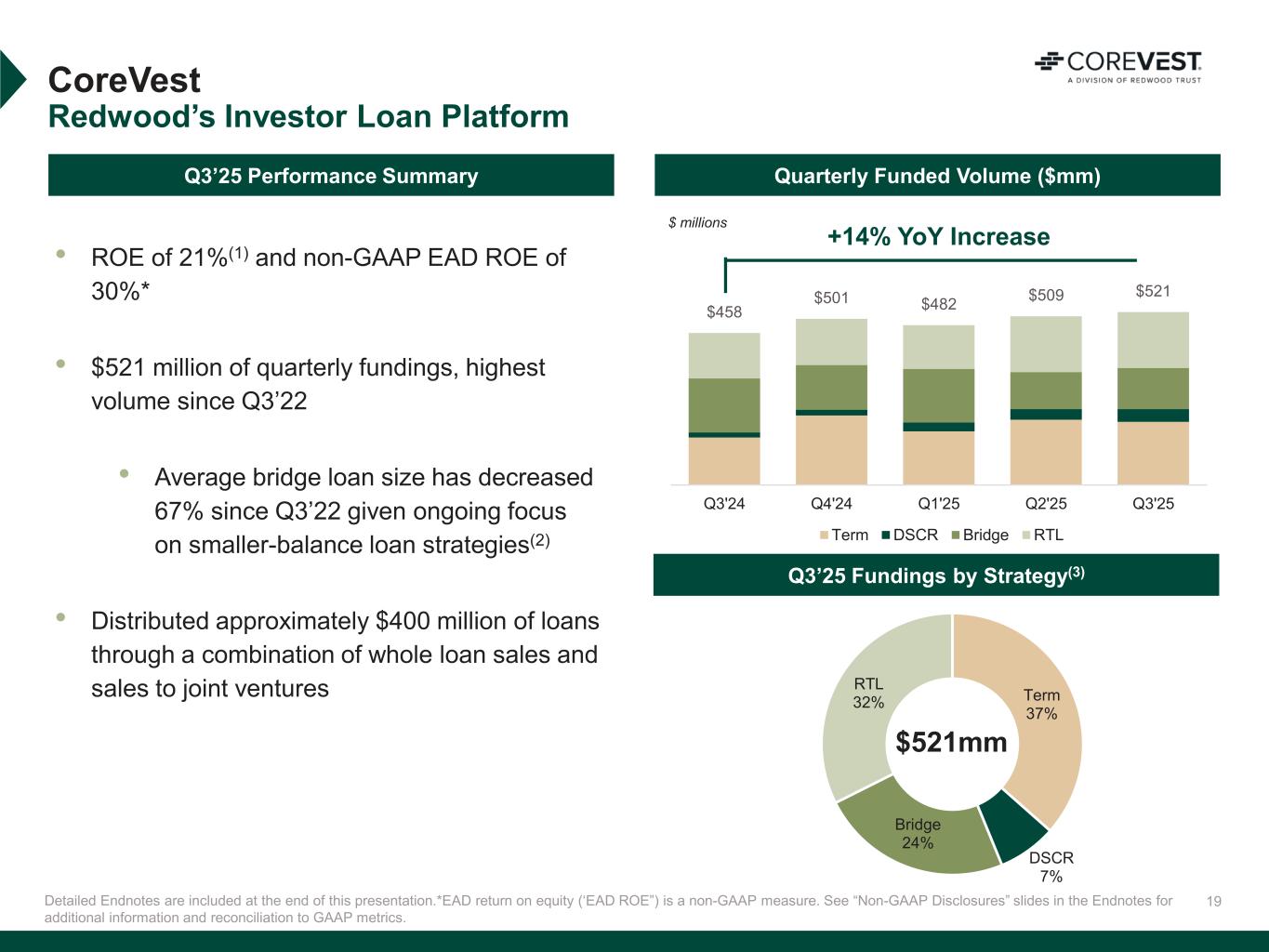

19 $458 $501 $482 $509 $521 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Term DSCR Bridge RTL Term 37% DSCR 7% Bridge 24% RTL 32% CoreVest Redwood’s Investor Loan Platform Quarterly Funded Volume ($mm) Detailed Endnotes are included at the end of this presentation.*EAD return on equity (‘EAD ROE”) is a non-GAAP measure. See “Non-GAAP Disclosures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. +14% YoY Increase $ millions Q3’25 Fundings by Strategy(3) $521mm • ROE of 21%(1) and non-GAAP EAD ROE of 30%* • $521 million of quarterly fundings, highest volume since Q3’22 • Average bridge loan size has decreased 67% since Q3’22 given ongoing focus on smaller-balance loan strategies(2) • Distributed approximately $400 million of loans through a combination of whole loan sales and sales to joint ventures Q3’25 Performance Summary

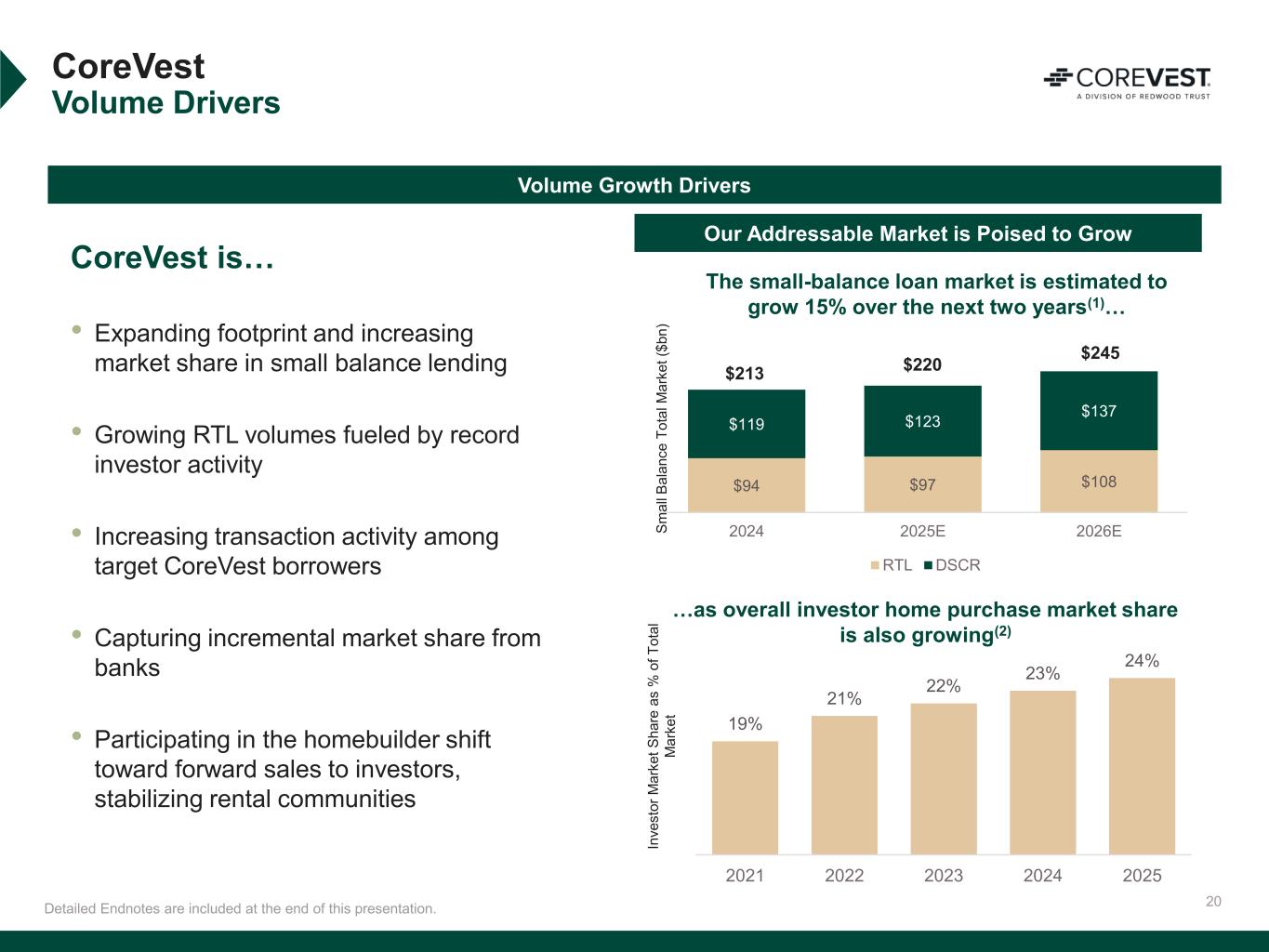

20 CoreVest Volume Drivers Detailed Endnotes are included at the end of this presentation. Volume Growth Drivers The small-balance loan market is estimated to grow 15% over the next two years(1)… $94 $97 $108 $119 $123 $137 2024 2025E 2026E RTL DSCR $213 $220 $245 CoreVest is… • Expanding footprint and increasing market share in small balance lending • Growing RTL volumes fueled by record investor activity • Increasing transaction activity among target CoreVest borrowers • Capturing incremental market share from banks • Participating in the homebuilder shift toward forward sales to investors, stabilizing rental communities Our Addressable Market is Poised to Grow 19% 21% 22% 23% 24% 2021 2022 2023 2024 2025 …as overall investor home purchase market share is also growing(2) S m a ll B a la n c e T o ta l M a rk e t ($ b n ) In v e s to r M a rk e t S h a re a s % o f T o ta l M a rk e t

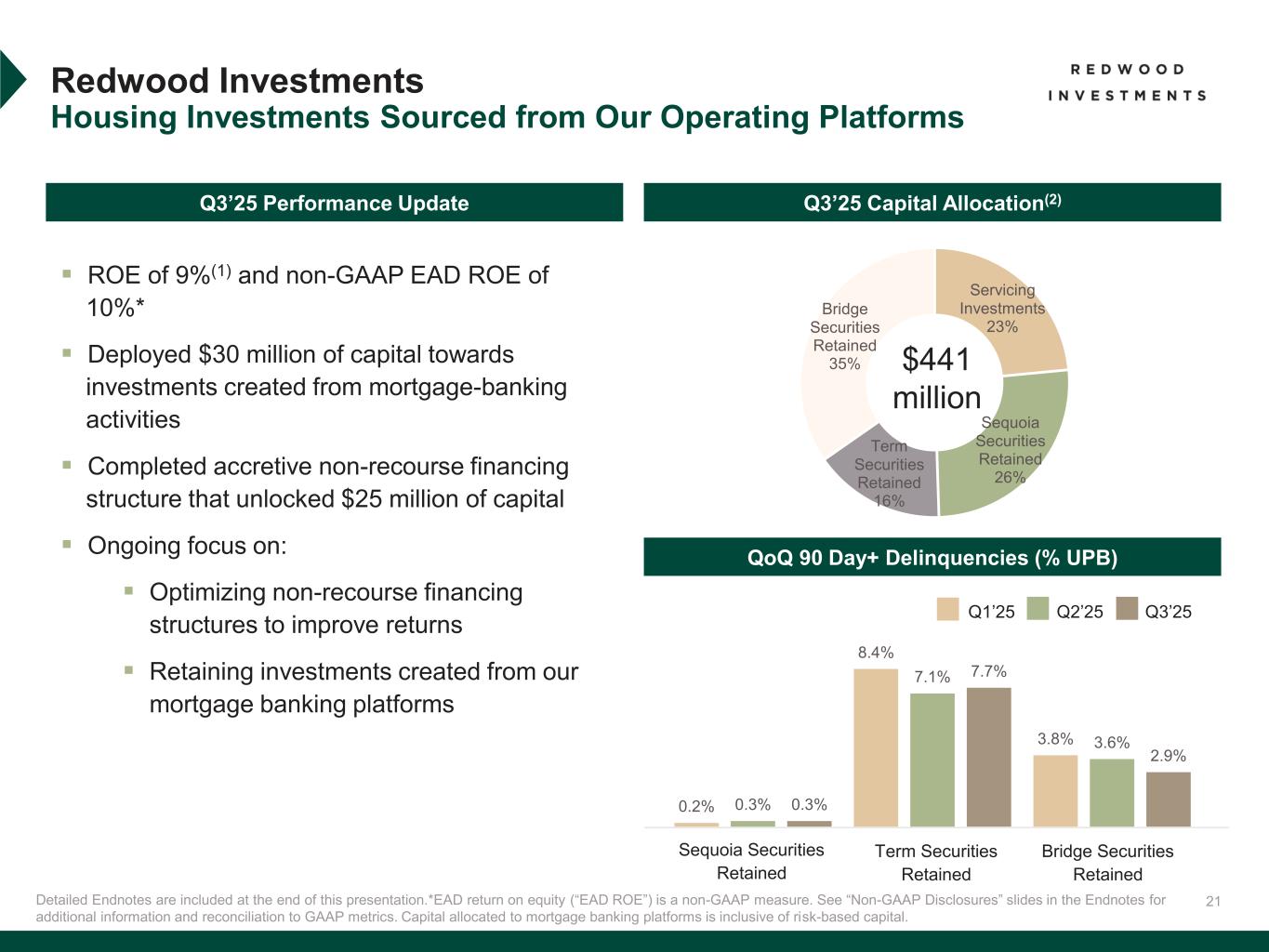

21 Redwood Investments Housing Investments Sourced from Our Operating Platforms Q3’25 Performance Update ▪ ROE of 9%(1) and non-GAAP EAD ROE of 10%* ▪ Deployed $30 million of capital towards investments created from mortgage-banking activities ▪ Completed accretive non-recourse financing structure that unlocked $25 million of capital ▪ Ongoing focus on: ▪ Optimizing non-recourse financing structures to improve returns ▪ Retaining investments created from our mortgage banking platforms $441 million Q3’25 Capital Allocation(2) Q2’25 QoQ 90 Day+ Delinquencies (% UPB) Q3’25 Detailed Endnotes are included at the end of this presentation.*EAD return on equity (“EAD ROE”) is a non-GAAP measure. See “Non-GAAP Disclosures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. Capital allocated to mortgage banking platforms is inclusive of risk-based capital. Q1’25 Servicing Investments 23% Sequoia Securities Retained 26% Term Securities Retained 16% Bridge Securities Retained 35% 0.2% 8.4% 3.8% 0.3% 7.1% 3.6% 0.3% 7.7% 2.9% Sequoia Securities Retained Term Securities Retained Bridge Securities Retained

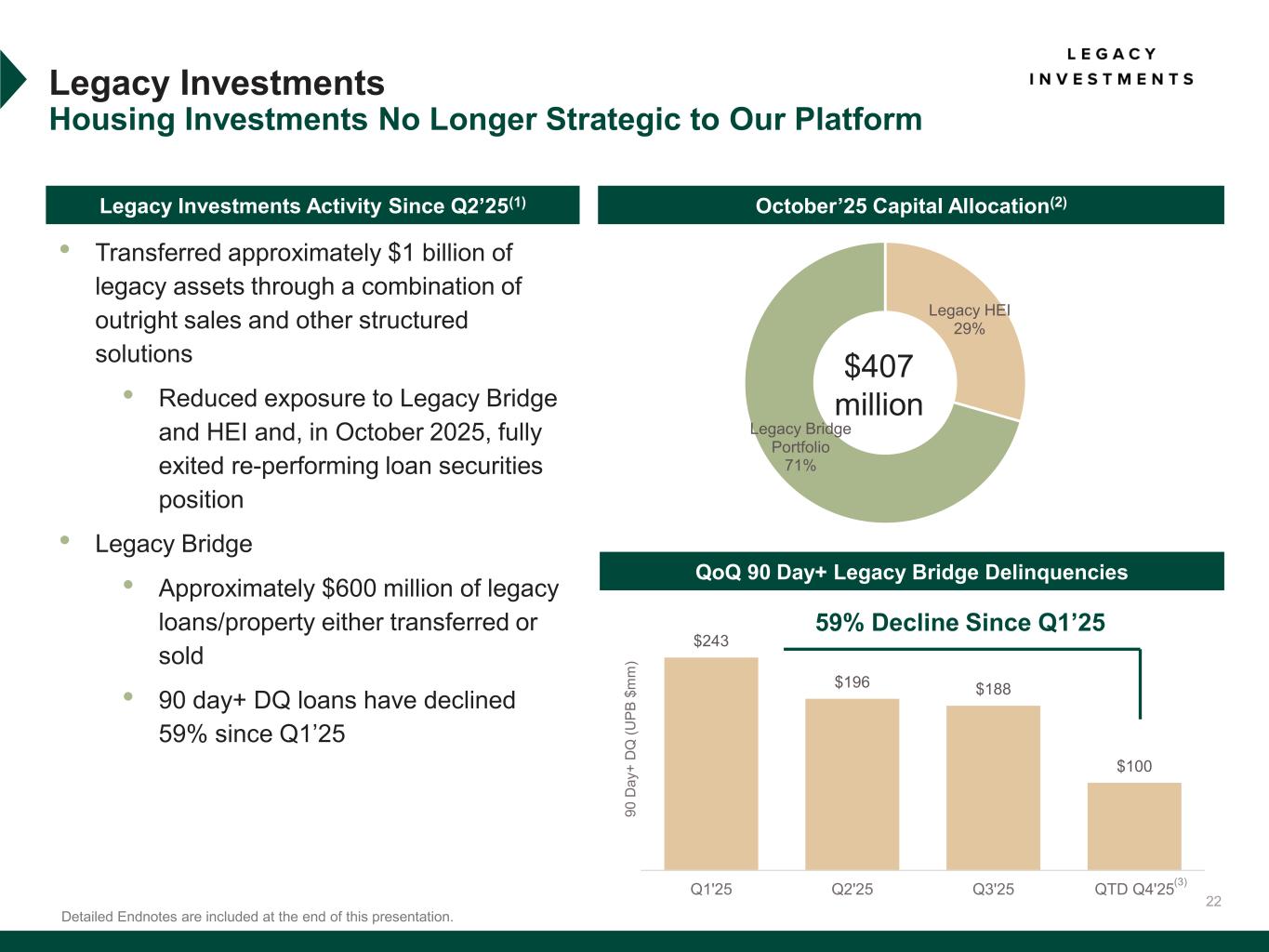

22 Legacy Investments Housing Investments No Longer Strategic to Our Platform Detailed Endnotes are included at the end of this presentation. Legacy Investments Activity Since Q2’25(1) QoQ 90 Day+ Legacy Bridge Delinquencies • Transferred approximately $1 billion of legacy assets through a combination of outright sales and other structured solutions • Reduced exposure to Legacy Bridge and HEI and, in October 2025, fully exited re-performing loan securities position • Legacy Bridge • Approximately $600 million of legacy loans/property either transferred or sold • 90 day+ DQ loans have declined 59% since Q1’25 $407 million October’25 Capital Allocation(2) Legacy HEI 29% Legacy Bridge Portfolio 71% 59% Decline Since Q1’25 $243 $196 $188 $100 Q1'25 Q2'25 Q3'25 QTD Q4'25 9 0 D a y + D Q ( U P B $ m m ) (3)

23 Financial Results

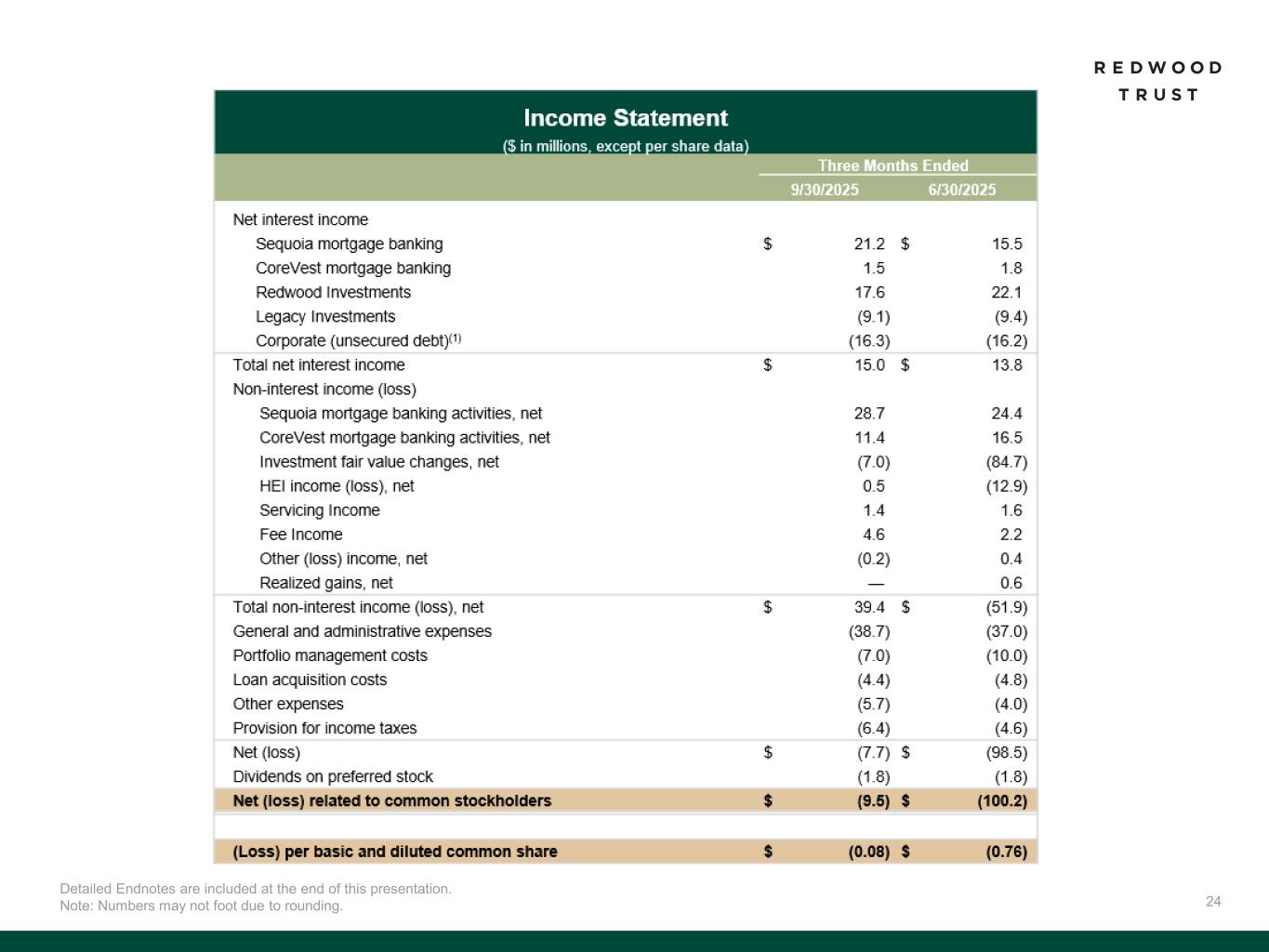

24 Detailed Endnotes are included at the end of this presentation. Note: Numbers may not foot due to rounding.

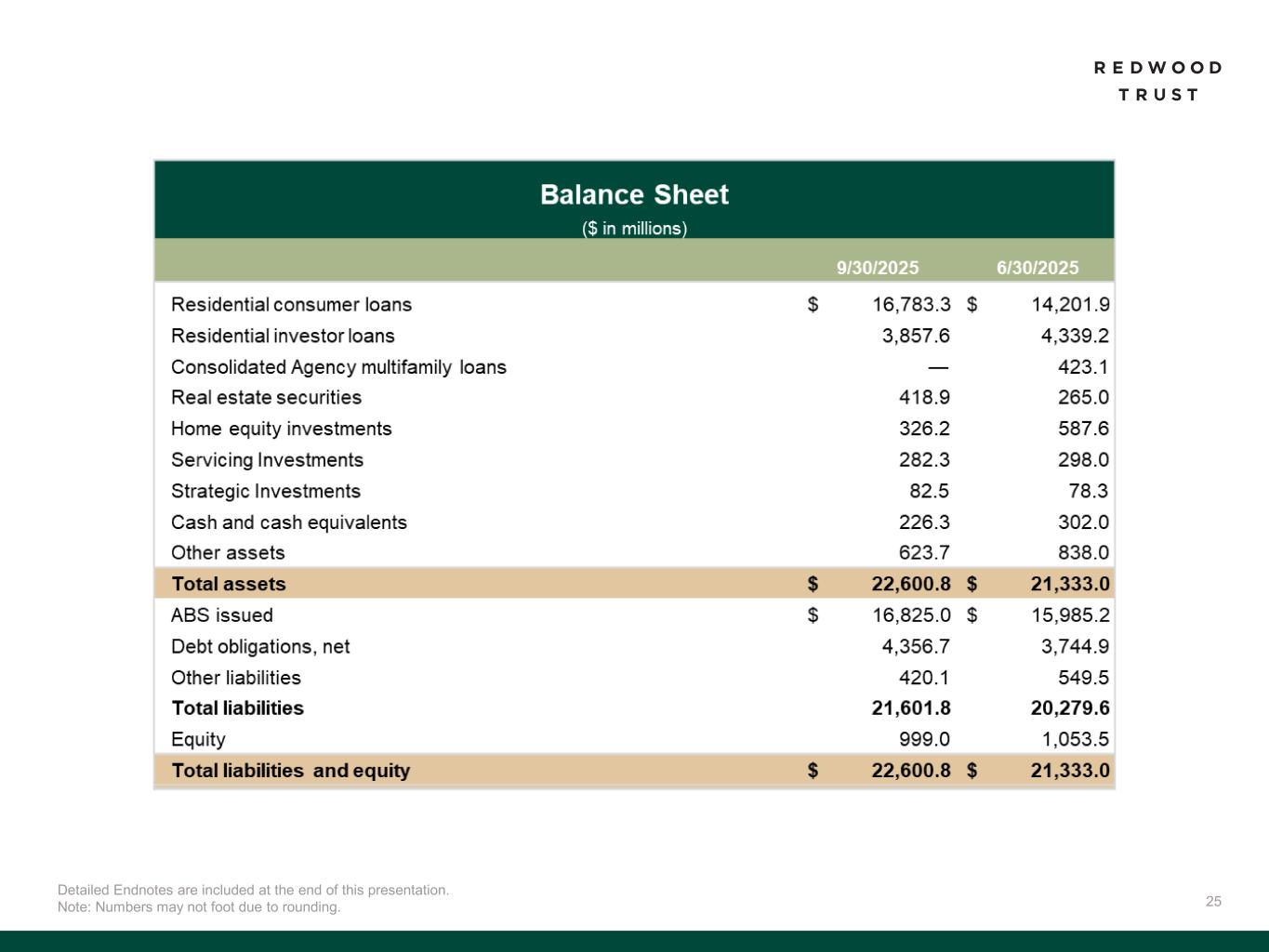

25 Detailed Endnotes are included at the end of this presentation. Note: Numbers may not foot due to rounding.

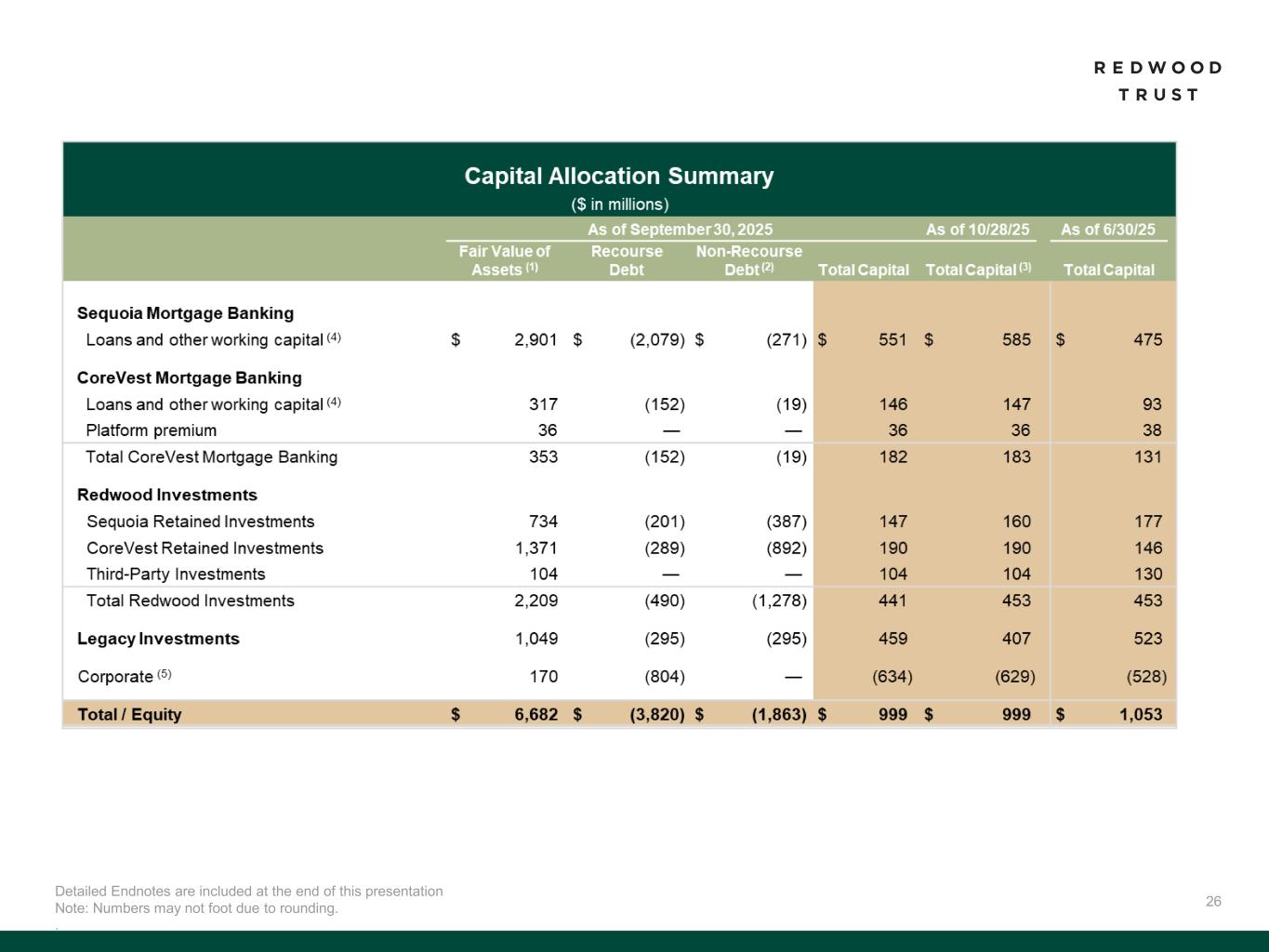

26 Detailed Endnotes are included at the end of this presentation Note: Numbers may not foot due to rounding. .

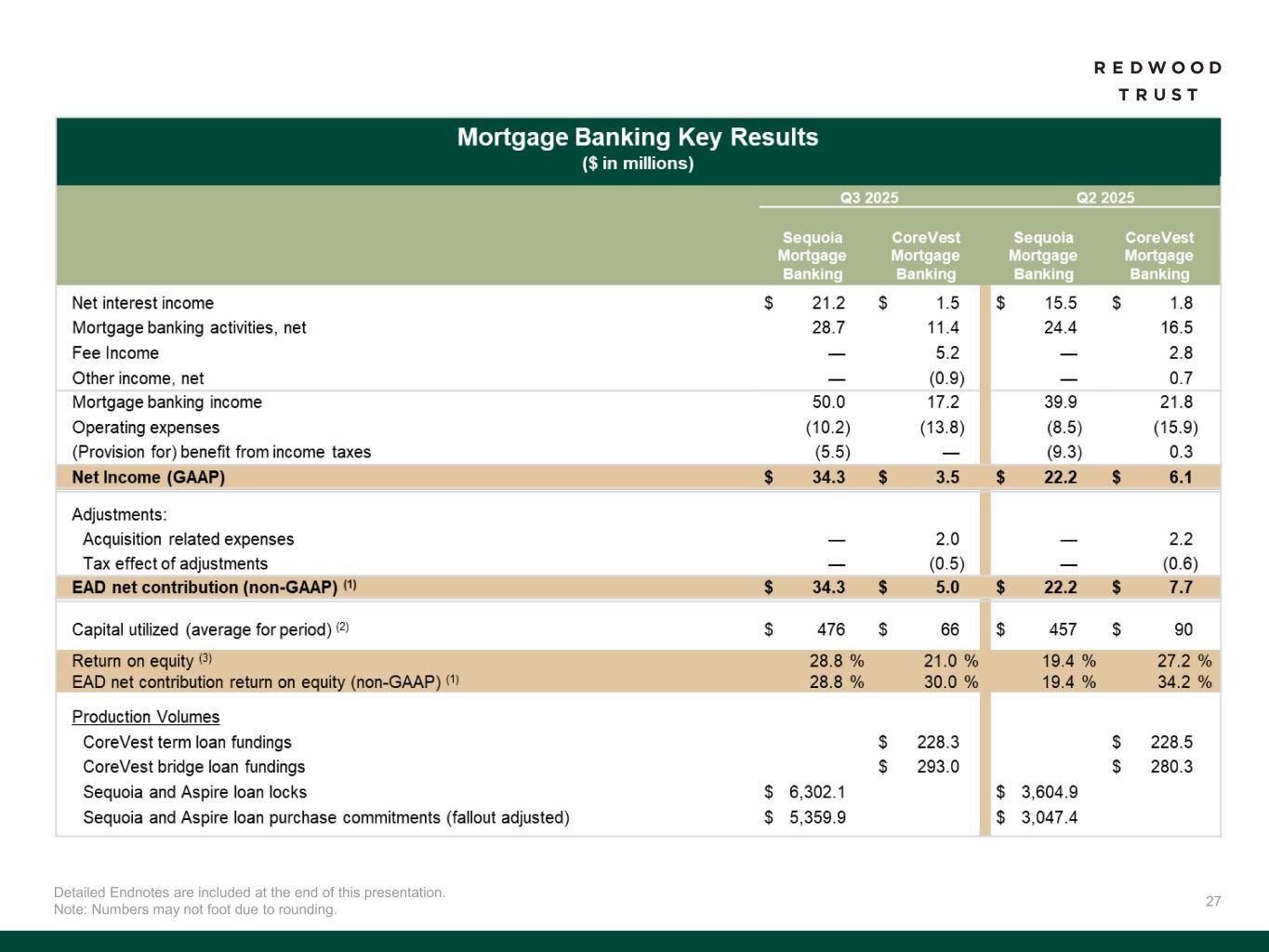

27 Detailed Endnotes are included at the end of this presentation. Note: Numbers may not foot due to rounding.

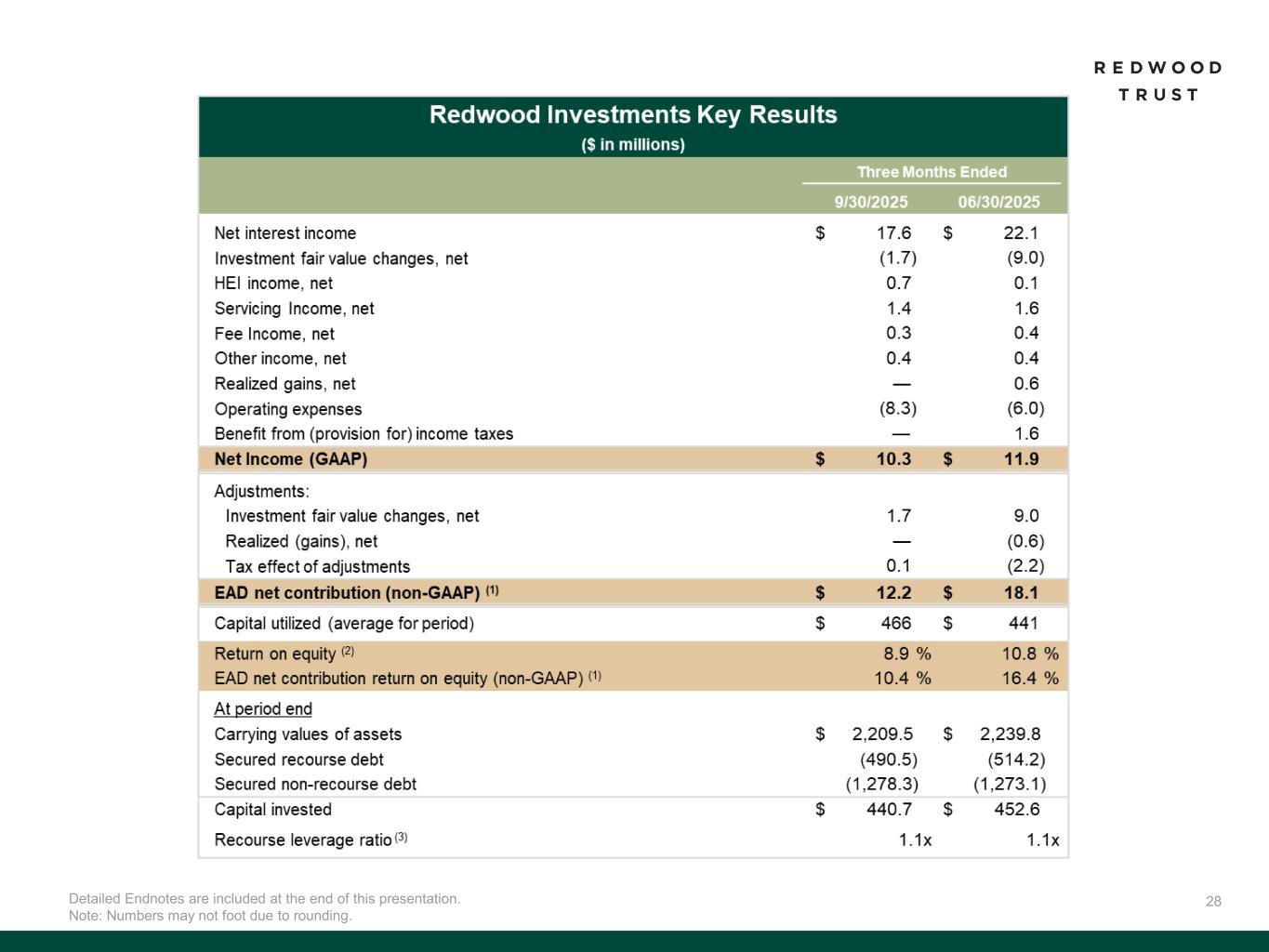

28Detailed Endnotes are included at the end of this presentation. Note: Numbers may not foot due to rounding.

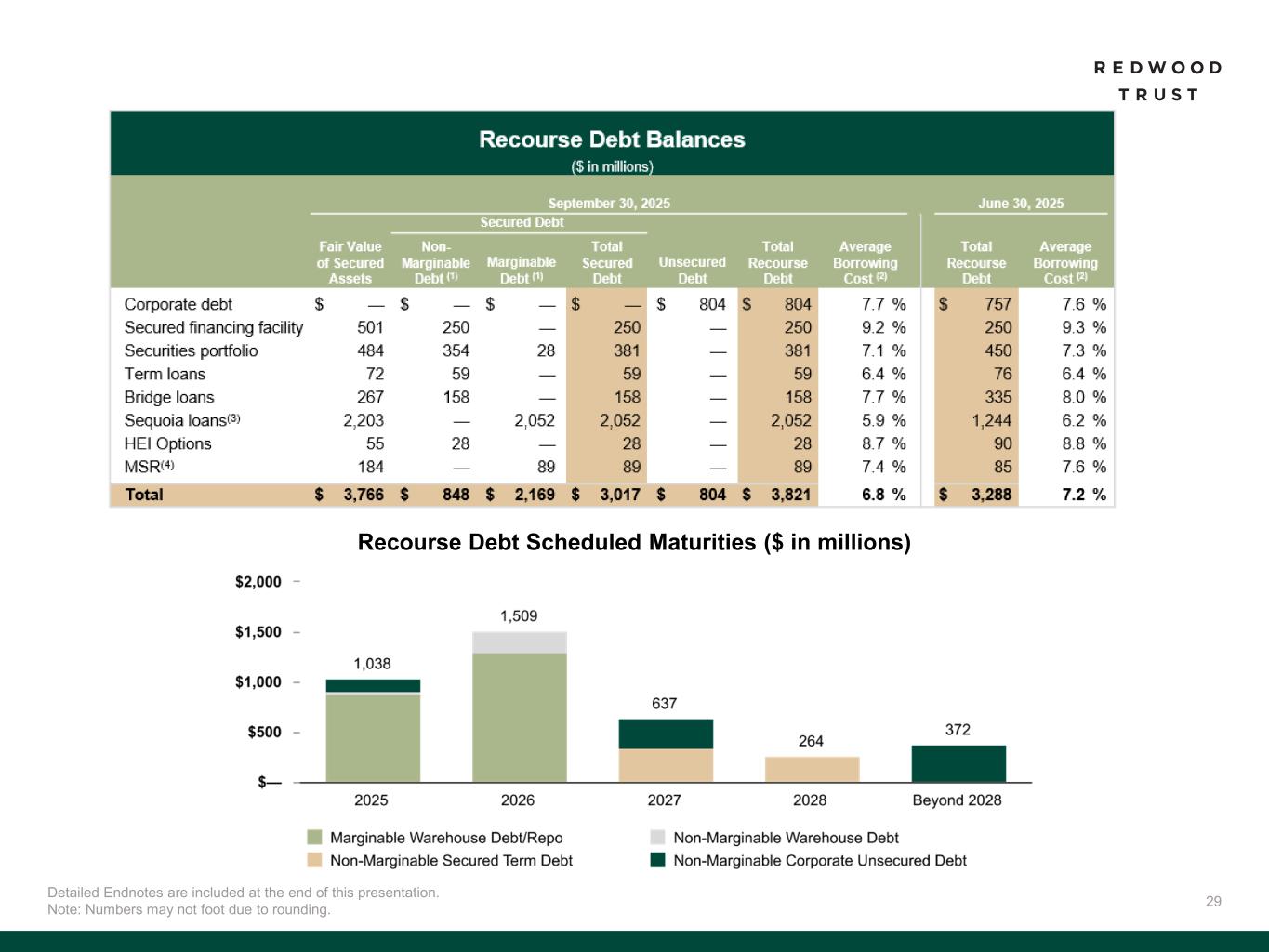

29 Detailed Endnotes are included at the end of this presentation. Note: Numbers may not foot due to rounding. Recourse Debt Scheduled Maturities ($ in millions)

30 Non-GAAP Disclosures

31 To supplement consolidated and segment financial information prepared and presented in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company also provides the following non-GAAP measures: • Core Segments Earnings Available for Distribution (“Core Segments EAD”) • Earnings Available for Distribution (“EAD”) Management believes these non-GAAP measures provide supplemental information to assist management and investors in analyzing the Company’s results of operations and help facilitate comparisons to industry peers. Management also believes that these non-GAAP measures are metrics that can supplement its analysis of the Company’s ability to pay dividends, by providing an indication of the current income generating capacity of the Company's operating platforms as of the quarter being presented. In addition, management believes its non-GAAP Core Segments EAD measure provide supplemental information to assist management and investors in analyzing the Company’s in process transition to a more scalable and simplified business model, which includes a wind-down of legacy portfolio holdings within its recently- established Legacy Investments segment. These non-GAAP measures should not be utilized in isolation, nor should they be considered as an alternative to GAAP net income (loss) available (related) to common stockholders, GAAP ROE or other measurements of results of operations computed in accordance with GAAP or for federal income tax purposes. Core Segments EAD. Core Segments EAD and Core Segments EAD ROE are non-GAAP measures established in the second quarter 2025 and are used to present management’s non-GAAP analysis (based on its non-GAAP Earnings Available for Distribution (“EAD”) measure further described below) of the combined performance the Company’s mortgage banking platforms and related investments (which consist of the Company’s Sequoia Mortgage Banking, CoreVest Mortgage Banking and Redwood Investments segments and are defined as the Company’s “Core Segments”, inclusive of an allocated portion of the Company’s Corporate segment relating to those segments). • Core Segments EAD excludes the Company’s Legacy Investments segment and excludes an allocated portion of the Company’s Corporate segment relating to the Legacy Investments segment. • Core Segments EAD per basic common share and Core Segments EAD ROE are also non-GAAP measures established in the second quarter 2025 and are calculated using Core Segments EAD. • Core Segments EAD ROE is defined as Core Segments EAD divided by average capital attributable to Core Segments. A further discussion of Core Segments EAD and a reconciliation of our non-GAAP Core Segments EAD measures to comparable GAAP measures is set forth below under the heading “Reconciliation of GAAP to non-GAAP Core Segments EAD”. Non-GAAP Disclosures

32 EAD. Earnings Available for Distribution (“EAD”) and EAD ROE are non-GAAP measures that the Company has historically reported and continue to be used to present management’s non-GAAP analysis of the performance of the Company’s different business segments, and that continue to be calculated exclusive of any allocation of the Company’s Corporate segment. • Consistent with prior quarter disclosures, EAD and EAD ROE are non-GAAP measures derived from GAAP Net income (loss) available (related) to common stockholders and GAAP Return on common equity ("GAAP ROE" or "ROE"), respectively. • Consistent with prior quarter disclosures, EAD is defined as: GAAP net income (loss) available (related) to common stockholders adjusted to (i) exclude investment fair value changes, net; (ii) exclude realized gains and losses; (iii) exclude acquisition related expenses; (iv) exclude certain organizational restructuring charges (as applicable); and (v) adjust for the hypothetical income taxes associated with these adjustments. • Consistent with prior quarter disclosures, EAD ROE is defined as EAD divided by average capital utilized for each respective period. A further discussion of EAD and a reconciliation of our non-GAAP EAD measures to comparable GAAP measures is set forth below under the heading “Reconciliation of GAAP to non-GAAP EAD”. Supplemental Non-GAAP Table - Illustrating EAD With Allocated Corporate Segment. Management is also presenting a supplemental non-GAAP table in this section under the heading “Supplemental Table - EAD With Allocated Corporate Segment” to clearly illustrate a key distinction between the methodology for calculating the two non-GAAP measures described above – namely, Core Segments EAD and EAD. That key distinction relates to whether or not the non-GAAP measure allocates the Company’s Corporate segment across its other reporting segments for purposes of calculating the non-GAAP measure of performance. Management believes this supplemental table assists management and investors in comparing the Company’s two distinct non-GAAP measures described above. Non-GAAP Disclosures (Continued)

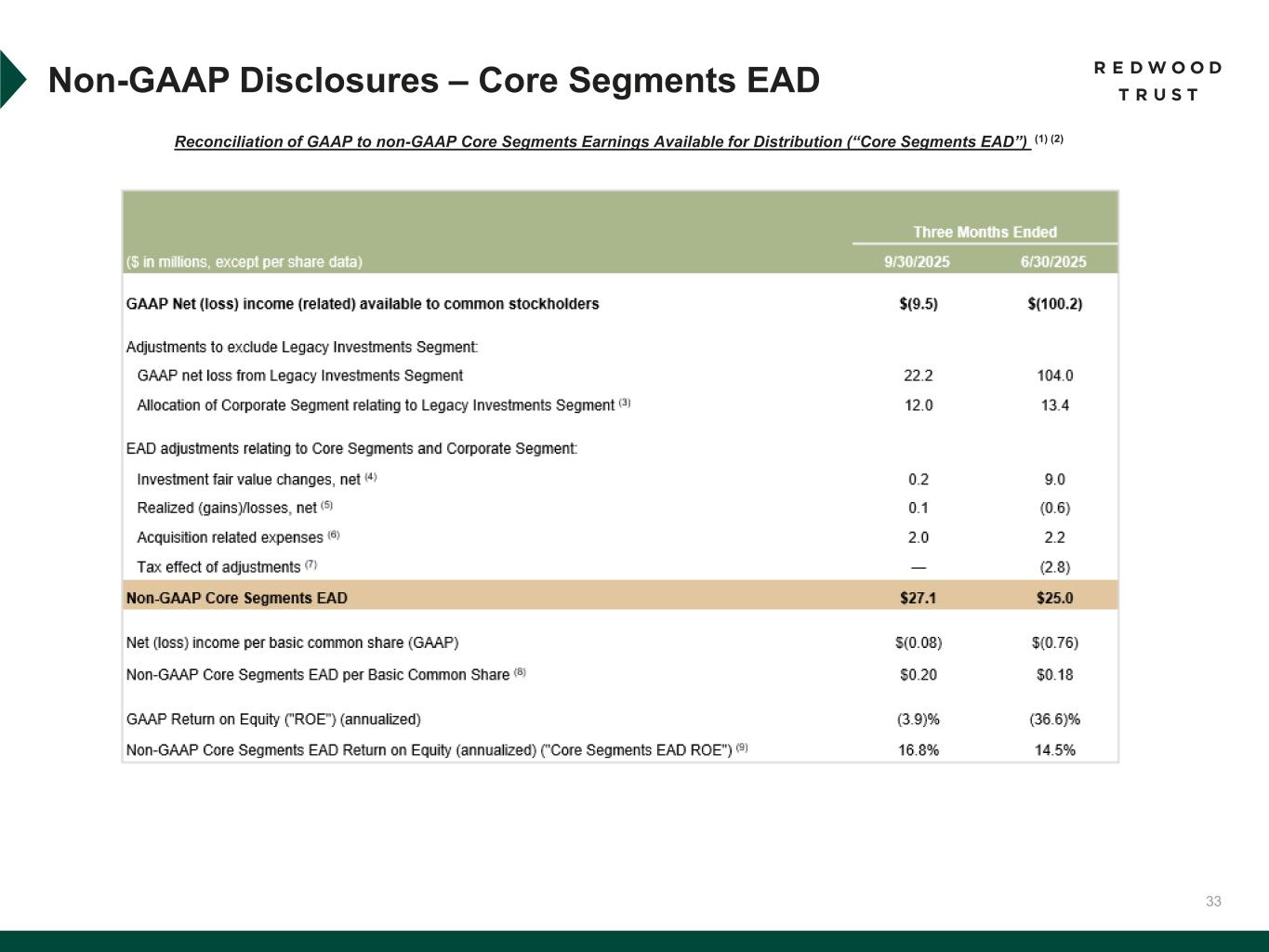

33 Reconciliation of GAAP to non-GAAP Core Segments Earnings Available for Distribution (“Core Segments EAD”) (1) (2) Non-GAAP Disclosures – Core Segments EAD See footnotes on next page

34 Non-GAAP Disclosures – Core Segments EAD (Continued) Footnotes: 1. Certain totals may not foot due to rounding. 2. Core Segments EAD and Core Segments EAD ROE are non-GAAP measures established in the second quarter 2025 and are used to present management’s non-GAAP analysis of the combined performance the Company’s mortgage banking platforms and related investments (which are defined as "Core Segments" and which consist of the Company’s Sequoia Mortgage Banking, CoreVest Mortgage Banking and Redwood Investments segments), inclusive of an allocated portion of the Company’s Corporate segment relating to those Core Segments. Core Segments EAD excludes the Company’s Legacy Investments segment and excludes an allocated portion of the Company’s Corporate segment relating to the Legacy Investments segment. Core Segments EAD is defined as: GAAP net income (loss) available (related) to common stockholders adjusted to (i) exclude GAAP net loss from the Legacy Investments Segment, (ii) exclude the portion of the Corporate Segment allocation relating to the Legacy Investments segment, (iii) exclude investment fair value changes, net; (iv) exclude realized gains and losses; (v) exclude acquisition related expenses; (vi) exclude certain organizational restructuring charges (as applicable); and (vii) adjust for the hypothetical income taxes associated with these adjustments. Refer to footnote 9 below for the definition of Core Segments EAD ROE. 3. Allocation of Corporate Segment relating to the Legacy Investments Segment is a non-GAAP adjustment based on average capital utilized by the Legacy Investments Segment of $498 million and $576 million for the three months ended September 30, 2025 and June 30, 2025, respectively. 4. Investment fair value changes, net includes all amounts within that same line item in our consolidated statements of (loss) income that are attributable to our Core Segments and Corporate segment, which primarily represents both realized and unrealized gains and losses on our investments held in our Core Segments and Corporate Segment and associated hedges. Realized and unrealized gains and losses on our HEI investments are reflected in a separate line item on our consolidated income statements titled "HEI income, net". 5. Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of (loss) income that are attributable to our Core Segments. 6. Acquisition related expenses include transaction costs paid to third parties, as applicable, and the ongoing amortization of intangible assets related to the Riverbend and CoreVest acquisitions. 7. Tax effect of adjustments represents the hypothetical income taxes associated with EAD adjustments used to calculate Core Segments EAD. 8. Core Segments EAD per basic common share is a non-GAAP measure established in the second quarter 2025 and is defined as Core Segments EAD divided by basic weighted average common shares outstanding at the end of the period. 9. Core Segments EAD ROE is a non-GAAP measure established in the second quarter 2025 and is defined as Core Segments EAD divided by average capital attributable to Core Segments of $643 million and $689 million for the three months ended September 30, 2025 and June 30, 2025, respectively.

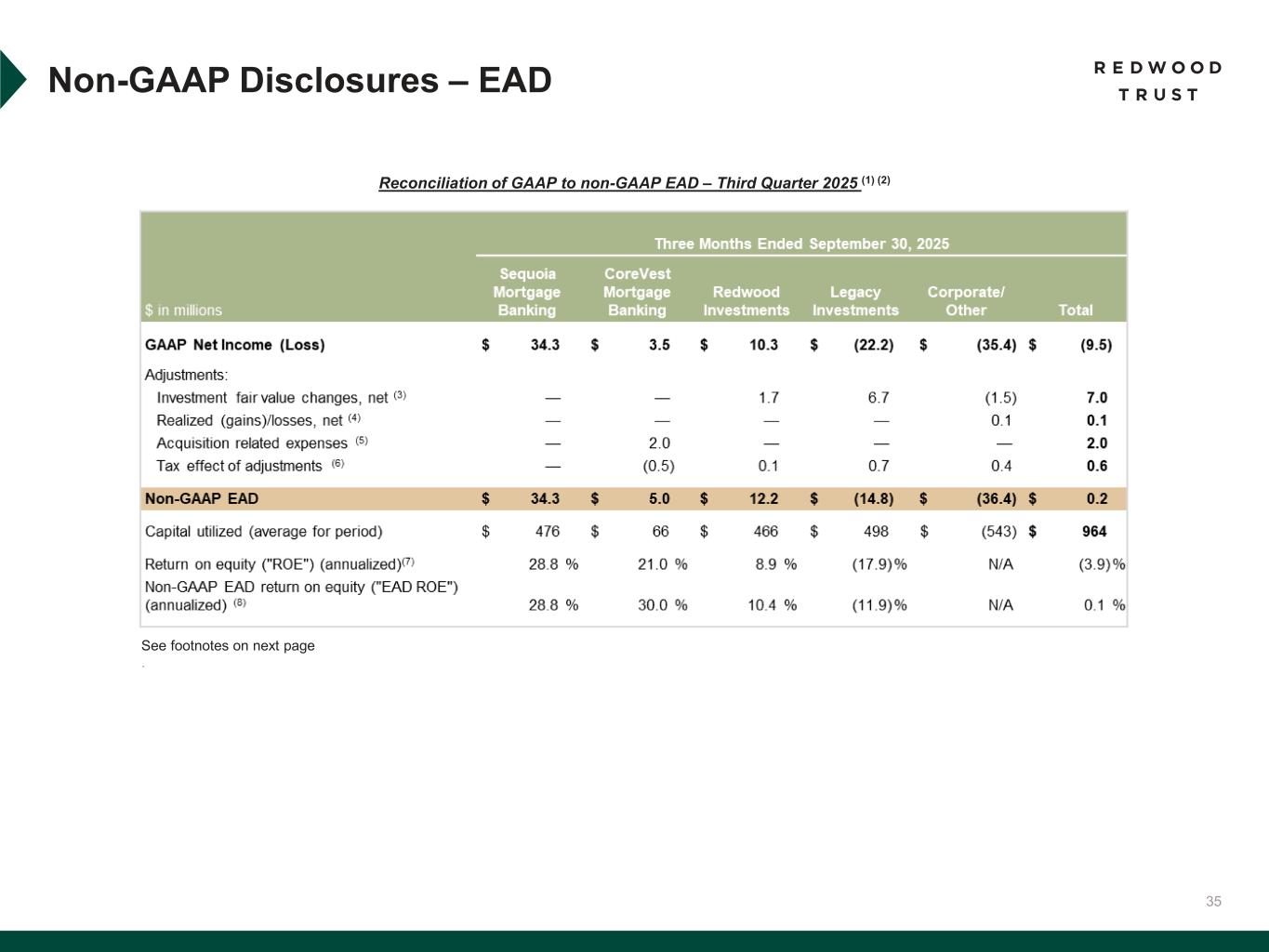

35 Reconciliation of GAAP to non-GAAP EAD – Third Quarter 2025 (1) (2) Non-GAAP Disclosures – EAD See footnotes on next page .

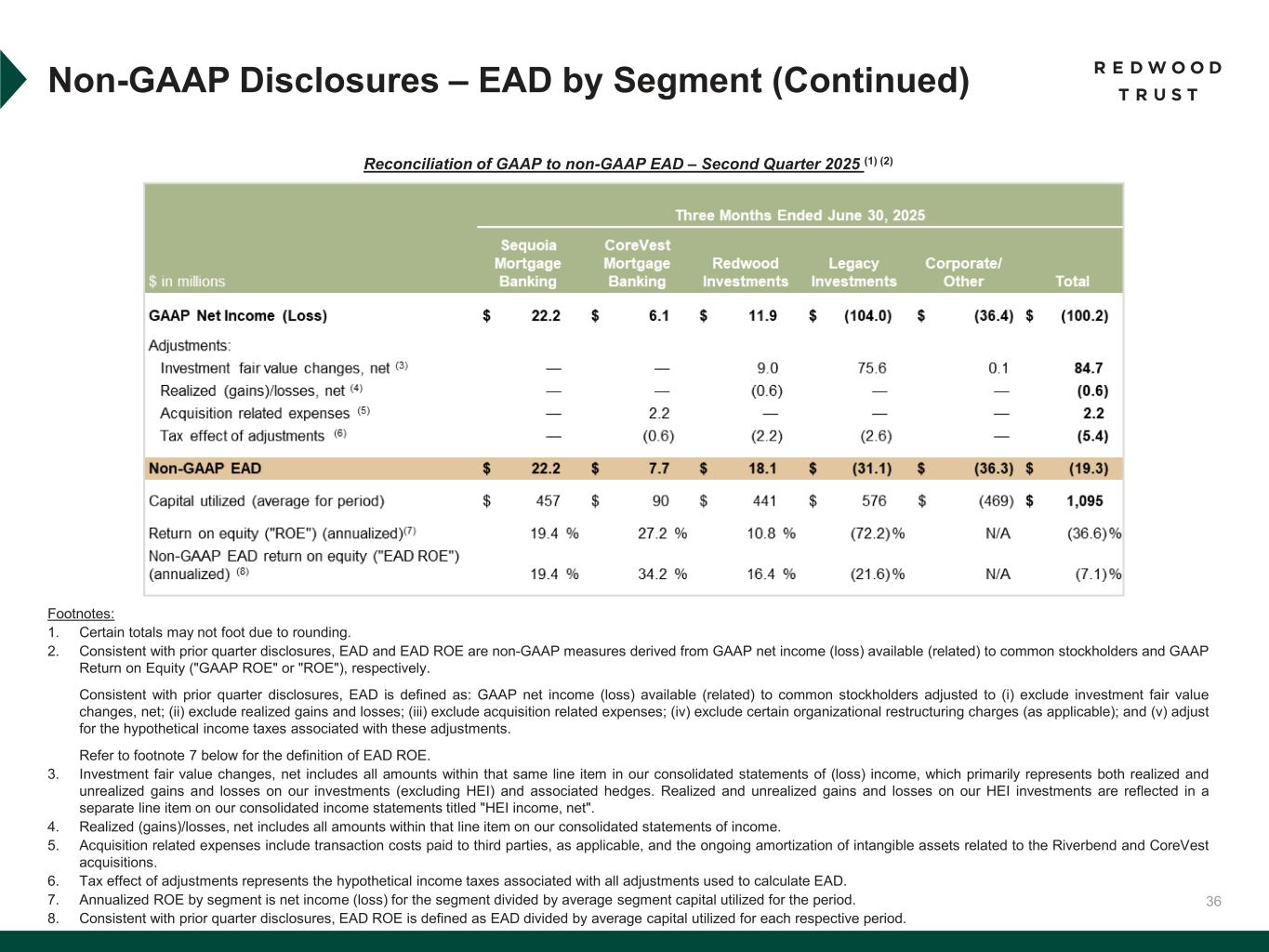

36 Reconciliation of GAAP to non-GAAP EAD – Second Quarter 2025 (1) (2) Non-GAAP Disclosures – EAD by Segment (Continued) Footnotes: 1. Certain totals may not foot due to rounding. 2. Consistent with prior quarter disclosures, EAD and EAD ROE are non-GAAP measures derived from GAAP net income (loss) available (related) to common stockholders and GAAP Return on Equity ("GAAP ROE" or "ROE"), respectively. Consistent with prior quarter disclosures, EAD is defined as: GAAP net income (loss) available (related) to common stockholders adjusted to (i) exclude investment fair value changes, net; (ii) exclude realized gains and losses; (iii) exclude acquisition related expenses; (iv) exclude certain organizational restructuring charges (as applicable); and (v) adjust for the hypothetical income taxes associated with these adjustments. Refer to footnote 7 below for the definition of EAD ROE. 3. Investment fair value changes, net includes all amounts within that same line item in our consolidated statements of (loss) income, which primarily represents both realized and unrealized gains and losses on our investments (excluding HEI) and associated hedges. Realized and unrealized gains and losses on our HEI investments are reflected in a separate line item on our consolidated income statements titled "HEI income, net". 4. Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of income. 5. Acquisition related expenses include transaction costs paid to third parties, as applicable, and the ongoing amortization of intangible assets related to the Riverbend and CoreVest acquisitions. 6. Tax effect of adjustments represents the hypothetical income taxes associated with all adjustments used to calculate EAD. 7. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. 8. Consistent with prior quarter disclosures, EAD ROE is defined as EAD divided by average capital utilized for each respective period.

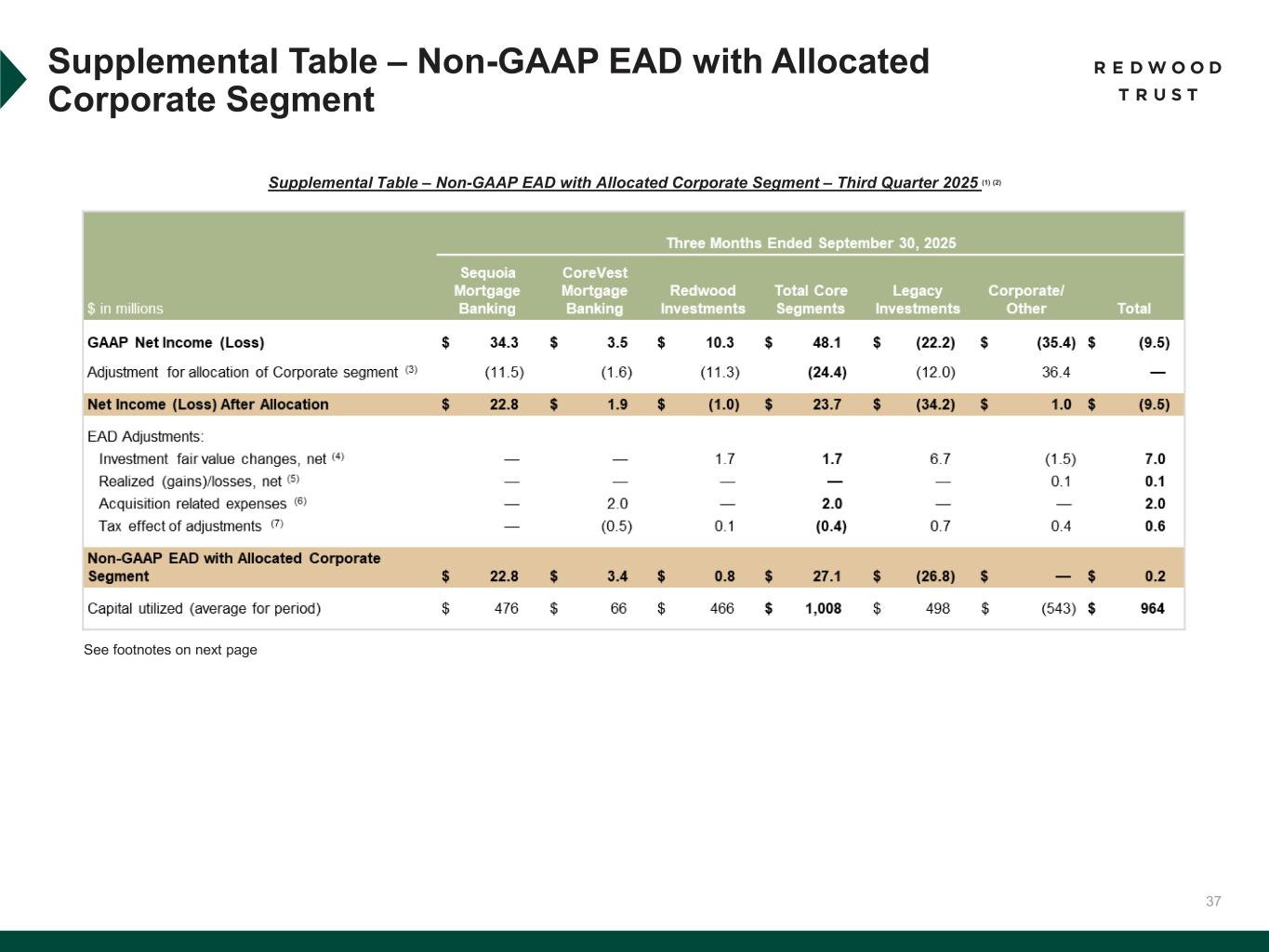

37 Supplemental Table – Non-GAAP EAD with Allocated Corporate Segment – Third Quarter 2025 (1) (2) See footnotes on next page Supplemental Table – Non-GAAP EAD with Allocated Corporate Segment

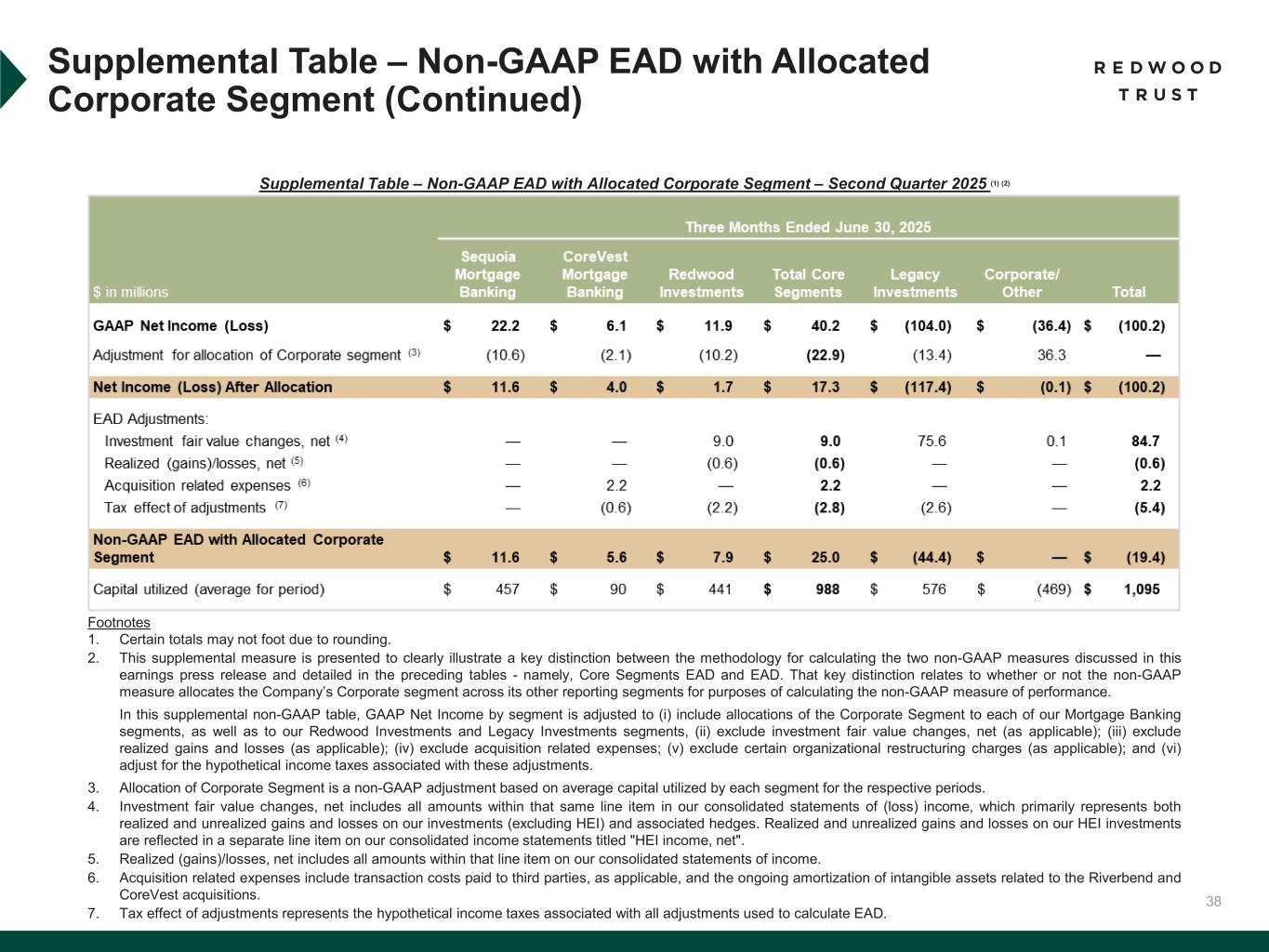

38 Supplemental Table – Non-GAAP EAD with Allocated Corporate Segment – Second Quarter 2025 (1) (2) Supplemental Table – Non-GAAP EAD with Allocated Corporate Segment (Continued) Footnotes 1. Certain totals may not foot due to rounding. 2. This supplemental measure is presented to clearly illustrate a key distinction between the methodology for calculating the two non-GAAP measures discussed in this earnings press release and detailed in the preceding tables - namely, Core Segments EAD and EAD. That key distinction relates to whether or not the non-GAAP measure allocates the Company’s Corporate segment across its other reporting segments for purposes of calculating the non-GAAP measure of performance. In this supplemental non-GAAP table, GAAP Net Income by segment is adjusted to (i) include allocations of the Corporate Segment to each of our Mortgage Banking segments, as well as to our Redwood Investments and Legacy Investments segments, (ii) exclude investment fair value changes, net (as applicable); (iii) exclude realized gains and losses (as applicable); (iv) exclude acquisition related expenses; (v) exclude certain organizational restructuring charges (as applicable); and (vi) adjust for the hypothetical income taxes associated with these adjustments. 3. Allocation of Corporate Segment is a non-GAAP adjustment based on average capital utilized by each segment for the respective periods. 4. Investment fair value changes, net includes all amounts within that same line item in our consolidated statements of (loss) income, which primarily represents both realized and unrealized gains and losses on our investments (excluding HEI) and associated hedges. Realized and unrealized gains and losses on our HEI investments are reflected in a separate line item on our consolidated income statements titled "HEI income, net". 5. Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of income. 6. Acquisition related expenses include transaction costs paid to third parties, as applicable, and the ongoing amortization of intangible assets related to the Riverbend and CoreVest acquisitions. 7. Tax effect of adjustments represents the hypothetical income taxes associated with all adjustments used to calculate EAD.

39 Endnotes

40 Slide 3 (Redwood Trust - Business Overview) Source: Company financial data as of September 30, 2025 unless otherwise noted. Slide 4 (Redwood Trust Has a Long Track Record of Providing Liquidity to the Housing Market) Source: Company financial data as of September 30, 2025 unless otherwise noted. Market data per Bloomberg as of September 30, 2025. Securitization data as of October 28, 2025. Slide 6 (Third Quarter 2025 Key Accomplishments) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Includes fourth quarter 2025 activity through October 28, 2025. 2. Includes loan locks at our Sequoia Mortgage Banking Segment and loans funded at our CoreVest Mortgage Banking Segment. Lock volume represents loans identified for purchase from loan sellers. Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process. Slide 7 (Our Consumer Platforms are Growing Faster than the Market) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Chart compares Sequoia & Aspire lock volume to industry volumes. QoQ represents volume change from Q2’25 to Q3’25. YoY represents volume change from Q1’24-Q3’24 to Q1’25- Q3’25. All Mortgages (Industry) data per MBA data (October 2025). Jumbo and Non-QM (Industry) data per Inside Mortgage Finance. QoQ metrics based on industry data and Company estimates. Slide 8 (Accelerated Shift Towards Operating Model with Wind-Down of Legacy Portfolio Holdings) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Includes fourth quarter 2025 activity through October 28, 2025. Includes $0.7 billion of legacy asset dispositions as of September 30, 2025 and $0.3 billion of fourth quarter 2025 activity through October 28, 2025. Unlocked $150 million of capital from dispositions reflects activity through October 28, 2025. 2. Reflects management’s estimates and actual results may vary materially. Slide 9 (Ongoing Balance Sheet Management) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Includes fourth quarter 2025 activity through October 28, 2025. Corporate debt includes our outstanding convertible debt, unsecured debt, and promissory notes. Information is shown pro forma for the repayment of $124 million of convertible debt on October 1, 2025. 2. Excludes $11 million of promissory notes payable on demand after 90-day notice. Slide 10 (CPP Investments Partnership Expansion) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Compares CoreVest Mortgage Banking volume (Q1’24: $326mm; Q3’25: $521 million) and efficiency (Q1’24 net cost to originate: 23%; Q3’25 net cost to originate: 13%) metrics from Q3’25 relative to Q1’24 (period before initial partnership announcement). Endnotes Slide 13 (Third Quarter 2025 Financial Performance) Source: Company financial data as of September 30, 2025 unless otherwise noted. Market data per Bloomberg as of September 30, 2025. 1. Total economic return is based on the periodic change in GAAP book value per common share plus dividends declared per common share during the period, divided by beginning period GAAP book value per common share. 2. Indicative dividend yield based on RWT closing stock price of $5.79 on September 30, 2025. 3. Includes fourth quarter 2025 activity through October 28, 2025. Capital allocation reflects our September 30, 2025 capital allocation pro forma for the sale of our re-performing loan investments in October 2025. 4. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. Slide 14 (We Have Maintained Consistent Operating Profitability as We Scale) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Annualized Combined ROE for Mortgage Banking is net income (loss) for the CoreVest and Sequoia Mortgage Banking segments divided by average capital utilized for the period at the Sequoia and CoreVest Mortgage Banking Segments. Slide 15 (Sequoia - Redwood’s Prime Residential Correspondent Platform) Source: Company financial data as of September 30, 2025 unless otherwise noted. References to “QoQ” are comparisons of the quarterly performances between Q2’25 and Q3’25. References to “YoY” are comparisons for the quarterly performances between Q3’24 and Q3’25. 1. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. 2. Lock volume represents loans identified for purchase from loan sellers. Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process. 3. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. 4. Average capital includes average working capital for Sequoia Mortgage banking operations. Slide 16 (Sequoia - Volume Drivers) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Lock volume represents loans identified for purchase from loan sellers. Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process. 2. Source: Inside Mortgage Finance data as of Q2’25. 3. Source: JP Morgan Research. Slide 17 (Aspire – Redwood’s Non-QM Residential Platform) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Aspire lock volume is included in the Sequoia Mortgage Banking business segment results. Lock volume represents loans identified for purchase from loan sellers. Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process. 2. Source: Inside Mortgage Finance. 3. Includes transactions priced but not closed as of October 28, 2025.

41 Endnotes Slide 27 (Appendix: Mortgage Banking Key Results) 1. EAD Net Contribution and EAD Net Contribution Return on Equity are non-GAAP measures that are also referred to as EAD and EAD ROE, respectively. Please refer to Non-GAAP Disclosures within the Endnotes section of this presentation for additional information on these measures. 2. Capital utilized for CoreVest operations does not include $34 million of platform premium. 3. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. Slide 28 (Appendix: Redwood Investments Key Results) 1. EAD Net Contribution and EAD Net Contribution Return on Equity are non-GAAP measures that are also referred to as EAD and EAD ROE, respectively. Please refer to Non-GAAP Disclosures within the Endnotes section of this presentation for more information on these measures. 2. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. 3. Recourse leverage ratio is calculated as Secured recourse debt balances divided by Capital invested, as presented within this table. Slide 29 (Appendix: Recourse Debt Balances) 1. Non-marginable debt and marginable debt refers to whether such debt is subject to margin calls based solely on the lender’s determination in its discretion of the market value of underlying collateral that is non-delinquent. Non-marginable debt may be subject to a margin call due to delinquency or another credit event related to the mortgage or security being financed, a decline in the value of the underlying asset securing the collateral, an extended dwell time (i.e., period of time financed using a particular financing facility) for certain types of loans, or a change in the interest rate of a specified reference security relative to a base interest rate amount, among other reasons. 2. Average borrowing cost represents the weighted average contractual balance of recourse debt outstanding at the end of each period presented and does not include deferred issuance costs or debt discounts. 3. Represents unsecuritized residential consumer loans, inclusive of Aspire loans. 4. Includes certificated mortgage servicing rights. Slide 19 (CoreVest - Redwood’s Investor Loan Platform) Source: Company financial data as of September 30, 2025 unless otherwise noted. References to “QoQ” are comparisons of the quarterly performances between Q2’25 and Q3’25. References to “YoY” are comparisons for the quarterly performances between Q3’24 and Q3’25. 1. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. 2. Compares average quarterly loan commitment size for bridge loans during Q3’22 and Q3’25. 3. Composition percentages are based on unpaid principal balance. Slide 20 (CoreVest - Volume Drivers) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Industry RTL volume based on Fannie Mae Single Family Total Home Sales and Attom Data Fix & Flip Percentage. Industry DSCR volume based on the same for the rest of the investor owned %. Analysis uses Wells Fargo Research. Figures are rounded. Actual results may vary materially. 2. Source: John Burns Research and Consulting, LLC. Slide 21 (Redwood Investments - Housing Investments Sourced from Our Operating Platforms) Source: Company financial data as of September 30, 2025 unless otherwise noted. 1. Annualized ROE by segment is net income (loss) for the segment divided by average segment capital utilized for the period. 2. Allocated capital includes investments retained from our Sequoia and CoreVest mortgage banking operations as well as certain third-party investments. Capital allocation excludes corporate capital and RWT Horizons. Further detail on the components of Q3’25 allocated capital is included in the Financial Results section of this presentation. Slide 22 (Legacy Investment - Housing Investments No Longer Strategic to our Platform) Source: Company financial data as of October 28, 2025 unless otherwise noted. 1. Includes $0.3 billion of legacy asset dispositions that occurred in the fourth quarter 2025. 2. Allocated capital includes legacy unsecuritized bridge loans primarily originated prior to 2024, and third-party originated HEI options and investments. 3. Includes fourth quarter 2025 activity through October 28, 2025. Slide 24 (Appendix: Income Statement) 1. Net interest expense from “Corporate (unsecured debt)” consists primarily of interest expense on corporate unsecured debt. Slide 26 (Appendix: Capital Allocation Summary) 1. Amounts of assets in our Redwood Investments segment, as presented in this table, represent our economic interests (including our economic interests in consolidated VIEs) and do not present the assets within VIEs that we consolidate under GAAP (except for our CAFL Bridge VIEs and SLST resecuritization). See our GAAP Balance Sheet and Reconciliation to Non-GAAP Economic Balance Sheet in the Supplemental Financial Tables available on our website for additional information on consolidated VIEs. 2. Consistent with our presentation of assets within this table, non-recourse debt presented within this table excludes ABS issued from certain securitizations consolidated on our balance sheet, including Residential Jumbo (SEMT), BPL Term (CAFL), Freddie Mac SLST, and HEI, as well as non-recourse debt used to finance certain servicing investments. 3. Balances adjusted for re-performing loan investment sale that occurred subsequent to September 30, 2025 and the reallocation of associated capital to operating segments 4. Capital allocated to mortgage banking operations represents the working capital we have allocated to manage our loan inventory at each of our mortgage banking segments. This amount generally includes our net capital in loans held on balance sheet (net of financing), capital to acquire / originate loans in our pipeline, net capital utilized for hedges, and risk capital. 5. Corporate capital includes, among other things, capital allocated to RWT Horizons and other strategic investments as well as available capital.

42*Earnings Available for Distribution (“EAD”) is a non-GAAP measure- See “Non-GAAP Measures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. Glossary of Terms Term Definition ARM Adjustable-Rate Mortgage BFR Build for rent bps Basis points CAFL® CoreVest securitization program CES Closed end second liens DQ Delinquency DSCR Debt Service Coverage Ratio EAD Earnings available for distribution* EPS Earnings per share FY Full year GoS Gain on Sale HEI Home equity investment HPA Home price appreciation IMB Independent mortgage banker JV Joint venture LOC Line of credit LTC Loan to cost Term Definition MB Mortgage banking MSR Mortgage servicing rights Non-QM Non-qualified mortgage QM Qualified mortgage QoQ Quarter over quarter (comparison of sequential quarters) RMBS Residential mortgage backed security RTL Residential transitional loans RPL Reperforming loans SEMT® Residential Consumer (Sequoia) securitization program SFR Single-family rental SMA Separately managed accounts TAM Total addressable market UPB Unpaid principal balance WA Weighted average YoY Year over year (comparison of same quarter performance over sequential years)