0000930236DEF 14AFALSE00009302362023-01-012023-12-31iso4217:USDxbrli:pure00009302362022-01-012022-12-3100009302362021-01-012021-12-3100009302362020-01-012020-12-310000930236rwt:ChangeInStockAwardsValueMemberecd:PeoMember2023-01-012023-12-310000930236rwt:ChangeInYearEndValueOfEquityAwardsGrantedInPriorYearsMemberecd:PeoMember2023-01-012023-12-310000930236rwt:ChangeInFairValueOfEquityAwardsGrantedInPriorYearsOutstandingMemberecd:PeoMember2023-01-012023-12-310000930236ecd:PeoMemberrwt:ChangeInFairValueOfPriorYearEquityAwardsInCoveredYearVestedMember2023-01-012023-12-310000930236ecd:PeoMemberrwt:DividendsEarnedInCoveredYearAndNotOtherwiseIncludedInFairValueMember2023-01-012023-12-310000930236ecd:NonPeoNeoMemberrwt:ChangeInStockAwardsValueMember2023-01-012023-12-310000930236ecd:NonPeoNeoMemberrwt:ChangeInYearEndValueOfEquityAwardsGrantedInPriorYearsMember2023-01-012023-12-310000930236ecd:NonPeoNeoMemberrwt:ChangeInFairValueOfEquityAwardsGrantedInPriorYearsOutstandingMember2023-01-012023-12-310000930236ecd:NonPeoNeoMemberrwt:ChangeInFairValueOfPriorYearEquityAwardsInCoveredYearVestedMember2023-01-012023-12-310000930236ecd:NonPeoNeoMemberrwt:DividendsEarnedInCoveredYearAndNotOtherwiseIncludedInFairValueMember2023-01-012023-12-31000093023612023-01-012023-12-31000093023652023-01-012023-12-31000093023622023-01-012023-12-31000093023632023-01-012023-12-31000093023642023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | |

| Filed by the Registrant: | ý |

| Filed by a Party other than the Registrant: | o |

Check the appropriate box:

| | | | | | | | |

| o | Preliminary Proxy Statement |

| | | | | | | | |

| o | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| | | | | | | | |

| x | Definitive Proxy Statement |

| | | | | | | | |

| o | Definitive Additional Materials |

| | | | | | | | |

| o | Soliciting Material under §240.14a-12 |

REDWOOD TRUST, INC.

| | |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | | | | | | | | | | | |

| | | |

| ý | No fee required. |

| | | |

| o | Fee paid previously with preliminary materials. |

| | | |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

REDWOOD TRUST, INC.

One Belvedere Place, Suite 300

Mill Valley, California 94941

(415) 389-7373

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Redwood Trust, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders of Redwood Trust, Inc., a Maryland corporation, to be held on May 21, 2024 at 8:30 a.m., Pacific time, at 4 Park Plaza, Suite 320, Irvine, California 92614 (the “Annual Meeting”), for the following purposes:

1.To consider and vote upon the election of Greg H. Kubicek, Christopher J. Abate, Doneene K. Damon, Armando Falcon, Douglas B. Hansen, Debora D. Horvath, Georganne C. Proctor, Dashiell I. Robinson, and Faith A. Schwartz to serve as directors until the annual meeting of stockholders in 2025 and until their successors are duly elected and qualify;

2.To consider and vote upon the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2024;

3.To consider and vote upon a non-binding advisory resolution to approve named executive officer compensation as described in this Proxy Statement;

4.To consider and vote upon an amendment to our 2002 Employee Stock Purchase Plan to increase the number of shares available for purchase; and

5.To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

We have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, stockholders will not receive paper copies of our proxy materials unless they specifically request them. We will send a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 11, 2024 to our stockholders of record as of the close of business on March 27, 2024. We are also providing access to our proxy materials over the Internet beginning on or about April 11, 2024. Electronic delivery of our proxy materials will reduce printing and mailing costs, as well as associated waste, relating to our Annual Meeting.

The Notice contains instructions for accessing the proxy materials, including the Proxy Statement and our annual report, and provides information on how stockholders may obtain paper copies free of charge. The Notice also provides the date and time of the Annual Meeting; the matters to be acted upon at the Annual Meeting and the Board of Directors' recommendation with regard to each matter to be acted upon; information about voting procedures; and information on how to attend the Annual Meeting.

| | |

| YOUR VOTE IS IMPORTANT. |

| PLEASE PROMPTLY AUTHORIZE A PROXY TO CAST YOUR VOTES THROUGH THE INTERNET FOLLOWING THE VOTING PROCEDURES DESCRIBED IN THE NOTICE OR, IF YOU HAVE REQUESTED AND RECEIVED PAPER COPIES OF THE PROXY MATERIALS, BY TELEPHONE OR BY SIGNING, DATING AND RETURNING THE PROXY CARD SENT TO YOU. |

Our Board of Directors has fixed the close of business on March 27, 2024 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement of the Annual Meeting.

We would like your shares to be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we respectfully request that you authorize your proxy over the Internet following the voting procedures described in the Notice. In addition, if you have requested or received a paper or email copy of the proxy materials, you can authorize your proxy over the telephone or by signing, dating and returning the proxy card sent to you. We encourage you to authorize your proxy by any of these methods even if you currently plan to attend the Annual Meeting. By doing so, you will ensure that your shares are represented and voted at the Annual Meeting.

By Order of the Board of Directors,

/s/ Andrew P. Stone

Secretary

April 1, 2024

TABLE OF CONTENTS

REDWOOD TRUST, INC.

One Belvedere Place, Suite 300

Mill Valley, California 94941

(415) 389-7373

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 21, 2024

INTRODUCTION

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Redwood Trust, Inc., a Maryland corporation (“Redwood,” the “Company,” “we,” or “us”), for exercise at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 21, 2024 at 8:30 a.m., Pacific time, at 4 Park Plaza, Suite 320, Irvine, California 92614, and at any adjournment or postponement thereof.

We have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record, while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice of internet availability of proxy materials. All stockholders will have the ability to access proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet on or about April 11, 2024 and to mail the Notice to all stockholders entitled to vote at the Annual Meeting on or about April 11, 2024. We intend to mail this Proxy Statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials on or about April 11, 2024 or within three business days of such request.

The address and telephone number of our principal executive office are as set forth above and our website is www.redwoodtrust.com. Information on our website is not a part of this Proxy Statement.

INFORMATION ABOUT THE ANNUAL MEETING

Who May Attend the Annual Meeting

Only stockholders who own our common stock as of the close of business on March 27, 2024, the record date for the Annual Meeting, will be entitled to attend the Annual Meeting. In the discretion of management, we may permit certain other individuals to attend the Annual Meeting, including members of the media and our employees.

Who May Vote

Each share of our common stock outstanding on the record date for the Annual Meeting entitles the holder thereof to one vote. The record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting is the close of business on March 27, 2024. As of March 28, 2024, there were 131,660,340 shares of common stock issued and outstanding. You can vote in person at the Annual Meeting or by proxy. You may authorize your proxy through the Internet by following the voting procedures described in the Notice or, if you have requested and received paper copies of the proxy materials, by telephone or by signing, dating, and returning the proxy card sent to you. To use a particular voting procedure, follow the instructions on the Notice or the proxy card that you request and receive by mail or email.

If your shares are held in the name of a bank, broker, or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. If your shares are not registered in your own name and you plan to cast your votes at the Annual Meeting, you should contact your broker or agent to obtain a broker’s proxy card and bring it to the Annual Meeting in order to vote.

Voting by Proxy; Board of Directors’ Voting Recommendations

You may authorize your proxy over the Internet or, if you request and receive a proxy card by mail or email, over the phone or by signing, dating and returning the proxy card sent to you. If you vote by proxy, the individuals named on the proxy, or their substitutes, will cast your votes in the manner you indicate. If you date, sign, and return a proxy card without marking your voting instructions, your votes will be cast in accordance with the recommendations of Redwood’s Board of Directors, as follows:

•For the election of each of the nine nominees to serve as directors until the annual meeting of stockholders in 2025 and until their successors are duly elected and qualify;

•For the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2024;

•For the approval of the non-binding advisory resolution approving the compensation of our named executive officers;

•For the approval of the amendment to our 2002 Employee Stock Purchase Plan to increase the number of shares available for purchase thereunder; and

•In the discretion of the proxy holder on any other matter that properly comes before the Annual Meeting.

You may revoke or change your proxy at any time before it is exercised by submitting a new proxy through the Internet or by telephone, delivering to us a signed proxy with a date later than your previously delivered proxy, by voting in person at the Annual Meeting, or by sending a written revocation of your proxy addressed to Redwood’s Secretary at our principal executive office.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Under rules adopted by the Securities and Exchange Commission (“SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending the Notice to our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce printing and mailing costs, as well as associated waste, relating to our Annual Meeting.

Quorum Requirement

The presence, by attendance at the Annual Meeting or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum for the transaction of business. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum. A broker non-vote occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares.

Other Matters

Our Board of Directors knows of no other matters that may be presented for stockholder action at the Annual Meeting. If other matters properly come before the Annual Meeting, however, it is intended that the persons named in the proxies will vote on those matters in their discretion.

Information About the Proxy Statement and the Solicitation of Proxies

Your proxy is solicited by our Board of Directors and we will bear the costs of this solicitation. Proxy solicitations will be made by mail, and also may be made by our directors, officers, and employees in person or by telephone, facsimile transmission, e-mail, or other means of communication. Banks, brokerage houses, nominees, and other fiduciaries will be requested to forward the proxy soliciting material to the beneficial owners of shares of our common stock entitled to be voted at the Annual Meeting and to obtain authorization for the execution of proxies on behalf of beneficial owners. We will, upon request, reimburse those parties for their reasonable expenses in forwarding proxy materials to their beneficial owners.

In addition, we have retained MacKenzie Partners, Inc., 1407 Broadway, 27th Floor, New York, NY 10018, to aid in the solicitation of proxies by mail, telephone, facsimile, e-mail and personal solicitation and to contact brokerage houses and other nominees, fiduciaries and custodians to request that such entities forward soliciting materials to beneficial owners of our common stock. For these services, we will pay MacKenzie Partners, Inc. a fee not expected to exceed $15,000, plus expenses.

Annual Report

Our 2023 Annual Report, consisting of our Annual Report on Form 10-K for the year ended December 31, 2023, is being made available to stockholders together with this Proxy Statement and contains financial and other information about Redwood, including audited financial statements for our fiscal year ended December 31, 2023. Certain sections of our 2023 Annual Report are incorporated into this Proxy Statement by reference, as described in more detail under “Information Incorporated by Reference” at the end of this Proxy Statement. Our 2023 Annual Report is also available on our website.

Householding

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders who have the same address and last name may receive only one copy of the Notice, unless one or more of these stockholders provide notice that they wish to continue receiving individual copies. This procedure reduces our printing and mailing costs, as well as associated waste.

Householding will not in any way affect dividend check mailings.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Notice, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of this document for your household, please contact your bank or broker.

If you participate in householding and wish to receive a separate copy of the Notice, or if you do not wish to participate in householding and prefer to receive separate copies of this document in the future, please contact your bank or broker.

Beneficial owners can request additional information about householding from their banks or brokers.

CORPORATE GOVERNANCE

Corporate Governance Standards

Our Board of Directors has adopted Corporate Governance Standards (“Governance Standards”). Our Governance Standards are available on our website as well as in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office. The Governance Standards contain general principles regarding the composition and functions of our Board of Directors and its committees.

Process for Nominating Potential Director Candidates

Identifying and Evaluating Nominees for Directors. Our Board of Directors nominates director candidates for election by stockholders at each annual meeting and elects new directors to fill vacancies on our Board of Directors between annual meetings of the stockholders. Our Board of Directors has delegated the selection and initial evaluation of potential director nominees to the Governance and Nominating Committee with input from the Chief Executive Officer and President. The Governance and Nominating Committee makes the final recommendation of candidates to our Board of Directors for nomination. Our Board of Directors, taking into consideration the assessment of the Governance and Nominating Committee, also determines whether a nominee would be an independent director.

Stockholders’ Nominees. Our Bylaws permit stockholders to nominate a candidate for election as a director at an annual meeting of the stockholders subject to compliance with certain notice and informational requirements, as more fully described below in this Proxy Statement under “Stockholder Proposals for the 2025 Annual Meeting.” A copy of the full text of our current Bylaws may be obtained by any stockholder upon written request addressed to Redwood’s Secretary at our principal executive office. Among other matters required under our Bylaws, any stockholder nominations should include the nominee’s name and qualifications for Board membership and should be addressed to Redwood’s Secretary at our principal executive office.

The policy of the Governance and Nominating Committee is to consider properly submitted stockholder nominations for candidates for election to our Board of Directors. The Governance and Nominating Committee evaluates stockholder nominations in connection with its responsibilities set forth in its written charter and applies the qualification and diversity criteria set forth in the Governance Standards.

Director Qualifications. Our Governance Standards contain Board membership criteria that apply to nominees for our Board of Directors. Each member of our Board of Directors must exhibit high standards of integrity, commitment, and independence of thought and judgment, and must be committed to promoting the best interests of Redwood. In addition, each director must devote the time and effort necessary to be a responsible and productive member of our Board of Directors. This includes developing knowledge about Redwood’s business operations and doing the work necessary to participate actively and effectively in Board and committee meetings.

Our Governance Standards also contain criteria that are intended to guide our Governance and Nominating Committee’s considerations of diversity in identifying nominees for our Board of Directors. In particular, our Governance Standards provide that the members of our Board of Directors should collectively possess a broad range

of talent, skill, expertise, background, and life experience useful to effective oversight of our business and affairs and sufficient to provide sound and prudent guidance with respect to our operations and interests. Our Board of Directors considers diversity as broadly construed to mean a variety of identities, perspectives, personal and professional experiences and backgrounds. This can be represented in characteristics that include but are not limited to race, ethnicity, national origin, gender and sexual orientation. The self-assessments that are conducted each year by our Board of Directors and our Governance and Nominating Committee include an assessment of whether the Board’s then current composition represents the broad range of talent, skill, expertise, background, and life experience that is called for by our Governance Standards.

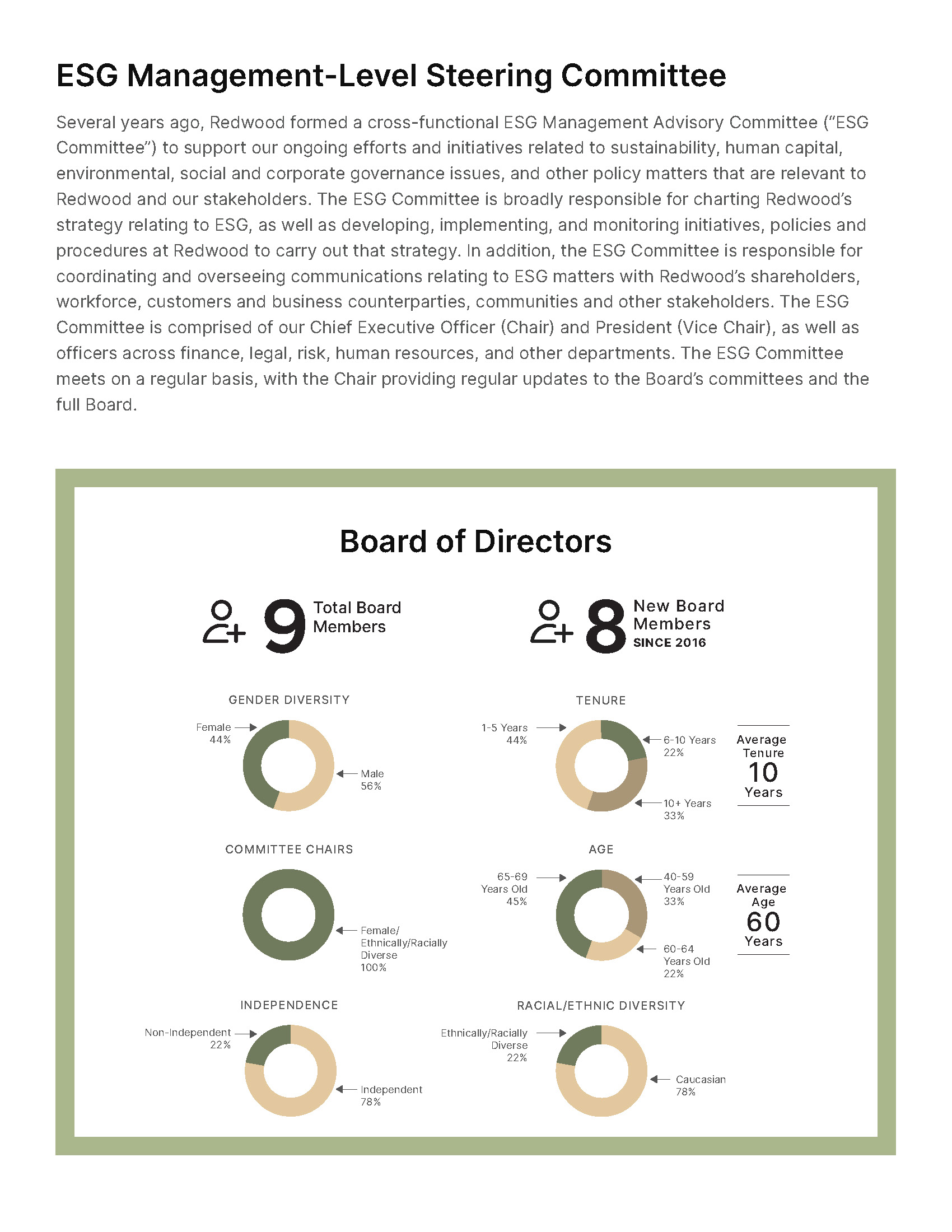

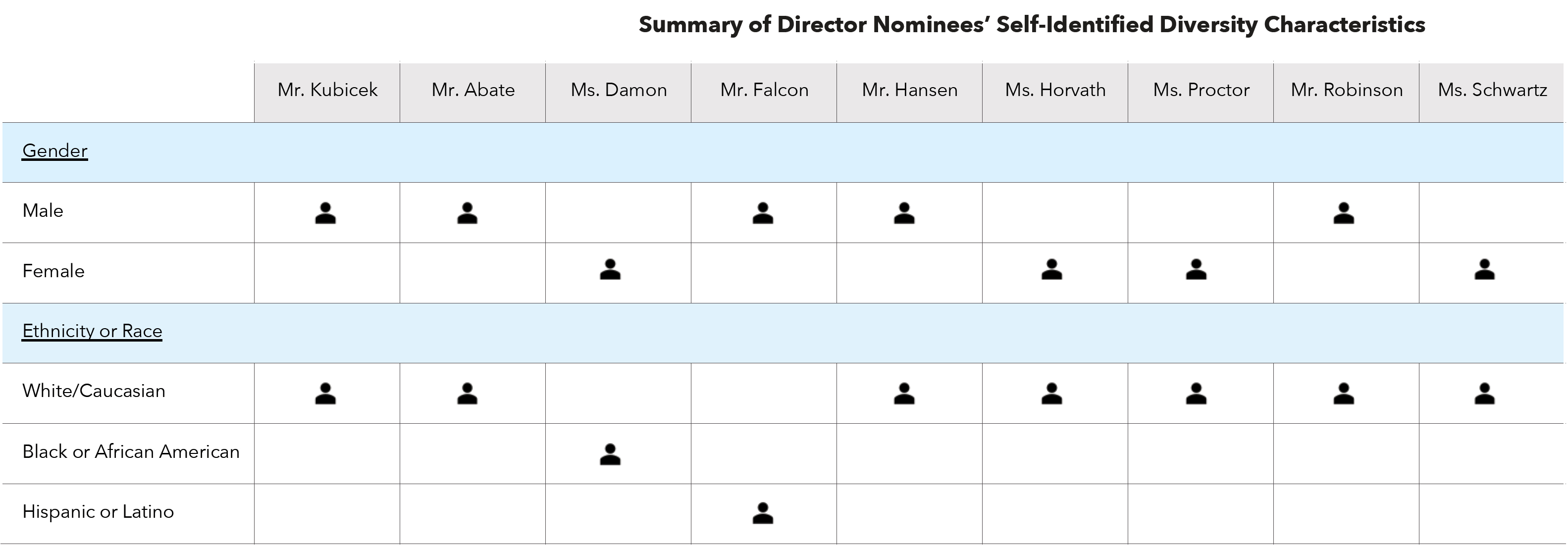

Among our nine nominees for election to the Board, four nominees are women and two nominees – one male and one female – self identify as individuals from an underrepresented community. For this purpose, an “individual from an underrepresented community” means an individual who self-identifies as Black, African American, Hispanic, Latino, Asian, Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender.

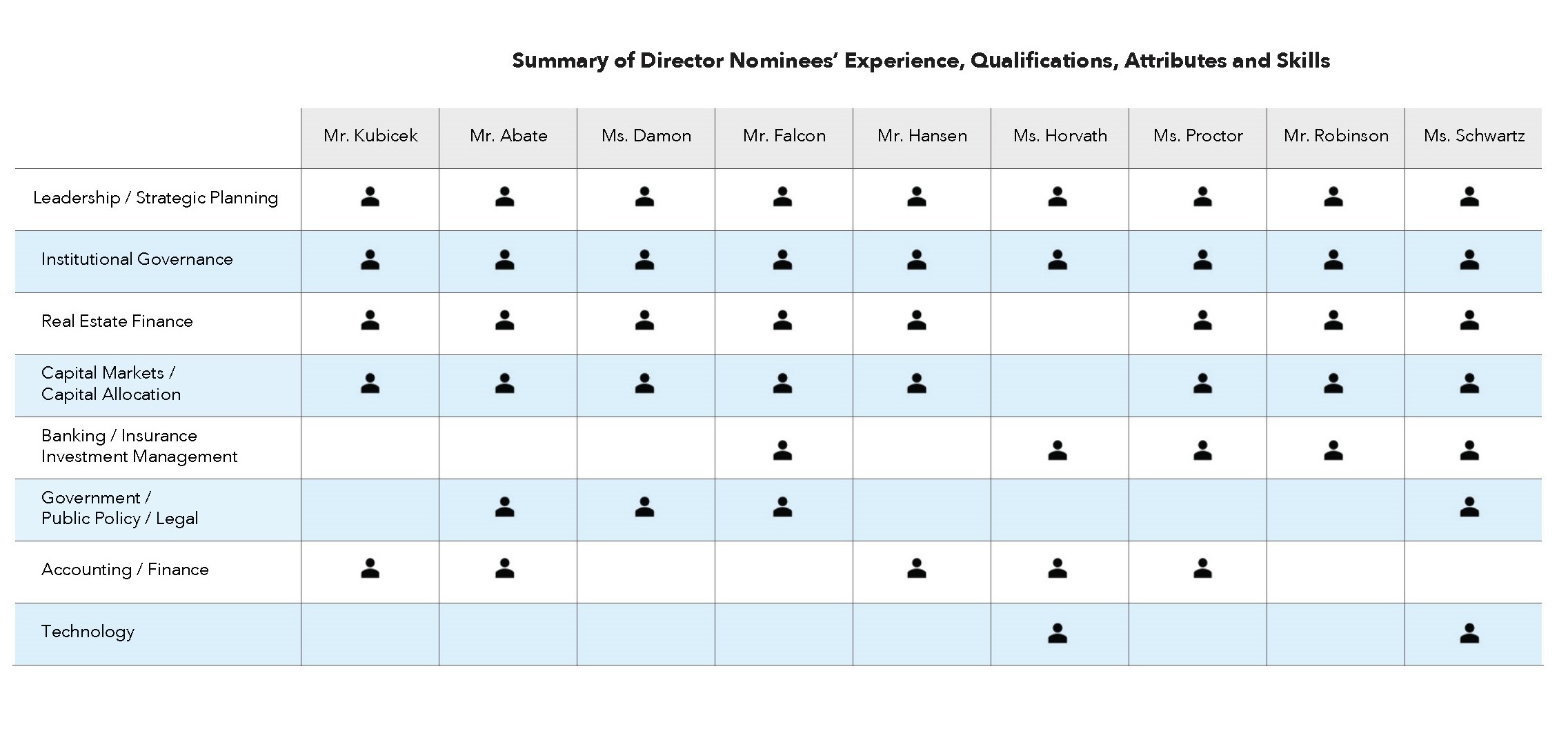

We believe our directors have a well-rounded variety of diversity, skills, qualifications and experience, and represent an effective mix of deep company knowledge and outside perspectives. Additional information regarding the mix of experience, qualifications, attributes and skills of our directors is included under Item 1—Election of Directors on pages 18 - 24 of this Proxy Statement.

Director Independence

As required under Section 303A of the New York Stock Exchange (“NYSE”) Listed Company Manual and our Governance Standards, on February 22, 2024 our Board of Directors affirmatively determined that none of the following directors have a material relationship (either directly or as a partner, shareholder, or officer of an organization that has a relationship) with us and that each of them qualifies as “independent” under Section 303A: Greg H. Kubicek, Doneene K. Damon, Armando Falcon, Douglas B. Hansen, Debora D. Horvath, Georganne C. Proctor, and Faith A. Schwartz. The Board of Directors’ determinations were made after consideration of, among other things, the matters described below under “Additional Information About Directors and Executive Officers — Certain Relationships and Related Party Transactions” on page 109 of this Proxy Statement. Two members of our Board of Directors, Mr. Abate and Mr. Robinson, do not qualify as “independent” under Section 303A of the NYSE Listed Company Manual or our Governance Standards because they are Redwood’s Chief Executive Officer and President, respectively.

Board Leadership Structure

At Redwood, there is a separation between the chair of the Board (“Board Chair”) and chief executive officer roles. Redwood’s Board Chair presides over meetings of the Board and serves as a liaison between the Board and management of Redwood. In addition, Redwood’s Board Chair provides input regarding Board agendas, materials, and areas of focus, and may represent Redwood to external constituencies such as investors, governmental representatives, and business counterparties. The Board Chair is currently Greg H. Kubicek, who was elected Chair in May 2022 and who has served as an independent director of Redwood since 2002.

In addition, under the Governance Standards, each of the Audit Committee, Compensation Committee, and Governance and Nominating Committee of Redwood’s Board of Directors is comprised solely of independent directors.

The Board believes this leadership structure is appropriate for Redwood, as it provides for the Board to be led by, and its standing committees to be comprised of, independent directors. As an independent Board Chair, Mr. Kubicek brings two decades of experience of serving on Redwood’s Board along with the important perspective of an independent director to this leadership position.

Executive Sessions

Pursuant to our Governance Standards, our non-employee directors (i.e., the seven of our nine current directors who are not Redwood employees) meet in executive session at each regularly scheduled quarterly meeting of our Board of Directors and at such other times as determined by the Board Chair. In addition, if any non-employee director is not also an independent director, then, under our Governance Standards, our independent directors meet at least annually in executive session without any such non-independent directors.

Board of Directors’ Role in Risk Oversight

The Board of Directors takes a primary role in risk oversight. At its regular meetings, the Board of Directors reviews Redwood’s business and investment strategies and plans and seeks an understanding of the related risks as well as management’s approach to identifying and managing those risks. In carrying out its role in risk oversight, the Board of Directors receives and discusses quarterly reports from the Chief Executive Officer (and other officers of Redwood) and the Audit Committee, which also carries out a risk oversight function delegated by the Board of Directors.

Under its charter, the Audit Committee is specifically charged with (i) inquiring of management and Redwood’s independent registered public accounting firm about significant risks or exposures with respect to corporate accounting, reporting practices of Redwood, the quality and integrity of the financial reports and controls of Redwood, regulatory and accounting initiatives, and any off balance sheet structures and (ii) assessing the steps management has taken to monitor or minimize such risks. In addition, the Audit Committee is specifically charged with regularly discussing with management Redwood’s policies with respect to risk assessment and risk management, including identification of Redwood’s major financial and operational risk exposures and the steps management has taken to monitor or control those exposures. For example, the Audit Committee receives quarterly reports from management regarding various financial risk management topics (such as credit risk, interest rate risk, liquidity risk, and counterparty risk), and various operational risk management topics (such as cybersecurity, operations and regulatory compliance) and regularly discusses with management Redwood's exposure to, and management of, financial and operational risks.

The Audit Committee carries out this function by, among other things, receiving a quarterly risk management report from Redwood’s Chief Executive Officer and other Redwood officers, and a quarterly internal audit report from Redwood’s head of internal audit, reviewing these reports, and discussing them by asking questions and providing direction to management. In addition, as noted below under “Audit Committee Matters – Audit Committee Report,” the Audit Committee also receives and discusses regular and required communications from Redwood’s independent registered public accounting firm regarding, among other things, Redwood’s internal controls. In addition to discussion of these reports during Audit Committee meetings, as circumstances merit, the Audit Committee holds separate executive sessions with one or more of the Chief Executive Officer, Chief Financial Officer, Redwood’s head of internal audit, and representatives of Redwood’s independent registered public accounting firm to discuss any matters that the Audit Committee or these persons believe should be discussed in the absence of other members of management. Redwood's Chief Financial Officer and head of internal audit each also regularly communicate with the Chair of the Audit Committee between Audit Committee meetings.

Oversight of Cybersecurity Risk. As part of its risk oversight function, the Board of Directors, including through delegation to the Audit Committee, regularly receives risk management reporting from various officers of the Company responsible for cybersecurity and information technology (“IT”) risk, and oversees management’s administration of Redwood’s cybersecurity risk management program. For example, officers within Redwood’s IT department provide periodic (generally at least once per quarter) reports from management to the Audit Committee related to cybersecurity, Redwood’s cybersecurity risk management program and related risks, with copies of these reports also provided to our full Board. These reports supplement materials and presentations from outside experts that are also provided to members of the Board of Directors from time to time as part of the Board’s and Audit Committee’s continuing education on risk oversight topics such as cybersecurity that impact companies in our industry and, more generally, publicly-traded companies. In addition, management has policies and procedures in place to ensure that event-driven updates are provided on a timely basis to the Audit Committee and the Board of Directors regarding any material cybersecurity incidents and, as appropriate, any incidents with lesser impact potential. Additional discussion of Redwood’s Cybersecurity Risk Management and Strategy, as well of Cybersecurity Governance at Redwood is included within Part I, Item 1C of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024.

In addition, when appropriate, the Board of Directors may delegate to the Compensation Committee and Governance and Nominating Committee risk oversight responsibilities with respect to certain matters or request that other committees review certain risk oversight matters. For example, the Compensation Committee has been delegated the responsibility for determining, on an annual basis, whether Redwood’s compensation policies and practices are reasonably likely to have a material adverse effect on Redwood. As another example, the Governance and Nominating Committee reports to the Board of Directors the results of its analysis of potential risks related to board leadership and composition, board structure, and executive succession planning.

The Board of Directors believes that this manner of administering the risk oversight function effectively integrates oversight into the Board of Directors’ leadership structure, because the risk oversight function is carried out both at the Board level as well as through delegation to the Audit Committee, which consists solely of independent directors, and, when appropriate, to the Compensation Committee and Governance and Nominating Committee, which also consist solely of independent directors.

Board of Directors’ Role in ESG Oversight

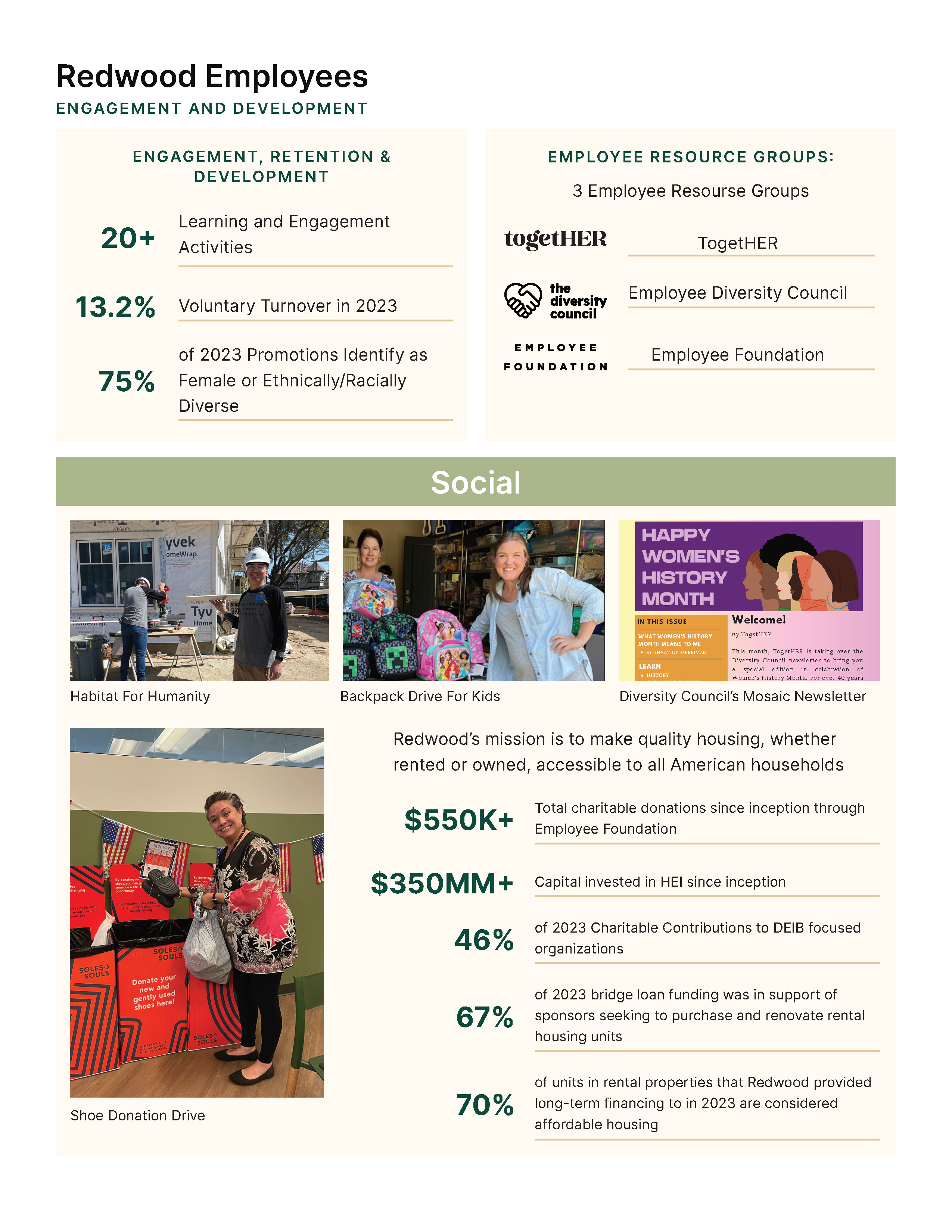

Redwood’s management, under the oversight of the Board of Directors, formulates Redwood’s strategic and operational approach to environmental, social, and governance (“ESG”) matters and executes on specific ESG initiatives. The Board of Directors’ oversight of management’s approach to ESG matters includes the Board’s standing Committees playing primary roles and regularly providing reports to the full Board regarding, among other things, the following:

•Investment and Environmental Matters. Risks and opportunities related to investments that have a nexus with the Company’s ESG initiatives are reviewed as part of the Audit Committee’s oversight of financial risk. In addition, the Audit Committee reviews updates from management regarding environmental- and climate change-related risk and disclosure requirements.

•Human Capital/Social Matters. The Compensation Committee reviews updates from management regarding risk and opportunity related to social matters, including, among other things, human capital-related matters such as workforce inclusion and diversity initiatives and employee engagement efforts.

•Governance Matters. The Governance and Nominating Committee is responsible for overseeing corporate governance matters at Redwood, including, among other things, Board structure, Board composition and succession planning, the Board’s self-evaluation process, and the receipt, retention, and treatment of reported concerns related to potential violations of Redwood’s Code of Ethics.

A further review of Corporate Responsibility/ESG at Redwood is set forth on pages 11 - 15 of this Proxy Statement. Additional information about Redwood’s corporate responsibility and sustainability programs and initiatives is included on Redwood’s corporate website at www.redwoodtrust.com under the heading “Corporate Responsibility.”

Board of Directors’ Self-Evaluation Process

The Board believes it is important to periodically assess its own performance and effectiveness in carrying out its strategic and oversight role with respect to the Company. The Board evaluates its performance through annual self assessments at the Board and Committee levels, as well as through annual individual director self assessments that include one-on-one meetings conducted by the Board Chair with each of the other directors (with respect to the Board Chair, the Chair of the Governance and Nominating Committee). These self assessments include analysis of the effectiveness of the Board, its Committees and its directors, how they are functioning and areas of potential improvement. The results of these performance reviews are also considered, among other things, by the Governance and Nominating Committee and the Board when considering whether to recommend a director for re-election and whether to consider new director candidates.

Board Tenure and Refreshment; Mandatory Retirement Age

Consistent with our Governance Standards, the Board is mindful that the composition of the Board, from a tenure and refreshment perspective, should reflect an appropriate mix of individuals with significant experience as a member of Redwood’s Board, together with individuals who are newer to service on Redwood’s Board, who bring fresh perspectives and additional diversity of thought. For example, given Redwood’s business model, which includes engaging in mortgage banking activities, investing in long-term mortgage loan obligations and regularly accessing the mortgage loan finance markets, directors who have served on Redwood’s Board through multiple economic and financial market cycles are valued for the continuity and long-term perspectives they provide to other Board members and to management. At the same time, the business environment in which Redwood operates is constantly evolving – including from human capital and technological perspectives – and, therefore, Board refreshment is important to the continued effectiveness of the Board in the oversight of these and other evolving matters of importance to Redwood.

At Redwood, refreshment of the composition of Redwood’s Board regularly occurs, for a variety of reasons, including the following:

•Director Retirement / Departure. Director departures and retirements, including in accordance with the mandatory retirement age set forth in our Governance Standards, prompt refreshment.

◦For example, in 2023, one director retired from the Board of Directors at age 69 in order to attend to family matters.

•Mandatory Retirement Age. Under our Governance Standards, an individual, including an incumbent director, is generally ineligible to stand for election or re-election to the Board after reaching age 75.

•For example, in 2022, two directors retired from the Board of Directors in accordance with the mandatory retirement provisions of our Governance Standards.

•Board Expansion. Redwood is permitted under its Charter to increase the size of the Board of Directors; expanding the size of the Board when merited enables Redwood to add new Board members to address emerging needs for Board-level expertise.

•For example, in November 2023, Redwood announced that the size of the Board would be increased, and Ms. Damon was elected to serve on the Board.

•Board’s Succession Planning / Self-Evaluation Process. The Board’s collective and individual self-assessment process (described further above under the heading “Board of Directors’ Self-Evaluation Process”) provides perspectives on Board composition that can prompt refreshment. In addition, Board refreshment results from the Board’s ongoing succession planning efforts to attract new directors to replace directors who are expected to retire or otherwise depart from the Board.

Refreshment of Board leadership positions is another area of focus that the Board believes is important to its continued effectiveness over the long-term. Redwood’s Governance Standards include provisions regarding the rotation of Board leadership positions, including a stated expectation that the Board Chair position, as well as the Committee Chair positions for each of the Board’s standing committees, will rotate at regular intervals.

Communications with the Board of Directors

Stockholders and other interested parties may communicate with our Board of Directors by e-mail addressed to [email protected]. The Board Chair has access to this e-mail address and provides access to other directors as appropriate. Communications that are intended specifically for non-employee directors should be addressed to the Board Chair.

Director Attendance at Annual Meetings of Stockholders

Pursuant to our Governance Standards, Redwood’s directors are expected to attend annual meetings of stockholders. All of Redwood’s directors nominated for election in 2023 attended the 2023 annual meeting of stockholders in person. We currently expect all directors nominated for election to attend this year's Annual Meeting.

Code of Ethics; Insider Trading Policy

The Board of Directors has adopted a Code of Ethics that applies to all of Redwood’s directors, officers, and employees. The Code of Ethics is available on our website as well as in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office. We intend to post on our website and disclose in a Current Report on Form 8-K, to the extent required by applicable regulations, any change to the provisions of Redwood’s Code of Ethics and any waiver of a provision of the Code of Ethics.

We have adopted an Insider Trading Policy and related procedures governing the purchase, sale, and/or other dispositions of our securities by directors, officers, employees and other covered persons that we believe are reasonably designed to promote compliance with insider trading laws, rules and regulations, and the listing requirements of the NYSE. This policy imposes regular blackout periods during which certain individuals may not transact in our securities and pre-clearance procedures for transactions by certain specified individuals, including, among others, the members of our Board and our executive officers. In addition, this policy prohibits certain transactions that we have determined are higher risk or for which there is a heightened appearance of potential improper or inappropriate conduct, including short sales of our securities, options trading in puts, calls or other derivative securities involving our securities, hedging transactions, and margin accounts and pledging of our securities. We regularly review our Insider Trading Policy with our Board and management. A copy of our Insider Trading Policy is filed as Exhibit 19.1 to Redwood’s Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 29, 2024.

STOCK OWNERSHIP REQUIREMENTS

Required Stock Ownership by Directors

Pursuant to our Governance Standards, non-employee directors are required to purchase from their own funds at least $50,000 of our common stock within three years from the date of commencement of their Board membership. Vested deferred stock units (“DSUs”) acquired by a director through the voluntary deferral of cash compensation that otherwise would have been paid to that director are counted towards this requirement. Any director whose status has changed from being an employee director to being a non-employee director is not subject to this requirement if that director held at least $50,000 of our common stock at the time of that change in status.

Additionally, non-employee directors are required to own common stock, including vested DSUs acquired through both voluntary and involuntary deferred compensation, equal to at least five times the annual cash retainer payable to non-employee directors (i.e., at least $450,000 in common stock based on the current annual cash retainer in effect) within five years from the date of commencement of their Board membership. Stock and DSUs acquired with respect to the $50,000 stock purchase requirement count toward the attainment of this additional stock ownership requirement. Compliance with these ownership requirements is measured on a purchase/acquisition cost basis.

As of the date of this Proxy Statement, all of our non-employee directors were in compliance with these requirements either due to ownership of the requisite number of shares and vested DSUs, or because the director was within the time period permitted to attain the required level of ownership.

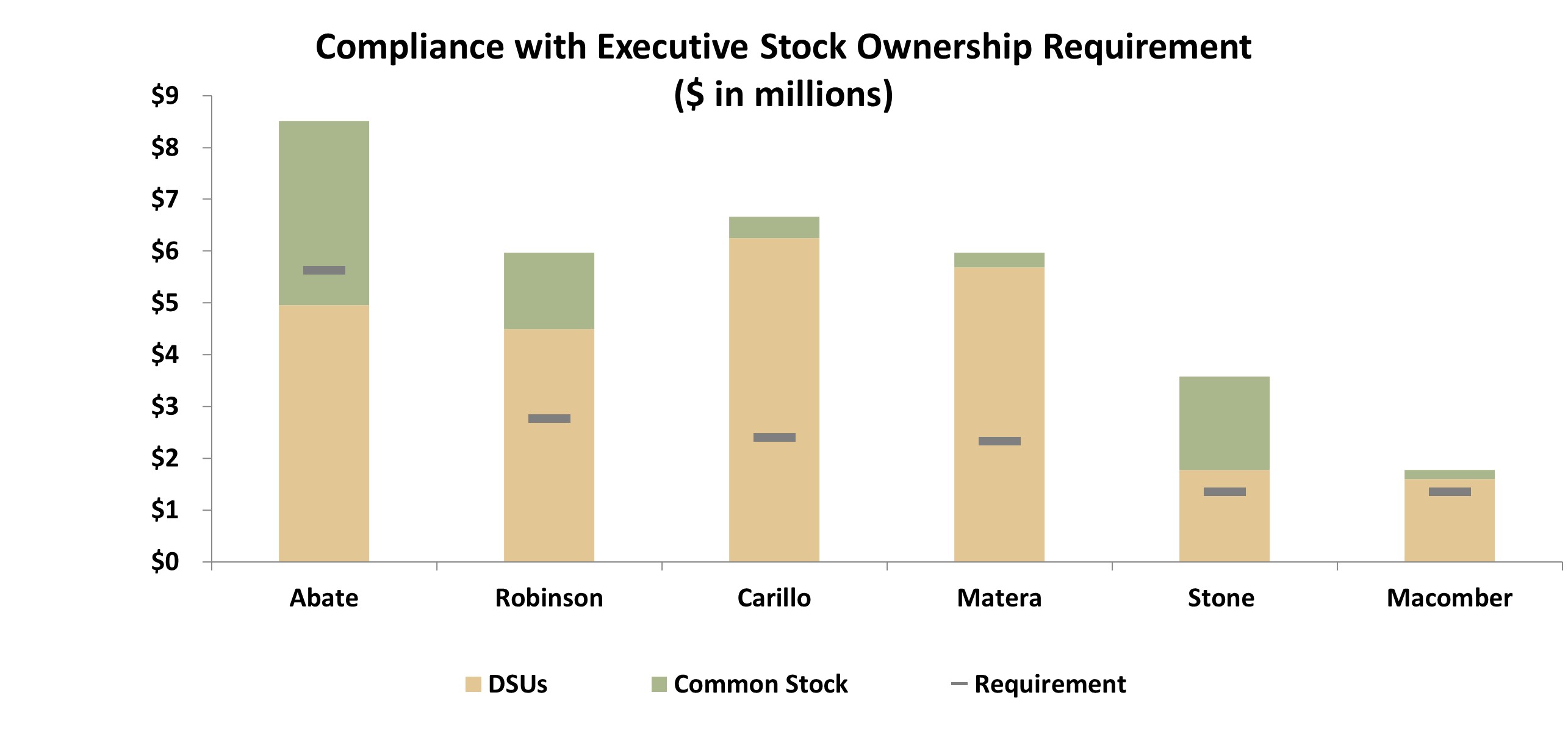

Required Stock Ownership by Executive Officers

The Compensation Committee of our Board of Directors has set the following executive stock ownership requirements with respect to our executive officers:

•Each executive officer is required to own stock with a value at least equal to (i) 6.25 times current salary for the Chief Executive Officer, (ii) 3.25 times current salary for the President, and (iii) three times current salary for the other executive officers;

•Five years are allowed to initially attain the required level of ownership and five years are allowed to acquire additional incremental shares if promoted to a position with a higher requirement or when a salary increase results in a higher requirement (if not in compliance at the indicated times, then the executive officer is required to retain net after-tax shares delivered as compensation or from the 2014 Incentive Plan or the Executive Deferred Compensation Plan until compliance is achieved);

•All shares owned outright are counted, including those held in trust for the executive officer and his or her immediate family, as well as vested and unvested DSUs and any other vested shares held pursuant to other employee plans; and

•Compliance with these requirements is measured on a purchase/acquisition cost basis for shares of common stock, and on grant date value for vested and unvested DSUs.

Redwood’s executive officers are currently the following individuals: Chief Executive Officer – Christopher J. Abate; President – Dashiell I. Robinson; Chief Financial Officer – Brooke E. Carillo; Chief Investment Officer – Fred J. Matera; Executive Vice President, Chief Legal Officer and Secretary – Andrew P. Stone; and Chief Human Resource Officer – Sasha G. Macomber. All of Redwood’s executive officers were in compliance with these stock ownership requirements either due to ownership of the requisite number of shares and vested and unvested DSUs, or because he or she was within the time period permitted to attain the required level of ownership. The chart below illustrates compliance relative to the applicable requirement for each of our executive officers as of March 28, 2024.

Further information about each of Redwood’s executive officers is included within “Information About Our Executive Officers” on pages 30 - 31 of this Proxy Statement.

ITEM 1 — ELECTION OF DIRECTORS

The nominees for the nine director positions are set forth below. In the event we are advised prior to the Annual Meeting that any nominee will be unable to serve or for good cause will not serve as a director if elected at the Annual Meeting, the proxies will cast votes for any person who shall be nominated by the present Board of Directors to fill such directorship. The nominees listed below currently are serving as directors of Redwood.

Vote Required

If a quorum is present, the election of each nominee as a director requires a majority of the votes cast with respect to such nominee at the Annual Meeting. For purposes of the election of directors, a majority of the votes cast means that the number of votes cast “for” a nominee for election as a director exceeds the number of votes cast “against” that nominee. Cumulative voting in the election of directors is not permitted. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote in the election of directors. In accordance with Redwood’s Bylaws and its Policy Regarding Majority Voting, any incumbent nominee for director must offer to resign from the Board if he or she fails to receive the required number of votes for re-election. The Governance and Nominating Committee will consider the offer of resignation and will recommend to the Board whether to accept the offer to resign. The Board will decide whether to accept the offer to resign and will publicly disclose its decision.

Nominees to Board of Directors

| | | | | | | | |

| Name | | Current Position with Redwood |

| Greg H. Kubicek | | Chair of the Board |

| Christopher J. Abate | | Director and Chief Executive Officer |

| Doneene K. Damon | | Director |

| Armando Falcon | | Director |

| Douglas B. Hansen | | Director |

| Debora D. Horvath | | Director |

| Georganne C. Proctor | | Director |

| Dashiell I. Robinson | | Director and President |

| Faith A. Schwartz | | Director |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE NOMINEES IDENTIFIED ABOVE.

Set forth below are summaries of the self-identified diversity characteristics, and the experience, qualifications, attributes and skills, of each of the nominees for election at the Annual Meeting, as well as certain biographical information regarding each of these individuals.

For each nominee for election as a director, set forth on the following pages is biographical information regarding the nominee, as well as factors supporting the Board of Directors’ conclusion to nominate the nominee for election to continue to serve as a director.

| | | | | |

| Greg H. Kubicek, age 67, is Chair of the Board, having previously served as Vice Chair of the Board from December 2020 to May 2022. After serving as Founder and CEO of The Holt Group, Inc. for 41 years, Mr. Kubicek was appointed CEO of GHK Enterprises, Inc. following Sekisui House’s acquisition of The Holt Group, Inc., a real estate company and its associated funds that purchase, develop, own, and manage real estate properties. Mr. Kubicek has also served as Chair of the |

the Board of Cascade Corporation, an international manufacturing corporation. Mr. Kubicek holds an A.B. in Economics from Harvard College. |

The Board of Directors concluded that Mr. Kubicek should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes •Management and entrepreneurial experience •Expertise and experience in the real estate development industry •Experience and expertise in the property management business •Professional and educational background |

| | | | | |

| Christopher J. Abate, age 44, has served as Chief Executive Officer since May 2018 and as a director since December 2017. Mr. Abate has been employed with Redwood since April 2006, previously serving as Redwood’s President from July 2016 to May 2018, Chief Financial Officer from March 2012 to August 2017, and Controller from January 2009 to March 2013. From October 2019 to December 2021, Mr. Abate served as Chair of the Board of Structured Finance Association |

Association. Before joining Redwood, Mr. Abate was employed by PricewaterhouseCoopers LLP. He holds a B.A. in accounting and finance from Western Michigan University, an M.B.A. from the University of California at Berkeley and Columbia University. |

The Board of Directors concluded that Mr. Abate should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes and management experience, including experience as Chief Executive Officer, President, Chief Financial Officer, and Controller of Redwood •Skill and experience in managing balance sheet exposures and managing risks •Skill and experience in executing capital markets transactions •Finance and accounting expertise and experience •Professional and educational background |

| | | | | |

| Doneene K. Damon, age 56, has been a director of Redwood since November 2023. Ms. Damon is a practicing attorney as a Director of Richards, Layton & Finger, P.A. (“RLF”), a multidisciplinary law firm based in Wilmington, Delaware, which she joined in 1992. Ms. Damon served as the President of RLF from 2019 to 2022, and currently serves as chair of the firm’s Corporate Trust and Agency Services Group and as Chief Diversity Director. Ms. Damon also currently serves on the |

the Board of Directors of Brown Advisory Delaware Trust Company and as a board member of the Structured Finance Association, the Forum of Executive Women and the Delaware Business Roundtable. Ms. Damon’s commitment to public service and nonprofit organizations includes current or past service as a member of Delaware’s Judicial Nominating Commission, the Delaware Prosperity Partnership, and the Delaware Bench and Bar Diversity Project. Ms. Damon previously served as the Chair of the Board of Directors of Christiana Care Health System, Inc. and Health Services, Inc., and she currently serves on the Board of Directors of St. Joseph’s University and is a member of the Board of Visitors of Temple University’s Beasley School of Law. Ms. Damon holds a B.S. in Accounting from St. Joseph’s University in Philadelphia and a J.D. from Temple University’s School of Law. |

The Board of Directors concluded that Ms. Damon should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes and management experience •Skill and experience in executing structured finance transactions •Expertise and experience in legal and regulatory matters •Expertise and experience relating to corporate and institutional governance •Professional and educational background |

| | | | | |

| Armando Falcon, age 63, has been a director of Redwood since March 2021. Mr. Falcon is CEO of Falcon Capital Advisors LLC, a management consulting firm based in Washington, DC, that provides strategic advice and technical assistance to financial services companies, mortgage industry companies, and government agencies on matters involving process reengineering, project management, regulatory compliance, and data analytics, which he founded in 2007. He previously served |

served as the Director of the Office of Federal Housing Enterprise Oversight, and as the General Counsel for the Committee on Banking and Financial Services of the U.S. House of Representatives. Mr. Falcon currently serves on the Board of Directors of the Structured Finance Association. Mr. Falcon also serves as an advisor to the Board of Directors of the National Association of Hispanic Real Estate Professionals. Mr. Falcon holds a B.A. from St. Mary’s University, an M.P.P. from Harvard University, and a J.D. from the University of Texas. |

The Board of Directors concluded that Mr. Falcon should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes and management experience •Experience in government service and financial regulation •Expertise and experience in the real estate finance and financial services industries •Expertise and experience relating to corporate and institutional governance •Professional and educational background |

| | | | | |

| Douglas B. Hansen, age 66, is a founder of Redwood, and served as Redwood’s President from 1994 through 2008. Mr. Hansen retired from his position as President of Redwood at the end of 2008. Mr. Hansen has been a director of Redwood since 1994. Mr. Hansen serves on the Board of Directors of Four Corners Property Trust, Inc., a publicly traded real estate investment trust. Mr. Hansen also serves on the board of River of Knowledge, a not-for-profit institution. Mr. Hansen holds |

holds an A.B. in Economics from Harvard College and an M.B.A. from Harvard Business School. |

The Board of Directors concluded that Mr. Hansen should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes and management experience, including experience as Redwood’s President since its founding in 1994 through 2008 •Skill and experience in investing in real estate-related assets and managing portfolios of such investments •Skill and experience in managing balance sheet exposures and managing risks •Skill and experience in executing capital markets transactions •Experience in finance and accounting matters •Professional and educational background |

| | | | | |

| Debora D. Horvath, age 69, has been a director of Redwood since 2016. Ms. Horvath is Principal of Horvath Consulting LLC, which she founded in 2010. Ms. Horvath served as an Executive Vice President for JP Morgan Chase & Co. from 2008 to 2010. Ms. Horvath served as an Executive Vice President and Chief Information Officer for Washington Mutual, Inc. (“WaMu”) from 2004 to 2008. In addition to being the technology leader at WaMu, Ms. Horvath was responsible for the Enterprise |

Enterprise Project Office and was Chair of WaMu’s Environmental Council. Ms. Horvath, a 25-year veteran from General Electric Company (“GE”), served 12 years as a Senior Vice President and Chief Information Officer for the GE insurance businesses. Ms. Horvath has been a Director of StanCorp Financial Group, Inc. since 2013. She was a director of the Federal Home Loan Bank of Seattle from 2012 to January 2014. Ms. Horvath holds a B.A. in Business Administration from Baldwin Wallace University and is a graduate of GE’s Financial Management Program (FMP). |

The Board of Directors concluded that Ms. Horvath should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes and management experience •Experience as a chief information officer •Expertise and experience relating to information technology and technology risk management •Accounting and finance experience •Expertise and experience relating to institutional governance •Professional and educational background |

| | | | | |

| Georganne C. Proctor, age 67, has been a director of Redwood since March 2006. Ms. Proctor is the former Chief Financial Officer of TIAA-CREF, and served in that position from June 2006 to July 2010. Additionally, Ms. Proctor served jointly as Chief Financial Officer and Executive Vice President for Enterprise Integration at TIAA-CREF from January 2010 to July 2010. From July 2010 to October 2010, she continued to serve as Executive Vice President for Enterprise Integration |

Integration at TIAA-CREF. From 2003 to 2005, Ms. Proctor was Executive Vice President of Golden West Financial Corporation, a thrift institution. From 1994 to 1997, Ms. Proctor was Vice President of Bechtel Group, a global engineering firm, and also served as its Senior Vice President and Chief Financial Officer from 1997 to 2002 and as a director from 1999 to 2002. From 1991 to 1994, Ms. Proctor served as finance director of certain divisions of The Walt Disney Company, a diversified worldwide entertainment company. Ms. Proctor previously served as Chair of Avantax, Inc.’s Board of Directors from July 2019 to November 2023. She also served on the Board of Directors of Sculptor Capital Management, Inc. from 2011-2021, Kaiser Aluminum Corporation from 2006 to 2009 and SunEdison, Inc. from 2013 to 2017. Ms. Proctor holds a B.S. in Business Management from the University of South Dakota and an M.B.A. from California State University East Bay. |

The Board of Directors concluded that Ms. Proctor should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Management experience •Expertise as a chief financial officer •Expertise and experience in the banking, insurance, and investment management industries •Professional and educational background |

| | | | | |

| Dashiell I. Robinson, age 44, has served as Redwood’s President since December 2017 and as a director since August 2021. Prior to joining Redwood in September 2017, Mr. Robinson was employed at Wells Fargo Securities, serving as the Head of Mortgage Finance within the Asset-Backed Finance Group. In that role, Mr. Robinson led a team of banking professionals responsible for financing and distributing an array of residential mortgage products, and serving a broad suite of |

of the firm's operating and investing clients. Prior to his employment at Wells Fargo, Mr. Robinson was employed within the Structured Credit Products Group at Wachovia Capital Markets from 2001 to 2008, serving in banking, structuring and risk mitigation roles. Mr. Robinson also serves as a member of the Board of Directors of the Jewish Community Center of San Francisco. Mr. Robinson holds a B.A. in English from Georgetown University. |

The Board of Directors concluded that Mr. Robinson should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes and management experience, including experience as President and Executive Vice President of Redwood •Expertise and experience in the real estate finance and financial services industries •Skill and experience investing in mortgages and other real estate-related assets and managing portfolios of such investments •Skill and experience in executing capital markets and structured finance transactions •Professional and educational background |

| | | | | |

| Faith A. Schwartz, age 63, has been a director of Redwood since March 2021. Ms. Schwartz is the Founder & CEO of Housing Finance Strategies, LLC, a professional services and advisory practice focusing on capital markets, rating agencies, and mortgage modernization and innovation, which she founded in 2016. Ms. Schwartz currently serves on the Board of Directors of Gateway First Bank, as well as on the boards of several other privately held mortgage industry-focused companies |

companies, including Class Valuation LLC. From 2013 to 2016, Ms. Schwartz served as Senior Vice President of Federal Practice of CoreLogic, Inc., a provider of property information, insight, analytics and data-enabled solutions. She is also the founder of HOPE NOW Alliance, a public-private initiative launched in 2007 to seek solutions for American families facing foreclosure during the Great Recession. Ms. Schwartz also previously served as Senior Vice President of Government, Housing, and Industry at Option One Mortgage Corporation, a subsidiary of H&R Block, from 2003 to 2007 and as Director of Alternative Markets and Director of National Sales at Freddie Mac between 1997 and 2003. From October 2021 to October 2023, Ms. Schwartz served on the Consumer Advisory Board for the Consumer Finance Protection Bureau (CFPB). She also previously served on the Federal Reserve Board’s Consumer Advisory Council. In 2010, Ms. Schwartz founded HOPE LoanPort, a technology non-profit organization that helps families reach and sustain their goal of homeownership. She started her career at Dominion Bancshares Mortgage Company as Vice President of Capital Markets and Wholesale Lending. Ms. Schwartz holds a B.S. from Shippensburg State College and an M.B.A. from the University of Pittsburgh. |

The Board of Directors concluded that Ms. Schwartz should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills: •Leadership attributes and management experience •Expertise and experience in the real estate finance industry and the use of technology within this industry •Expertise and experience in the banking and financial services industries •Professional and educational background |

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board of Directors currently consists of nine directors. Our Board of Directors has established three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee. The membership of each Committee and the function of each Committee are described below. Each of the Committees has adopted a charter and the charters of all Committees are available on our website and in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office.

Our Board of Directors held a total of nine meetings during 2023. The non-employee directors of Redwood met in executive session at five meetings during 2023. Mr. Kubicek presided at executive sessions of the non-employee directors during 2023, all of whom qualified as “independent” under Rule 303A of the NYSE Listed Company Manual. No director attended fewer than 75% of the meetings of the Board of Directors and the Committees on which he or she served and all of our directors attended last year’s annual meeting of stockholders in person.

Audit Committee. Redwood has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee’s function includes providing oversight regarding accounting, auditing, risk management, and financial reporting practices of Redwood. The Audit Committee consists solely of non-employee directors, all of whom our Board of Directors has determined are independent within the meaning of the listing standards of the NYSE and the rules of the SEC. Our Board of Directors has determined that all members of the Audit Committee are “financially literate” within the meaning of the applicable regulations and standards and has designated each of Ms. Horvath and Ms. Proctor as an “audit committee financial expert” within the meaning of the applicable regulations and standards. The Audit Committee met nine times in 2023 in order to carry out its responsibilities, as discussed below under “Audit Committee Matters — Audit Committee Report.”

Compensation Committee. The Compensation Committee’s function includes reviewing and approving Redwood’s compensation philosophy, reviewing the competitiveness of Redwood’s compensation practices, as well as risks that may arise from those practices, determining and approving the annual base salaries and incentive compensation paid to our executive officers, approving the terms and conditions of proposed incentive plans applicable to our executive officers and other employees, approving and overseeing the administration of Redwood’s employee benefit plans, and reviewing and approving hiring and severance arrangements for our executive officers. The Compensation Committee also oversees risk and opportunity related to human capital and social matters, which at Redwood includes, among other things, matters such as workforce inclusion and diversity initiatives and employee engagement efforts. The Compensation Committee consists solely of non-employee directors, each of whom our Board of Directors has determined is independent within the meaning of the listing standards of the NYSE and are “non-employee directors” within the meaning of the rules of the SEC. The Compensation Committee met five times in 2023 in order to carry out its responsibilities, as discussed below under “Executive Compensation — Compensation Discussion and Analysis.”

Governance and Nominating Committee. The Governance and Nominating Committee’s function includes reviewing and considering corporate governance guidelines and principles, evaluating potential director candidates and recommending qualified candidates to the full Board, reviewing executive succession planning, and evaluating executives in connection with succession planning, and overseeing the self-evaluation of the Board of Directors. The Governance and Nominating Committee also carries out responsibilities related to the receipt, retention, and treatment of reported concerns related to potential violations of Redwood’s Code of Ethics. The Governance and Nominating Committee consists solely of non-employee directors, each of whom our Board of Directors has determined is independent within the meaning of the listing standards of the NYSE. The Governance and Nominating Committee met four times in 2023 in order to carry out its responsibilities.

Committee Members

The current members of each of the three standing committees are listed below, with the Chair appearing first.

| | | | | | | | | | | | | | |

| Audit | | Compensation | | Governance and Nominating |

| Debora D. Horvath | | Georganne C. Proctor | | Armando Falcon |

| Georganne C. Proctor | | Doneene K. Damon | | Doneene K. Damon |

| Faith A. Schwartz | | Armando Falcon | | Greg H. Kubicek |

| | Debora D. Horvath | | Faith A. Schwartz |

| | Greg H. Kubicek | | |

DIRECTOR COMPENSATION

Information on our non-employee director cash compensation paid (or currently scheduled to be paid) during the annual periods commencing in May 2022, May 2023, and May 2024, is set forth in the tables below. Non-employee director cash compensation is paid quarterly, in arrears.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Non-Employee Director Cash Compensation | |

| | | | Annual Period Commencing May 1, | |

| | | | 2022, 2023, and 2024 | |

| | Annual Retainer * | | $ | 90,000 | | |

| | Retainer for Service as a Committee Member (per Committee)** | | $ | 12,500 | | |

| | ———— | | | |

| * | The Chairs of the Audit Committee and the Governance and Nominating Committee each receive an additional annual cash retainer of $20,000. The Chair of the Compensation Committee receives an additional annual cash retainer of $30,000 (increased from $20,000 in 2022). The additional annual cash retainer payable to the Chair of the Board of the Directors is currently $120,000. | |

| ** | Non-employee directors who are members of Board Committees receive a retainer for their service on each Committee and do not receive committee meeting attendance fees. In cases where a non-employee director is formally invited to participate in a committee meeting of which he or she is not a member, he or she will be paid $2,000 per meeting for in-person attendance and $1,000 per meeting for telephonic attendance. | |

After submission of appropriate documentation on a timely basis, non-employee directors are also reimbursed for reasonable out-of-pocket expenses incurred in attending Board and committee meetings, as well as for their and, in some cases, their guests’ attendance at other Redwood-related meetings or events. Non-employee directors may also be reimbursed for out-of-pocket expenses incurred in attending conferences or educational seminars that relate to their Board service and are approved by the Chair of the Governance and Nominating Committee.

Non-employee directors are also granted deferred stock units (“DSUs”), or comparable equity-based awards, each year at the time of the annual meeting of stockholders. The number of DSUs granted is determined by dividing the dollar value of the grant by the closing price of Redwood’s common stock on the NYSE on the day of grant (and rounding to the nearest whole share amount). In May 2023, non-employee directors received an annual DSU award valued at $125,000.

On the 2024 Annual Meeting date, non-employee directors who are re-elected will receive an annual grant of vested DSUs for the May 2024 to May 2025 annual period determined by dividing $125,000 by the closing price of Redwood’s common stock on the meeting date. Non-employee directors may also be granted equity-based awards upon their initial election to the Board. These initial and annual DSU grants are fully vested upon grant, and they are generally subject to a mandatory three-year holding period. Dividend equivalent rights on DSUs are generally paid in cash to directors on each dividend distribution date.

In August 2023, following a review of director compensation by the Compensation Committee and Governance and Nominating Committee, with the assistance of the Compensation Committee’s independent compensation consultant, Semler Brossy Consulting Group, LLC (“Semler Brossy”), the Board of Directors reviewed the compensation program for non-employee directors and determined to maintain the current compensation program with no additional changes beyond the increase of $10,000 for the annual cash retainer for service as Compensation Committee Chair which had been previously approved at the end of the May 2022 to May 2023 annual compensation cycle. In connection with this review, Semler Brossy conducted an independent review of Redwood’s non-employee director compensation program at the request of the Compensation Committee. The review conducted by Semler Brossy included a comparison against non-employee director compensation at the companies that comprise Redwood's executive compensation peer group. The non-employee director compensation program is intended to maintain Redwood’s total average annual compensation for non-employee directors at or near the compensation peer group median. Further detail regarding the executive compensation peer group is provided on pages 59 - 60 of this Proxy Statement under the heading “Executive Compensation in 2023 — Compensation Peer Group for 2023.” In particular, the Board approved the existing compensation program: an annual cash retainer for Board service of $90,000; an annual equity retainer for Board service of $125,000; an annual cash retainer for service as a Committee member of $12,500 (per Committee); an annual cash retainer for service as Audit Committee Chair of $20,000; an annual cash retainer for service as Governance and Nominating Committee Chair of $20,000; an annual cash retainer for service as Compensation Committee Chair of $30,000; and an annual cash retainer for service as Board Chair of $120,000.

Each director may elect to defer receipt of cash compensation or dividend equivalent rights through Redwood’s Executive Deferred Compensation Plan. Cash balances in the Executive Deferred Compensation Plan are unsecured liabilities of Redwood and are utilized by Redwood as available capital to fund investments and operations. Based on each director’s election, deferred compensation can either be deferred into a cash account and earn a rate of return that is equivalent to 120% of the applicable long-term federal rate published by the IRS compounded monthly or be deferred into deferred stock units which will, among other things, entitle them to receive dividend equivalent rights related to those units.

Each year the Compensation Committee and Governance and Nominating Committee review Redwood’s compensation of non-employee directors with the assistance of the Compensation Committee’s independent compensation consultant. Any changes to non-employee director compensation recommended by these Committees are subject to review and approval by the Board. These Committees intend to complete their annual review of Redwood’s non-employee director compensation prior to year-end in 2024, when updated comparative compensation data will be available. Any changes to non-employee director compensation that are approved by the Board following this 2024 review may increase or decrease non-employee director compensation for the May 2024 to May 2025 annual period from the amounts set forth in the “Non-Employee Director Cash Compensation” table on the preceding page.

Non-Employee Director Compensation — 2023

The following table provides information on non-employee director compensation for the 2023 calendar year. Director compensation is set by the Board and is subject to change. Directors who are employed by Redwood do not receive any compensation for their Board activities and do not appear in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current Non-Employee Directors | | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($)(2)(3) | | All Other

Compensation

($) | | Total

($) |

Doneene K. Damon(4) | | $ | 18,750 | | | $ | 69,519 | | | — | | $ | 88,269 | |

| Armando Falcon | | $ | 135,000 | | | $ | 124,996 | | | — | | $ | 259,996 | |

| Douglas B. Hansen | | $ | 98,000 | | | $ | 124,996 | | | — | | $ | 222,996 | |

| Debora D. Horvath | | $ | 135,000 | | | $ | 124,996 | | | — | | $ | 259,996 | |

| Greg H. Kubicek | | $ | 235,000 | | | $ | 124,996 | | | — | | $ | 359,996 | |

| Georganne C. Proctor | | $ | 151,071 | | | $ | 124,996 | | | — | | $ | 276,067 | |

| Faith A. Schwartz | | $ | 115,000 | | | $ | 124,996 | | | — | | $ | 239,996 | |

| Directors Retired During 2023 | | | | | | | | |

George W. Madison(5) | | $ | 86,250 | | | $ | 124,996 | | | — | | $ | 211,246 | |

(1)Fees earned are based on the non-employee director compensation policy in place for 2023: (i) annual cash retainer of $90,000; (ii) additional annual retainer for the Chair of the Board of $120,000; (iii) additional annual cash retainer for Audit Committee Chair and Governance and Nominating Committee Chair of $20,000 and for Compensation Committee Chair of $30,000; (iv) invitational committee fees of $2,000 (in person) and $1,000 (telephonic); and (v) an annual committee retainer of $12,500 per committee.

(2)Stock awards consisted of grants of vested DSUs. The value of DSUs awarded was determined in accordance with FASB Accounting Standards Codification Topic 718. The value of dividend equivalent rights associated with DSUs was taken into account in establishing the value of these DSUs and previously granted DSUs. Therefore, dividend equivalent rights payments made during 2023 to non-employee directors are not considered compensation or other amounts reported in the table above.

(3)As of December 31, 2023, the aggregate number of stock awards/DSUs outstanding for each then-serving non-employee director was as follows: Doneene K. Damon had 12,856 vested DSUs, Armando Falcon had 45,795 vested DSUs, Douglas B. Hansen had 44,767 vested DSUs; Debora D. Horvath had 83,298 vested DSUs; Greg H. Kubicek had 404,059 vested DSUs; George W. Madison had no DSUs; Georganne C. Proctor had 197,331 vested DSUs; and Faith A. Schwartz had 45,795 vested DSUs.

(4)Ms. Damon joined Redwood's Board effective November 2, 2023.

(5)Mr. Madison retired from Redwood's Board effective September 30, 2023.

The following table provides information on stock unit distributions in common stock to non-employee directors from our Executive Deferred Compensation Plan in 2023. Stock units distributed represent compensation previously granted in prior years and were reported as director compensation in those prior years.

| | | | | | | | | | | | | | | | | |

| Current Non-Employee Directors | | DSUs Distributed (#)(1) | | Aggregate Value of DSUs Distributed ($)(2) |

| Armando Falcon | | | 6,756 | | | $ | 42,429 | |

| Douglas B. Hansen | | 12,459 | | | $ | 79,364 | |

| Debora Horvath | | 12,459 | | | $ | 79,364 | |

| Faith A. Schwartz | | 6,756 | | | $ | 42,429 | |

| Directors Retired During 2023 | | | | |

George W. Madison(3) | | 103,480 | | | $ | 737,817 | |

| | | | | |

(1)Mr. Hansen and Ms. Horvath’s 2023 DSU distributions included annual director’s grants awarded in 2020. Mr. Falcon’s and Ms. Schwartz’s 2023 DSU distributions also included directors fees earned in 2021 which they elected to defer into additional DSUs under Redwood’s Executive Deferred Compensation Plan. Mr. Madison’s 2023 DSU distribution included annual director grants as well as certain DERs and directors fees earned from 2020 to 2023, which he elected to defer into additional DSUs under Redwood’s Executive Deferred Compensation Plan.

(2)The aggregate value of DSUs distributed is calculated by multiplying the number of DSUs distributed by the fair market value of Redwood common stock on the date of distribution.

(3)Mr. Madison retired from Redwood's Board effective September 30, 2023.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

Executive officers of Redwood are listed in the table below.

| | | | | | | | | | | | | | |

| Name | | Position | | Age |

| Christopher J. Abate | | Chief Executive Officer | | 44 |

| Dashiell I. Robinson | | President | | 44 |

| Brooke E. Carillo | | Chief Financial Officer | | 37 |

| Fred J. Matera | | Chief Investment Officer | | 60 |

| Andrew P. Stone | | Executive Vice President, Chief Legal Officer and Secretary | | 53 |

| Sasha G. Macomber | | Chief Human Resources Officer | | 55 |

Biographical information regarding these executive officers is set forth below.

Christopher J. Abate, age 44, serves as Chief Executive Officer and as a director of Redwood. Mr. Abate has been employed with Redwood since April 2006, previously serving as Redwood’s President from July 2016 to May 2018, Chief Financial Officer from March 2012 to August 2017, and Controller from January 2009 to March 2013. From October 2019 to December 2021, Mr. Abate served as Chair of the Board of the Structured Finance Association. Before joining Redwood, Mr. Abate was employed by PricewaterhouseCoopers LLP. He holds a B.A. in accounting and finance from Western Michigan University, and an M.B.A. from the University of California at Berkeley and Columbia University.