1 Q1 2023 Redwood Review April 27, 2023 Exhibit 99.3

2 Cautionary Statement; Forward-Looking Statements This presentation contains forward-looking statements, including statements regarding our 2023 forward outlook, estimates of upside and potential earnings in our investment portfolio from embedded discounts to par value on securities, target yields on investment opportunities, estimated forward-looking economic yields on our Investment Portfolio, and expected average dollar amount of draws per quarter on BPL bridge loans. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and any subsequent Quarterly Reports on Form 10-Q under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected may be described from time to time in reports the Company files with the Securities and Exchange Commission, including Current Reports on Form 8-K. Additionally, this presentation contains estimates and information concerning our industry, including market size and growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those referred to above, that could cause results to differ materially from those expressed in these publications and reports.

3 Redwood’s mission is to make quality housing, whether rented or owned, accessible to all American households Detailed Endnotes are included at the end of this presentation. 29-Year Track Record of Strong Performance and Earnings Generation Diversified Product Set with Balanced Earnings Streams Industry Leading Operating Platforms Best-in-Class Securitization Platforms and Distribution Channels Control Credit through Disciplined Underwriting Ability to Organically Create Assets for Balance Sheet Innovative Technology Organically and Through Partnerships Deep and Experienced Management Team O U R D I F F E R E N T IAT O R S R W T H O R I Z O N S

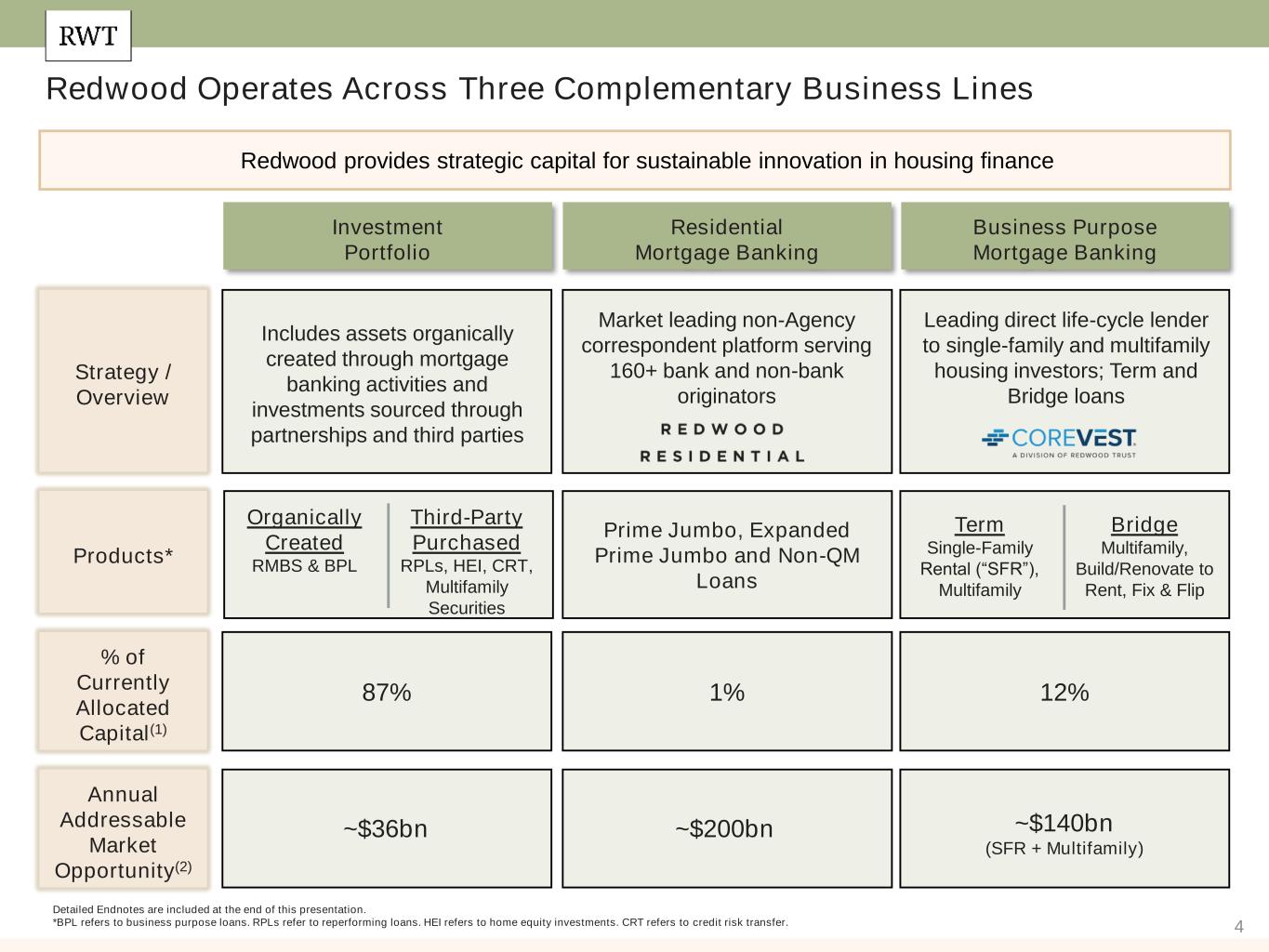

4 Detailed Endnotes are included at the end of this presentation. *BPL refers to business purpose loans. RPLs refer to reperforming loans. HEI refers to home equity investments. CRT refers to credit risk transfer. Redwood Operates Across Three Complementary Business Lines Redwood provides strategic capital for sustainable innovation in housing finance Residential Mortgage Banking Business Purpose Mortgage Banking Strategy / Overview ~$200bn ~$140bn (SFR + Multifamily) 1% 12% % of Currently Allocated Capital(1) Annual Addressable Market Opportunity(2) Products* Market leading non-Agency correspondent platform serving 160+ bank and non-bank originators Leading direct life-cycle lender to single-family and multifamily housing investors; Term and Bridge loans Investment Portfolio ~$36bn 87% Includes assets organically created through mortgage banking activities and investments sourced through partnerships and third parties Prime Jumbo, Expanded Prime Jumbo and Non-QM Loans Term Single-Family Rental (“SFR”), Multifamily Bridge Multifamily, Build/Renovate to Rent, Fix & Flip Organically Created RMBS & BPL Third-Party Purchased RPLs, HEI, CRT, Multifamily Securities

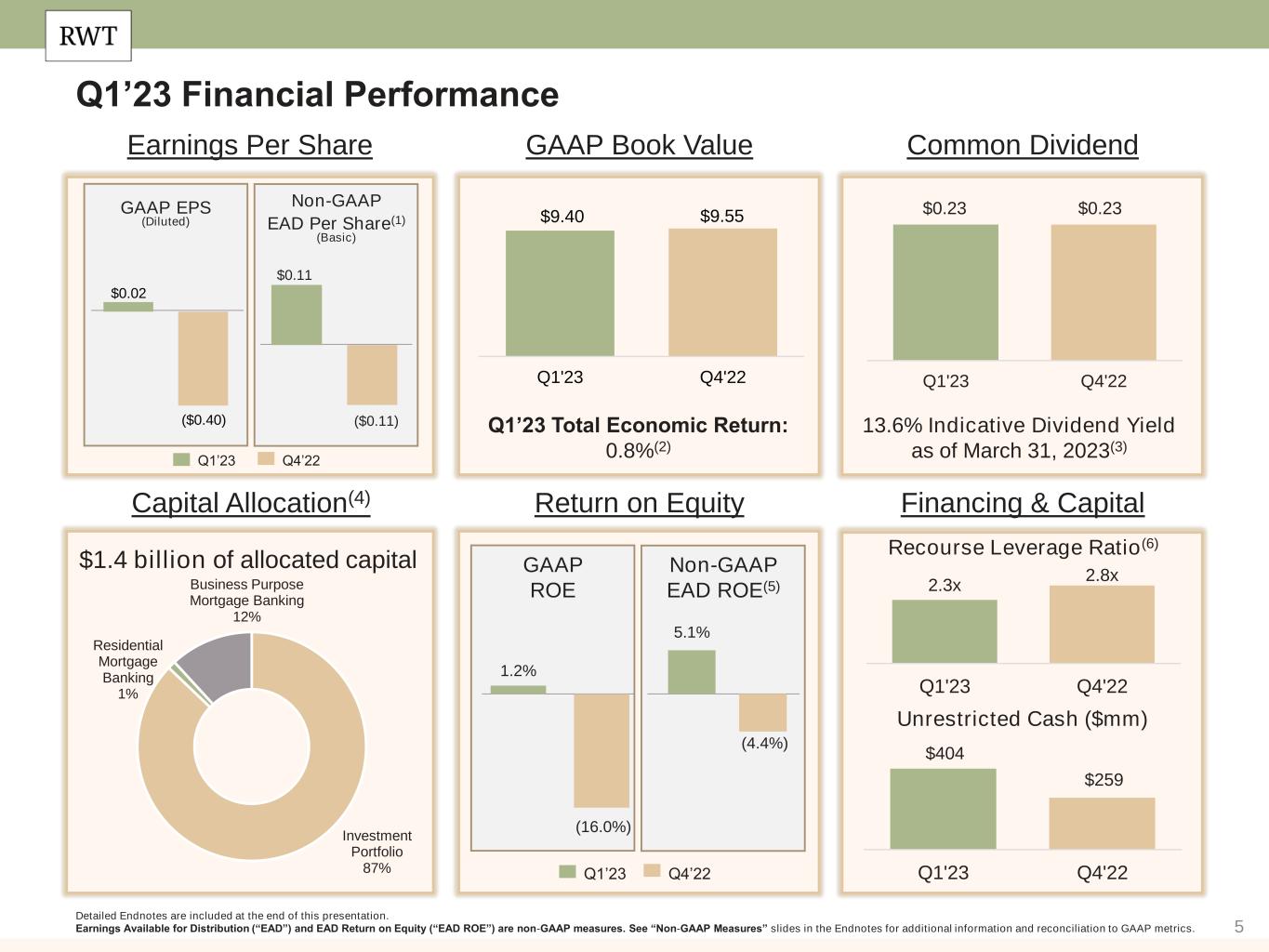

5 Q1’23 Financial Performance $1.4 billion of allocated capital Detailed Endnotes are included at the end of this presentation. Earnings Available for Distribution (“EAD”) and EAD Return on Equity (“EAD ROE”) are non-GAAP measures. See “Non-GAAP Measures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. Earnings Per Share GAAP Book Value Common Dividend Capital Allocation(4) Return on Equity Financing & Capital Recourse Leverage Ratio(6) Unrestricted Cash ($mm) Q1’23 Total Economic Return: 0.8%(2) 13.6% Indicative Dividend Yield as of March 31, 2023(3) GAAP ROE Non-GAAP EAD ROE(5) GAAP EPS (Diluted) Non-GAAP EAD Per Share(1) (Basic) Q1’23 Q4’22 Q1’23 Q4’22 $404 $259 Q1'23 Q4'22 Investment Portfolio 87% Residential Mortgage Banking 1% Business Purpose Mortgage Banking 12% $9.40 $9.55 Q1'23 Q4'22 2.3x 2.8x Q1'23 Q4'22 1.2% (16.0%) 5.1% (4.4%) $0.11 ($0.11) $0.02 ($0.40) $0.23 $0.23 Q1'23 Q4'22

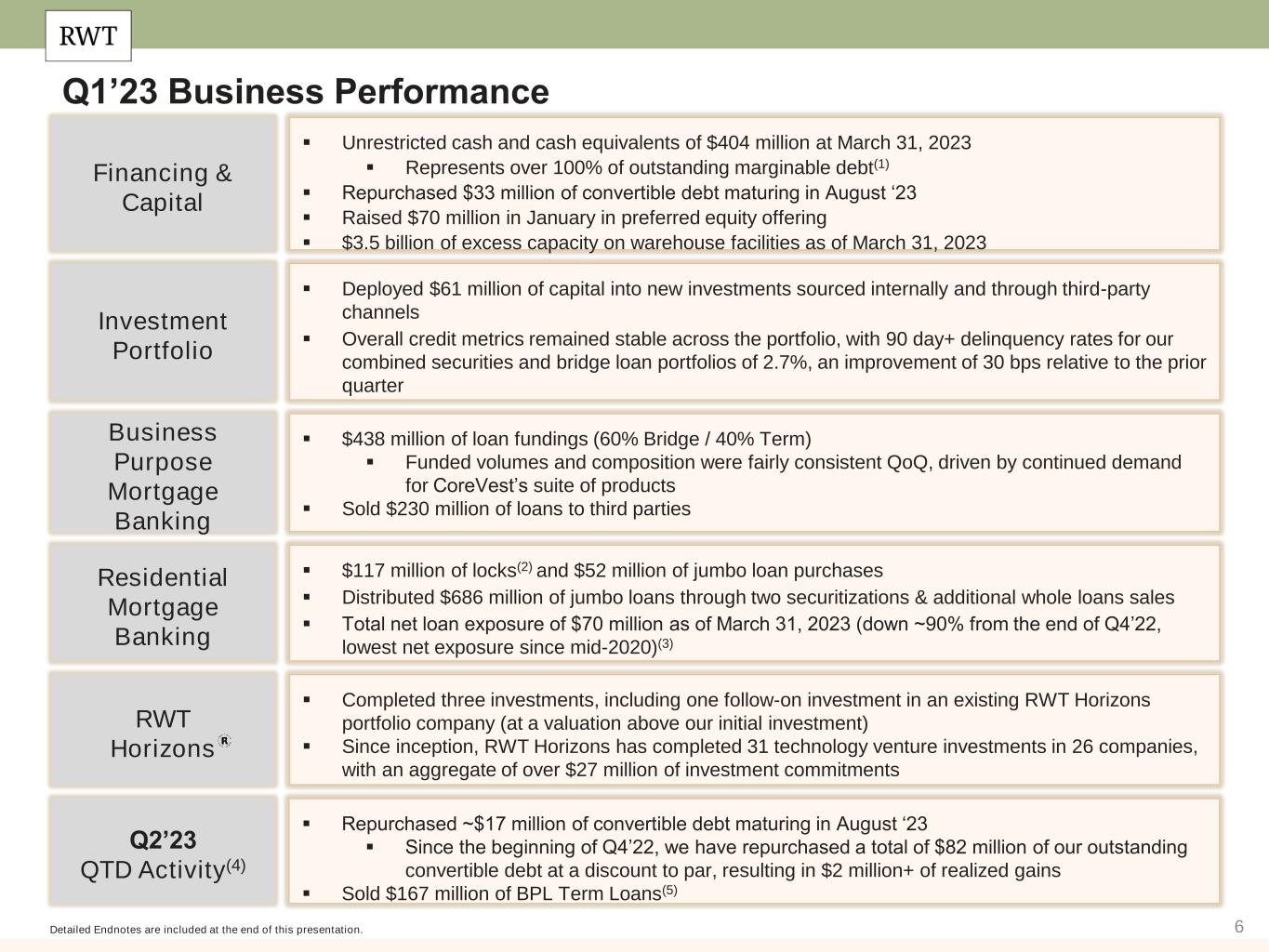

6 Q1’23 Business Performance Detailed Endnotes are included at the end of this presentation. ▪ $117 million of locks(2) and $52 million of jumbo loan purchases ▪ Distributed $686 million of jumbo loans through two securitizations & additional whole loans sales ▪ Total net loan exposure of $70 million as of March 31, 2023 (down ~90% from the end of Q4’22, lowest net exposure since mid-2020)(3) Residential Mortgage Banking ▪ Completed three investments, including one follow-on investment in an existing RWT Horizons portfolio company (at a valuation above our initial investment) ▪ Since inception, RWT Horizons has completed 31 technology venture investments in 26 companies, with an aggregate of over $27 million of investment commitments RWT Horizons ▪ $438 million of loan fundings (60% Bridge / 40% Term) ▪ Funded volumes and composition were fairly consistent QoQ, driven by continued demand for CoreVest’s suite of products ▪ Sold $230 million of loans to third parties Business Purpose Mortgage Banking ▪ Deployed $61 million of capital into new investments sourced internally and through third-party channels ▪ Overall credit metrics remained stable across the portfolio, with 90 day+ delinquency rates for our combined securities and bridge loan portfolios of 2.7%, an improvement of 30 bps relative to the prior quarter Investment Portfolio ▪ Unrestricted cash and cash equivalents of $404 million at March 31, 2023 ▪ Represents over 100% of outstanding marginable debt(1) ▪ Repurchased $33 million of convertible debt maturing in August ‘23 ▪ Raised $70 million in January in preferred equity offering ▪ $3.5 billion of excess capacity on warehouse facilities as of March 31, 2023 Financing & Capital ▪ Repurchased ~$17 million of convertible debt maturing in August ‘23 ▪ Since the beginning of Q4’22, we have repurchased a total of $82 million of our outstanding convertible debt at a discount to par, resulting in $2 million+ of realized gains ▪ Sold $167 million of BPL Term Loans(5) Q2’23 QTD Activity(4)

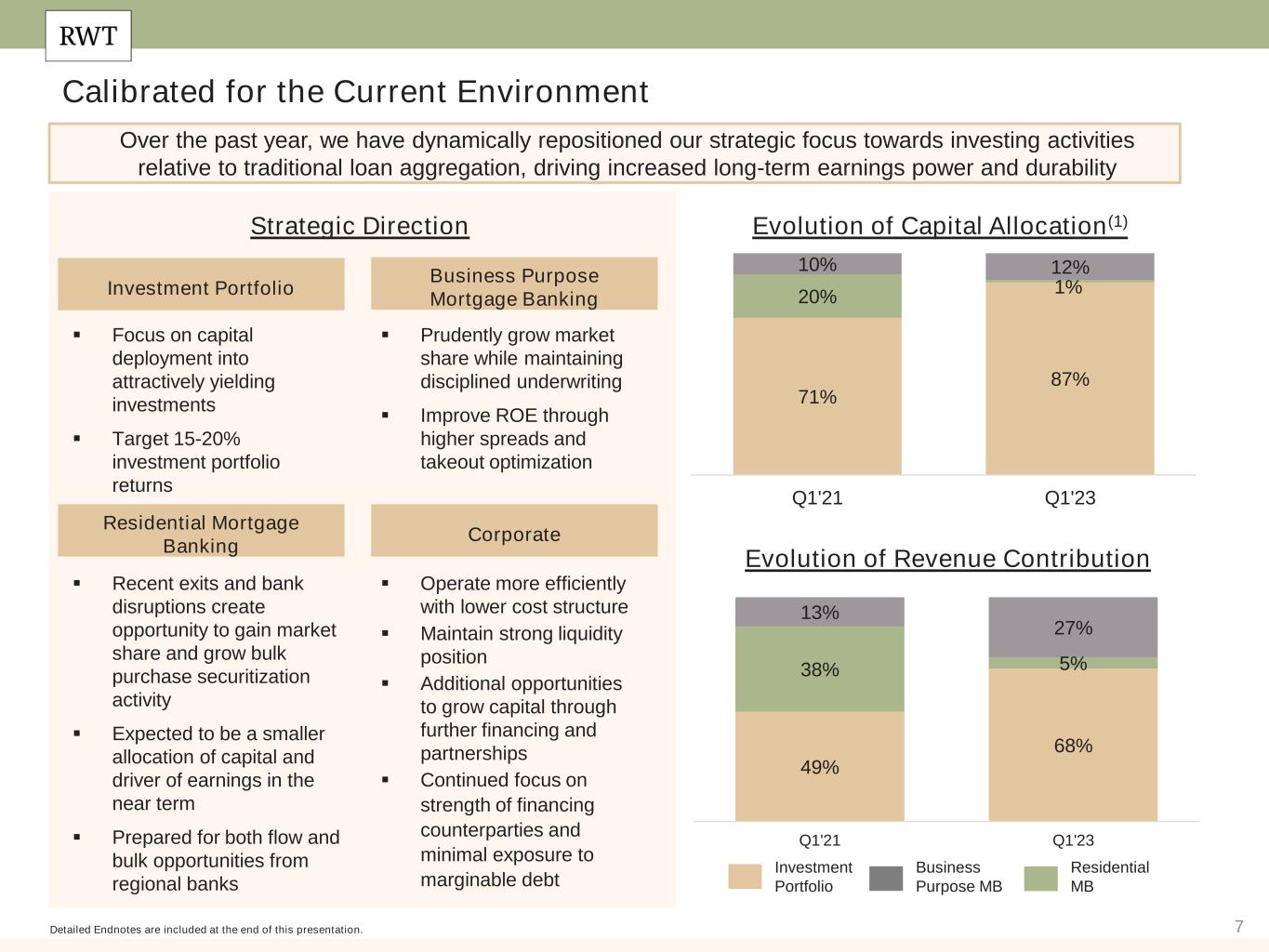

7 Calibrated for the Current Environment Detailed Endnotes are included at the end of this presentation. Over the past year, we have dynamically repositioned our strategic focus towards investing activities relative to traditional loan aggregation, driving increased long-term earnings power and durability Evolution of Capital Allocation(1) 71% 87% 20% 1% 10% 12% Q1'21 Q1'23 Residential Mortgage Banking ▪ Recent exits and bank disruptions create opportunity to gain market share and grow bulk purchase securitization activity ▪ Expected to be a smaller allocation of capital and driver of earnings in the near term ▪ Prepared for both flow and bulk opportunities from regional banks ▪ Operate more efficiently with lower cost structure ▪ Maintain strong liquidity position ▪ Additional opportunities to grow capital through further financing and partnerships ▪ Continued focus on strength of financing counterparties and minimal exposure to marginable debt Corporate Investment Portfolio Residential MB Business Purpose MB Evolution of Revenue Contribution Investment Portfolio Business Purpose Mortgage Banking ▪ Prudently grow market share while maintaining disciplined underwriting ▪ Improve ROE through higher spreads and takeout optimization ▪ Focus on capital deployment into attractively yielding investments ▪ Target 15-20% investment portfolio returns Strategic Direction 49% 68% 38% 5% 13% 27% Q1'21 Q1'23

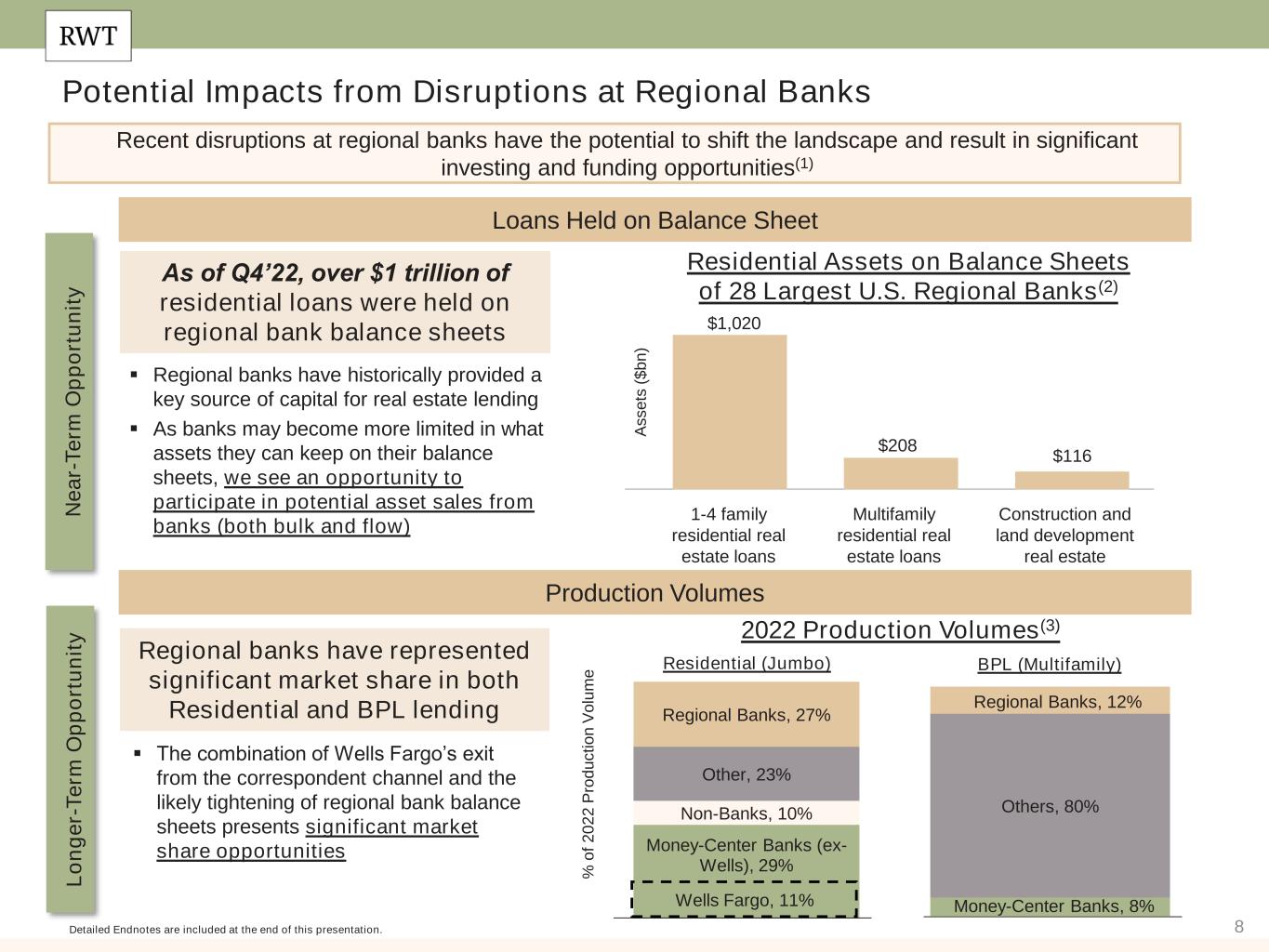

8 Potential Impacts from Disruptions at Regional Banks Detailed Endnotes are included at the end of this presentation. Recent disruptions at regional banks have the potential to shift the landscape and result in significant investing and funding opportunities(1) ▪ Regional banks have historically provided a key source of capital for real estate lending ▪ As banks may become more limited in what assets they can keep on their balance sheets, we see an opportunity to participate in potential asset sales from banks (both bulk and flow) Loans Held on Balance Sheet As of Q4’22, over $1 trillion of residential loans were held on regional bank balance sheets 1-4 family residential real estate loans Multifamily residential real estate loans Construction and land development real estate Residential Assets on Balance Sheets of 28 Largest U.S. Regional Banks(2) A s s e ts ( $ b n ) ▪ The combination of Wells Fargo’s exit from the correspondent channel and the likely tightening of regional bank balance sheets presents significant market share opportunities Production Volumes Regional banks have represented significant market share in both Residential and BPL lending Residential (Jumbo) BPL (Multifamily) % o f 2 0 2 2 P ro d u c ti o n V o lu m e N e a r- T e rm O p p o rt u n it y L o n g e r- T e rm O p p o rt u n it y $1,020 $208 $116 Money-Center Banks (ex- Wells), 29% Non-Banks, 10% Other, 23% Regional Banks, 27% Wells Fargo, 11% 2022 Production Volumes(3) Money-Center Banks, 8% Others, 80% Regional Banks, 12%

9 Investment Portfolio & Operating Businesses

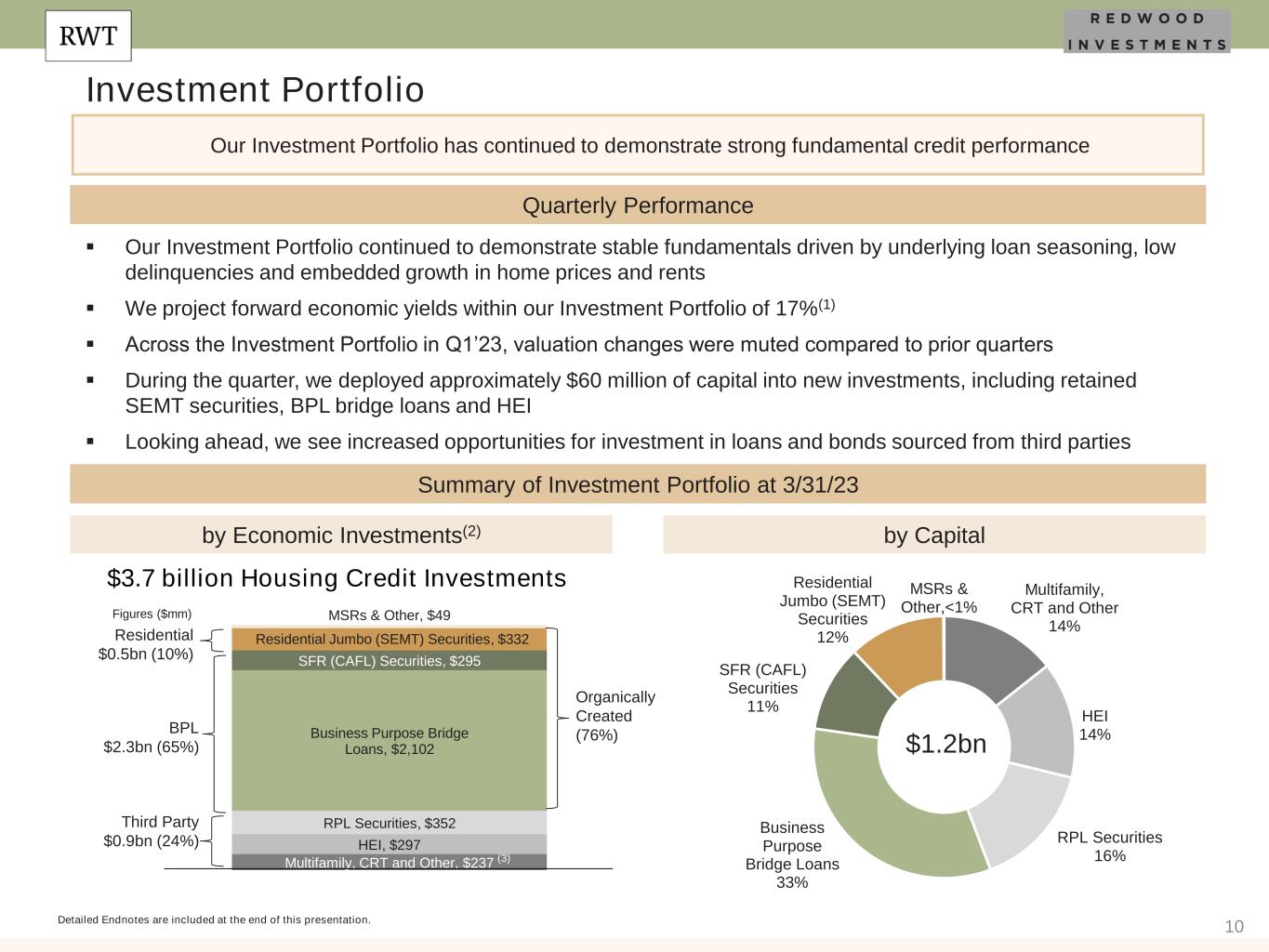

10 Multifamily, CRT and Other, $237 HEI, $297 RPL Securities, $352 Business Purpose Bridge Loans, $2,102 SFR (CAFL) Securities, $295 Residential Jumbo (SEMT) Securities, $332 MSRs & Other, $49 Investment Portfolio Quarterly Performance $3.7 billion Housing Credit Investments Organically Created (76%) Detailed Endnotes are included at the end of this presentation. Our Investment Portfolio has continued to demonstrate strong fundamental credit performance $1.2bn Third Party $0.9bn (24%) BPL $2.3bn (65%) Residential $0.5bn (10%) Figures ($mm) ▪ Our Investment Portfolio continued to demonstrate stable fundamentals driven by underlying loan seasoning, low delinquencies and embedded growth in home prices and rents ▪ We project forward economic yields within our Investment Portfolio of 17%(1) ▪ Across the Investment Portfolio in Q1’23, valuation changes were muted compared to prior quarters ▪ During the quarter, we deployed approximately $60 million of capital into new investments, including retained SEMT securities, BPL bridge loans and HEI ▪ Looking ahead, we see increased opportunities for investment in loans and bonds sourced from third parties Summary of Investment Portfolio at 3/31/23 by Economic Investments(2) by Capital (3) Multifamily, CRT and Other 14% HEI 14% RPL Securities 16% Business Purpose Bridge Loans 33% SFR (CAFL) Securities 11% Residential Jumbo (SEMT) Securities 12% MSRs & Other,<1%

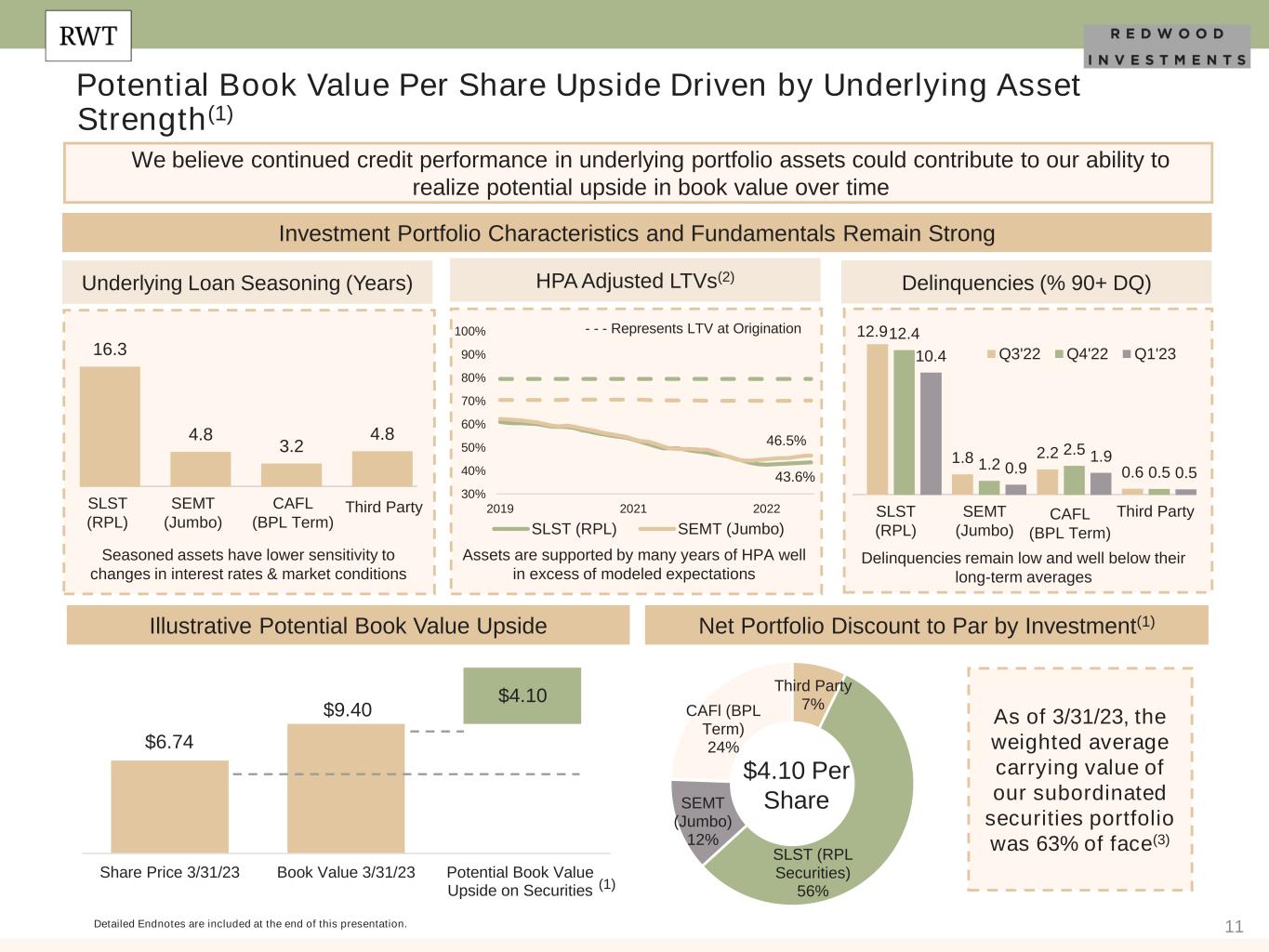

11 $6.74 $9.40 $4.10 Share Price 3/31/23 Book Value 3/31/23 Potential Book Value Upside on Securities (1) Net Portfolio Discount to Par by Investment(1) $4.10 Per Share Illustrative Potential Book Value Upside Detailed Endnotes are included at the end of this presentation. Potential Book Value Per Share Upside Driven by Underlying Asset Strength(1) As of 3/31/23, the weighted average carrying value of our subordinated securities portfolio was 63% of face(3) We believe continued credit performance in underlying portfolio assets could contribute to our ability to realize potential upside in book value over time Delinquencies (% 90+ DQ)HPA Adjusted LTVs(2) Investment Portfolio Characteristics and Fundamentals Remain Strong SLST (RPL) SEMT (Jumbo) CAFL (BPL Term) Third Party Underlying Loan Seasoning (Years) Assets are supported by many years of HPA well in excess of modeled expectations Delinquencies remain low and well below their long-term averages Seasoned assets have lower sensitivity to changes in interest rates & market conditions SLST (RPL) SEMT (Jumbo) CAFL (BPL Term) Third Party Third Party 7% SLST (RPL Securities) 56% SEMT (Jumbo) 12% CAFl (BPL Term) 24% 12.9 1.8 2.2 0.6 12.4 1.2 2.5 0.5 10.4 0.9 1.9 0.5 Q3'22 Q4'22 Q1'2316.3 4.8 3.2 4.8 43.6% 46.5% 30% 40% 50% 60% 70% 80% 90% 100% 2019 2021 2022 SLST (RPL) SEMT (Jumbo) - - - Represents LTV at Origination

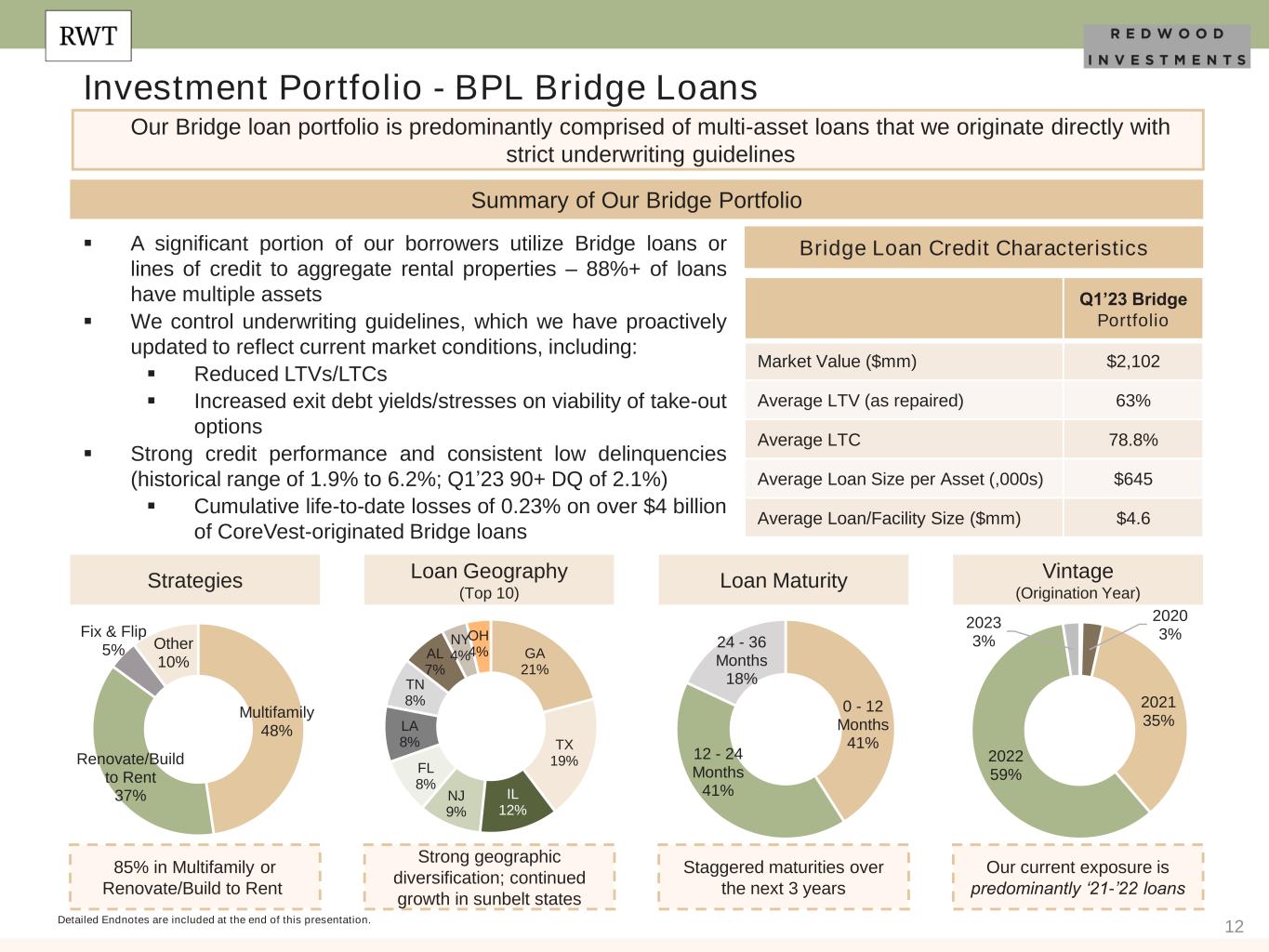

12 Investment Portfolio - BPL Bridge Loans Detailed Endnotes are included at the end of this presentation. Our Bridge loan portfolio is predominantly comprised of multi-asset loans that we originate directly with strict underwriting guidelines ▪ A significant portion of our borrowers utilize Bridge loans or lines of credit to aggregate rental properties – 88%+ of loans have multiple assets ▪ We control underwriting guidelines, which we have proactively updated to reflect current market conditions, including: ▪ Reduced LTVs/LTCs ▪ Increased exit debt yields/stresses on viability of take-out options ▪ Strong credit performance and consistent low delinquencies (historical range of 1.9% to 6.2%; Q1’23 90+ DQ of 2.1%) ▪ Cumulative life-to-date losses of 0.23% on over $4 billion of CoreVest-originated Bridge loans Vintage (Origination Year) Our current exposure is predominantly ‘21-’22 loans Loan Maturity Staggered maturities over the next 3 years Summary of Our Bridge Portfolio Bridge Loan Credit Characteristics Q1’23 Bridge Portfolio Market Value ($mm) $2,102 Average LTV (as repaired) 63% Average LTC 78.8% Average Loan Size per Asset (,000s) $645 Average Loan/Facility Size ($mm) $4.6 Strategies Loan Geography (Top 10) Strong geographic diversification; continued growth in sunbelt states 85% in Multifamily or Renovate/Build to Rent GA 21% TX 19% IL 12% NJ 9% FL 8% LA 8% TN 8% AL 7% NY 4% OH 4% 0 - 12 Months 41% 12 - 24 Months 41% 24 - 36 Months 18% 2020 3% 2021 35% 2022 59% 2023 3% Multifamily 48% Renovate/Build to Rent 37% Fix & Flip 5% Other 10%

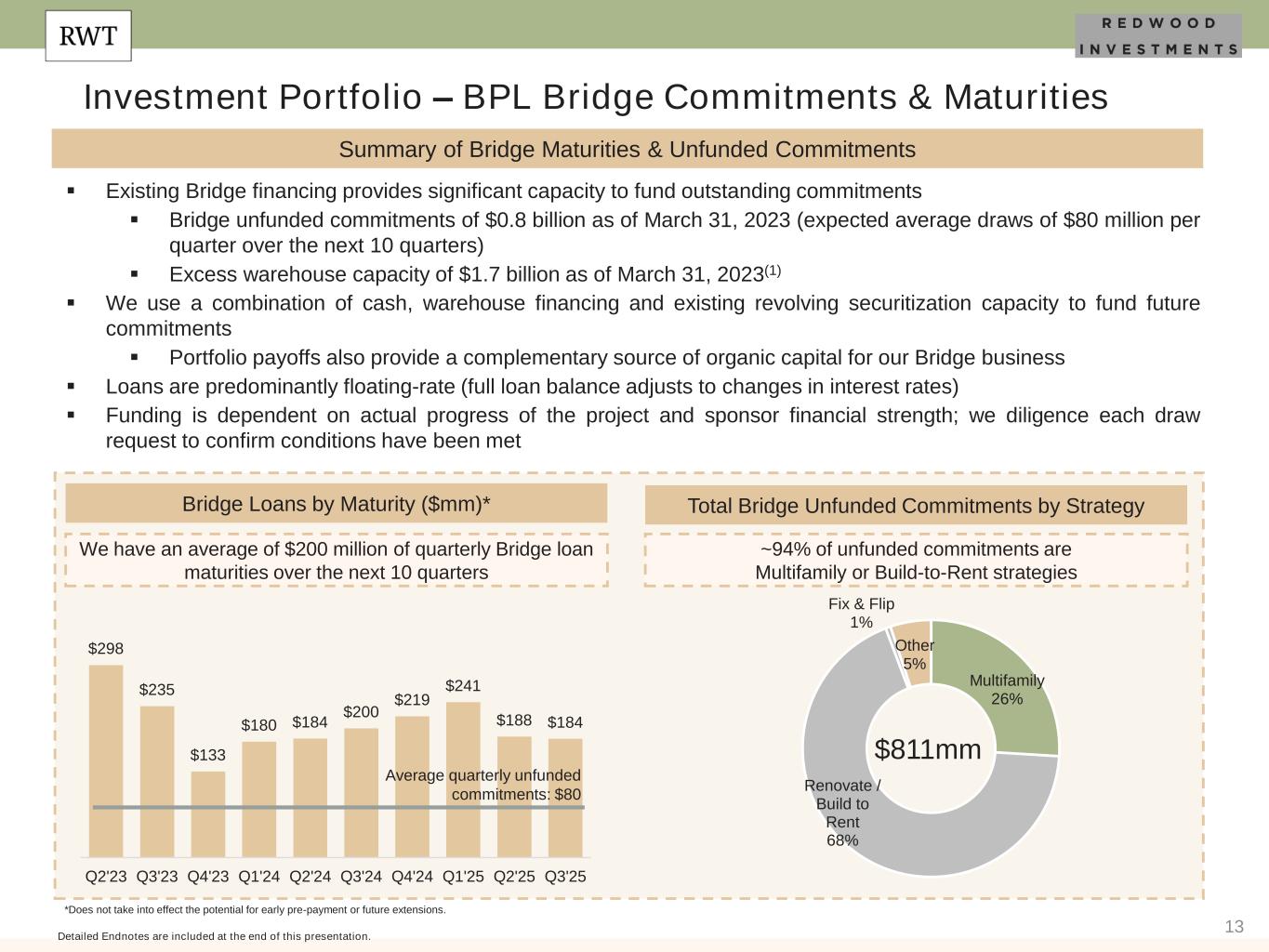

13 Investment Portfolio – BPL Bridge Commitments & Maturities Detailed Endnotes are included at the end of this presentation. Summary of Bridge Maturities & Unfunded Commitments ▪ Existing Bridge financing provides significant capacity to fund outstanding commitments ▪ Bridge unfunded commitments of $0.8 billion as of March 31, 2023 (expected average draws of $80 million per quarter over the next 10 quarters) ▪ Excess warehouse capacity of $1.7 billion as of March 31, 2023(1) ▪ We use a combination of cash, warehouse financing and existing revolving securitization capacity to fund future commitments ▪ Portfolio payoffs also provide a complementary source of organic capital for our Bridge business ▪ Loans are predominantly floating-rate (full loan balance adjusts to changes in interest rates) ▪ Funding is dependent on actual progress of the project and sponsor financial strength; we diligence each draw request to confirm conditions have been met Bridge Loans by Maturity ($mm)* We have an average of $200 million of quarterly Bridge loan maturities over the next 10 quarters *Does not take into effect the potential for early pre-payment or future extensions. Total Bridge Unfunded Commitments by Strategy ~94% of unfunded commitments are Multifamily or Build-to-Rent strategies $811mm $298 $235 $133 $180 $184 $200 $219 $241 $188 $184 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Average quarterly unfunded commitments: $80 Multifamily 26% Renovate / Build to Rent 68% Fix & Flip 1% Other 5%

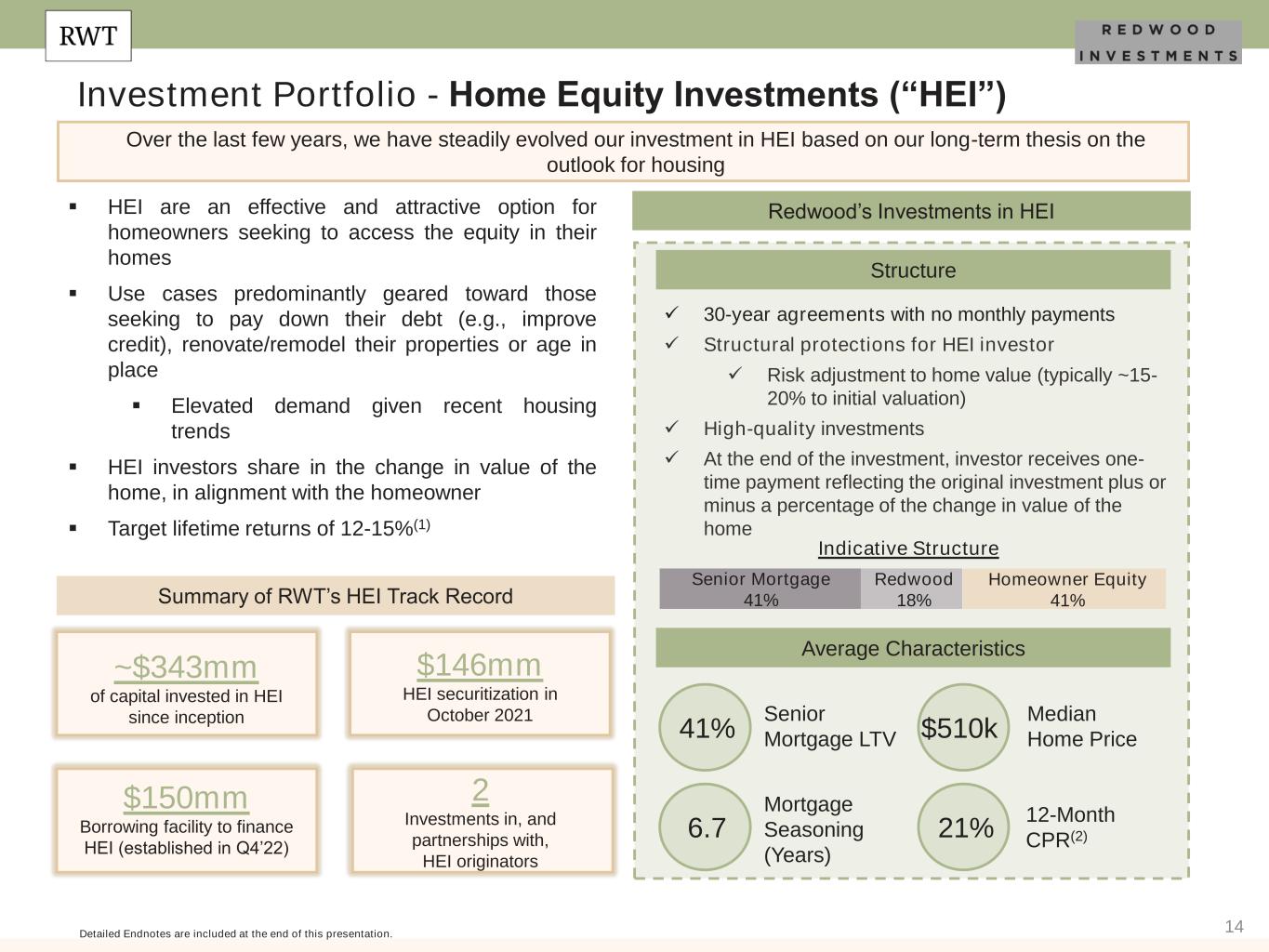

14 Investment Portfolio - Home Equity Investments (“HEI”) Over the last few years, we have steadily evolved our investment in HEI based on our long-term thesis on the outlook for housing Structure ▪ HEI are an effective and attractive option for homeowners seeking to access the equity in their homes ▪ Use cases predominantly geared toward those seeking to pay down their debt (e.g., improve credit), renovate/remodel their properties or age in place ▪ Elevated demand given recent housing trends ▪ HEI investors share in the change in value of the home, in alignment with the homeowner ▪ Target lifetime returns of 12-15%(1) Detailed Endnotes are included at the end of this presentation. Average Characteristics $146mm HEI securitization in October 2021 ✓ 30-year agreements with no monthly payments ✓ Structural protections for HEI investor ✓ Risk adjustment to home value (typically ~15- 20% to initial valuation) ✓ High-quality investments ✓ At the end of the investment, investor receives one- time payment reflecting the original investment plus or minus a percentage of the change in value of the home Summary of RWT’s HEI Track Record 2 Investments in, and partnerships with, HEI originators Redwood’s Investments in HEI 41% 6.7 $510k 21% Senior Mortgage LTV Mortgage Seasoning (Years) Median Home Price 12-Month CPR(2) Indicative Structure Senior Mortgage 41% Homeowner Equity 41% Redwood 18% ~$343mm of capital invested in HEI since inception $150mm Borrowing facility to finance HEI (established in Q4’22)

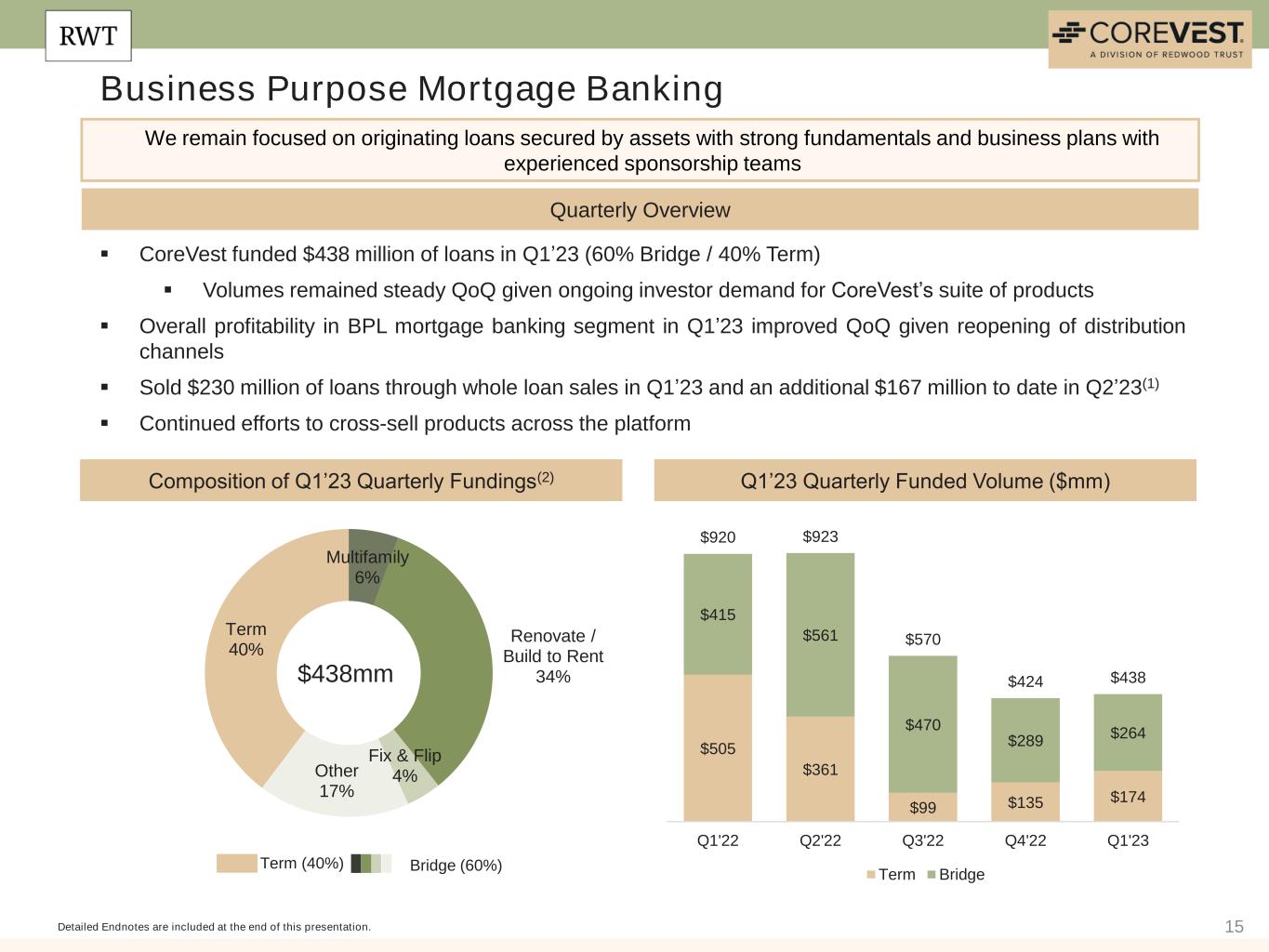

15 Business Purpose Mortgage Banking Quarterly Overview Composition of Q1’23 Quarterly Fundings(2) Detailed Endnotes are included at the end of this presentation. We remain focused on originating loans secured by assets with strong fundamentals and business plans with experienced sponsorship teams Q1’23 Quarterly Funded Volume ($mm) Term (40%) Bridge (60%) ▪ CoreVest funded $438 million of loans in Q1’23 (60% Bridge / 40% Term) ▪ Volumes remained steady QoQ given ongoing investor demand for CoreVest’s suite of products ▪ Overall profitability in BPL mortgage banking segment in Q1’23 improved QoQ given reopening of distribution channels ▪ Sold $230 million of loans through whole loan sales in Q1’23 and an additional $167 million to date in Q2’23(1) ▪ Continued efforts to cross-sell products across the platform $438mm $505 $361 $99 $135 $174 $415 $561 $470 $289 $264 $920 $923 $570 $424 $438 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Term Bridge Multifamily 6% Renovate / Build to Rent 34% Fix & Flip 4%Other 17% Term 40%

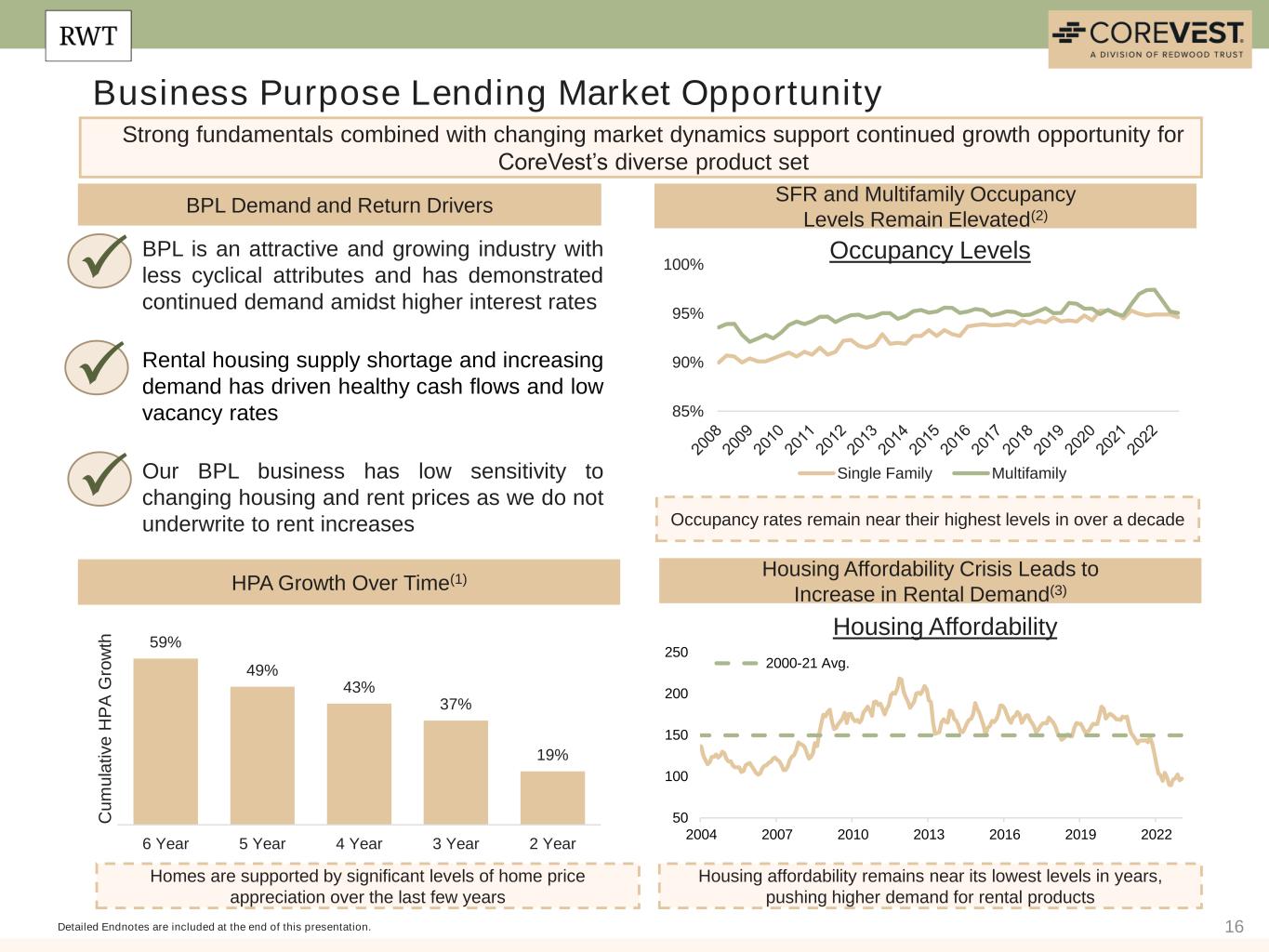

16 Business Purpose Lending Market Opportunity BPL Demand and Return Drivers Housing Affordability Crisis Leads to Increase in Rental Demand(3) Detailed Endnotes are included at the end of this presentation. Strong fundamentals combined with changing market dynamics support continued growth opportunity for CoreVest’s diverse product set SFR and Multifamily Occupancy Levels Remain Elevated(2) Occupancy rates remain near their highest levels in over a decade Housing affordability remains near its lowest levels in years, pushing higher demand for rental products Occupancy Levels Housing Affordability BPL is an attractive and growing industry with less cyclical attributes and has demonstrated continued demand amidst higher interest rates Rental housing supply shortage and increasing demand has driven healthy cash flows and low vacancy rates Our BPL business has low sensitivity to changing housing and rent prices as we do not underwrite to rent increases HPA Growth Over Time(1) P P P 50 100 150 200 250 2004 2007 2010 2013 2016 2019 2022 2000-21 Avg. 59% 49% 43% 37% 19% 6 Year 5 Year 4 Year 3 Year 2 Year C u m u la ti v e H P A G ro w th 85% 90% 95% 100% Single Family Multifamily Homes are supported by significant levels of home price appreciation over the last few years

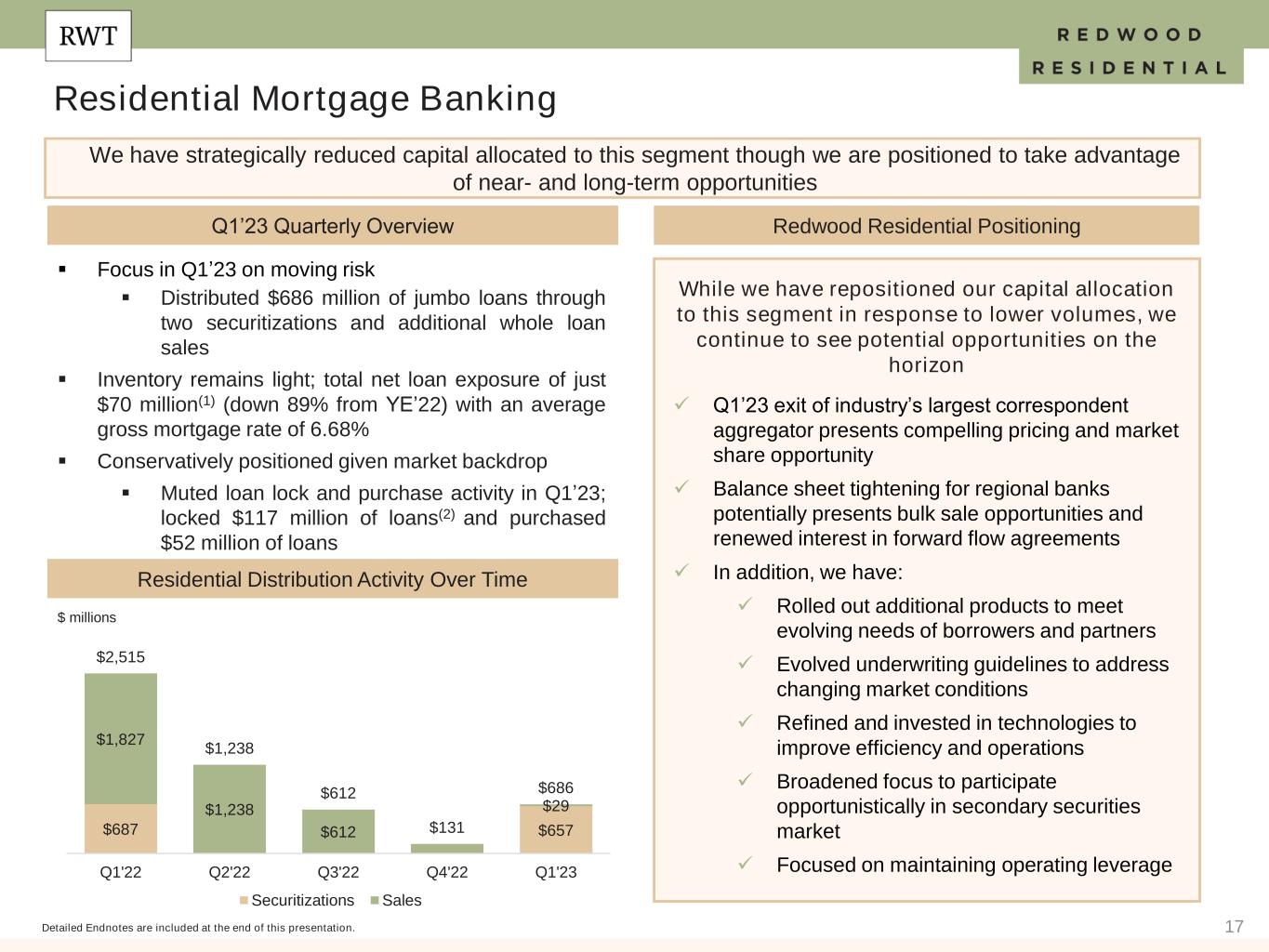

17 ▪ Focus in Q1’23 on moving risk ▪ Distributed $686 million of jumbo loans through two securitizations and additional whole loan sales ▪ Inventory remains light; total net loan exposure of just $70 million(1) (down 89% from YE’22) with an average gross mortgage rate of 6.68% ▪ Conservatively positioned given market backdrop ▪ Muted loan lock and purchase activity in Q1’23; locked $117 million of loans(2) and purchased $52 million of loans Residential Mortgage Banking Redwood Residential PositioningQ1’23 Quarterly Overview Detailed Endnotes are included at the end of this presentation. We have strategically reduced capital allocated to this segment though we are positioned to take advantage of near- and long-term opportunities While we have repositioned our capital allocation to this segment in response to lower volumes, we continue to see potential opportunities on the horizon $ millions $687 $657 $1,827 $1,238 $612 $29 $2,515 $1,238 $612 $131 $686 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Securitizations Sales Residential Distribution Activity Over Time ✓ Q1’23 exit of industry’s largest correspondent aggregator presents compelling pricing and market share opportunity ✓ Balance sheet tightening for regional banks potentially presents bulk sale opportunities and renewed interest in forward flow agreements ✓ In addition, we have: ✓ Rolled out additional products to meet evolving needs of borrowers and partners ✓ Evolved underwriting guidelines to address changing market conditions ✓ Refined and invested in technologies to improve efficiency and operations ✓ Broadened focus to participate opportunistically in secondary securities market ✓ Focused on maintaining operating leverage

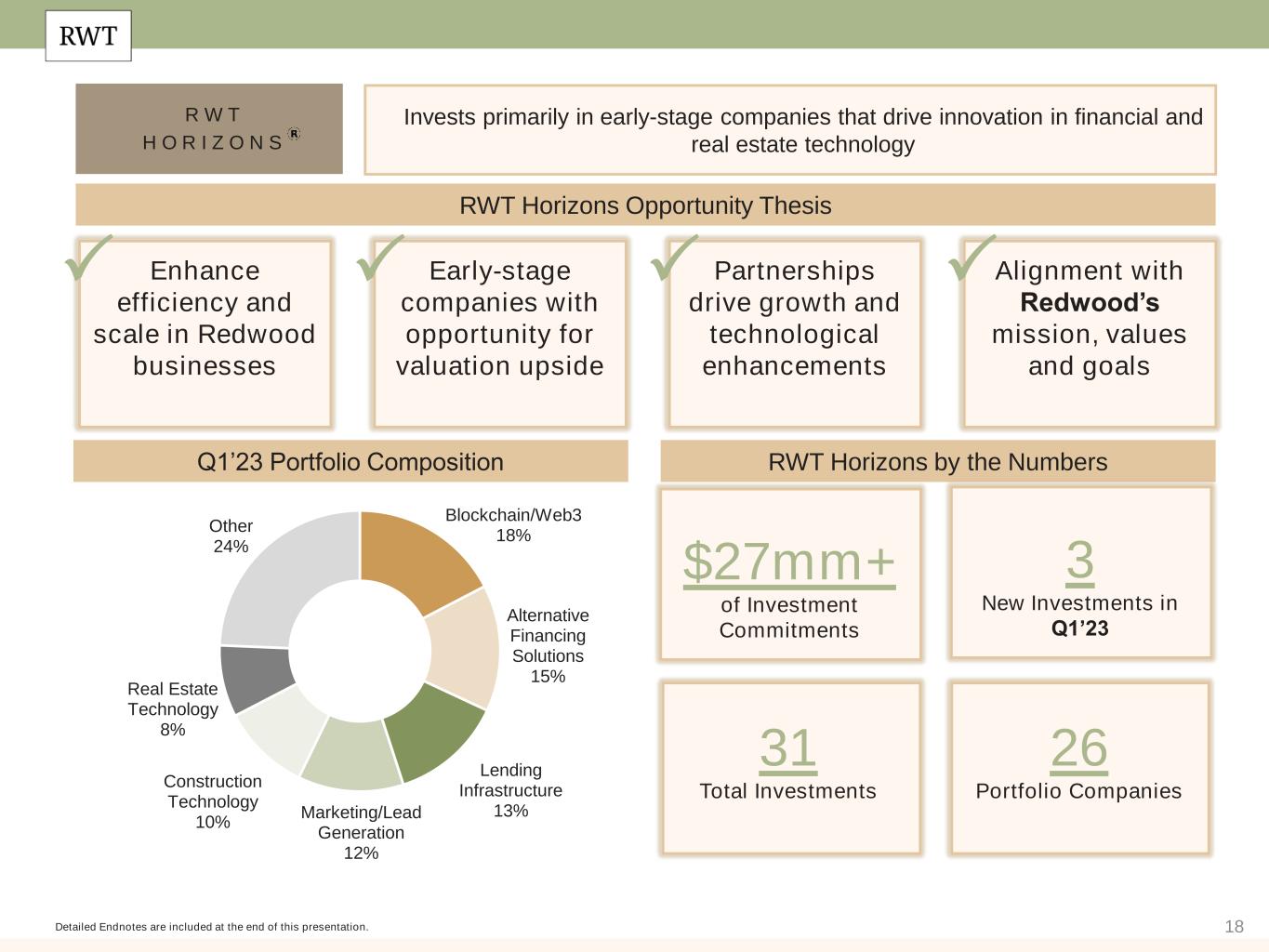

18 R W T H O R I Z O N S RWT Horizons by the Numbers Detailed Endnotes are included at the end of this presentation. Invests primarily in early-stage companies that drive innovation in financial and real estate technology RWT Horizons Opportunity Thesis Enhance efficiency and scale in Redwood businesses Early-stage companies with opportunity for valuation upside Partnerships drive growth and technological enhancements Alignment with Redwood’s mission, values and goals P P P P $27mm+ of Investment Commitments 31 Total Investments 26 Portfolio Companies Q1’23 Portfolio Composition 3 New Investments in Q1’23 Blockchain/Web3 18% Alternative Financing Solutions 15% Lending Infrastructure 13%Marketing/Lead Generation 12% Construction Technology 10% Real Estate Technology 8% Other 24%

19 Liquidity & Financing

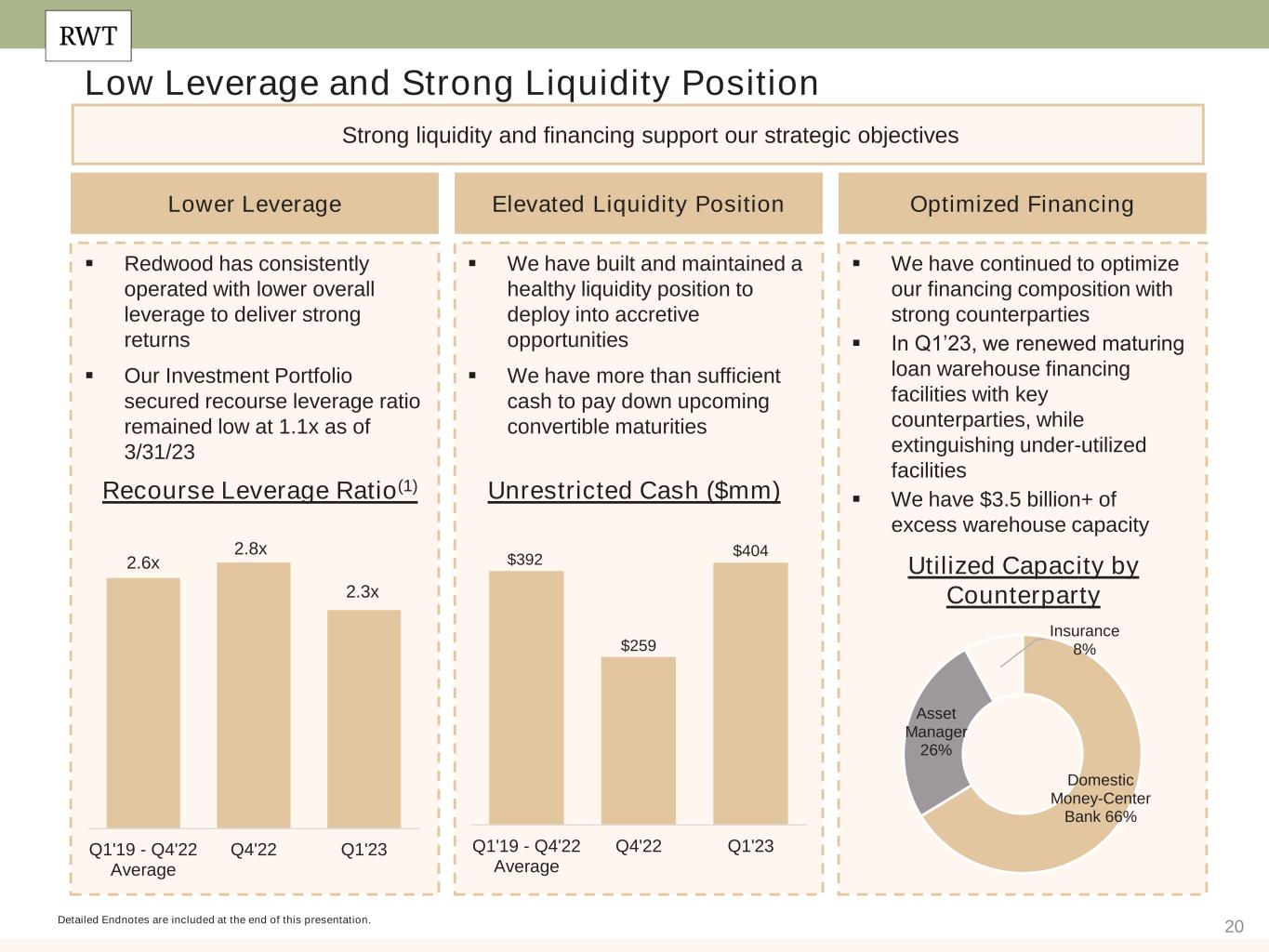

20 Low Leverage and Strong Liquidity Position Strong liquidity and financing support our strategic objectives Detailed Endnotes are included at the end of this presentation. Lower Leverage Optimized FinancingElevated Liquidity Position ▪ Redwood has consistently operated with lower overall leverage to deliver strong returns ▪ Our Investment Portfolio secured recourse leverage ratio remained low at 1.1x as of 3/31/23 ▪ We have built and maintained a healthy liquidity position to deploy into accretive opportunities ▪ We have more than sufficient cash to pay down upcoming convertible maturities ▪ We have continued to optimize our financing composition with strong counterparties ▪ In Q1’23, we renewed maturing loan warehouse financing facilities with key counterparties, while extinguishing under-utilized facilities ▪ We have $3.5 billion+ of excess warehouse capacity 2.6x 2.8x 2.3x Q1'19 - Q4'22 Average Q4'22 Q1'23 $392 $259 $404 Q1'19 - Q4'22 Average Q4'22 Q1'23 Utilized Capacity by Counterparty Domestic Money-Center Bank 66% Asset Manager 26% Insurance 8% Recourse Leverage Ratio(1) Unrestricted Cash ($mm)

21 Financial Results

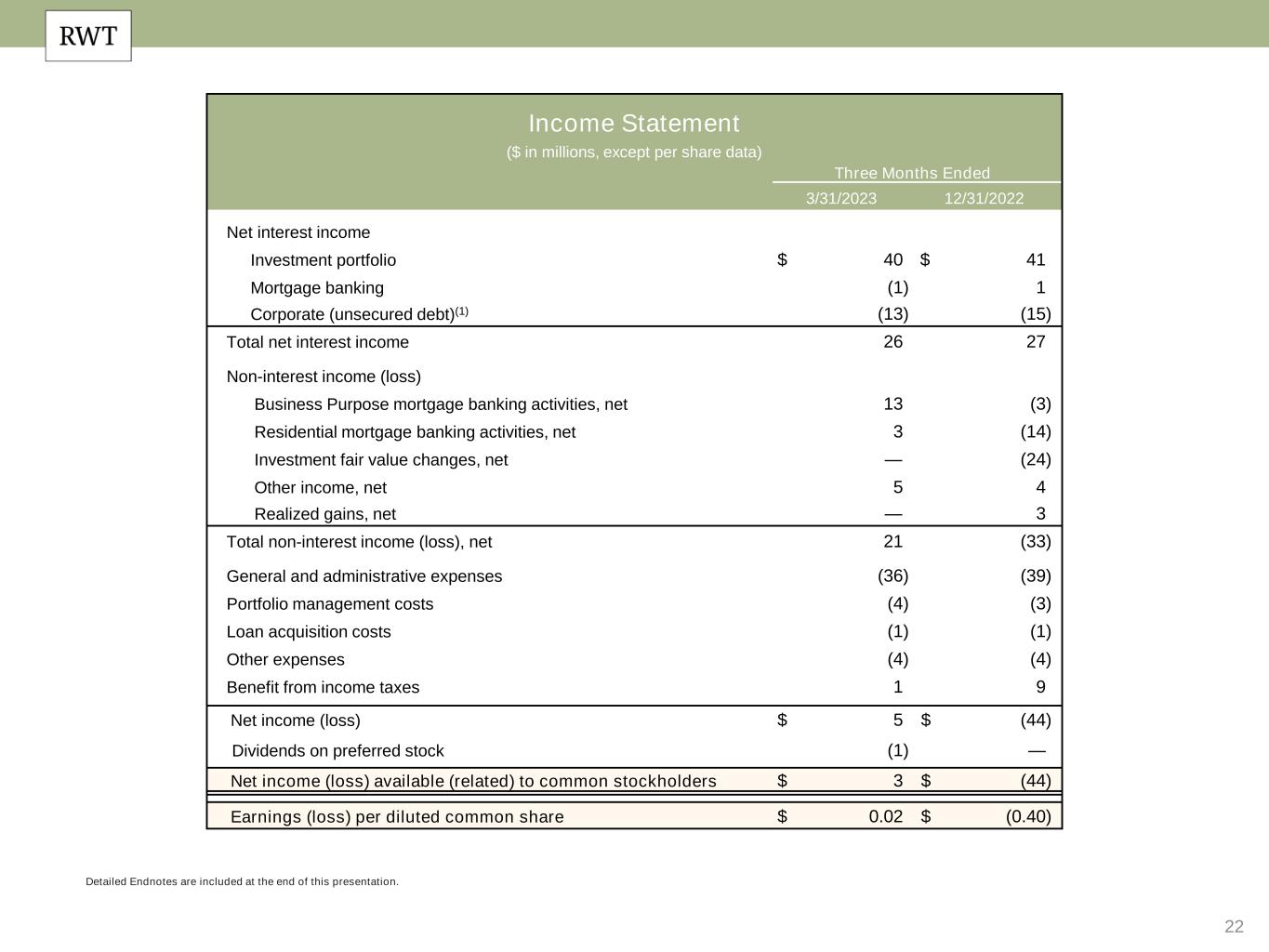

22 Detailed Endnotes are included at the end of this presentation. Income Statement ($ in millions, except per share data) Three Months Ended 3/31/2023 12/31/2022 Net interest income Investment portfolio $ 40 $ 41 Mortgage banking (1) 1 Corporate (unsecured debt)(1) (13) (15) Total net interest income 26 27 Non-interest income (loss) Business Purpose mortgage banking activities, net 13 (3) Residential mortgage banking activities, net 3 (14) Investment fair value changes, net — (24) Other income, net 5 4 Realized gains, net — 3 Total non-interest income (loss), net 21 (33) General and administrative expenses (36) (39) Portfolio management costs (4) (3) Loan acquisition costs (1) (1) Other expenses (4) (4) Benefit from income taxes 1 9 Net income (loss) $ 5 $ (44) Dividends on preferred stock (1) — Net income (loss) available (related) to common stockholders $ 3 $ (44) Earnings (loss) per diluted common share $ 0.02 $ (0.40)

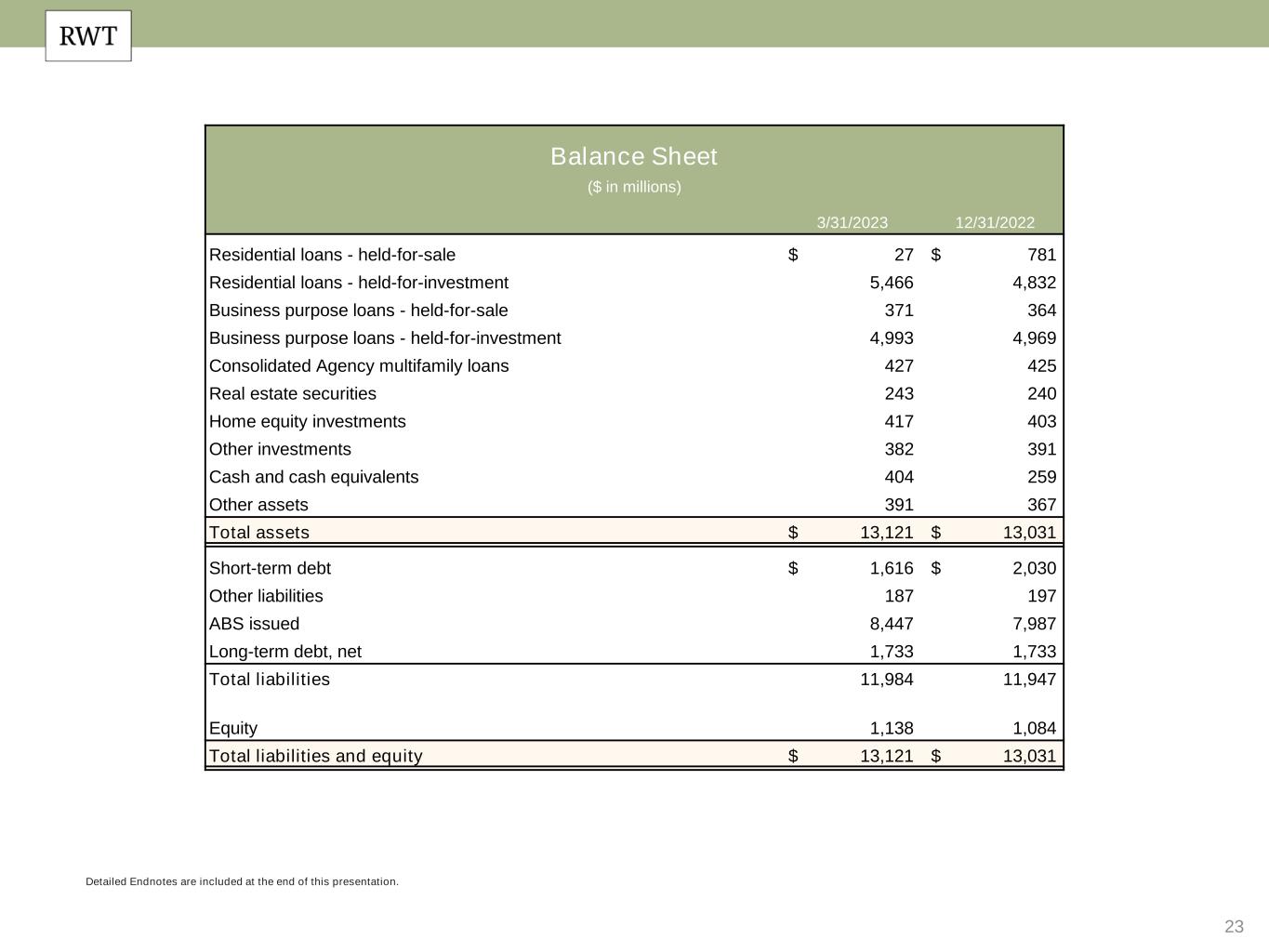

23 Detailed Endnotes are included at the end of this presentation. Balance Sheet ($ in millions) 3/31/2023 12/31/2022 Residential loans - held-for-sale $ 27 $ 781 Residential loans - held-for-investment 5,466 4,832 Business purpose loans - held-for-sale 371 364 Business purpose loans - held-for-investment 4,993 4,969 Consolidated Agency multifamily loans 427 425 Real estate securities 243 240 Home equity investments 417 403 Other investments 382 391 Cash and cash equivalents 404 259 Other assets 391 367 Total assets $ 13,121 $ 13,031 Short-term debt $ 1,616 $ 2,030 Other liabilities 187 197 ABS issued 8,447 7,987 Long-term debt, net 1,733 1,733 Total liabilities 11,984 11,947 Equity 1,138 1,084 Total liabilities and equity $ 13,121 $ 13,031

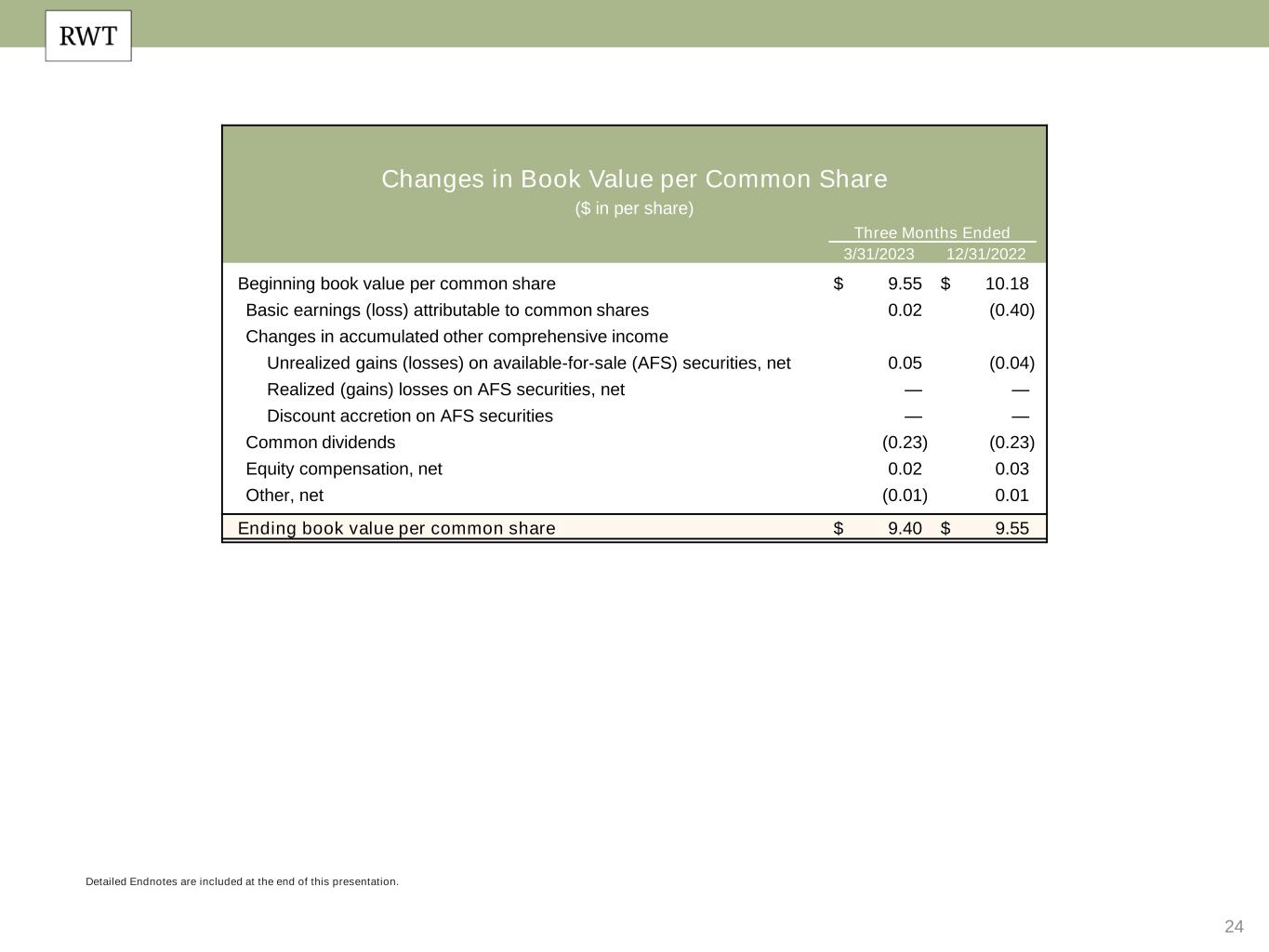

24 Detailed Endnotes are included at the end of this presentation. Changes in Book Value per Common Share ($ in per share) Three Months Ended 3/31/2023 12/31/2022 Beginning book value per common share $ 9.55 $ 10.18 Basic earnings (loss) attributable to common shares 0.02 (0.40) Changes in accumulated other comprehensive income Unrealized gains (losses) on available-for-sale (AFS) securities, net 0.05 (0.04) Realized (gains) losses on AFS securities, net — — Discount accretion on AFS securities — — Common dividends (0.23) (0.23) Equity compensation, net 0.02 0.03 Other, net (0.01) 0.01 Ending book value per common share $ 9.40 $ 9.55

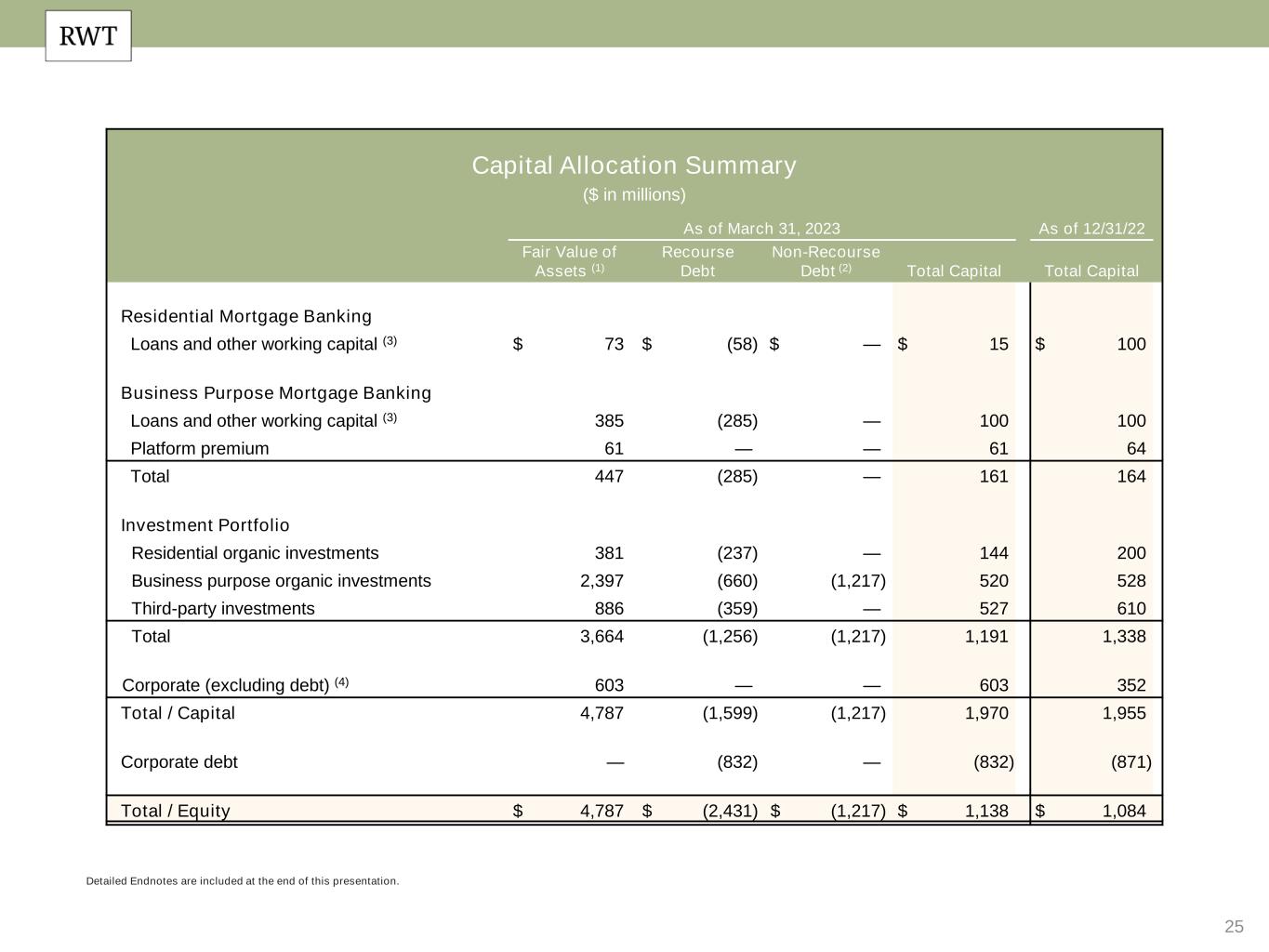

25 Detailed Endnotes are included at the end of this presentation. Capital Allocation Summary ($ in millions) As of March 31, 2023 As of 12/31/22 Fair Value of Assets (1) Recourse Debt Non-Recourse Debt (2) Total Capital Total Capital Residential Mortgage Banking Loans and other working capital (3) $ 73 $ (58) $ — $ 15 $ 100 Business Purpose Mortgage Banking Loans and other working capital (3) 385 (285) — 100 100 Platform premium 61 — — 61 64 Total 447 (285) — 161 164 Investment Portfolio Residential organic investments 381 (237) — 144 200 Business purpose organic investments 2,397 (660) (1,217) 520 528 Third-party investments 886 (359) — 527 610 Total 3,664 (1,256) (1,217) 1,191 1,338 Corporate (excluding debt) (4) 603 — — 603 352 Total / Capital 4,787 (1,599) (1,217) 1,970 1,955 Corporate debt — (832) — (832) (871) Total / Equity $ 4,787 $ (2,431) $ (1,217) $ 1,138 $ 1,084

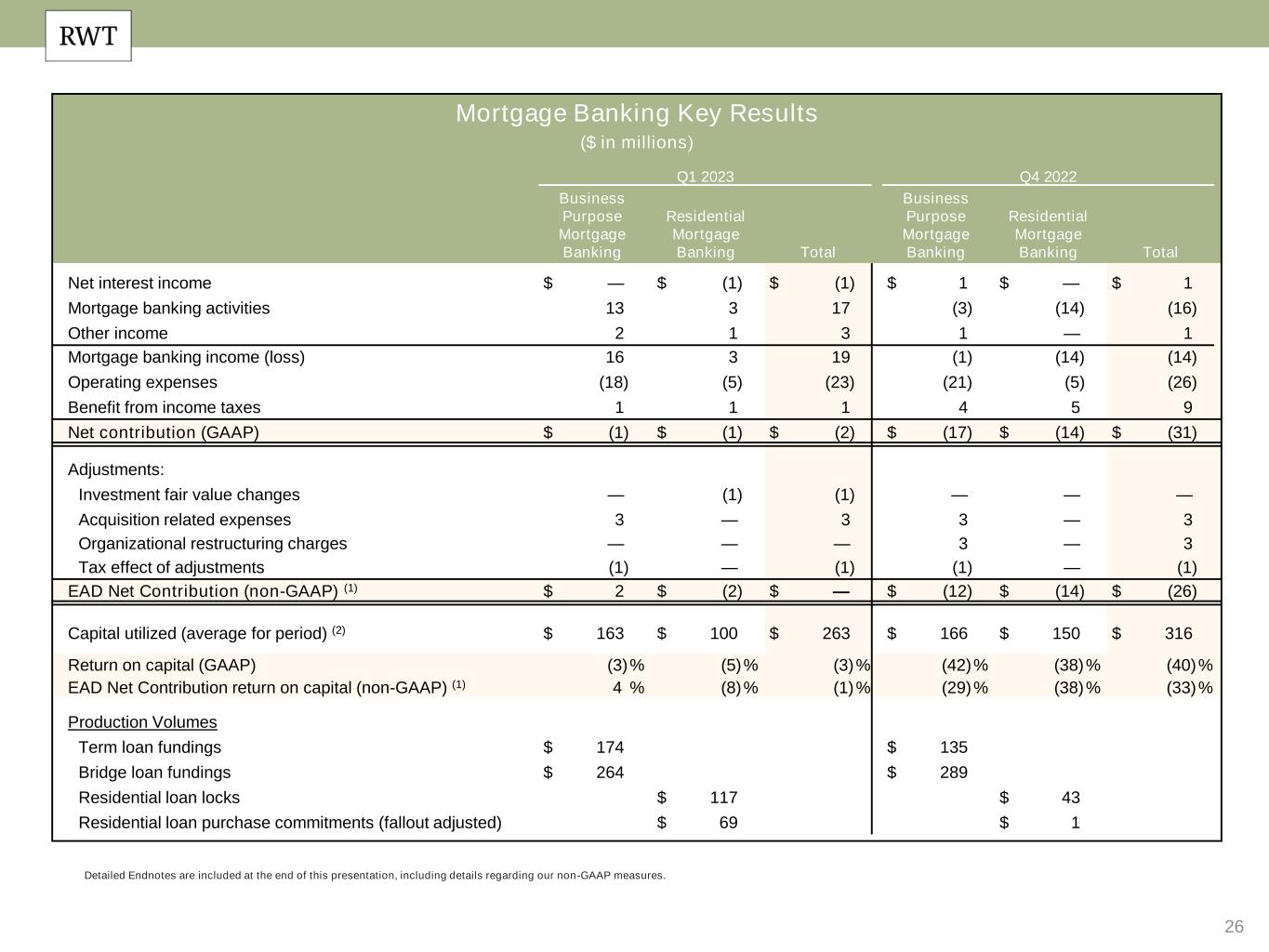

26 Detailed Endnotes are included at the end of this presentation, including details regarding our non-GAAP measures. Mortgage Banking Key Results ($ in millions) Q1 2023 Q4 2022 Business Purpose Mortgage Banking Residential Mortgage Banking Total Business Purpose Mortgage Banking Residential Mortgage Banking Total Net interest income $ — $ (1) $ (1) $ 1 $ — $ 1 Mortgage banking activities 13 3 17 (3) (14) (16) Other income 2 1 3 1 — 1 Mortgage banking income (loss) 16 3 19 (1) (14) (14) Operating expenses (18) (5) (23) (21) (5) (26) Benefit from income taxes 1 1 1 4 5 9 Net contribution (GAAP) $ (1) $ (1) $ (2) $ (17) $ (14) $ (31) Adjustments: Investment fair value changes — (1) (1) — — — Acquisition related expenses 3 — 3 3 — 3 Organizational restructuring charges — — — 3 — 3 Tax effect of adjustments (1) — (1) (1) — (1) EAD Net Contribution (non-GAAP) (1) $ 2 $ (2) $ — $ (12) $ (14) $ (26) Capital utilized (average for period) (2) $ 163 $ 100 $ 263 $ 166 $ 150 $ 316 Return on capital (GAAP) (3)% (5)% (3)% (42)% (38)% (40)% EAD Net Contribution return on capital (non-GAAP) (1) 4 % (8)% (1)% (29)% (38)% (33)% Production Volumes Term loan fundings $ 174 $ 135 Bridge loan fundings $ 264 $ 289 Residential loan locks $ 117 $ 43 Residential loan purchase commitments (fallout adjusted) $ 69 $ 1

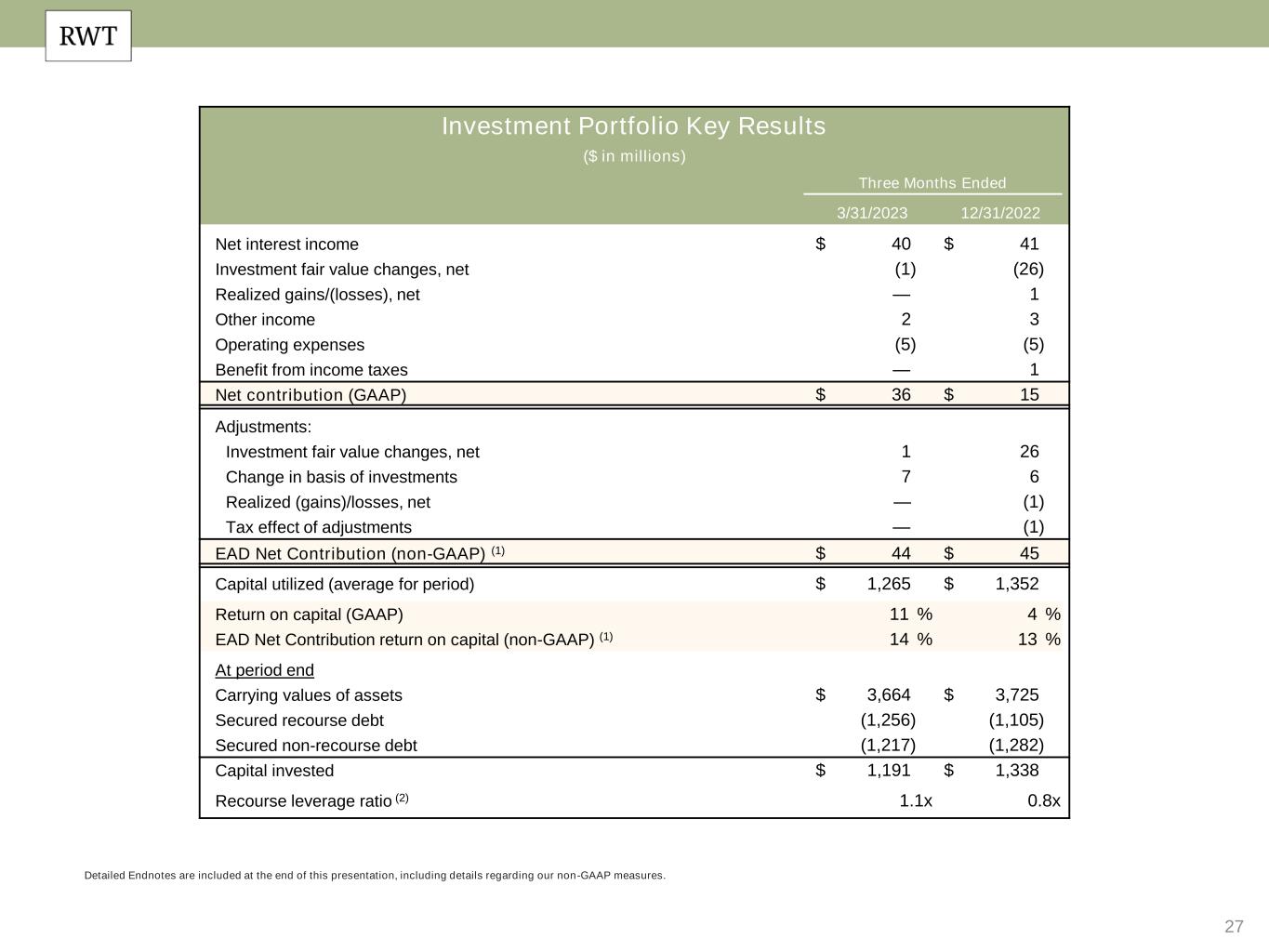

27 Detailed Endnotes are included at the end of this presentation, including details regarding our non-GAAP measures. Investment Portfolio Key Results ($ in millions) Three Months Ended 3/31/2023 12/31/2022 Net interest income $ 40 $ 41 Investment fair value changes, net (1) (26) Realized gains/(losses), net — 1 Other income 2 3 Operating expenses (5) (5) Benefit from income taxes — 1 Net contribution (GAAP) $ 36 $ 15 Adjustments: Investment fair value changes, net 1 26 Change in basis of investments 7 6 Realized (gains)/losses, net — (1) Tax effect of adjustments — (1) EAD Net Contribution (non-GAAP) (1) $ 44 $ 45 Capital utilized (average for period) $ 1,265 $ 1,352 Return on capital (GAAP) 11 % 4 % EAD Net Contribution return on capital (non-GAAP) (1) 14 % 13 % At period end Carrying values of assets $ 3,664 $ 3,725 Secured recourse debt (1,256) (1,105) Secured non-recourse debt (1,217) (1,282) Capital invested $ 1,191 $ 1,338 Recourse leverage ratio (2) 1.1x 0.8x

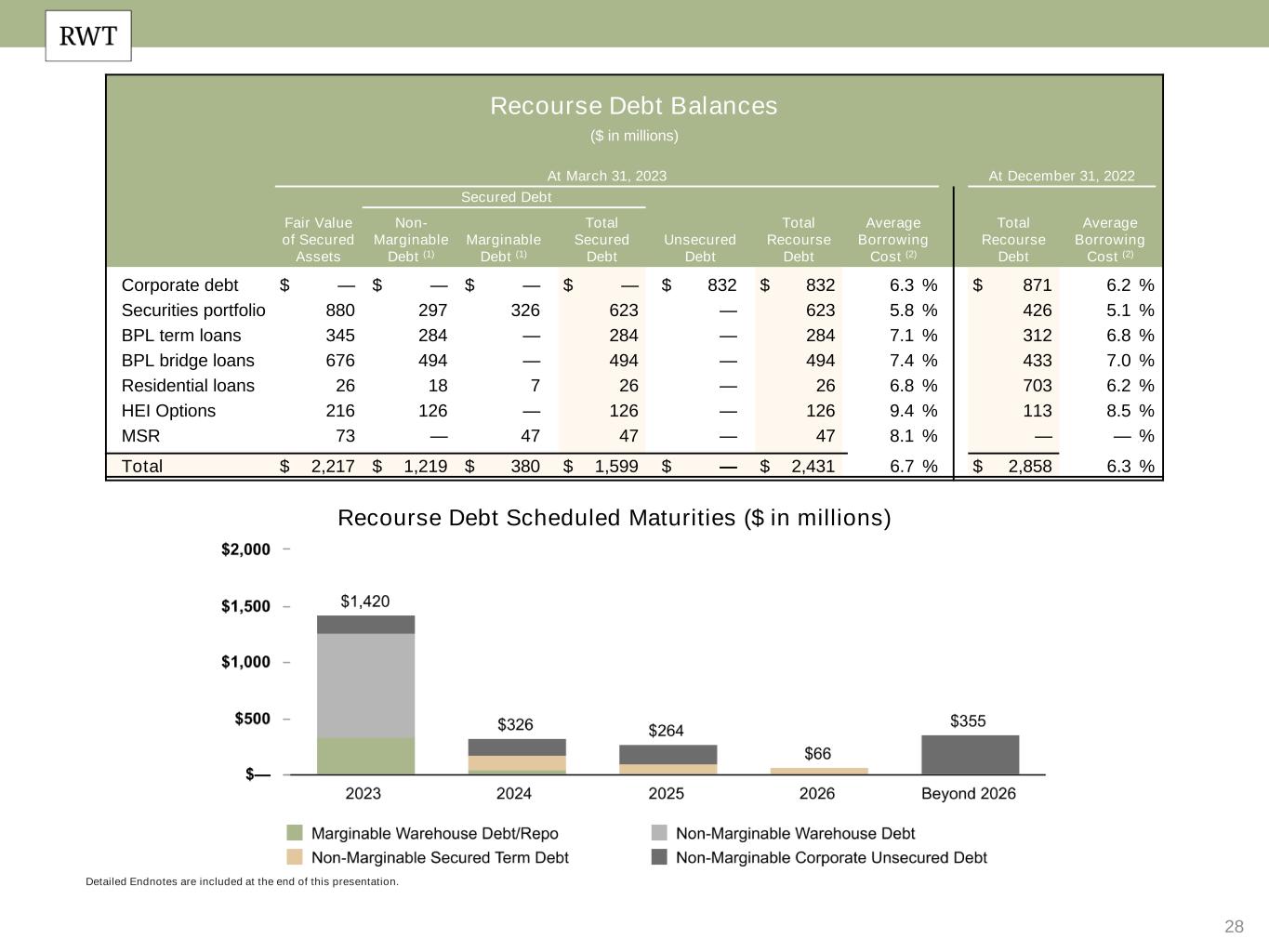

28 Detailed Endnotes are included at the end of this presentation. Recourse Debt Scheduled Maturities ($ in millions) Recourse Debt Balances ($ in millions) At March 31, 2023 At December 31, 2022 Secured Debt Fair Value of Secured Assets Non- Marginable Debt (1) Marginable Debt (1) Total Secured Debt Unsecured Debt Total Recourse Debt Average Borrowing Cost (2) Total Recourse Debt Average Borrowing Cost (2) Corporate debt $ — $ — $ — $ — $ 832 $ 832 6.3 % $ 871 6.2 % Securities portfolio 880 297 326 623 — 623 5.8 % 426 5.1 % BPL term loans 345 284 — 284 — 284 7.1 % 312 6.8 % BPL bridge loans 676 494 — 494 — 494 7.4 % 433 7.0 % Residential loans 26 18 7 26 — 26 6.8 % 703 6.2 % HEI Options 216 126 — 126 — 126 9.4 % 113 8.5 % MSR 73 — 47 47 — 47 8.1 % — — % Total $ 2,217 $ 1,219 $ 380 $ 1,599 $ — $ 2,431 6.7 % $ 2,858 6.3 %

29 Endnotes

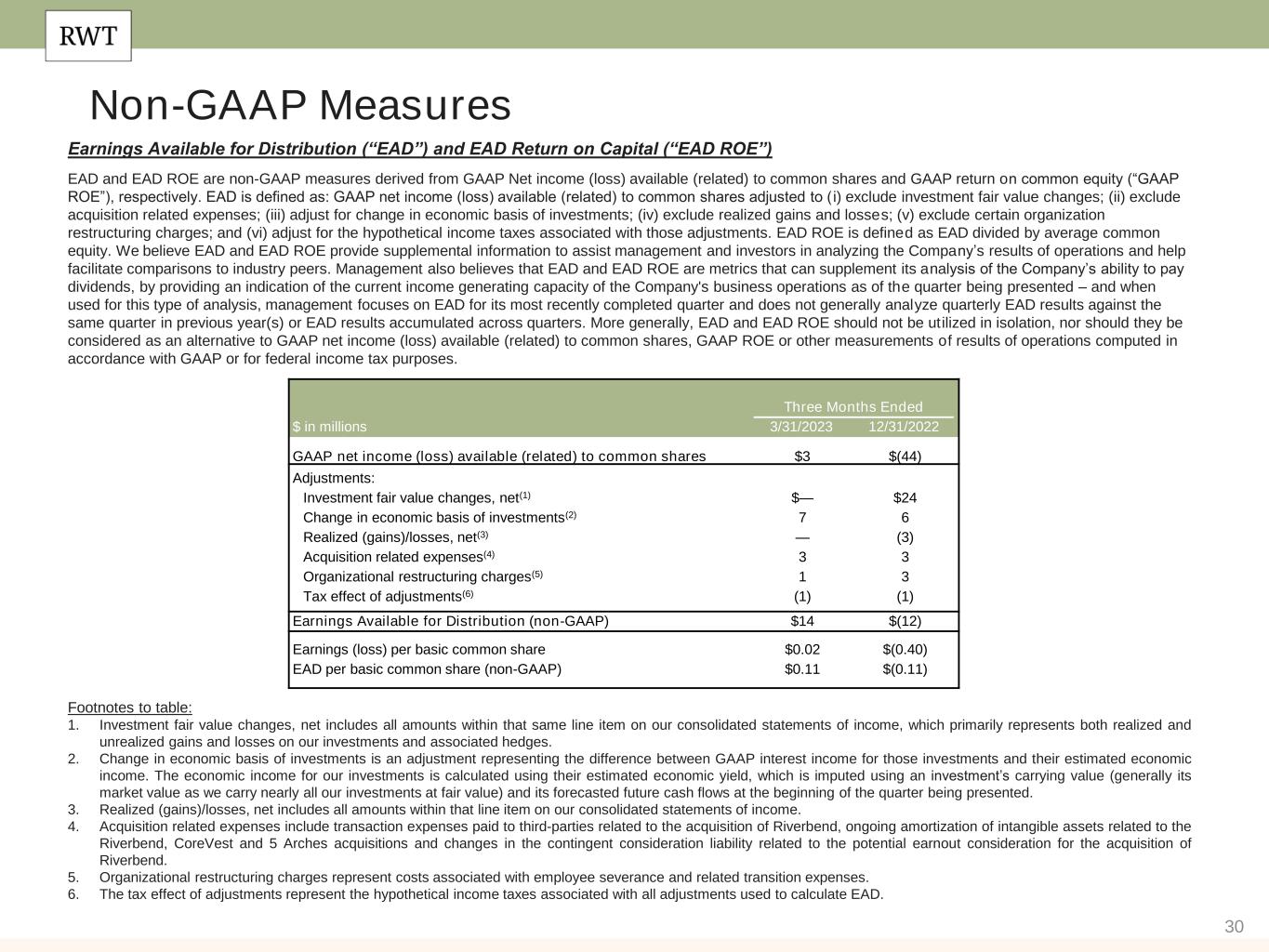

30 Non-GAAP Measures Earnings Available for Distribution (“EAD”) and EAD Return on Capital (“EAD ROE”) EAD and EAD ROE are non-GAAP measures derived from GAAP Net income (loss) available (related) to common shares and GAAP return on common equity (“GAAP ROE”), respectively. EAD is defined as: GAAP net income (loss) available (related) to common shares adjusted to ( i) exclude investment fair value changes; (ii) exclude acquisition related expenses; (iii) adjust for change in economic basis of investments; (iv) exclude realized gains and losses; (v) exclude certain organization restructuring charges; and (vi) adjust for the hypothetical income taxes associated with those adjustments. EAD ROE is defined as EAD divided by average common equity. We believe EAD and EAD ROE provide supplemental information to assist management and investors in analyzing the Company’s results of operations and help facilitate comparisons to industry peers. Management also believes that EAD and EAD ROE are metrics that can supplement its analysis of the Company’s ability to pay dividends, by providing an indication of the current income generating capacity of the Company's business operations as of the quarter being presented – and when used for this type of analysis, management focuses on EAD for its most recently completed quarter and does not generally analyze quarterly EAD results against the same quarter in previous year(s) or EAD results accumulated across quarters. More generally, EAD and EAD ROE should not be utilized in isolation, nor should they be considered as an alternative to GAAP net income (loss) available (related) to common shares, GAAP ROE or other measurements of results of operations computed in accordance with GAAP or for federal income tax purposes. Footnotes to table: 1. Investment fair value changes, net includes all amounts within that same line item on our consolidated statements of income, which primarily represents both realized and unrealized gains and losses on our investments and associated hedges. 2. Change in economic basis of investments is an adjustment representing the difference between GAAP interest income for those investments and their estimated economic income. The economic income for our investments is calculated using their estimated economic yield, which is imputed using an investment’s carrying value (generally its market value as we carry nearly all our investments at fair value) and its forecasted future cash flows at the beginning of the quarter being presented. 3. Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of income. 4. Acquisition related expenses include transaction expenses paid to third-parties related to the acquisition of Riverbend, ongoing amortization of intangible assets related to the Riverbend, CoreVest and 5 Arches acquisitions and changes in the contingent consideration liability related to the potential earnout consideration for the acquisition of Riverbend. 5. Organizational restructuring charges represent costs associated with employee severance and related transition expenses. 6. The tax effect of adjustments represent the hypothetical income taxes associated with all adjustments used to calculate EAD. Three Months Ended $ in millions 3/31/2023 12/31/2022 GAAP net income (loss) available (related) to common shares $3 $(44) Adjustments: Investment fair value changes, net(1) $— $24 Change in economic basis of investments(2) 7 6 Realized (gains)/losses, net(3) — (3) Acquisition related expenses(4) 3 3 Organizational restructuring charges(5) 1 3 Tax effect of adjustments(6) (1) (1) Earnings Available for Distribution (non-GAAP) $14 $(12) Earnings (loss) per basic common share $0.02 $(0.40) EAD per basic common share (non-GAAP) $0.11 $(0.11)

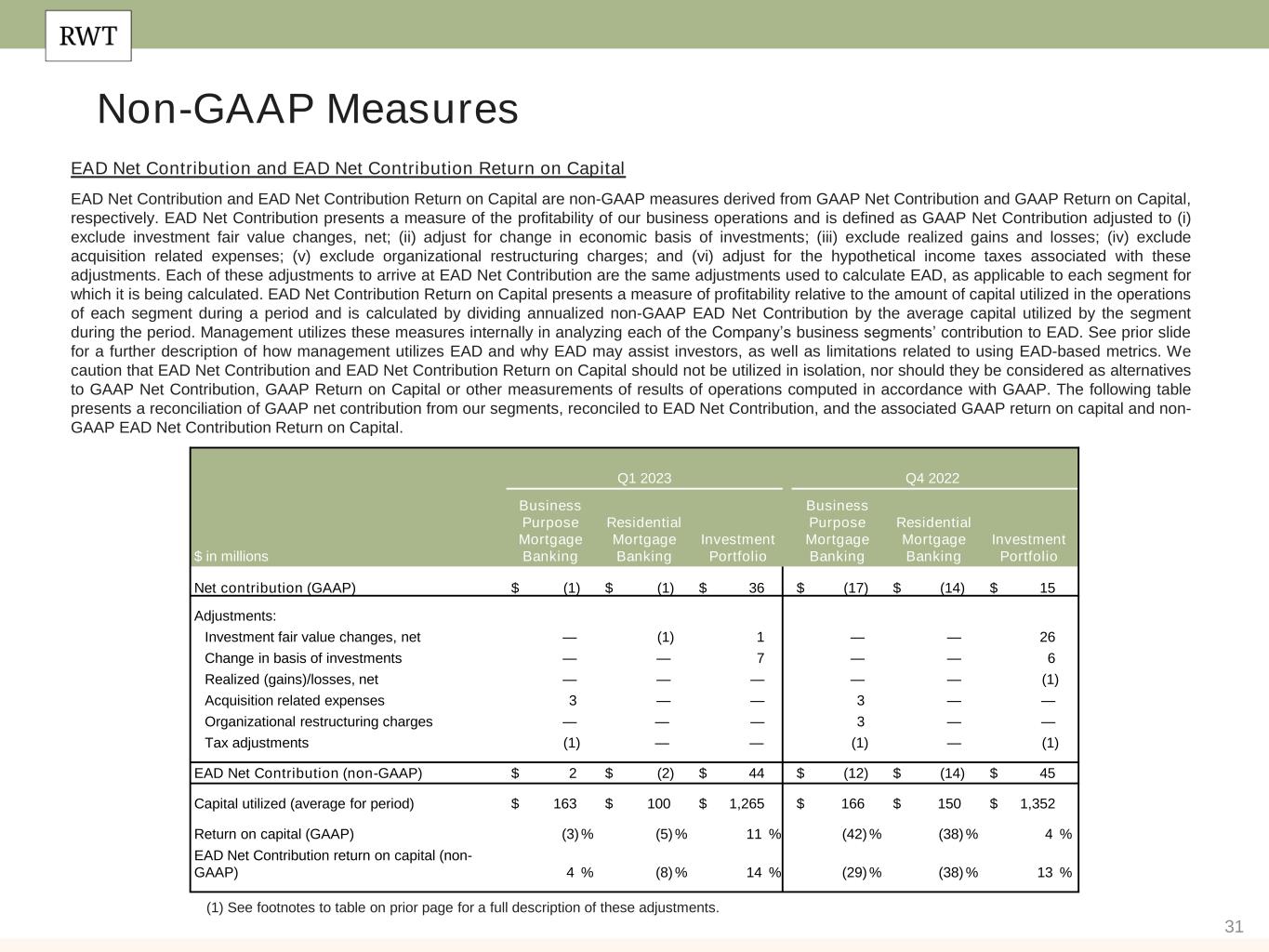

31 Non-GAAP Measures EAD Net Contribution and EAD Net Contribution Return on Capital EAD Net Contribution and EAD Net Contribution Return on Capital are non-GAAP measures derived from GAAP Net Contribution and GAAP Return on Capital, respectively. EAD Net Contribution presents a measure of the profitability of our business operations and is defined as GAAP Net Contribution adjusted to (i) exclude investment fair value changes, net; (ii) adjust for change in economic basis of investments; (iii) exclude realized gains and losses; (iv) exclude acquisition related expenses; (v) exclude organizational restructuring charges; and (vi) adjust for the hypothetical income taxes associated with these adjustments. Each of these adjustments to arrive at EAD Net Contribution are the same adjustments used to calculate EAD, as applicable to each segment for which it is being calculated. EAD Net Contribution Return on Capital presents a measure of profitability relative to the amount of capital utilized in the operations of each segment during a period and is calculated by dividing annualized non-GAAP EAD Net Contribution by the average capital utilized by the segment during the period. Management utilizes these measures internally in analyzing each of the Company’s business segments’ contribution to EAD. See prior slide for a further description of how management utilizes EAD and why EAD may assist investors, as well as limitations related to using EAD-based metrics. We caution that EAD Net Contribution and EAD Net Contribution Return on Capital should not be utilized in isolation, nor should they be considered as alternatives to GAAP Net Contribution, GAAP Return on Capital or other measurements of results of operations computed in accordance with GAAP. The following table presents a reconciliation of GAAP net contribution from our segments, reconciled to EAD Net Contribution, and the associated GAAP return on capital and non- GAAP EAD Net Contribution Return on Capital. (1) See footnotes to table on prior page for a full description of these adjustments. Q1 2023 Q4 2022 $ in millions Business Purpose Mortgage Banking Residential Mortgage Banking Investment Portfolio Business Purpose Mortgage Banking Residential Mortgage Banking Investment Portfolio Net contribution (GAAP) $ (1) $ (1) $ 36 $ (17) $ (14) $ 15 Adjustments: Investment fair value changes, net — (1) 1 — — 26 Change in basis of investments — — 7 — — 6 Realized (gains)/losses, net — — — — — (1) Acquisition related expenses 3 — — 3 — — Organizational restructuring charges — — — 3 — — Tax adjustments (1) — — (1) — (1) EAD Net Contribution (non-GAAP) $ 2 $ (2) $ 44 $ (12) $ (14) $ 45 Capital utilized (average for period) $ 163 $ 100 $ 1,265 $ 166 $ 150 $ 1,352 Return on capital (GAAP) (3) % (5) % 11 % (42) % (38) % 4 % EAD Net Contribution return on capital (non- GAAP) 4 % (8) % 14 % (29) % (38) % 13 %

32 Slide 4 (Redwood Operates Across Three Complementary Business Lines) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. Allocated capital includes working capital and platform premium for mortgage banking operations and all investments net of associated debt for investment portfolio. Note, capital allocation excludes corporate capital and RWT Horizons. Further detail on the components of allocated capital is included in the Financial Results section of this presentation. 2. Annualized Addressable Market Opportunity. Residential Mortgage Banking represents Q4’22 volumes of Jumbo origination annualized (Source: Inside Nonconforming Markets as of March 2023). Business Purpose Mortgage Banking based on combined opportunity for SFR and Multifamily Rental. SFR based on March 2023 data and potential financing opportunity for SFR of $120 billion over 3-4 years (Source: John Burns Real Estate Consulting, LLC and internal Company estimates). Multifamily based on Freddie Mac 2023 multifamily origination estimate of $400 billion and applying the estimated percentage from latest available FNMA data for origination by non-traditional multifamily lenders. Investment Portfolio represents estimated investment opportunities across private label securities (“PLS”) subordinate securities, Credit Risk Transfer (“CRT”), HEI, Multifamily, Non-QM, NPL/RPL, Bridge and CAFL® SFR investments (Source: internal Company estimates). Endnotes Slide 5 (Q1’23 Financial Performance) Source: Company financial data as of March 31, 2023 unless otherwise noted. Market data per Bloomberg as of March 31, 2023. 1. Earnings Available for Distribution (“EAD”) is a non-GAAP measure. See slide in the Endnotes section of this presentation for additional information and reconciliation to GAAP net income. 2. Total economic return is based on the periodic change in GAAP book value per common share plus dividends declared per common share during the period, divided by beginning period GAAP book value per common share. 3. Indicative dividend yield based on RWT closing stock price of $6.74 on March 31, 2023. 4. Allocated capital includes working capital and platform premium for mortgage banking operations and all investments net of associated debt for investment portfolio. Capital allocation excludes corporate capital and RWT Horizons. Further detail on the components of allocated capital is included in the Financial Results section of this presentation. 5. EAD ROE is a non-GAAP metric. Please refer to Non-GAAP Measures in the Endnotes section of this presentation for additional information. 6. Recourse leverage ratio is defined as recourse debt at Redwood exclusive of other liabilities, divided by tangible stockholders' equity. Recourse debt excludes $9.4 billion of consolidated securitization debt (ABS issued and servicer advance financing) and other debt that is non-recourse to Redwood, and tangible stockholders' equity excludes $61 million of goodwill and intangible assets.

33 Endnotes Slide 6 (Q1’23 Business Performance) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. Non-marginable debt and marginable debt refer to whether such debt is subject to margin calls based solely on the lender’s determination in its discretion of the market value of underlying collateral that is non- delinquent. Non-marginable debt may be subject to a margin call due to delinquency or another credit event related to the mortgage or security being financed, a decline in the value of the underlying asset securing the collateral, an extended dwell time (i.e., period of time financed using a particular financing facility) for certain types of loans, or a change in the interest rate of a specified reference security relative to a base interest rate amount, among other reasons. 2. Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process. 3. Total net loan exposure represents the sum of $28 million of loans held on balance sheet and $47 million of loans identified for purchase (locked loans not yet purchased), less $4 million of loans subject to forward sale commitments, each at March 31, 2023. 4. Includes Q2’23 activity through April 26, 2023. 5. Sale expected to close by end of April 2023. Slide 7 (Calibrated for the Current Environment) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. Allocated capital includes working capital and platform premium for mortgage banking operations and all investments net of associated debt for investment portfolio. Capital allocation excludes corporate capital and RWT Horizons. Further detail on the components of allocated capital is included in the Financial Results section of this presentation. Slide 8 (Potential Impacts from Disruptions at Regional Banks) 1. Represents management’s views and actual results may vary materially. 2. Source: John Burns Real Estate Consulting, LLC. Data subject to revisions. 3. Source: “Residential Jumbo” represents FY’22 jumbo production volume from Top 50 Jumbo Producers per Inside Non-Conforming Markets. “BPL” represents estimated FY’22 multifamily volumes and includes data from Fannie Mae and John Burns Real Estate Consulting, LLC. “Regional Banks” defined as banks with $25 billion to $250 billion in assets. Slide 10 (Investment Portfolio) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. The projected forward economic yield is calculated using March 31, 2023 market values of the assets and associated financing in our investment portfolio and management’s projection of future cash flows from these investments. Projections are based on management’s expectations and calculations and actual results may vary materially. 2. Figures reflect our investments held in our Investment Portfolio on balance sheet and our economic interests in securities we own in securitizations we consolidate in accordance with GAAP (and excludes the assets within these consolidated securitizations that appear on our balance sheet) as of March 31, 2023. 3. $237 million of “Multifamily, CRT, and Other” includes $45 million net investment of multifamily securities, $67 million of CRT, $26 million of third-party securities, and $99 million of other investments. Slide 11 (Potential Book Value Per Share Upside Driven by Underlying Asset Strength) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. Represents potential book value per share upside on our securities portfolio due to the net discount to par value, net of portfolio hedges. There are several factors that may impact our ability to realize all, or a portion, of this amount which may be outside our control, including credit performance and prepayment speeds. Actual realized book value returns may differ materially. 2. Source: Bloomberg (HPI LTV (Amort) %), Home Price Indexed Amortized Loan to Value. 3. Represents the market value of subordinate securities at March 31, 2023 divided by the outstanding principal balance at March 31, 2023 as a dollar price per $100 par value.

34 Endnotes Slide 12 (Investment Portfolio - BPL Bridge Loans) Source: Company financial data as of March 31, 2023 unless otherwise noted. Note: Pie charts include all CoreVest-originated bridge loans as well as those purchased from third parties. Composition percentages are based on unpaid principal balance. Slide 13 (Investment Portfolio – BPL Bridge Commitment and Maturities) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. Investment Portfolio and Business Purpose Mortgage Banking unused capacity is a common amount given that certain financing may be shared across these segments. Slide 14 (Investment Portfolio - Home Equity Investments (“HEI”)) Source: Company financial data as of March 31, 2023. 1. Target lifetime returns represent blended returns based on leverage assumptions and are based on management’s expectations and calculations. Actual results may vary materially. 2. Based on underlying HEI population from October 2021 Redwood HEI securitization. Slide 15 (Business Purpose Mortgage Banking) Source: Company financial data as of March 31, 2023. 1. Includes Q2’23 activity through April 26, 2023. Sale expected to close by end of April 2023. 2. Composition percentages are based on unpaid principal balance. Slide 16 (Business Purpose Lending Market Opportunity) Source: Company financial data as March 31, 2023. 1. Source: John Burns Real Estate Consulting, LLC. Data subject to revisions. 2. Source: John Burns Real Estate Consulting, LLC; US Census. Data subject to revisions. Data through December 31, 2022. 3. Source: National Association of Realtors, Bloomberg, Piper Sandler. Slide 17 (Residential Mortgage Banking) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. Total net loan exposure represents the sum of $28 million of loans held on balance sheet and $47 million of loans identified for purchase (locked loans not yet purchased), less $4 million of loans subject to forward sale commitments, each at March 31, 2023. 2. Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process. Slide 18 (RWT Horizons) Source: Company financial data as of March 31, 2023 unless otherwise noted. Slide 20 (Low Leverage and Strong Liquidity Position) Source: Company financial data as of March 31, 2023 unless otherwise noted. 1. Recourse leverage ratio is defined as recourse debt at Redwood exclusive of other liabilities, divided by tangible stockholders' equity. Recourse debt excludes $9.4 billion of consolidated securitization debt (ABS issued and servicer advance financing) and other debt that is non-recourse to Redwood, and tangible stockholders' equity excludes $61 million of goodwill and intangible assets. Slide 22 (Appendix: Income Statement) 1. Net interest expense from “Corporate (unsecured debt)” consists primarily of interest expense on corporate unsecured debt as well as net interest income from Legacy Sequoia consolidated VIEs.

35 Endnotes Slide 25 (Appendix: Capital Allocation Summary) 1. Amounts of assets in our Investment Portfolio, as presented in this table, represent our economic interests (including our economic interests in consolidated VIEs) and do not present the assets within VIEs that we consolidate under GAAP. See our GAAP to Economic Balance Sheet in the Supplemental Financial Tables available on our website for additional information on consolidated VIEs. 2. Non-recourse debt presented within this table excludes ABS issued from certain securitizations consolidated on our balance sheet, including Residential Jumbo (SEMT), SFR (CAFL), Freddie Mac SLST and K- Series, and HEI, as well as non-recourse debt used to finance certain servicing investments. 3. Capital allocated to mortgage banking operations represents the working capital we have allocated to manage our loan inventory at each of our operating businesses. This amount generally includes our net capital in loans held on balance sheet (net of financing), capital to acquire loans in our pipeline, net capital utilized for hedges, and risk capital. 4. Corporate capital includes among other things, capital allocated to RWT Horizons and other strategic investments as well as available capital. Slide 26 (Appendix: Mortgage Banking Key Results) 1. EAD Net Contribution and EAD Net Contribution Return on Capital are non-GAAP measures. Please refer to Non-GAAP Measures in the Endnotes section of this presentation for additional information on these measures. 2. Capital utilized for business purpose mortgage banking operations includes platform premium. Slide 27 (Appendix: Investment Portfolio Key Results) 1. EAD Net Contribution and EAD Net Contribution Return on Capital are non-GAAP measures. Please refer to Non-GAAP Measures in the Endnotes section of this presentation for more information on these measures. 2. Leverage ratio is calculated as Secured debt balances divided by capital invested, as presented within this table. Recourse Leverage ratio is calculated as Recourse Secured debt balances divided by Capital invested, as presented within this table. Slide 28 (Appendix: Recourse Debt Balances) 1. Non-marginable debt and marginable debt refers to whether such debt is subject to margin calls based solely on the lender’s determination in its discretion of the market value of underlying collateral that is non- delinquent. Non-marginable debt may be subject to a margin call due to delinquency or another credit event related to the mortgage or security being financed, a decline in the value of the underlying asset securing the collateral, an extended dwell time (i.e., period of time financed using a particular financing facility) for certain types of loans, or a change in the interest rate of a specified reference security relative to a base interest rate amount, among other reasons. 2. Average borrowing cost represents the weighted average contractual cost of recourse debt outstanding at the end of each period presented and does not include deferred issuance costs or debt discounts.